As blockchain technology continues to disrupt traditional industries, decentralized marketplaces have emerged as an alternative to centralized e-commerce platforms. Decentralized marketplaces allow users to buy, sell, and trade goods or digital assets directly, without intermediaries. These marketplaces are often based on blockchain technology, offering transparency, security, and ownership to participants. However, to grow and sustain vibrant communities of buyers and sellers, decentralized marketplaces need effective strategies to attract users. This is where airdrops come in.

Airdrops, which are the free distribution of tokens to users, have become an essential tool for attracting users and fostering engagement in decentralized marketplaces. In this article, we’ll explore how decentralized marketplaces are leveraging airdrops to bring in buyers and sellers, incentivize engagement, and create thriving blockchain-powered communities.

1. Understanding Decentralized Marketplaces

A decentralized marketplace is an online platform that facilitates peer-to-peer transactions without a central authority or middleman. Unlike traditional platforms like Amazon or eBay, which control and profit from user data, decentralized marketplaces are powered by smart contracts on blockchain networks, enabling secure and transparent transactions.

In these marketplaces, users can trade a variety of assets, including:

- Physical goods: Items sold directly from seller to buyer with secure payment options.

- Digital assets: NFTs, digital art, music, and collectibles.

- Financial products: DeFi marketplaces for trading tokens, lending, or staking.

Decentralized marketplaces allow users to retain full control over their assets and offer lower transaction fees, increased privacy, and better user control. However, to attract a critical mass of users, these platforms often need a compelling incentive to encourage people to join, interact, and remain engaged. This is where airdrops play a crucial role.

2. The Role of Airdrops in Decentralized Marketplaces

Airdrops serve as a powerful tool for incentivizing participation and building community in decentralized marketplaces. By distributing tokens or other digital assets to users, marketplaces can create excitement, attract new users, and encourage active participation. Here are some of the ways airdrops are used in decentralized marketplaces:

A. Attracting New Buyers and Sellers

One of the primary challenges for any new marketplace is attracting a large enough base of buyers and sellers to create a viable ecosystem. Airdrops provide an enticing way to bring new users to the platform by offering them free tokens or other digital assets upon signing up.

Example: A decentralized NFT marketplace may offer token airdrops to users who sign up and create a profile on the platform. This initial incentive encourages users to join and explore the marketplace, while also giving them a stake in the platform’s ecosystem.

B. Rewarding Early Adopters

Early adopters play a vital role in the success of decentralized marketplaces, as they provide the initial momentum needed to attract more users. Airdrops allow marketplaces to reward these early adopters with tokens, making them feel appreciated and more likely to stay active on the platform.

Example: A new DeFi marketplace could airdrop tokens to the first 1,000 users who make a transaction on the platform. This approach incentivizes early adoption and builds a loyal community of initial users who are more likely to support the marketplace’s growth.

C. Incentivizing Transactions and Engagement

Airdrops can also be used to encourage specific actions, such as buying, selling, or even just browsing listings on the platform. By rewarding users for these actions, decentralized marketplaces can drive engagement and keep the community active.

Example: A decentralized e-commerce marketplace could airdrop tokens to users who complete a certain number of purchases within a set period. This incentivizes buyers to return to the platform and make repeat transactions, helping the marketplace build a loyal customer base.

D. Building a Community Around Governance

Many decentralized marketplaces are community-driven and governed by their users. In these platforms, airdrops of governance tokens encourage users to participate in the decision-making process, shaping the future of the marketplace.

Example: A marketplace might airdrop governance tokens to active buyers and sellers, allowing them to vote on key issues such as platform upgrades, fee structures, and promotional events. This approach builds a community of stakeholders who feel invested in the platform’s success.

E. Promoting Loyalty with Exclusive NFT Airdrops

NFTs (Non-Fungible Tokens) play a significant role in decentralized marketplaces, especially in those focused on digital art, collectibles, or gaming. By offering exclusive NFTs as airdrops, marketplaces can encourage user loyalty and reward long-term participants.

Example: A decentralized NFT marketplace might airdrop limited-edition digital collectibles to users who have been active on the platform for a certain period. These exclusive NFTs create a sense of value and exclusivity, strengthening the marketplace’s relationship with its users.

3. Airdrop Strategies in Decentralized Marketplaces

Decentralized marketplaces employ various airdrop strategies to engage users and build a sustainable community. Here are some of the most effective approaches:

A. Retroactive Airdrops

Retroactive airdrops reward users based on their past interactions with the platform. This strategy recognizes and rewards users who have been early adopters or consistent participants, encouraging them to stay engaged.

Example: A marketplace may retroactively airdrop tokens to users who have made a certain number of purchases or sales over the past year. This creates excitement and gratitude among loyal users, as they feel recognized for their contributions.

B. Referral-Based Airdrops

Referral-based airdrops incentivize users to bring new participants to the platform. By rewarding users who refer friends or colleagues, decentralized marketplaces can grow their user base organically and cost-effectively.

Example: A decentralized marketplace might offer a small token airdrop to both the referrer and the new user when someone signs up through a referral link. This approach drives organic growth and creates a network effect as users invite others to join.

C. Task-Based Airdrops

Task-based airdrops reward users for completing specific actions or tasks, such as making a transaction, listing a product, or participating in a community event. This type of airdrop encourages users to engage in ways that directly benefit the marketplace.

Example: A marketplace may offer airdrops to users who complete their first five sales or purchases on the platform. This incentivizes early engagement and motivates users to reach specific milestones within the marketplace.

D. Seasonal or Event-Based Airdrops

Some decentralized marketplaces conduct airdrops during special events, such as platform anniversaries, partnerships, or new feature launches. Seasonal or event-based airdrops create excitement and give users a reason to check back on the platform.

Example: A marketplace could hold an anniversary event and airdrop tokens to all users who made a transaction within that month. This seasonal reward encourages users to stay connected and look out for future events.

4. Benefits of Airdrops in Decentralized Marketplaces

Using airdrops to attract and retain users offers numerous benefits for decentralized marketplaces:

- Increased User Base: Airdrops help bring in new buyers and sellers, creating a robust ecosystem that benefits all users.

- Enhanced User Engagement: By rewarding users for specific actions, airdrops incentivize continued participation and help retain active users.

- Community Building: Airdrops foster a sense of community by distributing tokens that represent ownership or voting rights, making users feel like stakeholders in the platform.

- Higher Liquidity and Transaction Volume: As more users engage with the marketplace, the liquidity and transaction volume increase, making the platform more attractive to buyers and sellers.

5. Examples of Decentralized Marketplaces Using Airdrops

Several decentralized marketplaces are already using airdrops to drive engagement and build communities. Here are a few examples:

a. OpenSea

OpenSea, one of the largest NFT marketplaces, has used token airdrops to engage its community and incentivize activity. While OpenSea doesn’t have a native token yet, rumors of a potential airdrop have driven interest, leading many users to actively engage in anticipation. This strategy shows how even the prospect of an airdrop can encourage user engagement.

b. Rarible

Rarible, a popular NFT marketplace, has issued RARI tokens as rewards to users who buy and sell on the platform. These tokens are distributed weekly based on users’ transaction volumes, rewarding active participants and giving them voting rights in the platform’s governance. This airdrop strategy has been instrumental in building Rarible’s community and promoting user engagement.

c. Uniswap

Although primarily a decentralized exchange, Uniswap also operates as a marketplace for token swaps. Uniswap’s massive retroactive airdrop of its UNI governance token to early users was a groundbreaking move that attracted global attention. This airdrop not only rewarded early adopters but also positioned Uniswap as a community-driven platform, inspiring other marketplaces to consider similar approaches.

6. Challenges of Using Airdrops in Decentralized Marketplaces

While airdrops are effective, they come with challenges:

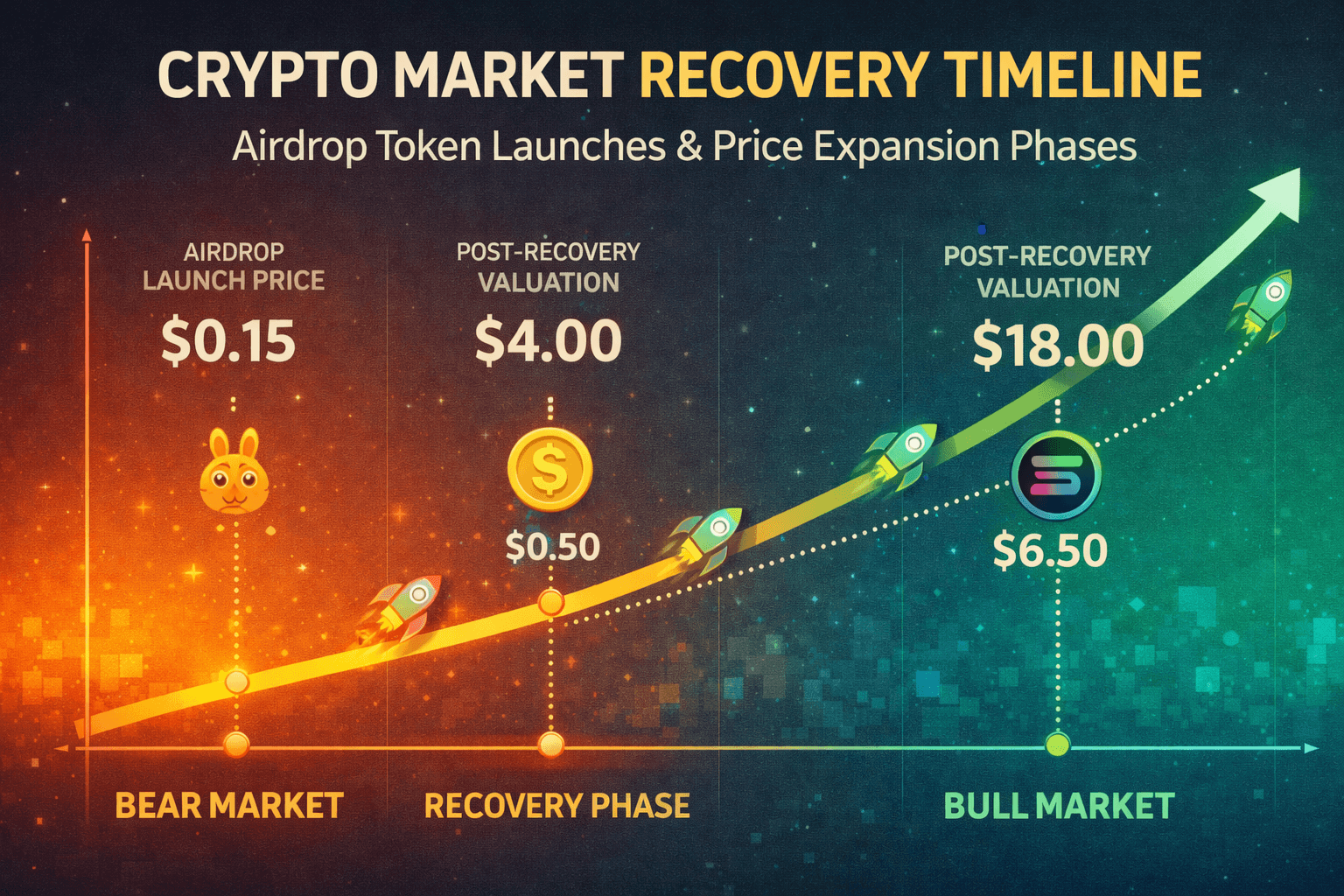

- Risk of Token Dumping: Users may sell their airdropped tokens immediately, leading to price drops and volatility. To prevent this, marketplaces can consider time-locked airdrops to encourage long-term commitment.

- Cost of Airdrop Campaigns: Airdrops, especially on a large scale, can be costly. Platforms need to weigh the benefits against the cost of distributing tokens.

- Compliance and Regulation: Airdrops may face regulatory scrutiny, especially if tokens have monetary value. Marketplaces must ensure compliance to avoid legal issues.

Conclusion

Airdrops are transforming decentralized marketplaces by offering a powerful tool for user acquisition, engagement, and retention. By distributing tokens to users, decentralized marketplaces attract buyers and sellers, reward loyalty, and encourage participation in governance. Airdrops make users feel like stakeholders, fostering a sense of community and commitment that is crucial for the growth of these platforms.

As blockchain-based marketplaces continue to expand, airdrops will likely remain a key strategy for attracting users and building sustainable communities.

For more insights on airdrops and decentralized platforms, visit our Cryptocurrency Comparisons Guides.

Stay Updated

For the latest updates on airdrops and decentralized marketplaces, follow us on:

Stay informed with the latest crypto insights at FreeCoins24.io.

Special Offer

Want to trade tokens from decentralized marketplace airdrops? Sign up on Bybit today and enjoy up to $30,000 in deposit bonuses! Trade confidently on a top crypto platform.