1. The High-Stakes World of Cryptocurrency Investing

Cryptocurrency investing is an exciting yet high-stakes endeavor. The potential for significant returns draws many investors to the crypto market, but the same market is also known for its extreme volatility and risk. Prices can skyrocket one day and plummet the next, making it crucial for investors to have a solid risk management strategy in place. Proper risk management can mean the difference between riding out market downturns and facing substantial losses. In this guide, we’ll explore essential risk management techniques for crypto investors, helping you protect your investments and navigate the volatile world of cryptocurrency.

2. Diversification: The Foundation of Risk Management

Diversification is a fundamental risk management technique that involves spreading your investments across various assets to reduce the impact of a poor-performing investment. By diversifying your portfolio, you can mitigate the risk associated with any single cryptocurrency and improve your chances of achieving stable returns.

A. Diversify Across Different Cryptocurrencies

The most straightforward way to diversify in the crypto market is by investing in multiple cryptocurrencies. This strategy reduces your exposure to the risks associated with any one coin and allows you to benefit from the growth of various assets.

- Example: Instead of investing all your money in Bitcoin, you could diversify by allocating a portion of your portfolio to Ethereum, Binance Coin, and several other altcoins. This way, if Bitcoin’s price drops, gains in other cryptocurrencies might offset the loss.

B. Diversify Across Different Sectors

Another way to diversify is by investing in different sectors within the cryptocurrency space. The crypto market is composed of various sectors, including decentralized finance (DeFi), non-fungible tokens (NFTs), stablecoins, and layer-1 platforms (like Ethereum and Solana).

- Example: An investor might allocate funds across sectors by investing in a mix of Bitcoin (a store of value), Chainlink (a DeFi oracle), and Decentraland (a metaverse token). This approach spreads risk across different areas of the market, potentially stabilizing the portfolio.

C. Diversify by Market Capitalization

You can also diversify by market capitalization, which involves spreading investments across large-cap, mid-cap, and small-cap cryptocurrencies. Large-cap coins like Bitcoin and Ethereum are generally less volatile, while small-cap coins have the potential for higher growth but come with higher risk.

- Example: A balanced portfolio might include 50% large-cap coins (e.g., Bitcoin, Ethereum), 30% mid-cap coins (e.g., Polkadot, Avalanche), and 20% small-cap coins (e.g., The Sandbox, Axie Infinity).

3. Position Sizing: Managing the Size of Your Investments

Position sizing is a crucial risk management technique that involves determining the appropriate amount of capital to allocate to each investment. By controlling the size of your positions, you can limit the impact of a single trade or investment on your overall portfolio.

A. Avoid Overexposure to a Single Asset

Overexposure to a single asset can significantly increase your risk, especially in a volatile market like cryptocurrency. Position sizing helps you avoid putting too much capital into any one investment, which can protect you from significant losses.

- Example: If you have $10,000 to invest, instead of putting $5,000 into one altcoin, you might allocate $2,000 to each of five different assets. This way, if one investment underperforms, it only affects 20% of your portfolio, rather than 50%.

B. Use the 1% Rule

One popular position sizing strategy is the 1% rule, where you limit any single investment to 1% of your total capital. This rule helps you manage risk by ensuring that no single trade or investment can cause significant damage to your portfolio.

- Example: If your portfolio is worth $50,000, you would invest no more than $500 in any single cryptocurrency. This minimizes the impact of a poor-performing investment on your overall portfolio.

4. Stop-Loss Orders: Limiting Potential Losses

Stop-loss orders are an essential risk management tool that automatically sells a cryptocurrency when its price falls to a predetermined level. This technique helps limit your losses in a declining market and protects your capital from further erosion.

A. Setting Stop-Loss Orders

To use a stop-loss order effectively, you need to determine a price point at which you’re willing to exit a trade to prevent further losses. The key is to set a stop-loss level that gives your investment room to fluctuate without triggering a sale prematurely, while still protecting your capital.

- Example: If you buy Bitcoin at $40,000, you might set a stop-loss order at $36,000 (a 10% decline). If Bitcoin’s price drops to this level, the stop-loss order will automatically sell your position, limiting your loss to 10%.

B. Trailing Stop-Loss Orders

A trailing stop-loss order is a more advanced version of the stop-loss. It adjusts the stop-loss level as the price of the cryptocurrency increases, allowing you to lock in profits while still protecting against downside risk.

- Example: If Bitcoin rises from $40,000 to $50,000, a trailing stop-loss set at 10% would automatically adjust the stop-loss level to $45,000. If Bitcoin’s price then falls to $45,000, the trailing stop-loss order would execute, locking in a $5,000 gain.

5. Risk-Reward Ratio: Evaluating Potential Returns vs. Risk

The risk-reward ratio is a tool used to evaluate the potential return of an investment relative to the risk involved. By focusing on investments with favorable risk-reward ratios, you can make more informed decisions and improve your overall investment strategy.

A. Calculating the Risk-Reward Ratio

The risk-reward ratio is calculated by dividing the potential profit of a trade by the potential loss. A ratio of 2:1, for example, means that for every $1 of risk, you stand to gain $2. In general, you should aim for investments with a risk-reward ratio of 2:1 or higher.

- Example: If you’re considering an investment where the potential upside is $1,000 and the potential downside is $500, the risk-reward ratio is 2:1. This indicates a favorable trade where the potential reward outweighs the risk.

B. Using the Risk-Reward Ratio in Decision-Making

By incorporating the risk-reward ratio into your process, you can prioritize investments that offer the best balance between potential returns and risks. This helps you avoid high-risk, low-reward trades that could harm your portfolio.

- Example: If you’re deciding between two investments, one with a 3:1 risk-reward ratio and another with a 1:1 ratio, the 3:1 investment offers a better potential return for the amount of risk involved and would likely be the better choice.

6. Stay Informed: Research and Continuous Learning

Staying informed about the latest developments in the cryptocurrency market is critical for effective risk management. The crypto market is highly dynamic, with new projects, regulatory changes, and market trends emerging regularly.

A. Conduct Thorough Research

Before making any investment, conduct thorough research on the cryptocurrency, the team behind it, the technology, and the market conditions. Understanding what you’re investing in reduces the likelihood of making uninformed decisions that can lead to losses.

- Example: Before investing in a new altcoin, you research its whitepaper, assess its use case, analyze the development team’s track record, and look at market sentiment. This research helps you make an informed decision about whether the coin is a good addition to your portfolio.

B. Follow Market News and Trends

Keeping up with market news and trends allows you to anticipate potential risks and opportunities. Whether it’s monitoring regulatory developments, technological advancements, or macroeconomic factors, staying informed helps you adapt your strategy as needed.

- Example: If you hear about upcoming regulatory changes that could impact a cryptocurrency you hold, you might decide to reduce your exposure or adjust your portfolio to mitigate potential risks.

7. Emotional Discipline: Controlling Fear and Greed

Emotional discipline is one of the most challenging yet essential aspects of risk management in cryptocurrency investing. Fear and greed can lead to impulsive decisions that often result in losses. By maintaining emotional discipline, you can stick to your investment strategy and make decisions based on logic rather than emotion.

A. Avoiding Panic Selling

Panic selling is a common reaction during market downturns, where investors sell their assets at a loss out of fear that prices will continue to drop. Emotional discipline helps you avoid panic selling and encourages you to stick to your long-term strategy.

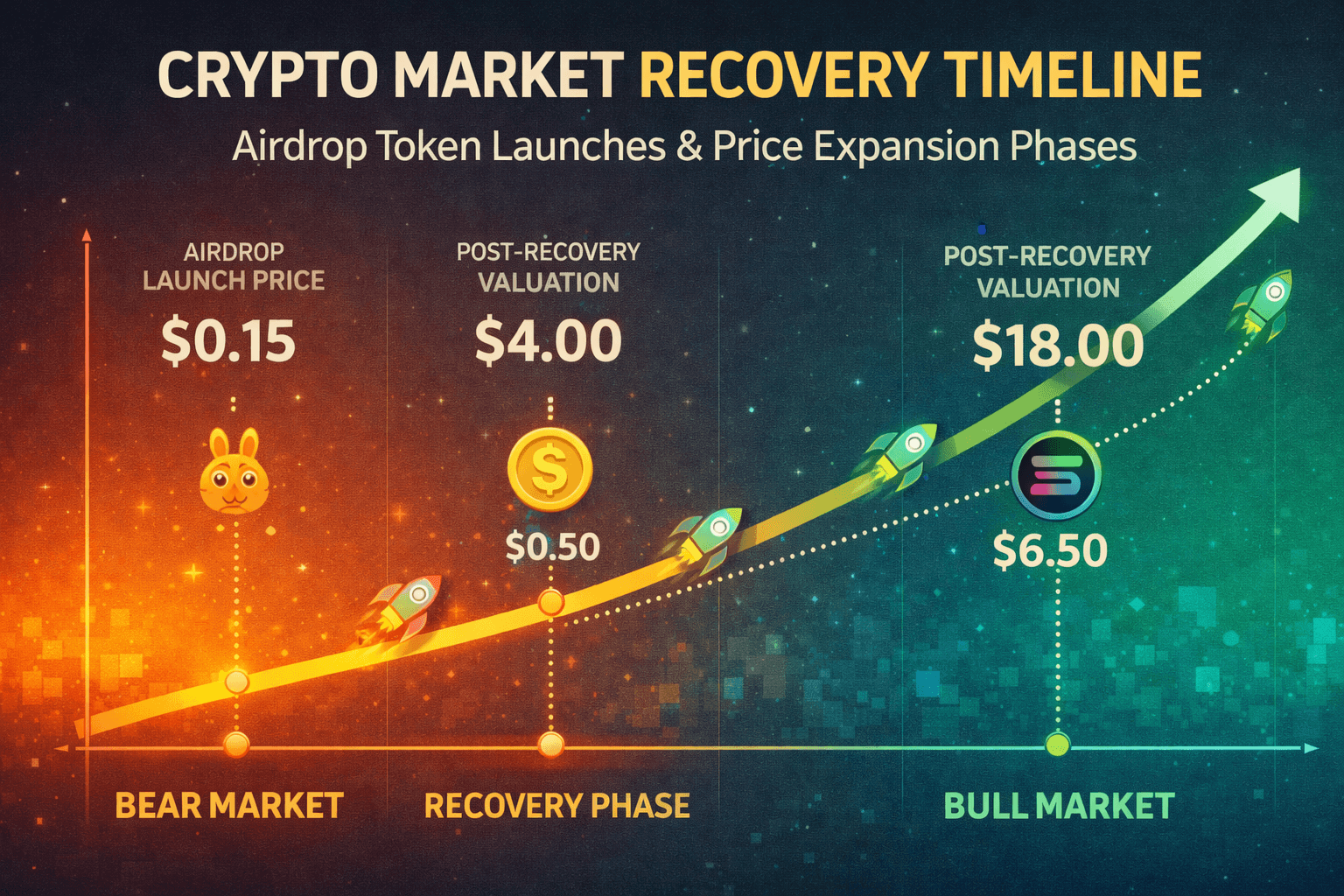

- Example: During a sudden market crash, you might be tempted to sell your assets to avoid further losses. However, by staying calm and sticking to your strategy, you could ride out the downturn and benefit from the eventual market recovery.

B. Resisting FOMO (Fear of Missing Out)

The fear of missing out (FOMO) can lead to impulsive buying decisions when you see others making profits from a particular cryptocurrency. Emotional discipline helps you resist FOMO and avoid chasing after investments without proper research.

- Example: If you see a coin skyrocketing in price and feel the urge to buy in, emotional discipline would remind you to conduct proper research first and assess whether the investment aligns with your overall strategy.

Effective Risk Management: The Key to Long-Term Success in Crypto Investing

Risk management is a crucial component of successful cryptocurrency investing. By diversifying your portfolio, using position sizing and stop-loss orders, evaluating the risk-reward ratio, staying informed, and maintaining emotional discipline, you can protect your investments and navigate the volatile crypto market with confidence. Remember, the goal of risk management is not to eliminate risk entirely—an impossible task in any investment—but to manage it in a way that aligns with your financial goals and risk tolerance. With a solid risk management strategy in place, you’ll be well-positioned to achieve long-term success in the dynamic world of cryptocurrency investing.

For more insights and detailed guides on cryptocurrency investment strategies, visit our Cryptocurrency Comparisons Guides.

Stay Updated

For the latest tips and strategies on managing risk in cryptocurrency investing, follow us on:

Stay informed with the latest strategies and insights in the world of cryptocurrency at FreeCoins24.io.

Special Offer

Ready to start managing your crypto investments more effectively? Sign up on Bybit today and take advantage of up to $30,000 in deposit bonuses. Implement your risk management strategy on a trusted platform.