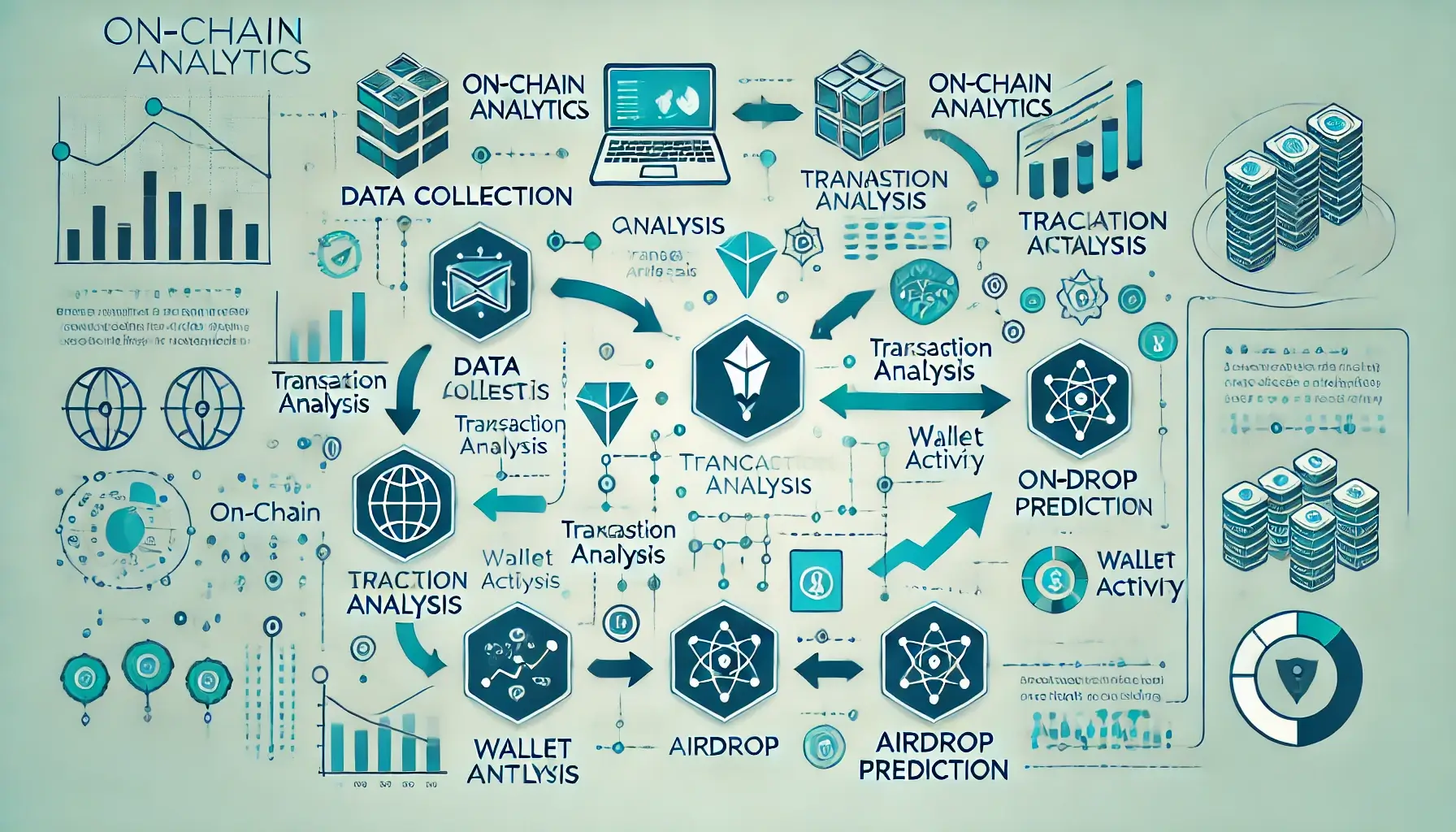

In the world of cryptocurrency, airdrops are an exciting way for projects to distribute tokens, build a community, and generate awareness. However, with hundreds of airdrops happening regularly, it’s challenging to know which ones are worth participating in. On-chain analytics for airdrop success offers a data-driven approach to help users evaluate and predict the potential success of airdrop campaigns. By analyzing on-chain metrics, users can better understand community engagement, token liquidity, and overall project viability. In this guide, we’ll explore how to leverage on-chain data to make smarter decisions when it comes to airdrops.

1. What is On-Chain Analytics?

On-chain analytics involves examining data that is publicly available on the blockchain. This data includes transaction volume, wallet activity, token transfers, and liquidity metrics. Unlike off-chain metrics, which rely on third-party data sources, on-chain data is transparent and verifiable. On-chain analytics tools allow users to access this data to gain insights into a project’s activity, user engagement, and the overall health of the network.

When it comes to airdrops, on-chain analytics can reveal valuable information about the project’s community, liquidity levels, and token distribution patterns. This can help users determine whether an airdrop has the potential to be successful and profitable.

2. Key On-Chain Metrics to Evaluate Airdrop Success

Using on-chain analytics to evaluate airdrop success requires focusing on specific metrics. Here are the most important on-chain metrics that can provide insight into an airdrop’s potential profitability:

2.1 Active Addresses and Community Growth

One of the first indicators of a potentially successful airdrop is the number of active addresses interacting with the project. Active addresses indicate user interest and engagement with the project. A higher number of active addresses signals a more engaged community, which is often necessary for a successful airdrop.

For example, if a project like Uniswap or Aave has thousands of active addresses before an airdrop, this signals high community interest and a likely demand for the airdropped tokens. Tools like Dune Analytics and Glassnode can help track active addresses over time, giving users an idea of how engaged a community is.

2.2 Token Holder Distribution

Analyzing token distribution among holders is also crucial. If tokens are concentrated in the hands of a few large wallets, this might indicate a high risk of price manipulation or dumping after the airdrop. A more evenly distributed token supply is preferable, as it reduces the likelihood of sudden price volatility.

For instance, on-chain analytics can show if a project has a decentralized token distribution. If many small wallets hold the token, it reflects a broader community interest and could mean a more stable post-airdrop price. Platforms like Etherscan and Nansen offer tools to view token holder distribution, helping users assess the risk associated with the airdrop.

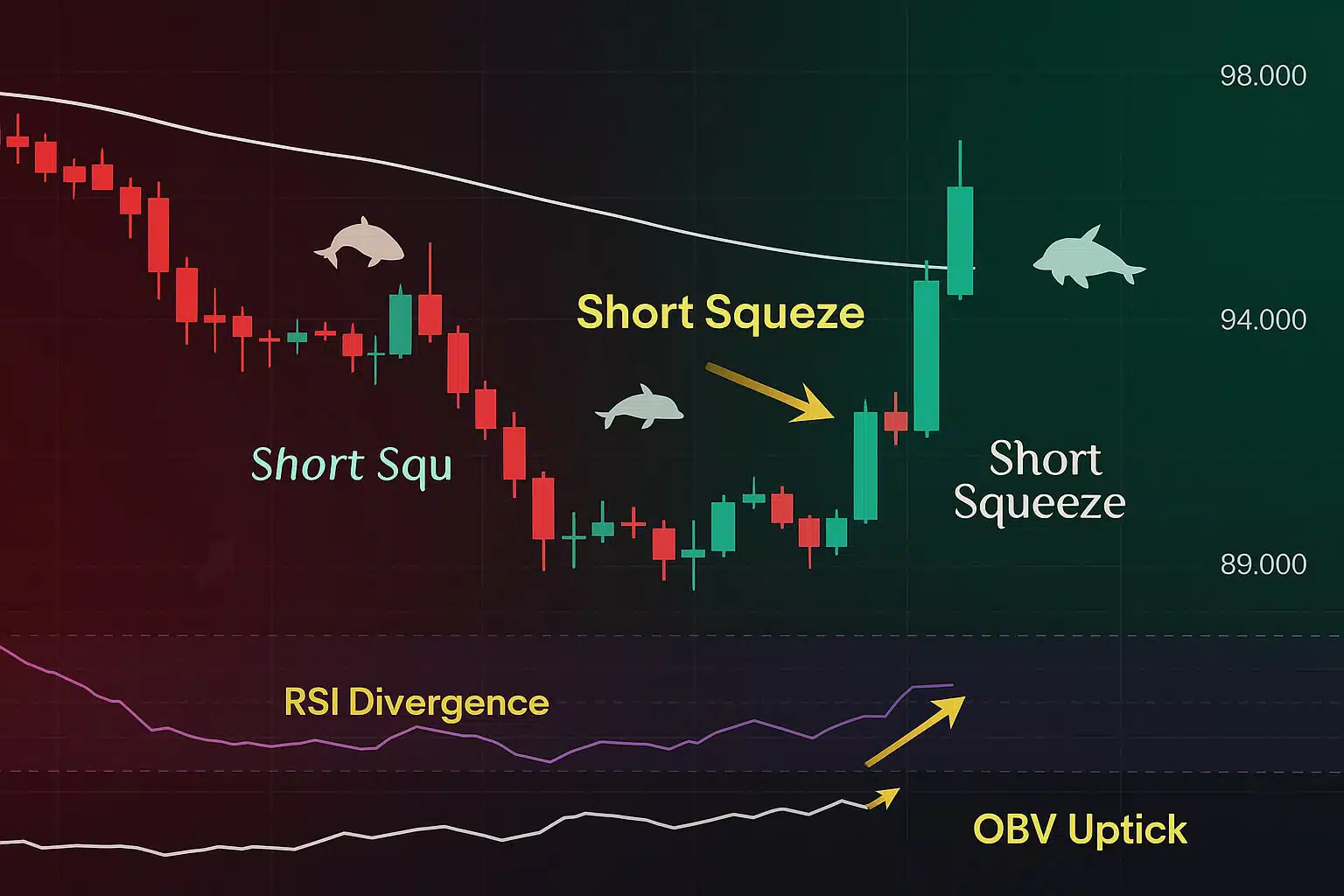

2.3 Transaction Volume and Liquidity

Transaction volume is a direct indicator of a token’s popularity and usability. Higher transaction volume suggests that the token is actively traded, which is beneficial for potential liquidity after the airdrop. Low transaction volume may indicate limited interest or use cases for the token.

Liquidity metrics are also essential. Adequate liquidity ensures that users can buy and sell tokens without significant price impact. If a project shows low liquidity in decentralized exchanges (DEXs) like Uniswap or SushiSwap, it may signal that the token will struggle to maintain value post-airdrop. DeFi Pulse and DappRadar are valuable tools for tracking liquidity and transaction volumes.

3. Using Historical Airdrop Data to Predict Success

Another effective way to evaluate airdrop success is by examining historical data from past airdrops. By analyzing previous campaigns, users can identify patterns and trends that may indicate a successful airdrop. Here’s how to use historical data for insights:

3.1 Compare with Similar Projects

Looking at successful airdrops from similar projects can provide clues about the potential success of an upcoming airdrop. For instance, if a project in the decentralized finance (DeFi) space, like Compound or SushiSwap, has had a successful airdrop, another DeFi project with similar characteristics might follow the same trend.

Historical data, such as community growth and token price movements after previous airdrops, can guide predictions. On-chain analytics platforms like Nansen offer historical data and comparisons, making it easier to gauge the potential success of similar projects.

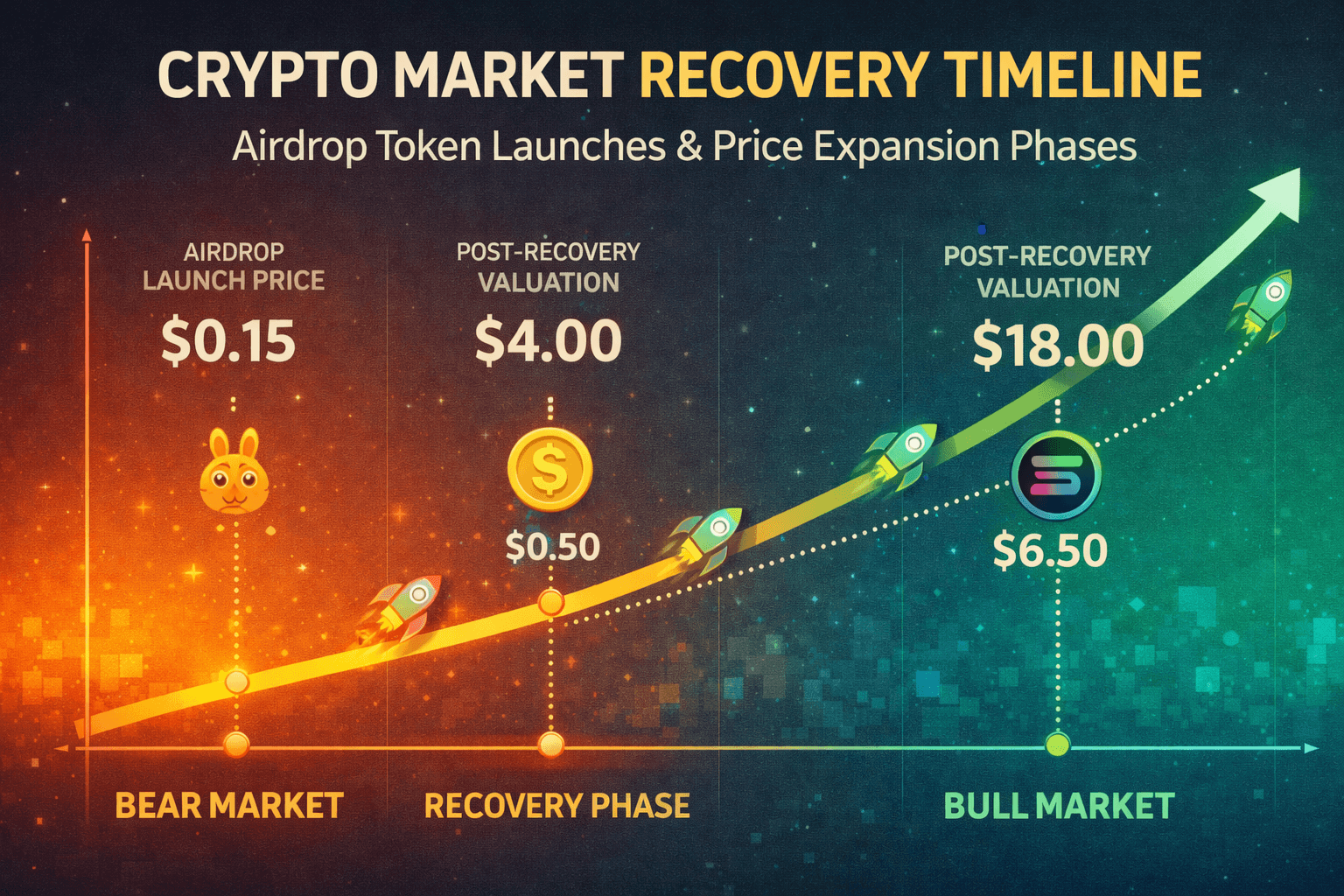

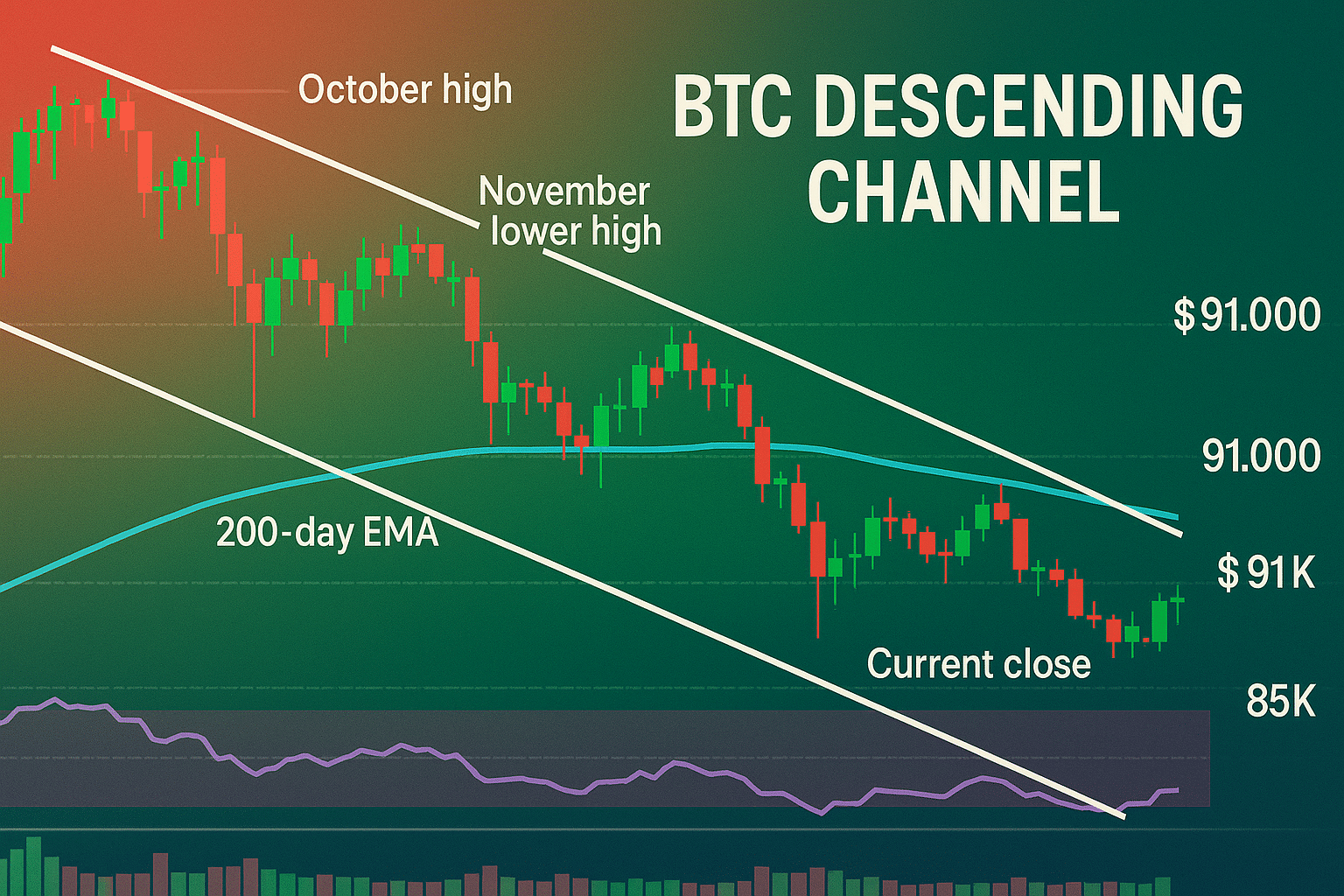

3.2 Analyze Post-Airdrop Token Price Performance

One key factor to evaluate is how the token price performs after an airdrop. Many tokens experience a price spike followed by a correction as users sell off their airdropped tokens. By studying previous airdrops, you can assess whether a project has the potential for long-term value retention.

For example, tokens from projects like Uniswap and 1inch saw initial price surges post-airdrop, followed by periods of stabilization. Using on-chain analytics to track price trends after airdrops can help set realistic expectations for future campaigns.

4. Red Flags to Watch for in On-Chain Data

While on-chain analytics provide valuable insights, they can also reveal red flags that may suggest an airdrop is less likely to be successful. Here are a few red flags to be aware of:

4.1 High Concentration in a Few Wallets

If a large portion of the tokens is held by just a few wallets, it’s a potential risk. These holders could quickly dump the token post-airdrop, leading to significant price drops. This is especially common in projects where early investors or insiders hold large stakes.

4.2 Low Community Engagement

A low number of active addresses and limited on-chain activity may suggest that the project lacks a strong community. This could lead to low demand for the token after the airdrop, making it less valuable for recipients. Checking active user growth over time can signal whether the community is genuinely interested in the project.

4.3 Low Liquidity in DeFi Markets

Low liquidity can result in high price volatility, making it difficult to buy or sell tokens without a significant price impact. If the project has low liquidity on major DEXs, it may be a sign of limited demand, which could negatively affect the token’s value after the airdrop.

5. Recommended Tools for On-Chain Analytics in Airdrop Evaluation

Several platforms provide on-chain analytics, helping users evaluate upcoming airdrops based on real data:

- Nansen: Offers wallet tracking, token flow analysis, and community metrics.

- Glassnode: Provides metrics on active addresses, token distribution, and network health.

- Dune Analytics: Customizable dashboards for tracking specific on-chain data points like transaction volume and token distribution.

- Etherscan: Allows users to explore wallet activities and token distribution directly on the Ethereum blockchain.

- DeFi Pulse: Great for tracking liquidity levels and transaction volumes in DeFi tokens, providing insights into token demand.

These tools provide the data necessary to make informed decisions on which airdrops have the best chance for success and profitability.

Conclusion

On-chain analytics for airdrop success is transforming the way crypto users evaluate potential airdrop opportunities. By analyzing key metrics like active addresses, token distribution, liquidity, and transaction volume, users can predict which airdrops are more likely to succeed and provide long-term value. With platforms like Nansen, Dune Analytics, and Glassnode, users have access to powerful data that helps them make informed decisions.

Whether you’re an active participant in airdrops or a casual observer, using on-chain data provides a clearer picture of each opportunity’s potential. This data-driven approach can help avoid risky airdrops and maximize the rewards from profitable ones. As the blockchain space grows, on-chain analytics will continue to be a valuable resource for predicting and evaluating airdrop success.

For more insights and detailed guides on blockchain applications and analytics, visit our Blockchain Technology Guides.

Stay Updated

For the latest insights on on-chain analytics, airdrop strategies, and crypto trends, follow us on:

Stay informed with the latest strategies and insights in the world of cryptocurrency at FreeCoins24.io.

Special Offer

Looking to trade tokens from cross-chain airdrops? Sign up on Bybit today and enjoy up to $30,000 in deposit bonuses! Trade confidently on a top crypto platform.