Decentralized Finance (DeFi) is all about giving power back to the community. Unlike traditional financial systems, where decisions are made behind closed doors, DeFi thrives on open, community-driven decision-making. One of the key ways that projects ensure decentralized governance is through the use of airdrops. Airdrops are not just about distributing free tokens they have become essential tools for giving users a real voice in the governance of a project.

In this article, we’ll explore how airdrops are being used to distribute governance tokens, how they help build engaged communities, and why they are critical to the growth and decentralization of DeFi projects.

1. What Is DeFi Governance and Why Are Airdrops Important?

DeFi governance allows users to influence the direction of a decentralized project by voting on important decisions. Instead of relying on centralized entities, DeFi platforms use governance tokens to distribute decision-making power among users. These tokens are often distributed through airdrops, ensuring that the governance structure remains fair and community-focused.

Key Roles of Governance Tokens:

- Voting Rights: Governance tokens give holders the right to vote on proposals, such as changes in fees, new feature development, or community grants.

- Community Ownership: Through airdrops, these tokens are distributed to users, making the community stakeholders in the project.

- Incentivized Participation: Users with governance tokens are incentivized to actively participate, ensuring that their interests align with the success of the project.

Airdrops help achieve these roles by distributing governance tokens to a broad audience. They ensure that decision-making is not dominated by a few but is distributed across a wider user base, fostering true decentralization.

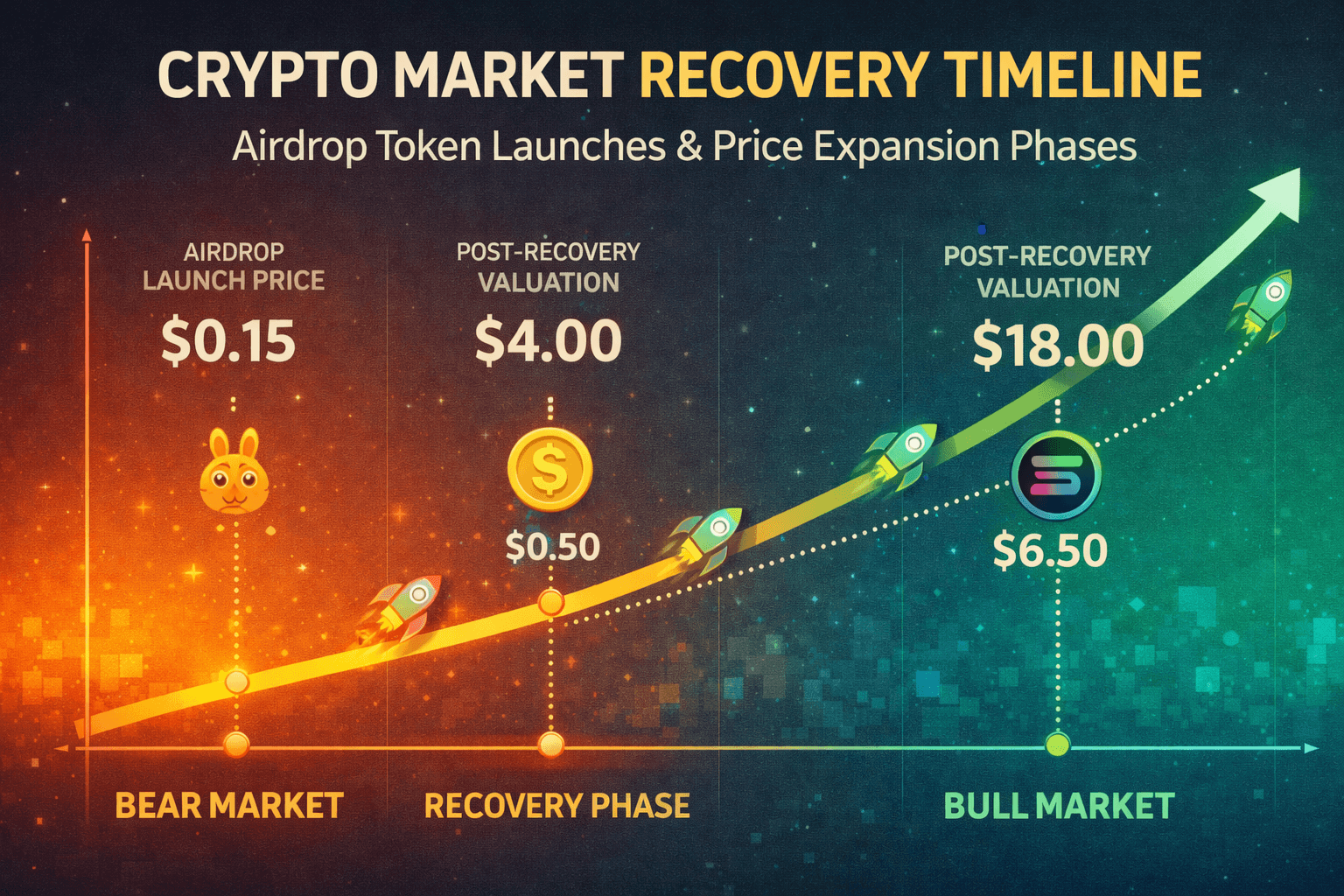

2. How Airdrops Distribute Governance Tokens

Airdrops distribute governance tokens to individuals based on their activity, support, or loyalty to a project. Instead of selling governance tokens directly, projects often airdrop them to users who are already contributing to or engaging with the project in meaningful ways. This ensures that governance rights are held by people who care about the platform.

Methods for Distributing Governance Tokens:

- Rewarding Early Users: Airdrops often reward early adopters who provided liquidity, used dApps, or interacted with the protocol. This approach encourages continued loyalty and ensures that those who helped build the project get a say in its future.

- Incentivizing Active Participants: Projects airdrop governance tokens to those who engage in governance processes, such as voting on proposals or participating in governance discussions.

- Creating Fair Access: By distributing governance tokens through airdrops, projects can avoid having voting power concentrated in the hands of a few early investors or big whales. Instead, they ensure that smaller participants also have a voice.

Airdrops are an ideal mechanism for distributing governance tokens because they align the interests of the community with the success of the project.

3. Real-World Examples of Governance Airdrops in DeFi

Several successful DeFi projects have used airdrops as a way to distribute governance tokens and involve their users in decision-making processes. Here are some real-world examples of governance airdrops and how they impacted their communities.

Example 1: Uniswap’s UNI Airdrop

In 2020, Uniswap, one of the most well-known DeFi protocols, launched its governance token, UNI, through an airdrop. Users who had interacted with Uniswap’s decentralized exchange before a specific date were eligible to receive 400 UNI tokens.

The UNI airdrop achieved several objectives:

- Rewarded Loyalty: The airdrop rewarded early users who believed in and used the platform, encouraging further loyalty.

- Created Governance Opportunities: UNI token holders received governance rights, enabling them to vote on important changes, such as fee structures and liquidity pools.

- Increased User Engagement: After receiving the airdrop, many users began participating in Uniswap’s governance, helping shape the future of the platform.

The UNI airdrop set the stage for how governance airdrops could be used effectively to involve users and decentralize control.

Example 2: Compound’s COMP Airdrop

Compound is another major DeFi project that distributed its governance token, COMP, through an airdrop. Users who supplied or borrowed assets through the Compound protocol received COMP tokens. These tokens allowed holders to propose changes and vote on the future direction of the protocol.

Key outcomes of the COMP airdrop included:

- Community-Driven Decisions: With governance tokens distributed widely, COMP holders gained the ability to influence decisions about interest rates, assets, and platform upgrades.

- Enhanced Decentralization: The airdrop ensured that control over the protocol was distributed across a large group of users rather than a few central entities.

By using airdrops, Compound empowered its community and ensured that governance remained truly decentralized.

4. Benefits of Airdrops for DeFi Governance

Airdrops play a crucial role in ensuring that DeFi governance remains decentralized, community-focused, and fair. They help distribute decision-making power to a wide audience, promoting participation and aligning the community’s interests with the project’s growth.

Key Benefits of Governance Airdrops:

- Broadened Voting Power: By distributing governance tokens to a broad group of users, airdrops help avoid concentration of power. This ensures that decisions reflect the community’s interests rather than just those of major investors.

- Active User Engagement: Airdrops incentivize users to become more actively involved. When users receive governance tokens, they are encouraged to vote, discuss proposals, and contribute ideas.

- Strengthening Community Trust: Airdrops reward early adopters and active participants, which fosters a sense of belonging and builds long-term trust in the project.

For example, after the Uniswap UNI airdrop, thousands of new participants started engaging in the governance process, contributing their opinions on key protocol changes. This kind of participation is vital for building a decentralized and self-sustaining community.

5. Airdrops as Incentives for Decentralized Decision-Making

Airdrops also serve as incentives to encourage broader community participation in governance. By distributing governance tokens, projects empower users to make decisions that impact the protocol’s direction. These airdrops are designed to ensure that users with governance tokens are incentivized to vote actively.

How Governance Airdrops Incentivize Users:

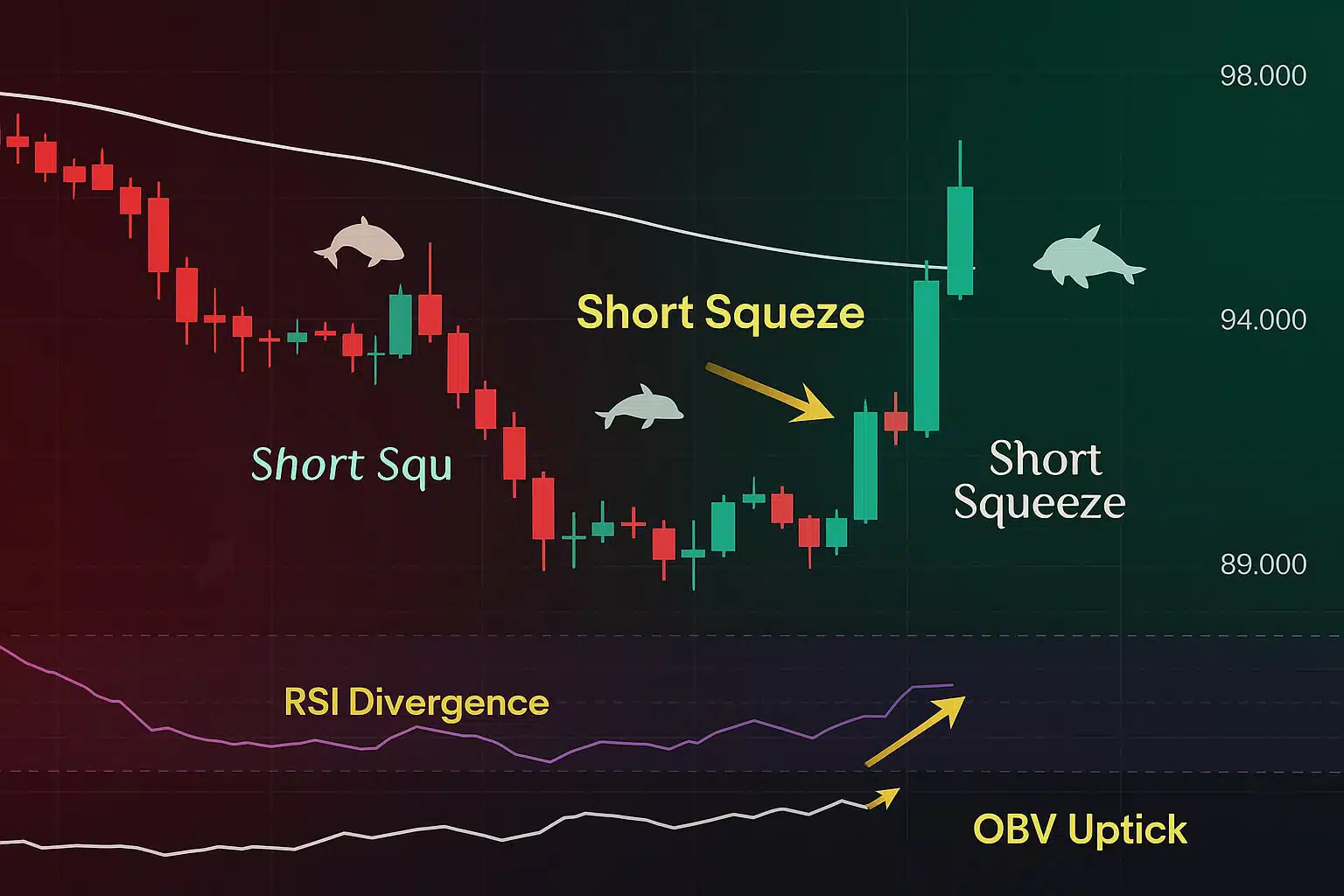

- Monetary Value: Governance tokens often carry value, providing holders with an incentive to participate and stay engaged. This value encourages users to hold and vote rather than simply sell their tokens.

- Rewards for Voting: Some projects reward users who participate in votes, offering additional governance tokens to those who actively contribute to the decision-making process.

- Long-Term Investment: Receiving governance tokens via an airdrop makes users stakeholders in the project’s success, leading to long-term involvement. When users feel they have a stake in the project, they are more likely to contribute meaningfully to its growth.

Governance airdrops effectively align the interests of the community with the success of the project, ensuring that users are invested both financially and ideologically.

Conclusion

Airdrops have transformed from simple marketing tools into powerful instruments for ensuring decentralized governance in DeFi. By distributing governance tokens through airdrops, projects like Uniswap and Compound have empowered their users to participate directly in the decision-making process, ensuring that their platforms remain community-driven.

Governance airdrops broaden the distribution of power, foster active user engagement, and reward community loyalty. As DeFi continues to evolve, airdrops will likely remain a key mechanism for distributing governance tokens and keeping decision-making truly decentralized.

For more insights into the role of airdrops in DeFi and governance token distribution, visit our DeFi Governance Airdrop Guides.

Stay Updated

For the latest updates on DeFi governance and airdrop opportunities, follow us on:

Stay informed with the latest crypto insights at FreeCoins24.io.

Special Offer

Want to trade tokens earned from governance airdrops? Sign up on Bybit today and enjoy up to $30,000 in deposit bonuses. Trade with confidence on a trusted platform.