How to Start Trading Cryptocurrencies: A Beginner’s Guide

Cryptocurrency trading has become an exciting way to potentially profit from the volatile world of digital currencies. However, if you’re new to the crypto space, the idea of buying, selling, and managing digital assets might seem overwhelming. But don’t worry; getting started is simpler than it seems. This guide will walk you through how to start trading cryptocurrencies, from understanding the basics to making your first trade.

Understanding Cryptocurrency Trading

Before diving into the world of crypto trading, it’s essential to understand what it involves. Cryptocurrency trading is the act of buying and selling digital currencies on a crypto exchange or through a broker. The goal is to profit from the price fluctuations of cryptocurrencies like Bitcoin, Ethereum, and others. However, unlike traditional markets, crypto trading operates 24/7, and the market can be highly volatile, offering both significant opportunities and risks.

If you’re entirely new to cryptocurrencies, you might want to check out this beginner’s guide to cryptocurrencies, which covers the fundamental concepts and types of digital currencies.

Steps to Start Trading Cryptocurrencies

Here’s a step-by-step guide on how to start trading cryptocurrencies:

1. Educate Yourself

The first step to successful cryptocurrency trading is education. Understanding how the market works, familiarizing yourself with key terms, and learning about different cryptocurrencies will help you make informed decisions. Websites like CoinMarketCap and CoinGecko provide detailed information on various cryptocurrencies, market trends, and historical data.

In addition to learning about cryptocurrencies, you should also educate yourself on trading strategies. These include day trading, swing trading, and long-term investing. Each strategy has its own risk profile and time commitment, so it’s essential to find one that aligns with your goals and lifestyle.

2. Choose a Cryptocurrency Exchange

To start trading cryptocurrencies, you’ll need to choose a cryptocurrency exchange or broker. An exchange is a platform where you can buy, sell, and trade cryptocurrencies directly with other users. When selecting an exchange, consider factors such as security, fees, available cryptocurrencies, and user experience.

Some of the most popular exchanges for beginners include:

- Binance: Known for its wide variety of cryptocurrencies and low trading fees, Binance is an excellent choice for both beginners and experienced traders.

- Bybit: Bybit offers a user-friendly interface and a secure platform, making it a top choice for beginners looking to buy and sell major cryptocurrencies.

- MEXC: MEXC is known for its strong security features and a broad range of cryptocurrencies, making it a solid option for those who prioritize safety.

For a more in-depth comparison of exchanges, you can read our guide on the difference between a cryptocurrency broker and an exchange.

3. Create and Secure Your Account

Once you’ve chosen an exchange, the next step is to create an account. You’ll need to provide some personal information and, in most cases, verify your identity by submitting a government-issued ID. This process is known as KYC (Know Your Customer) and is required by most exchanges to comply with regulations.

After setting up your account, it’s crucial to secure it properly. Enable two-factor authentication (2FA) to add an extra layer of security. Additionally, consider using a hardware wallet like Ledger or Trezor to store your cryptocurrencies securely, rather than keeping them on the exchange.

4. Deposit Funds

To start trading, you’ll need to deposit funds into your exchange account. Most exchanges allow you to deposit fiat currency (like USD or EUR) via bank transfer or credit card. You can also deposit cryptocurrencies if you already own some. Once your funds are deposited, you can use them to purchase cryptocurrencies on the exchange.

5. Start Trading

With your account funded, you’re ready to start trading. Most exchanges offer various types of orders, such as market orders, limit orders, and stop orders. Understanding how these work is crucial for successful trading:

- Market Orders: These orders execute immediately at the current market price. They’re straightforward but may result in higher costs during times of high volatility.

- Limit Orders: With limit orders, you specify the price at which you’re willing to buy or sell. The order will only execute if the market reaches your specified price, giving you more control over your trades.

- Stop Orders: Stop orders are used to limit losses or lock in profits. For example, you can set a stop-loss order to sell a cryptocurrency if its price falls below a certain level, preventing further losses.

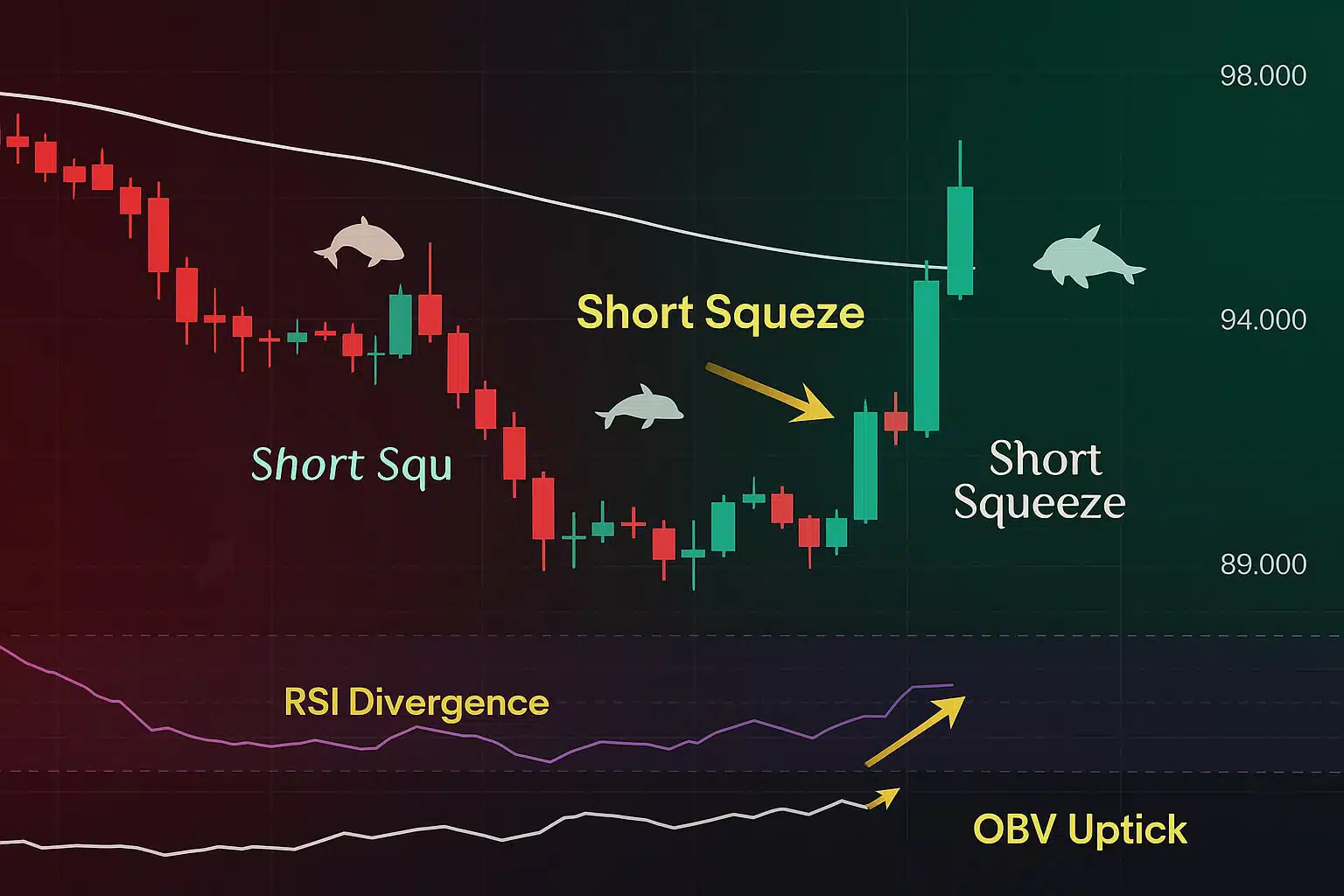

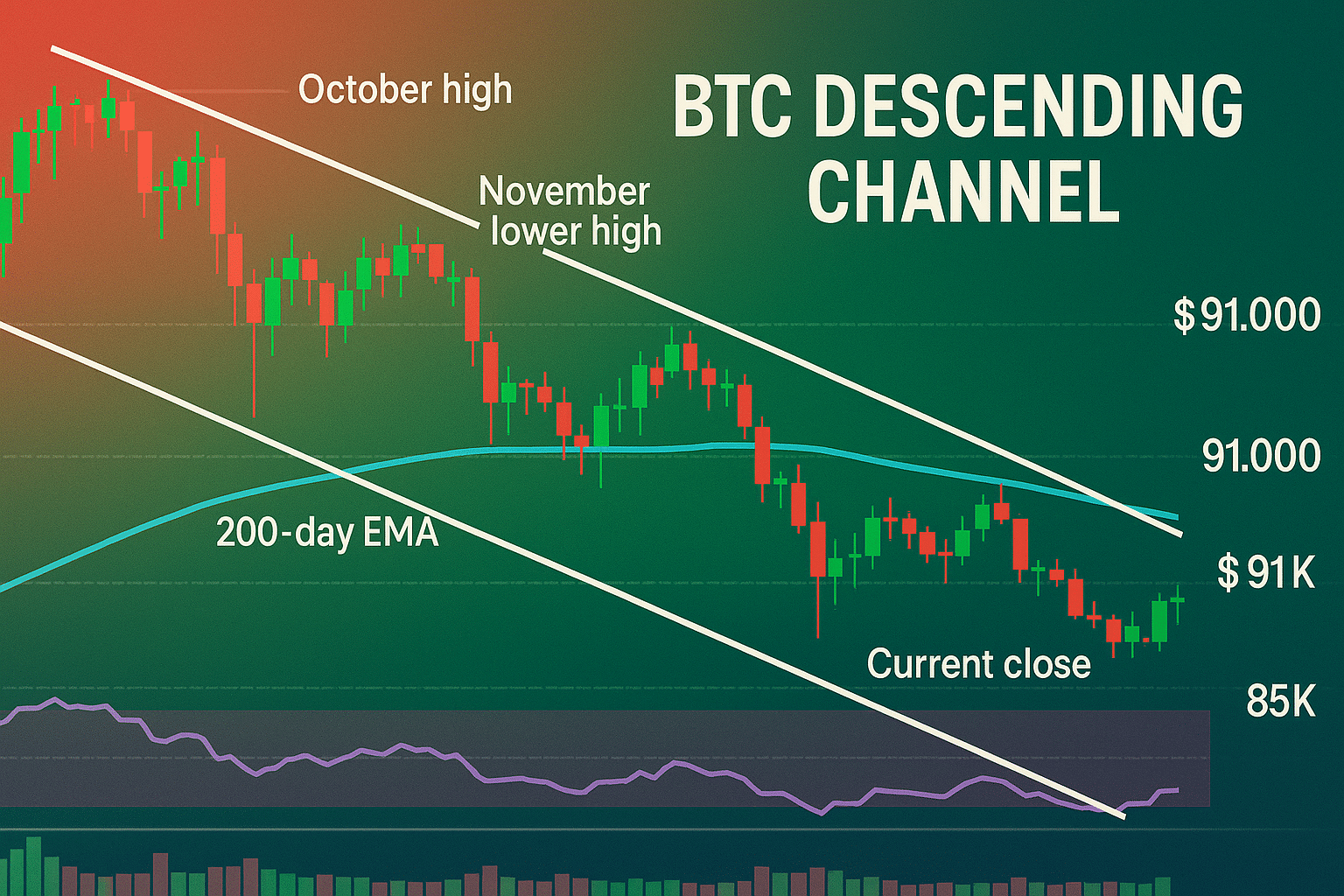

6. Monitor the Market and Your Portfolio

Once you’ve made your first trade, it’s essential to monitor the market and your portfolio regularly. Cryptocurrency prices can fluctuate wildly, and staying informed will help you make better trading decisions. Many exchanges offer tools and charts to help you track market trends and analyze price movements.

Additionally, consider using a portfolio tracker like CoinTracker or Delta to keep an eye on your investments and track your performance over time.

Tips for Successful Cryptocurrency Trading

While trading cryptocurrencies can be profitable, it’s important to approach it with caution. Here are some tips to help you succeed:

1. Start Small

If you’re new to trading, start with a small amount of money that you can afford to lose. The cryptocurrency market is volatile, and it’s easy to make mistakes when you’re just starting out. As you gain experience and confidence, you can gradually increase your investment.

2. Diversify Your Portfolio

Don’t put all your eggs in one basket. Diversifying your investments across multiple cryptocurrencies can reduce risk and increase your chances of profiting. Consider investing in a mix of established coins like Bitcoin and Ethereum, along with some promising altcoins.

3. Stay Informed

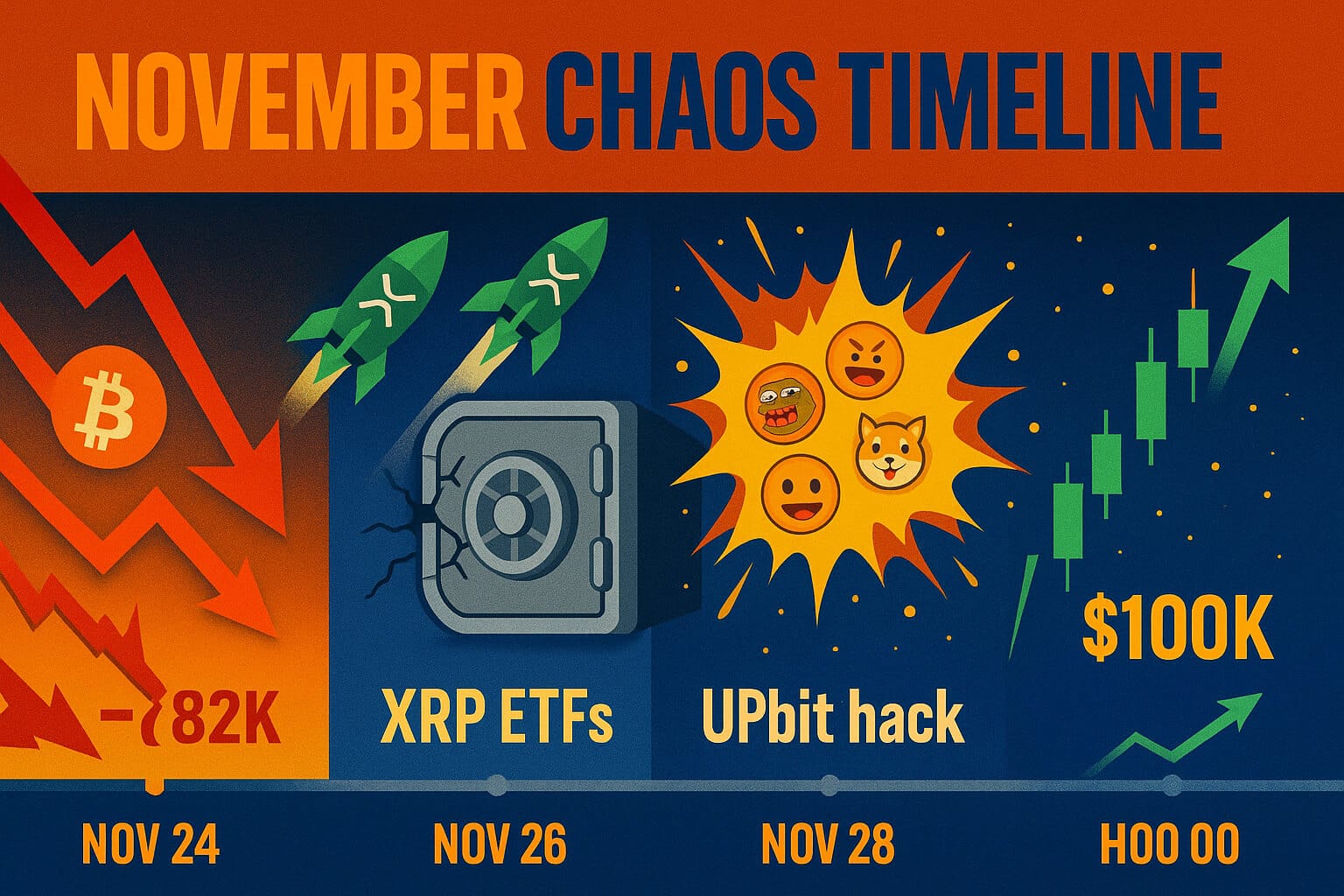

The cryptocurrency market moves quickly, and staying informed is key to making smart trading decisions. Follow reputable news sources like CoinDesk and Cointelegraph to stay up-to-date on market trends, regulatory changes, and new developments in the crypto world.

4. Don’t Let Emotions Drive Your Decisions

Crypto markets can be highly emotional, with prices swinging rapidly in both directions. It’s essential to keep a level head and avoid making impulsive decisions based on fear or greed. Stick to your trading strategy and avoid chasing quick profits or panic selling during market dips.

Wrapping It Up

Learning how to start trading cryptocurrencies can open up a world of financial opportunities. By educating yourself, choosing the right platform, and following a disciplined trading strategy, you can navigate the exciting yet volatile crypto market with confidence. Remember, while the potential for profit is significant, so are the risks, so always trade responsibly.

For more insights and detailed guides on cryptocurrency, visit our Crypto Guides Section.

Stay Updated

For the latest updates on cryptocurrency trends and news, follow us on:

- Twitter: https://twitter.com/FreeCoins24

- Telegram: https://t.me/freecoins24

Stay informed with the latest strategies and insights in the world of cryptocurrency at FreeCoins24.io.

Special Offer

For an enhanced trading experience, consider Bybit. Sign up through our referral link to unlock exclusive rewards, including up to $30,000 in deposit bonuses, and elevate your trading journey.