In recent days, rumors about BlackRock forking Bitcoin have taken the crypto world by storm. Some speculate that the world’s largest asset manager, holding over $55 billion in Bitcoin, might create its own forked version of the network. The concerns arose from language in BlackRock’s Bitcoin ETF filing, which mentions fork-related risks.

But is this a real threat to Bitcoin’s integrity, or is it just baseless FUD (Fear, Uncertainty, and Doubt)? Let’s explore the facts and assess the risks of this scenario.

What Does BTC Forking Mean?

Forking refers to the process of creating a new blockchain by modifying the original code. Developers do not change the existing protocol but instead create a separate network with new rules.

Examples of previous Bitcoin forks include:

- Bitcoin Cash (BCH): Forked in 2017 to address scalability issues by increasing block size.

- Bitcoin SV (BSV): Another fork, spearheaded by Craig Wright, aimed at further increasing block size but failed to gain widespread traction.

Forks can create significant market disruptions, divide communities, and generate confusion among investors.

Why Are People Talking About BlackRock Forking Bitcoin?

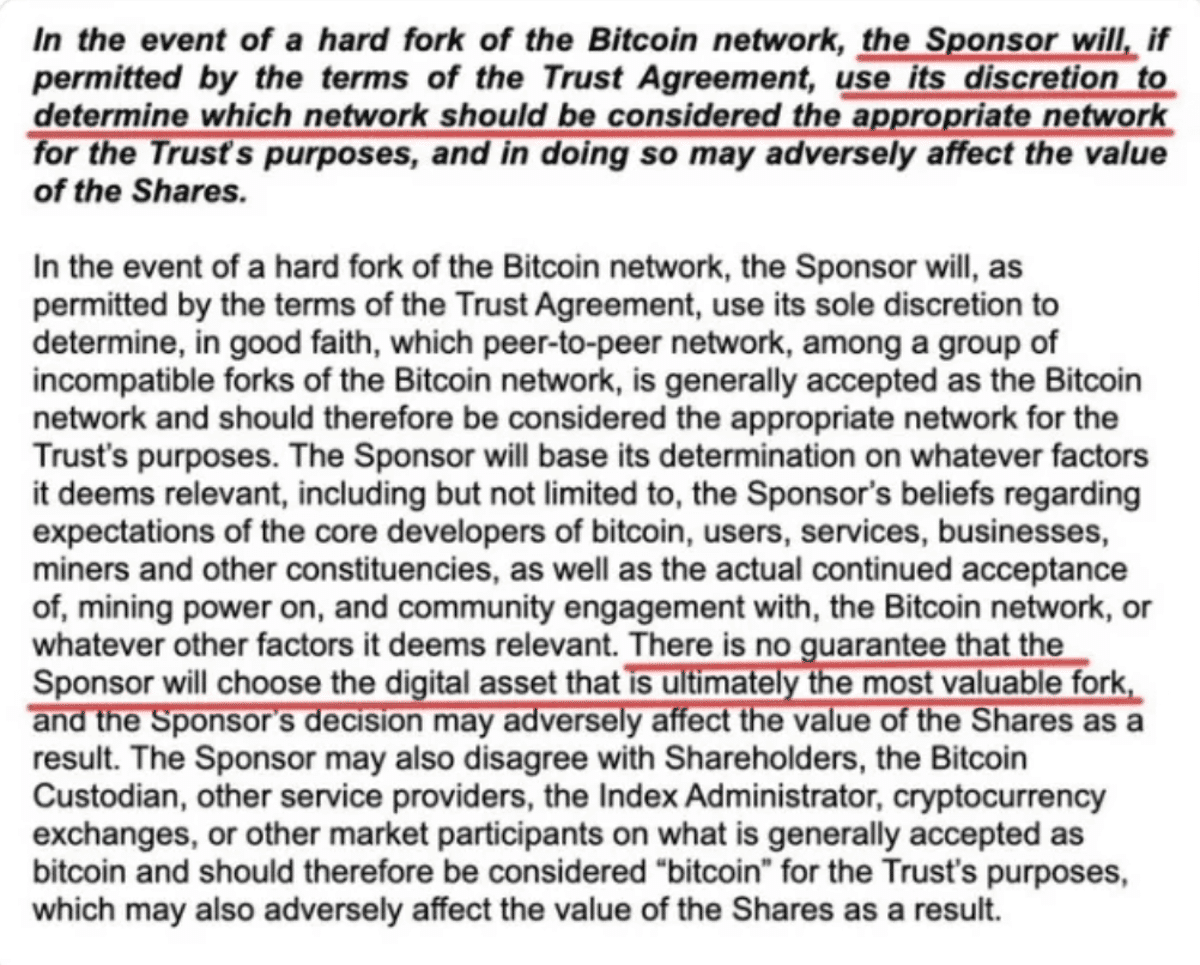

The speculation stems from risk disclosure language in BlackRock’s Bitcoin ETF filing. On page 22 of the official prospectus, BlackRock mentions potential risks related to forking events. While this language is standard for ETF filings, some took it as a sign that BlackRock might be planning to fork Bitcoin.

As @DeFiTracer pointed out:

“The concern began with speculation, but the reality is far less dramatic. Fork declarations in ETF documents are standard and not indicative of malicious intent.”

The disclosure explains that in the event of a fork, BlackRock reserves the right to decide which chain to support. However, this does not mean the firm is planning to create its own fork.

Key Concerns Raised by the Crypto Community

Despite the lack of evidence, some crypto enthusiasts have voiced concerns about the potential risks of a BlackRock-initiated fork:

1. Centralization of Influence

BlackRock holds an enormous amount of Bitcoin, estimated at $55 billion. A fork led by a single entity could give the firm disproportionate influence over the market.

2. Loss of Trust in Bitcoin

Bitcoin’s value lies in its decentralization. A fork initiated by a corporate giant like BlackRock could undermine this trust, even if the fork gains little traction.

3. Market Manipulation

The mere mention of a potential fork can cause market turbulence. Uncertainty often leads to volatility, which can hurt both retail and institutional investors.

4. Regulatory Implications

A high-profile fork by BlackRock could attract increased regulatory scrutiny, potentially creating new challenges for the crypto industry.

Why BlackRock Forking Bitcoin Is Unlikely

- Standard Language in ETF Filings

The mention of forks in BlackRock’s ETF filing is not unique. Similar language appears in all Bitcoin ETF prospectuses, as it is part of the standard risk disclosure requirements. - Bitcoin Forks Have Historically Failed

Past forks like Bitcoin Cash (BCH) and Bitcoin SV (BSV) failed to dethrone Bitcoin or gain significant adoption. The market devalued these forks, leaving them largely irrelevant. - No Evidence of Intent

BlackRock has not made any public statements suggesting plans to fork Bitcoin. As @btc_overflow clarified:

“BlackRock is not forking Bitcoin. This is boilerplate risk disclosure, not an intent to fork Bitcoin.”

- Community Resistance

Bitcoin’s strength lies in its global community of miners, developers, and holders. Any attempt to fork the network would likely face strong resistance from this community, making it difficult to succeed.

Understanding the Real Risks of Forks

While BlackRock forking Bitcoin is unlikely, it’s important to understand the potential risks of forks in general:

- Market confusion: Forks can divide investors, creating uncertainty about which chain to support.

- Price volatility: Competing chains can disrupt markets, leading to significant price swings.

- Fragmentation: Forks dilute network resources, weakening the overall ecosystem.

What Does This Mean for Bitcoin Investors?

For Bitcoin holders, the key takeaway is to stay informed and not panic over rumors. Here’s what you can do:

- Focus on fundamentals: Bitcoin remains decentralized and secure, with a proven track record of resilience.

- Monitor credible sources: Follow updates from trusted experts to separate facts from FUD.

- Avoid reactionary decisions: Don’t let speculation dictate your investment strategy.

Conclusion

The rumors about BlackRock and BTC forking appear to be baseless. The mention of forks in BlackRock’s ETF filing is a standard risk disclosure, not a declaration of intent. While it’s wise to remain cautious about any potential market disruptions, the current narrative seems to be more rumor than reality.

Bitcoin remains a robust and decentralized network, and any attempt to fork it would face immense challenges in gaining community support or adoption. For now, investors should focus on Bitcoin’s fundamentals and stay vigilant against misinformation.

Special Offer

Navigate the crypto market with confidence. Sign up on Bybit today and get up to $30,000 in deposit bonuses for advanced trading tools and insights.

For More Insights

For in-depth guides and analyses on cryptocurrency trends, visit our Cryptocurrency Comparisons Guides.