1. The Dawn of Digital Payments

Digital payments have revolutionized how we conduct transactions. From credit cards to mobile payments, they have made money transfers faster, easier, and more accessible. However, no innovation has been as transformative as the rise of cryptocurrencies. Unlike traditional digital payments, cryptocurrencies are decentralized, borderless, and secure, offering new possibilities for global transactions. This article explores the evolution of digital payments with cryptocurrencies, highlighting how they have changed the financial landscape and what the future holds.

2. The Emergence of Cryptocurrencies: A New Era in Payments

A. Bitcoin and the Birth of Crypto Payments

Cryptocurrency payments began with Bitcoin Satoshi Nakamoto introduced Bitcoin in 2008, aiming to create a peer-to-peer electronic cash system. Bitcoin operates without intermediaries like banks or governments, making it revolutionary.

- The First Bitcoin Transaction: The first Bitcoin transaction occurred in 2010. Laszlo Hanyecz, a programmer, famously paid 10,000 BTC for two pizzas. This transaction may seem trivial, but it marked the beginning of using Bitcoin as a medium of exchange.

- Early Adoption: Initially, Bitcoin appealed mostly to tech enthusiasts. Its volatility and lack of acceptance limited its use in everyday transactions. For example, few merchants were willing to accept Bitcoin, fearing it would lose value overnight.

B. The Growth of Altcoins and Blockchain Technology

Bitcoin’s success led to the creation of other cryptocurrencies, known as altcoins. Each altcoin offers unique features and use cases, expanding the possibilities for digital payments.

- Ethereum and Smart Contracts: Ethereum, launched in 2015, introduced smart contracts. These are self-executing contracts where the terms of the agreement are written in code. Smart contracts enable complex transactions and automate processes, broadening the scope of what digital payments can achieve. For instance, a smart contract could automate the release of funds when a service is completed, ensuring trust between parties.

- Expanding the Ecosystem: The rise of altcoins also led to the development of a broader cryptocurrency ecosystem. Companies like Coinbase and BitPay began offering services that made it easier for individuals and businesses to buy, sell, and accept cryptocurrencies. For example, BitPay enables businesses to accept Bitcoin payments and convert them instantly into local currency, reducing the risk of volatility.

3. The Present State of Cryptocurrency Payments

Cryptocurrency payments have come a long way since Bitcoin’s early days. Today, they are becoming an integral part of the global financial system, with growing adoption by businesses and consumers.

A. Adoption by Businesses and Consumers

Businesses and consumers are increasingly adopting cryptocurrencies as a viable payment method. The ease of use and security features of crypto payments are driving this trend.

- E-commerce and Retail: Major companies like Microsoft, Overstock, and AT&T accept Bitcoin and other cryptocurrencies. E-commerce platforms like Shopify have integrated crypto payment gateways, allowing merchants to offer customers the option to pay with crypto. For example, a customer could purchase a product online using Bitcoin, and the merchant could receive the payment in their local currency, converted instantly.

- Consumer Adoption: More people are using cryptocurrencies for everyday purchases. With the availability of user-friendly wallets and payment apps, consumer adoption is increasing. For instance, platforms like Travala.com allow users to book travel accommodations using a wide range of cryptocurrencies, making crypto more accessible for travel enthusiasts.

B. The Role of Stablecoins

Stablecoins are cryptocurrencies pegged to stable assets like the US dollar. They play a crucial role in the adoption of crypto payments by addressing the issue of volatility.

- Tether (USDT) and USD Coin (USDC): Tether and USD Coin are popular stablecoins. They offer the benefits of cryptocurrency without the price fluctuations associated with assets like Bitcoin. Businesses and individuals prefer stablecoins for transactions because they maintain a consistent value. For example, an online retailer can accept USDC as payment, knowing its value won’t drop suddenly.

- Decentralized Finance (DeFi): DeFi platforms have integrated stablecoins into their financial systems. Users can lend, borrow, and earn interest on their stablecoins, making them a vital part of the cryptocurrency payment landscape. For example, a user could lend USDC on a DeFi platform and earn interest, while another user borrows it for a low-interest rate.

C. Cryptocurrency Payment Solutions

Several payment solutions bridge the gap between traditional finance and the cryptocurrency world, making it easier for businesses and consumers to use cryptocurrencies for transactions.

- Payment Gateways: Services like BitPay, CoinGate, and CoinPayments offer cryptocurrency payment gateways. These gateways allow merchants to accept crypto payments online and in-store. For example, a café could use CoinGate to accept Bitcoin for coffee, with the payment instantly converted to local currency.

- Cryptocurrency Debit Cards: Companies like Crypto.com, Binance, and BitPay offer cryptocurrency debit cards. These cards allow users to spend their crypto holdings at any merchant that accepts Visa or Mastercard. For instance, a user could use their Crypto.com card to pay for groceries, with the crypto automatically converted to local currency at the point of sale.

4. The Future of Digital Payments with Cryptocurrencies

Cryptocurrency technology is evolving rapidly. Its impact on the future of digital payments will likely be profound. Here are some key trends and developments to watch.

A. Increased Integration with Traditional Finance

The line between traditional finance and cryptocurrencies is blurring. Financial institutions are integrating crypto into their services, making it more mainstream.

- Central Bank Digital Currencies (CBDCs): Central banks are exploring the development of CBDCs, digital versions of national currencies. CBDCs are inspired by blockchain technology and could coexist with cryptocurrencies. This would further legitimize digital payments and offer new possibilities for cross-border transactions.

- Crypto Banking Services: Traditional banks are beginning to offer cryptocurrency services, such as custody solutions and crypto trading. For example, a bank could offer its customers the option to buy, sell, and store Bitcoin securely through its platform. This integration will likely lead to increased consumer confidence and adoption of crypto payments.

B. Expansion of DeFi and Decentralized Payments

Decentralized finance (DeFi) is revolutionizing how financial services are delivered. Its impact on digital payments is significant.

- Peer-to-Peer Payments: DeFi platforms enable peer-to-peer payments without intermediaries, reducing costs and increasing transaction speed. For example, two parties could exchange funds directly on a DeFi platform, bypassing banks and reducing fees.

- Programmable Money: Smart contracts and blockchain technology allow for programmable money, where payments can be automated based on specific conditions. For example, a business could automate payroll with smart contracts, ensuring employees are paid automatically when they complete their tasks.

C. Global Financial Inclusion

Cryptocurrencies have the potential to increase financial inclusion by providing access to digital payments for the unbanked or underbanked.

- Cross-Border Payments: Cryptocurrencies enable fast and low-cost cross-border payments, making them an attractive option for remittances. For example, a worker in the U.S. could send money to their family in Mexico using Bitcoin, with the transaction completed in minutes and with minimal fees.

- Micropayments: Cryptocurrencies make micropayments feasible, opening up opportunities for content creators and small businesses. For instance, a blogger could receive micro-tips from readers in crypto, allowing them to monetize their content easily.

5. Challenges and Considerations

While the evolution of digital payments with cryptocurrencies holds great promise, several challenges remain.

A. Regulatory Uncertainty

Cryptocurrencies operate in a complex and rapidly changing regulatory environment. Governments are still determining how to classify and regulate cryptocurrencies.

- Regulatory Clarity: Clear and consistent regulations are needed to provide businesses and consumers with the confidence to use cryptocurrencies for payments. For example, without clear regulations, a business might hesitate to accept crypto, fearing potential legal repercussions.

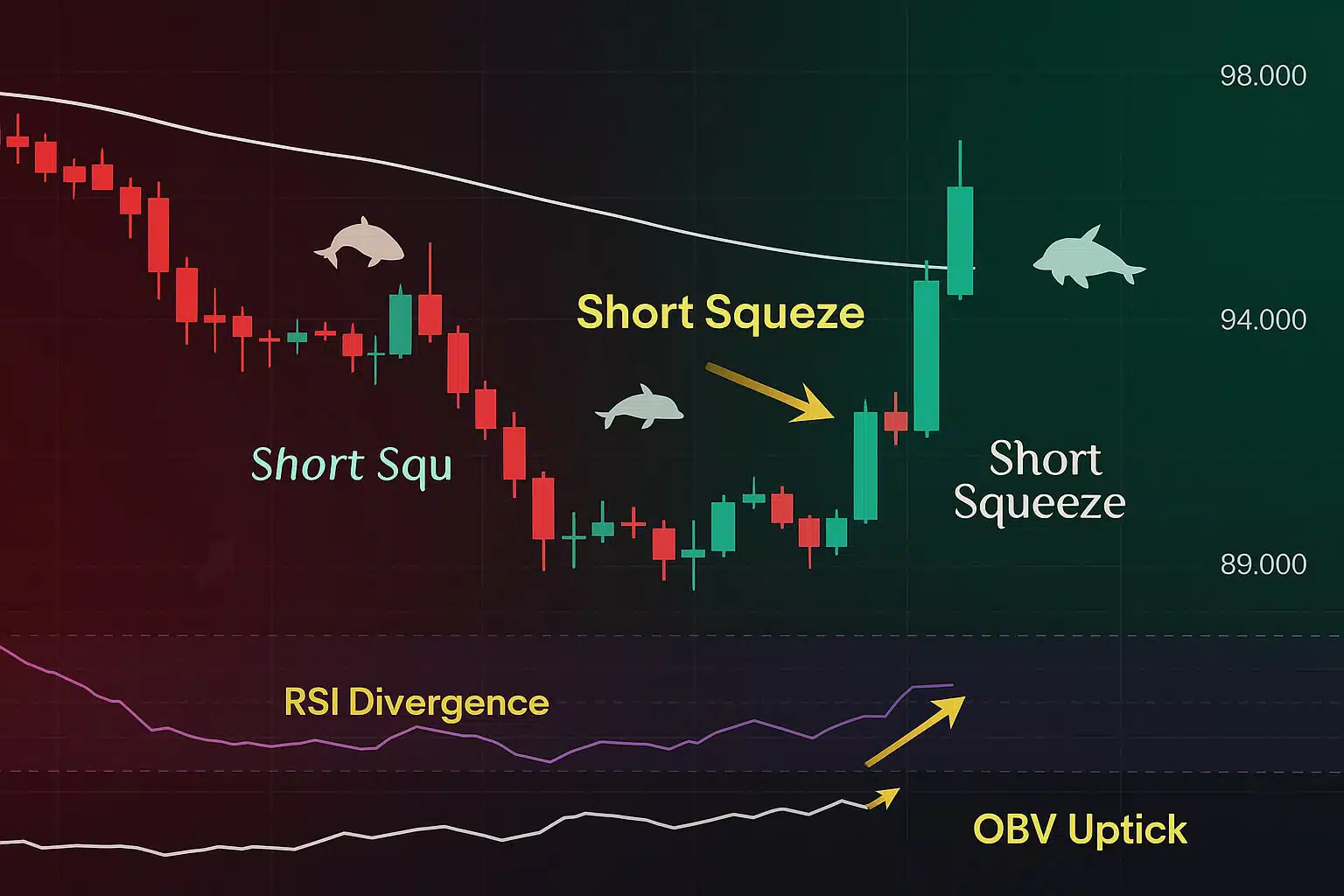

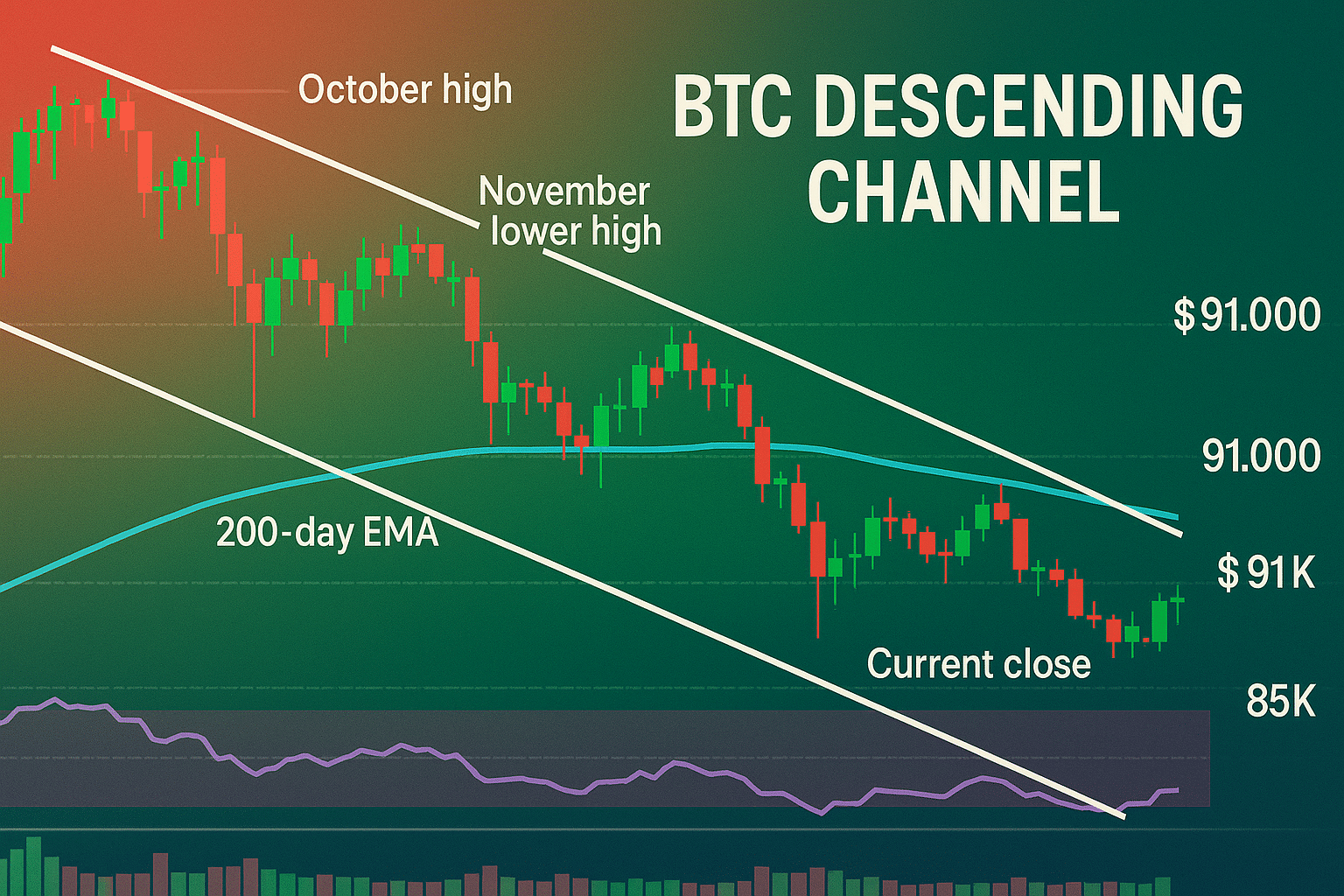

B. Volatility and Stability

Despite the rise of stablecoins, the volatility of many cryptocurrencies remains a barrier to their widespread use.

- Price Stability: For cryptocurrencies to become mainstream payment options, solutions addressing price volatility are essential. This could involve developing more stablecoins or mechanisms that stabilize cryptocurrency values in real-time.

C. Security and Fraud Prevention

While blockchain technology offers enhanced security, the risk of fraud and hacking in the cryptocurrency space remains a concern.

- Security Measures: As crypto payments become more popular, robust security measures will be necessary to protect users from fraud and theft. For instance, multi-factor authentication, encryption, and secure storage solutions will be vital in safeguarding crypto assets.

The Future of Digital Payments with Cryptocurrencies

The evolution of digital payments with cryptocurrencies marks a significant shift in the global financial landscape. From the early days of Bitcoin to the rise of stablecoins and DeFi, cryptocurrencies have transformed how we think about money and transactions. As technology continues to evolve, cryptocurrencies will play an increasingly important role in the future of digital payments. However, for crypto payments to reach their full potential, challenges such as regulatory uncertainty, volatility, and security must be addressed. With continued innovation and adoption, cryptocurrencies could become a cornerstone of the global digital economy, offering new opportunities for businesses and consumers alike.

For more insights and detailed guides on cryptocurrency applications, visit our Cryptocurrency Comparisons Guides.

Stay Updated

For the latest updates on the evolution of digital payments and cryptocurrencies, follow us on:

Stay informed with the latest strategies and insights in the world of cryptocurrency at FreeCoins24.io.

Special Offer

Looking to stay ahead in the evolving world of cryptocurrency payments? Sign up on Bybit today and take advantage of up to $30,000 in deposit bonuses. Don’t miss out on the opportunity to enhance your digital payment strategies with a trusted platform.