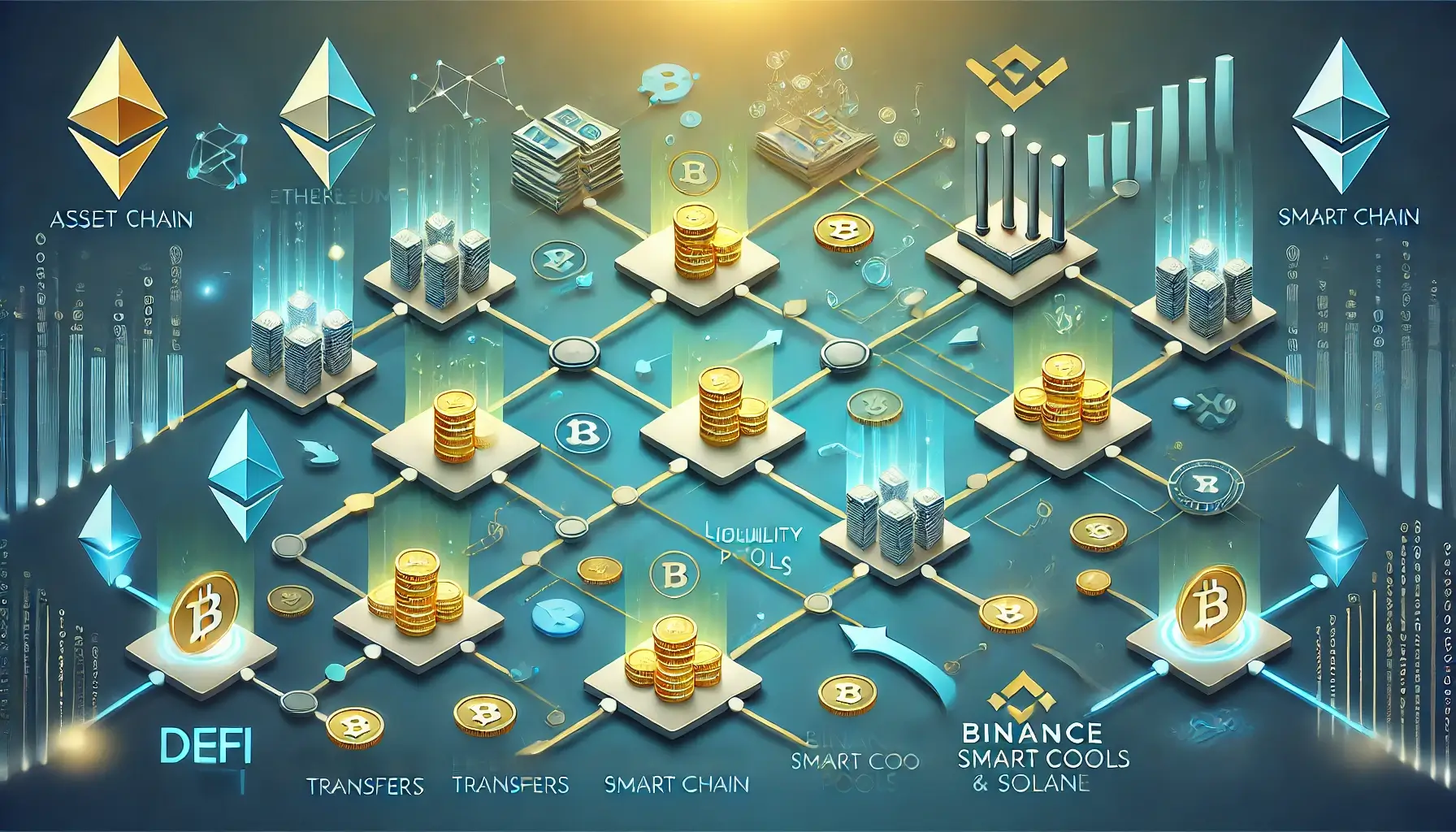

Decentralized Finance (DeFi) is no longer confined to individual blockchains. Cross-chain DeFi protocols are connecting ecosystems, enabling seamless asset transfers, and fostering interoperability across networks like Ethereum, Binance Smart Chain, Solana, and Avalanche. However, building a robust cross-chain ecosystem requires liquidity, user engagement, and trust key areas where airdrops in cross-chain DeFi protocols are playing a transformative role.

Airdrops, or free token distributions, have become a popular mechanism for incentivizing users, attracting liquidity, and promoting adoption in multi-chain DeFi ecosystems. This article explores how airdrops are driving growth in cross-chain DeFi, their impact on liquidity and user engagement, and strategies for leveraging them effectively.

1. Understanding Cross-Chain DeFi Protocols

1.1 What Are Cross-Chain DeFi Protocols?

Cross-chain DeFi protocols are decentralized applications (dApps) and platforms designed to operate across multiple blockchain networks. They aim to:

- Enable seamless asset transfers between chains.

- Facilitate multi-chain liquidity pooling.

- Promote interoperability and user choice.

Examples include platforms like ThorChain, Cosmos, and Polkadot, which focus on connecting different ecosystems to create a unified DeFi experience.

1.2 Challenges in Cross-Chain DeFi Adoption

Despite their potential, cross-chain protocols face obstacles such as:

- Liquidity Fragmentation: Limited user participation across chains reduces overall liquidity.

- User Onboarding: Convincing users to engage with new platforms can be challenging.

- Trust Issues: Users often hesitate to adopt new protocols due to concerns about security and reliability.

This is where airdrops come in, offering a solution to incentivize participation and build trust.

2. How Airdrops Drive Adoption in Cross-Chain DeFi

2.1 Attracting Early Users

Airdrops reward early adopters who engage with cross-chain platforms. By providing free tokens, projects encourage users to:

- Test bridges and swap assets between chains.

- Explore liquidity pools across multiple networks.

- Become familiar with the platform’s functionality.

For example, ThorChain distributed its RUNE tokens to attract liquidity providers and bootstrap its cross-chain swapping mechanism.

2.2 Boosting Liquidity in Multi-Chain Pools

Liquidity is critical for DeFi protocols to function effectively. Airdrops incentivize users to deposit assets into liquidity pools, enabling:

- Seamless Token Swaps: Improved liquidity allows users to swap assets across chains with lower fees and slippage.

- Yield Farming Opportunities: Many cross-chain protocols reward liquidity providers with additional tokens, increasing user engagement.

2.3 Incentivizing Governance Participation

Governance tokens distributed via airdrops empower users to participate in protocol decision-making. This fosters a sense of ownership and aligns user incentives with the platform’s growth.

- Example: Cosmos distributed ATOM tokens to promote governance and ecosystem expansion across its interconnected blockchains.

2.4 Driving Interoperability Awareness

Airdrops encourage users to explore the benefits of interoperability by interacting with cross-chain tools. These interactions often include:

- Bridging assets between networks.

- Using decentralized exchanges (DEXs) that support cross-chain functionality.

- Staking tokens on cross-chain platforms.

3. Key Examples of Airdrops in Cross-Chain DeFi

3.1 Optimism (OP)

Optimism rewarded early adopters of its Ethereum Layer 2 solution with OP tokens. These tokens incentivized liquidity provision and governance participation while promoting interoperability between Ethereum and its Layer 2 ecosystem.

3.2 Polkadot and Kusama Parachain Auctions

Polkadot and Kusama used airdrops to reward users who participated in their parachain auctions. Token rewards like DOT and KSM incentivized staking and liquidity provision for cross-chain functionality.

3.3 ThorChain (RUNE)

ThorChain distributed RUNE tokens to bootstrap liquidity and reward users who participated in cross-chain swaps. These incentives helped establish ThorChain as a leader in the multi-chain DeFi space.

3.4 Avalanche Rush Program

Avalanche’s incentive program distributed AVAX tokens to liquidity providers and DeFi users, promoting cross-chain activity and increasing user adoption.

4. Benefits of Airdrops for Cross-Chain DeFi Protocols

4.1 Rapid User Acquisition

Airdrops attract new users by offering tangible rewards for exploring cross-chain platforms. This onboarding strategy helps grow the user base quickly.

4.2 Improved Liquidity

By incentivizing liquidity provision, airdrops ensure that users can trade assets efficiently across chains, reducing barriers to entry.

4.3 Ecosystem Growth

Distributing tokens across chains encourages developers to build on the protocol, fostering a thriving ecosystem of dApps and services.

4.4 Enhanced User Engagement

Airdrops tied to governance or staking encourage long-term participation, ensuring sustained engagement with the platform.

5. Strategies for Leveraging Cross-Chain Airdrops

5.1 Stay Active Across Ecosystems

Engage with protocols like Polkadot, Cosmos, and Avalanche to qualify for airdrops. Activities include:

- Staking tokens.

- Participating in governance.

- Using bridges to transfer assets.

5.2 Use Airdrop Aggregators

Platforms like Earnifi, AirdropAlert, and DappRadar list active cross-chain airdrops. Monitor these platforms to stay updated on high-value opportunities.

5.3 Diversify Participation

Interact with multiple blockchains to maximize your chances of qualifying for airdrops. For example, bridge assets on ThorChain while staking on Cosmos to increase your rewards.

5.4 Hold Airdropped Tokens

Governance tokens acquired through airdrops often appreciate in value over time. Instead of selling immediately, consider holding tokens to benefit from long-term growth.

6. Challenges in Airdrop Campaigns

6.1 Token Dumping

Many users sell their tokens immediately, leading to price volatility. Protocols can mitigate this by implementing vesting schedules or requiring staking.

6.2 Attracting Opportunistic Users

Airdrops may attract users who participate solely for rewards without engaging with the protocol long-term. Requiring meaningful contributions can reduce this issue.

6.3 Sustainability

Over-reliance on airdrops can strain tokenomics. Projects need to balance reward distribution with long-term sustainability.

Conclusion

Airdrops in cross-chain DeFi protocols are driving innovation by attracting users, boosting liquidity, and promoting ecosystem growth. Projects like ThorChain, Cosmos, and Polkadot demonstrate how well-structured airdrop campaigns can foster adoption and engagement in multi-chain ecosystems.

For users, participating in cross-chain airdrop campaigns offers not only financial rewards but also an opportunity to explore cutting-edge technologies and support the evolution of decentralized finance. Start leveraging airdrops today to become an active part of the cross-chain DeFi revolution.

For more insights and detailed guides on blockchain strategies, visit our Cryptocurrency Comparisons Guides.

Stay Updated

For the latest updates on DeFi strategies and cross-chain incentives, follow us on:

Special Offer

Ready to explore cross-chain DeFi opportunities? Sign up on Bybit today and claim up to $30,000 in deposit bonuses. Start trading on one of the most trusted crypto platforms.