In the world of cryptocurrency and decentralized finance (DeFi), airdrops are a popular way for blockchain projects to distribute tokens to users. Airdrops often serve as a reward for early adoption, participation in a community, or as an incentive for certain behaviors, such as staking. As interest in airdrops grows, so does the competition for receiving these rewards. One effective strategy for increasing your chances of receiving larger airdrop allocations is to utilize staking pools.

Staking pools allow you to combine your resources with other users, maximizing your staking power. By participating in staking pools, you not only earn staking rewards but also increase your eligibility for larger and more frequent airdrops. In this article, we’ll explore how staking pools work, why they’re beneficial for airdrop hunters, and specific strategies you can use to maximize your airdrop rewards.

1. Understanding Staking Pools and Airdrop Rewards

Staking involves locking up a certain amount of cryptocurrency in a blockchain network to support its operations, such as validating transactions or securing the network. In return, stakers receive rewards, typically in the form of the network’s native tokens. A staking pool is a group of investors who combine their assets to increase their staking power, which often leads to higher returns.

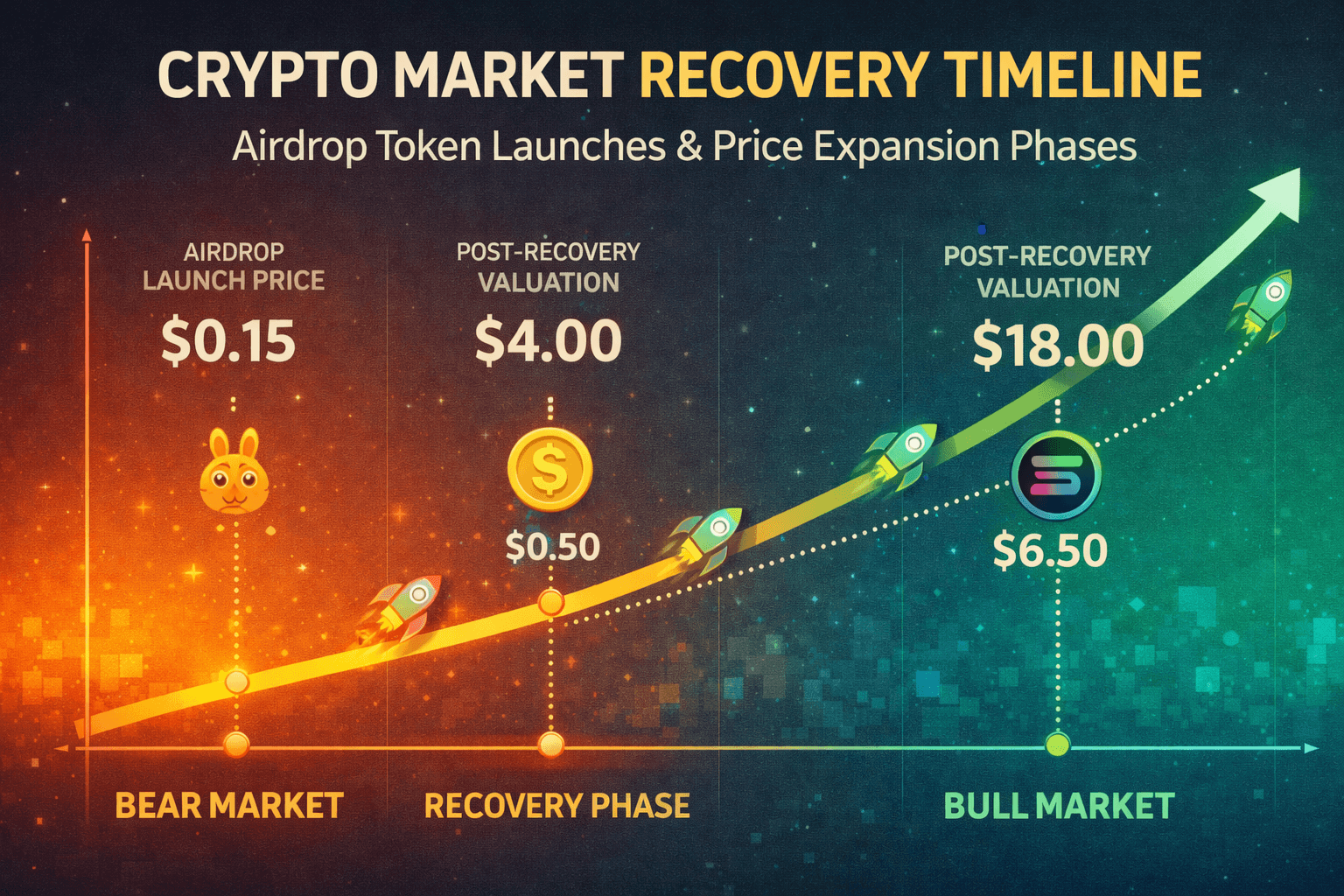

In recent years, airdrops have become a popular way for blockchain projects to distribute tokens to stakers. Many projects reward those who actively stake tokens within their ecosystem, viewing them as dedicated and valuable community members. Some airdrops are given exclusively to stakers, making staking pools an attractive option for those who want to increase their chances of receiving these token rewards.

2. How Staking Pools Can Increase Airdrop Rewards

Staking pools can enhance your eligibility for airdrops in several ways:

A. Pooling Resources for Higher Staking Power

By joining a staking pool, you’re combining your resources with other participants, which increases your total staking power. In many blockchain ecosystems, staking rewards and airdrop allocations are proportional to the amount of tokens staked. Therefore, participating in a pool gives you more staking weight, which can lead to .

Example: In networks like Cosmos or Polkadot, the more tokens you stake, the higher your potential rewards. By joining a pool, you collectively stake more tokens, increasing your chances of qualifying for larger airdrops.

B. Consistent Staking Activity

Many airdrops target users who have a consistent staking history, rewarding those who have staked continuously over a certain period. Staking pools make it easier to maintain consistent staking because they handle the technical aspects, like validator selection and rewards management. This consistency can make you eligible for airdrops that reward loyal and consistent stakers.

Example: A project may airdrop tokens to users who have staked continuously for six months. By joining a staking pool, you ensure that your assets remain staked without interruption, meeting the eligibility criteria for such airdrops.

C. Access to Airdrops for Smaller Holders

Some airdrops have minimum staking thresholds, meaning only those who stake above a certain amount qualify. For smaller investors, meeting these thresholds alone might be challenging. By joining a staking pool, you can combine your holdings with others to meet these minimum requirements and gain access to airdrops that would otherwise be out of reach.

Example: A project may require users to stake at least 500 tokens to qualify for an airdrop. If you only hold 100 tokens, joining a pool with other small holders can help you meet the threshold and receive the airdrop.

3. Strategies for Using Staking Pools to Maximize Airdrop Rewards

To make the most out of staking pools for airdrop rewards, you’ll need to adopt some specific strategies. Here are a few ways to boost your chances of receiving valuable airdrops by using staking pools effectively:

A. Choose the Right Staking Pool

Not all staking pools are created equal. When selecting a staking pool, consider factors like pool fees, reputation, staking power, and the network’s airdrop history. Look for pools with a strong track record in the network you’re interested in, as some pools are more active and have better access to exclusive airdrops.

Tip: Research the pool’s past performance and see if they’ve successfully participated in airdrops. Pools with high staking power and reputable validators are more likely to be considered by projects for future airdrops.

B. Focus on Networks Known for Airdrops

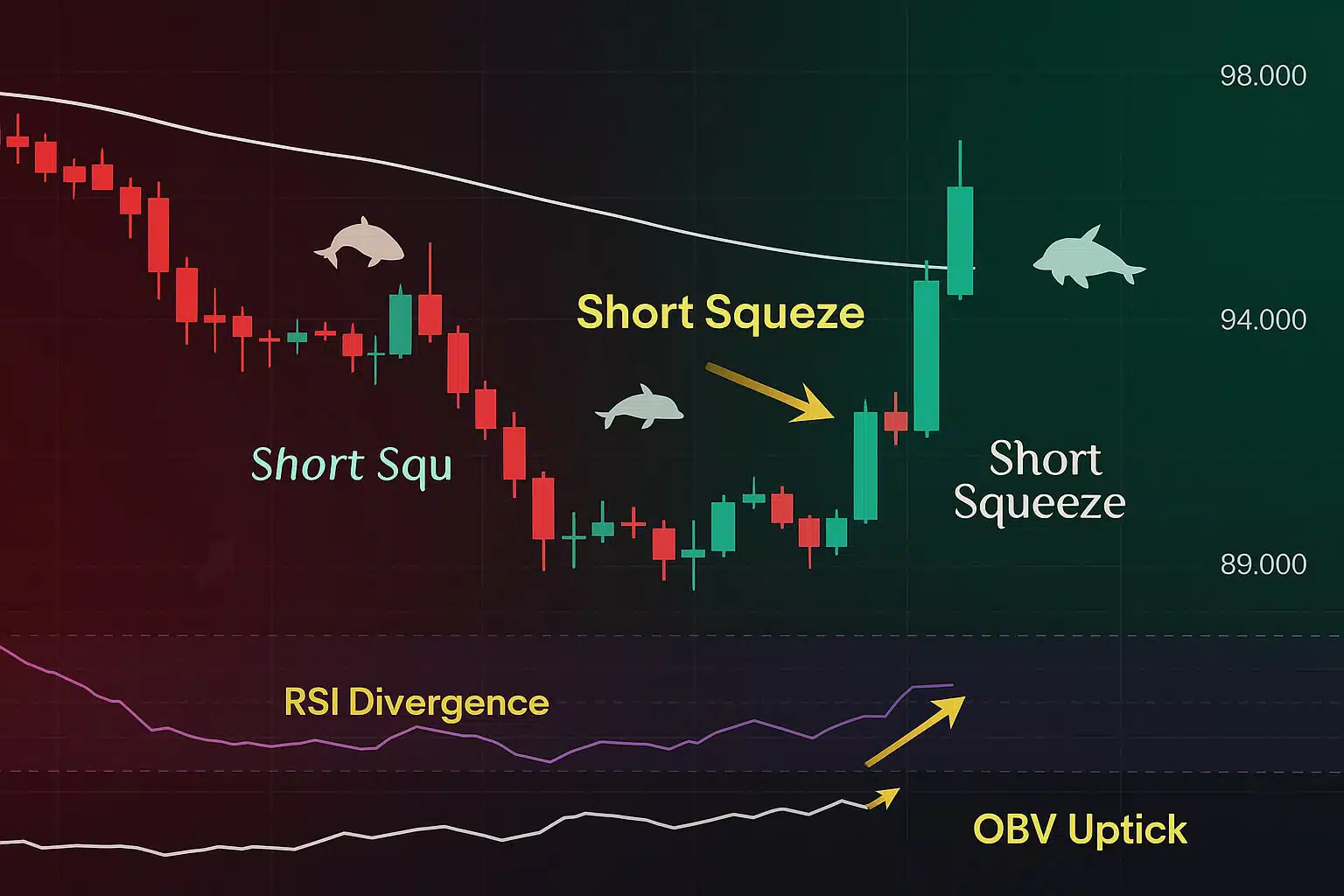

Some blockchain networks are more airdrop-friendly than others. Cosmos, Polkadot, and Solana are known for frequent airdrops to stakers. By joining staking pools on these networks, you increase your chances of receiving airdrop rewards. Keep an eye on projects that are launching on these networks, as they often reward early adopters and active stakers.

Tip: Research upcoming projects on networks that have a history of airdrops. Platforms like Cosmos and Polkadot have robust ecosystems with multiple projects that distribute tokens to stakers.

C. Diversify Across Multiple Staking Pools

To maximize your airdrop rewards, consider diversifying across multiple staking pools on different networks. This strategy not only spreads risk but also increases your exposure to different airdrop opportunities. If one pool or network doesn’t receive an airdrop, another one might, ensuring you have multiple opportunities to earn rewards.

Example: You could stake some assets in a Cosmos pool, another portion in a Polkadot pool, and additional assets in a Solana pool. This way, you’re eligible for airdrops across multiple ecosystems.

D. Stay Informed About Upcoming Airdrops

Many airdrops are announced in advance or hinted at by projects. Staying informed allows you to adjust your staking strategy accordingly. Join relevant forums, social media groups, and Discord communities to keep up-to-date on potential airdrops. If a project announces an airdrop for stakers, you can consider joining a staking pool or increasing your stake to qualify.

Tip: Follow Twitter accounts, newsletters, and communities focused on airdrop announcements and DeFi opportunities. Websites like CoinMarketCap and platforms like Twitter often share upcoming airdrops.

E. Reinvest Your Staking Rewards

In many staking pools, the rewards you earn from staking can be compounded by restaking them. By reinvesting your staking rewards, you gradually increase your staking power, which can improve your eligibility for future airdrops. Over time, compounding your rewards can lead to significantly larger airdrop allocations.

Example: If you earn staking rewards in a Cosmos pool, consider restaking them to build up your holdings. This increased stake will make you more attractive for future airdrops.

4. Benefits of Using Staking Pools for Airdrop Rewards

Participating in staking pools offers several advantages beyond increasing your airdrop potential:

- Higher Returns: Pools often have higher staking rewards due to their collective power, providing additional financial gains beyond airdrops.

- Access to Exclusive Airdrops: Some projects only distribute airdrops to larger stakeholders or specific validators. By joining a pool, you may gain access to exclusive rewards.

- Passive Income: Staking pools handle all the technical aspects, allowing you to earn rewards passively without constant monitoring.

- Community and Information Sharing: Many staking pools foster communities where members share insights and tips on upcoming airdrops and DeFi opportunities.

5. Examples of Staking Pools Known for Airdrop Rewards

Here are a few staking pools and networks that are popular for airdrop seekers:

a. Cosmos Hub Staking Pools

Cosmos has a strong history of airdrops to ATOM stakers. Projects launching within the Cosmos ecosystem often reward ATOM stakers with token airdrops, making Cosmos staking pools a prime choice for airdrop hunters.

b. Polkadot Parachain Slot Auctions

Polkadot’s unique parachain slot auction system frequently rewards DOT stakers with tokens from projects that secure a parachain slot. Many staking pools within Polkadot’s ecosystem facilitate these auctions, distributing rewards to stakers who participate.

c. Solana Staking Pools

Solana has an active staking ecosystem, and several projects in the Solana network have conducted airdrops to SOL stakers. By joining a SOL staking pool, you can increase your chances of receiving rewards from upcoming Solana-based projects.

Conclusion

Staking pools offer a powerful way to increase your airdrop rewards by leveraging collective staking power, consistent participation, and access to a broader range of opportunities. By joining staking pools, crypto investors can maximize their chances of receiving larger airdrop allocations while earning staking rewards. Whether you’re new to DeFi or an experienced airdrop hunter, utilizing staking pools can help you gain more value from your cryptocurrency holdings.

To make the most out of staking pools, remember to choose the right networks, diversify across multiple pools, and stay informed about upcoming airdrop opportunities. With the right strategies, staking pools can be an invaluable tool in your crypto investment arsenal.

For more insights on DeFi strategies and airdrop tips, visit our Cryptocurrency Comparisons Guides.

Stay Updated

For the latest updates on staking, airdrops, and DeFi strategies, follow us on:

Stay informed with the latest crypto insights at FreeCoins24.io.

Special Offer

Want to trade and earn rewards from staking? Sign up on Bybit today and enjoy up to $30,000 in deposit bonuses! Trade confidently on a top crypto platform.