Decentralized exchanges (DEXs) are revolutionizing the way we trade cryptocurrencies by offering greater security and privacy. In this guide, we’ll dive into what DEXs are, how they work, and why they are becoming increasingly popular.

What Are Decentralized Exchanges?

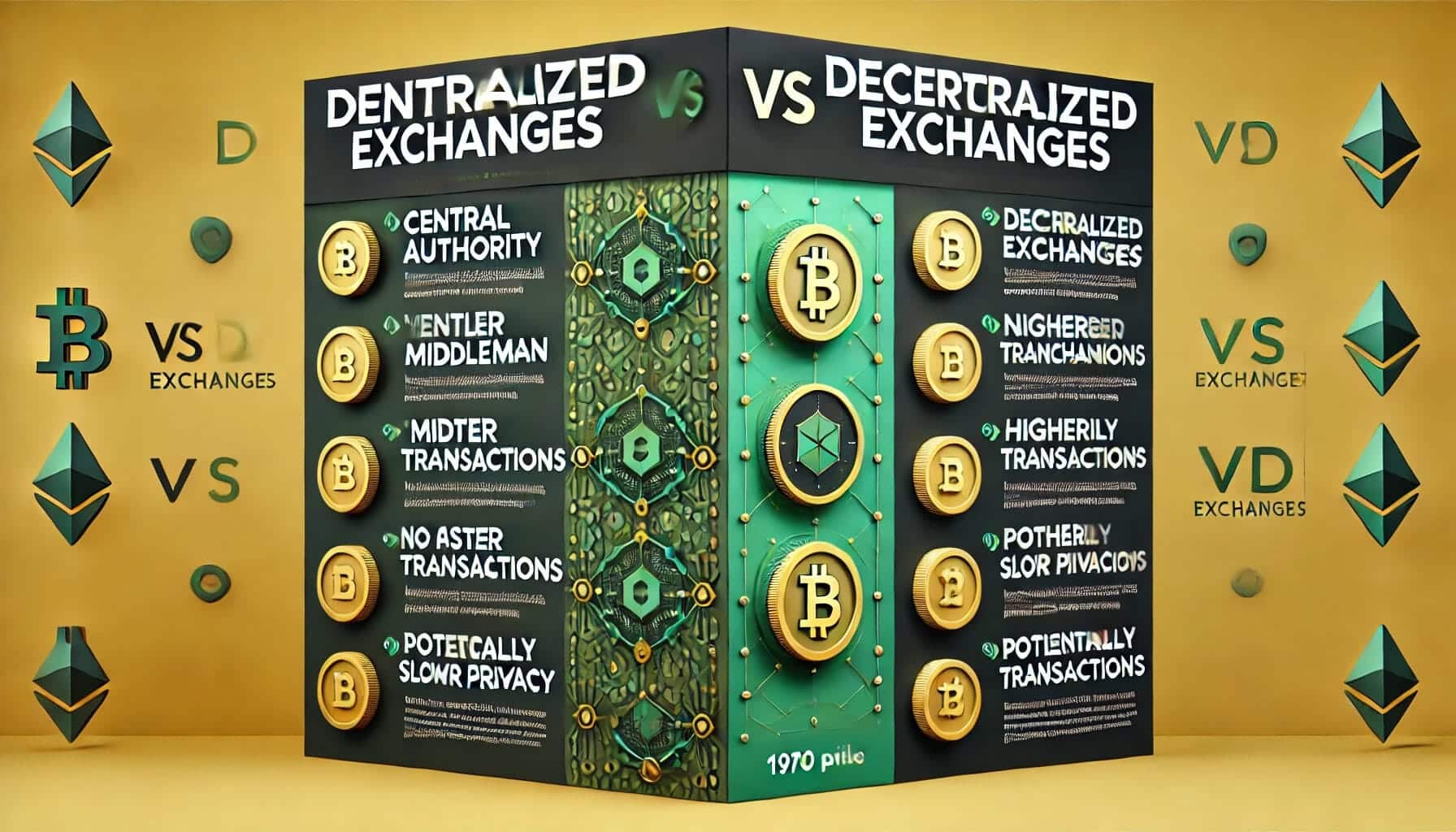

Decentralized exchanges (DEXs) are platforms that allow users to trade cryptocurrencies directly with one another without the need for an intermediary. In contrast, while centralized exchanges (CEXs) are managed by a single entity, DEXs operate on a decentralized network of nodes. The importance of DEXs lies in their ability to provide a more secure, private, and transparent trading experience. By eliminating intermediaries, DEXs reduce the risk of hacks and misuse of funds, making them a preferred choice for many crypto enthusiasts.

How Do Decentralized Exchanges Work?

-

Automated Market Makers (AMMs)

One of the core technologies behind many DEXs is the Automated Market Maker (AMM) system. AMMs create liquidity pools using smart contracts, allowing users to trade assets directly. Instead of traditional order books, AMMs determine prices by using algorithms based on the ratio of assets in the pool.

-

Liquidity Pools

-

Order Book Model

Some DEXs still use the traditional order book model, where buy and sell orders are matched directly between users. Although less common, this model is still employed by certain decentralized platforms to facilitate peer-to-peer trading.

Advantages of Using DEXs

-

Greater Security

DEXs provide enhanced security by allowing users to retain control of their private keys. This reduces the risk of hacks and theft, which are more common on centralized exchanges.

-

Increased Privacy

Trading on DEXs offers greater privacy since users don’t need to provide personal information or go through Know Your Customer (KYC) procedures.

-

Transparency and Trustlessness

All transactions on a DEX are recorded on the blockchain, providing complete transparency. This trustless environment ensures that users can trade without relying on a central authority.

Popular Decentralized Exchanges

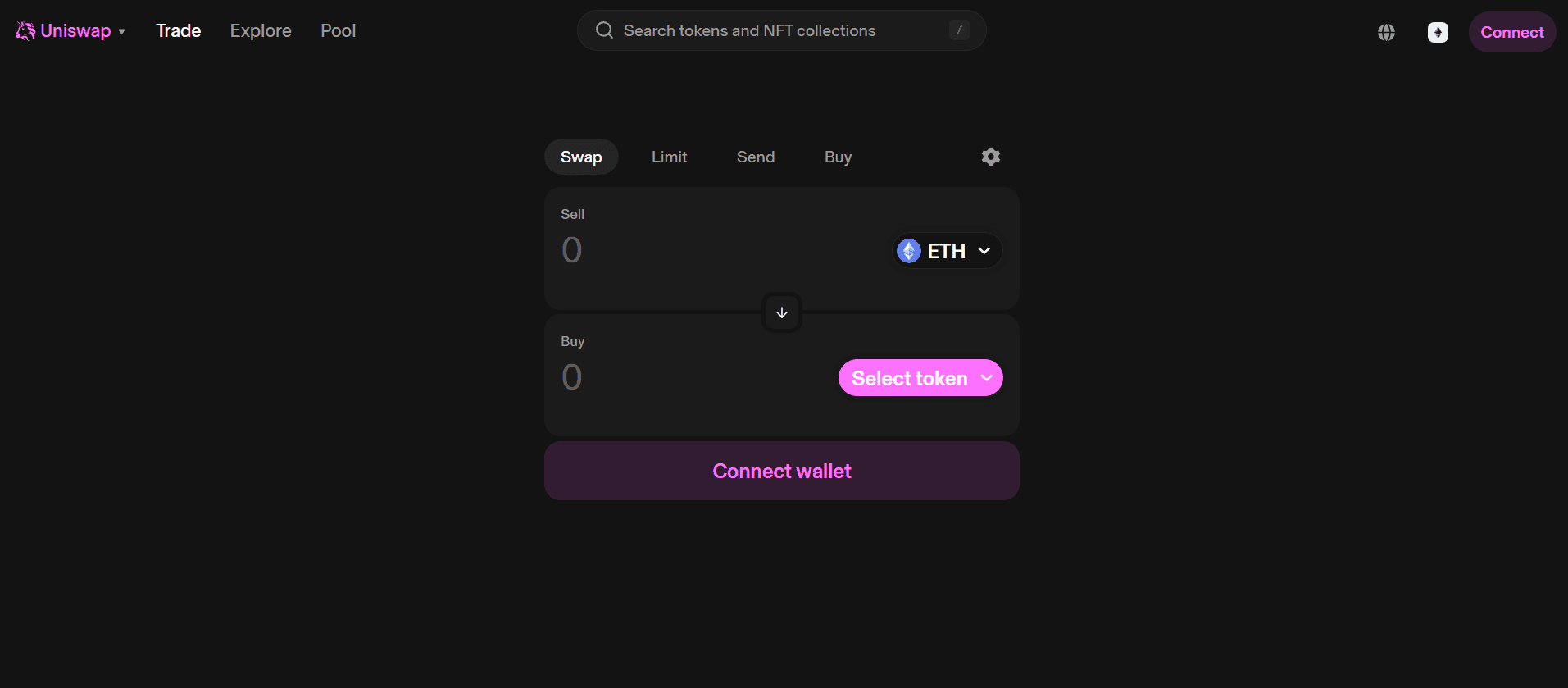

Uniswap is one of the most well-known DEXs, utilizing the AMM model to facilitate seamless token swaps. It features a user-friendly interface and supports a wide range of ERC-20 tokens.

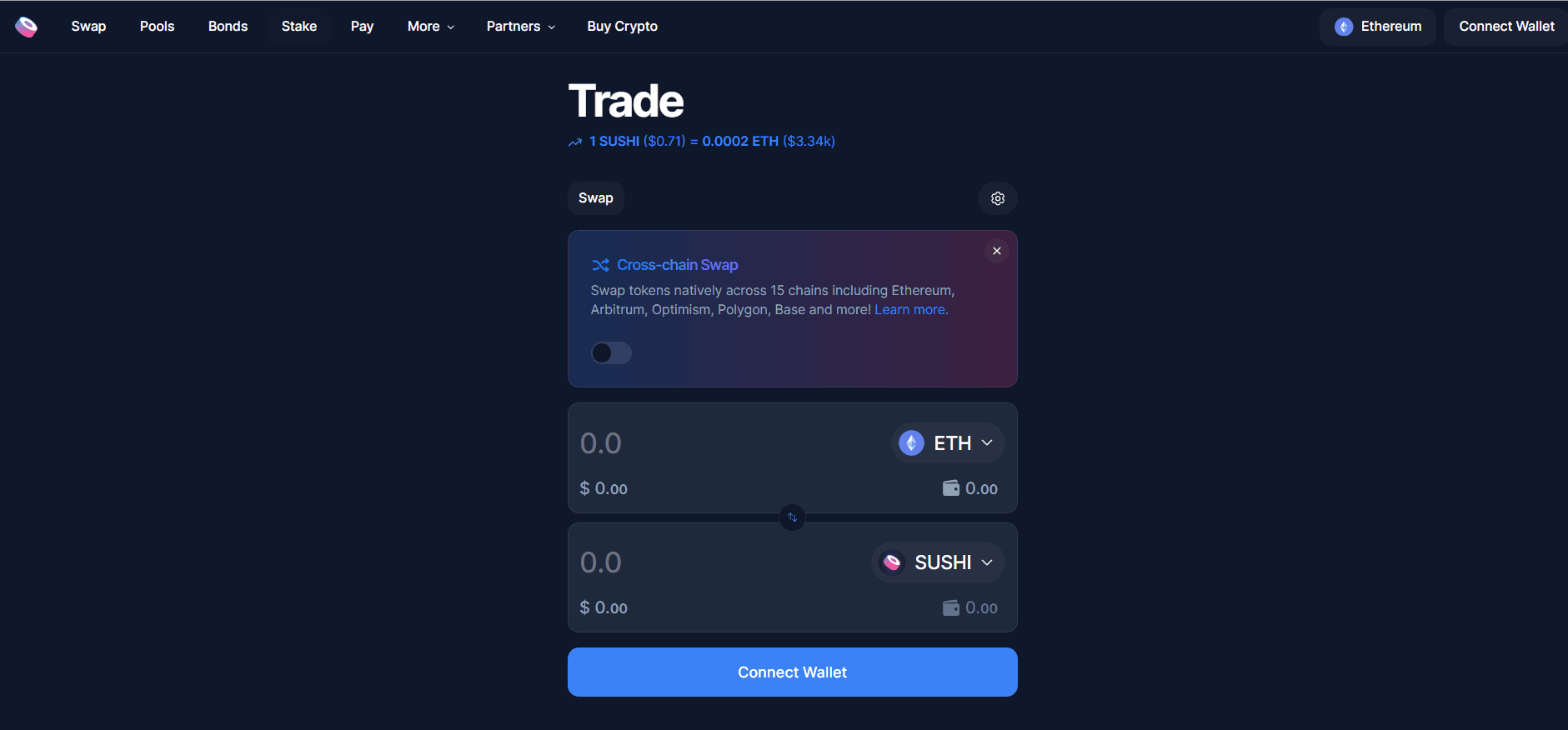

SushiSwap is another popular DEX that started as a fork of Uniswap. It offers additional features like yield farming and staking, making it a versatile platform for users.

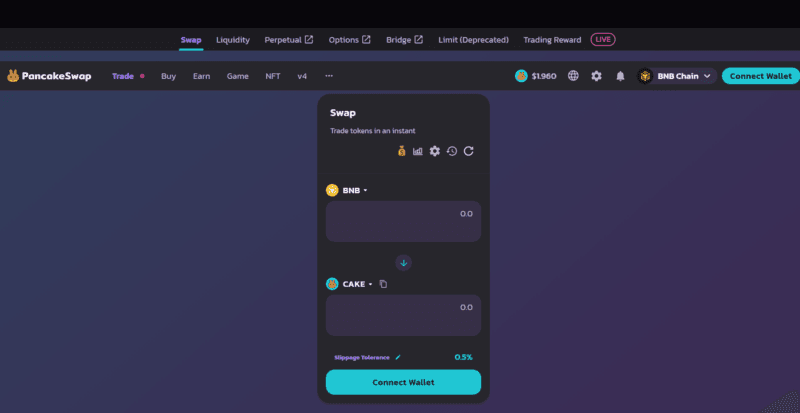

PancakeSwap operates on the Binance Smart Chain (BSC) and is known for its low transaction fees and high-speed trading. It is a favorite among users looking to trade BEP-20 tokens.

How to Get Started with DEXs

-

Choose a Wallet

To start trading on a DEX, you’ll need a cryptocurrency wallet that supports decentralized applications (dApps). MetaMask and Trust Wallet are popular choices.

-

Connect to a DEX

Once you have a wallet, connect it to your chosen DEX. Most DEXs have a simple connect button that integrates with your wallet.

-

Start Trading

After connecting your wallet, you can start trading by selecting the tokens you want to exchange and confirming the transaction. Always double-check transaction details to avoid errors.

FAQs

What is the main difference between DEXs and CEXs?

The primary difference is that DEXs operate without a central authority, allowing peer-to-peer trading directly on the blockchain, whereas CEXs are managed by centralized entities.

Are DEXs safe to use?

Yes, DEXs are generally safer in terms of reducing the risk of hacks, as users retain control of their private keys. However, users should still exercise caution and perform due diligence.

How can I add liquidity to a DEX?

You can add liquidity by depositing your assets into a liquidity pool on the DEX platform. In return, you’ll earn a portion of the trading fees generated from that pool.

Decentralized exchanges are transforming the cryptocurrency trading landscape by offering greater security, privacy, and transparency. As you explore the world of DEXs, staying informed and cautious will help you make the most of these innovative platforms. To learn more about decentralized exchanges and other cryptocurrency trends, follow us on Twitter and Telegram. Join our community to stay updated with the latest insights and news.