The Largest Crypto Exchange Breach in History – $1.4 Billion Stolen

On February 21, 2025, Bybit, one of the largest cryptocurrency exchanges, suffered the biggest security breach in crypto history. The attack resulted in the loss of over $1.4 billion worth of Ethereum and staked ETH from a single cold wallet. This incident exposed critical security vulnerabilities and sparked a major debate about the risks of keeping assets on centralized exchanges.

The attack was highly sophisticated, relying on a masked transaction technique that tricked Bybit’s internal systems into approving a fraudulent transfer. Despite the scale of the breach, Bybit has assured users that the exchange remains solvent and capable of covering the entire loss without affecting customer funds.

However, the hack has triggered intense discussions within the crypto community, with some users questioning Bybit’s security measures and others praising its financial strength in handling the crisis.

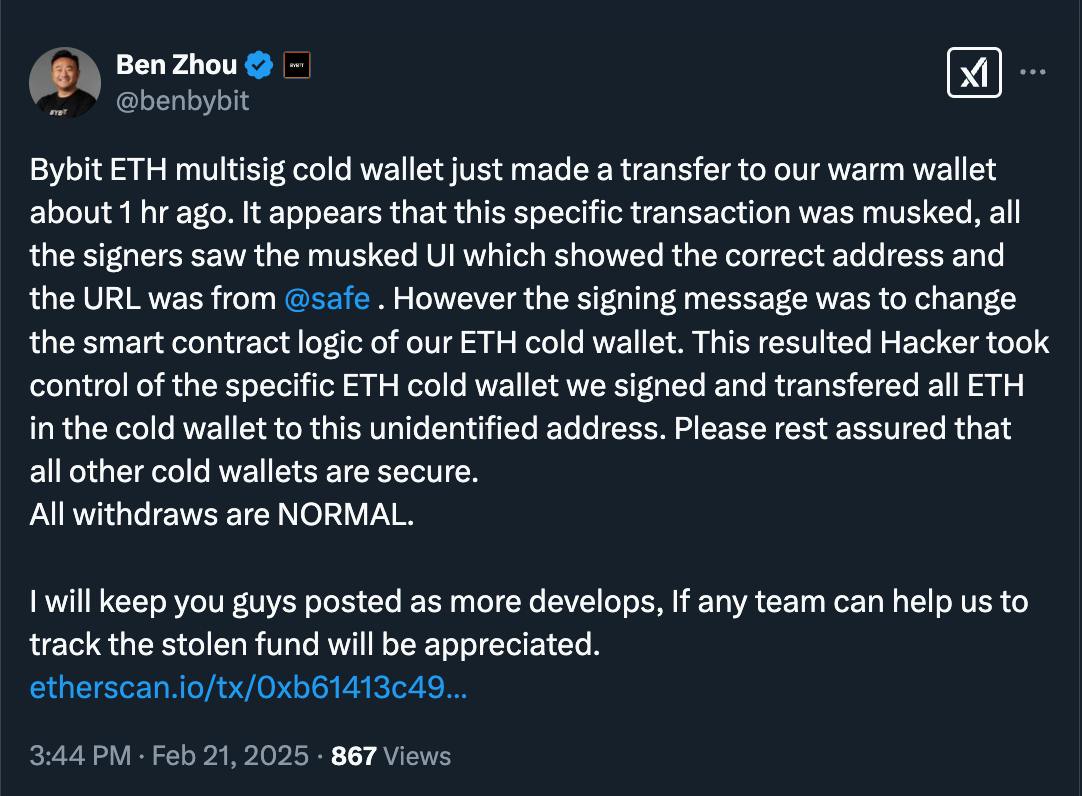

How the Bybit Hack Happened

The hackers exploited a flaw in Bybit’s multisignature Ethereum cold wallet by using a masked transaction attack. This method involved manipulating the transaction interface to make a fraudulent transfer appear legitimate.

Bybit’s security team believed they were processing a routine transfer from a cold wallet to a warm wallet. However, behind the scenes, the transaction message was altered, modifying the wallet’s smart contract logic. This change allowed the hackers to siphon funds without triggering any immediate alarms.

Once the transaction was approved, the attackers quickly moved the stolen assets through decentralized exchanges such as Uniswap and Curve Finance to obfuscate their trail. This tactic made it difficult for Bybit and blockchain analysts to freeze or recover the stolen funds.

What Was Stolen in the Bybit Hack?

The hackers targeted Ethereum-based assets stored in Bybit’s cold wallet. The stolen assets included:

- Ethereum (ETH), the primary cryptocurrency lost in the attack.

- Staked Ethereum (stETH), representing ETH locked in staking contracts.

- Mantle Staked ETH (mETH), another form of tokenized Ethereum used for staking.

These assets were quickly swapped for more liquid cryptocurrencies, making it nearly impossible to track them in real-time.

Community Reactions and Sentiment

The Bybit hack has ignited heated discussions on X (formerly Twitter), with users expressing a mix of frustration, concern, and confidence in Bybit’s response.

Some users criticized Bybit for allowing such a large-scale attack to happen in the first place. One user, @murtaza, described the hack as “careless and unprofessional,” arguing that Bybit should have had better safeguards in place. Others echoed similar sentiments, with @hiiamstan2 stating that the breach significantly damaged trust in centralized exchanges.

However, not all reactions were negative. Some users pointed out that Bybit’s ability to absorb a $1.4 billion loss without affecting user funds was a sign of financial strength. @hasufl noted that “Bybit has way more than $1.4 billion in revenue per year. They are good for the money and will make all customers whole,” suggesting that users should not worry about losing their funds.

Another user, @camelagainagain, reassured the community by stating that Bybit would likely recover most of the lost assets, predicting that hackers might return 90 to 95 percent of the stolen funds.

Security Concerns and Calls for Accountability

Some users believe this attack should serve as a wake-up call for better security in the crypto industry. @mansasuma argued that “a $1.4 billion hack in one go is unacceptable,” calling for Bybit to make significant changes to its security protocols.

Others, like @notfortrade123, pointed out that the hack, while damaging, might push Bybit to improve its systems, stating that “they just got burned, probably after this their security will be revised and updated, making it better.”

Regulatory concerns were also raised, with @RoderickMelvin questioning whether the crypto industry could survive without stronger regulations, saying, “We can’t expect the sheep of retail to get into crypto when the shepherds lead them to their own slaughter.“

Bybit’s Response and the Aftermath

Immediate Actions Taken

Bybit quickly responded to the incident, confirming that while $1.4 billion was lost, the exchange remains financially stable. They reassured users that:

- The exchange is solvent and capable of covering the loss.

- Withdrawals and trading remain operational.

- A security audit is being conducted to strengthen its defenses.

Despite the enormous scale of the breach, Bybit’s ability to continue operations without halting withdrawals has been seen as a strong indicator of its financial health.

Future Security Measures

Bybit is expected to implement new security measures, including:

- Enhanced transaction verification processes.

- Improved internal monitoring systems to detect suspicious activities.

- Stricter cold wallet management protocols.

These changes are aimed at preventing similar attacks in the future.

Is Bybit Still Safe to Use?

While Bybit has reassured users of its financial strength, the hack raises questions about the security of centralized exchanges. Some users are now reconsidering whether they should keep large amounts of cryptocurrency on trading platforms.

For those who continue to use Bybit, it is recommended to:

- Enable two-factor authentication (2FA) for additional security.

- Use hardware wallets for long-term storage.

- Withdraw significant holdings to self-custody wallets rather than leaving them on exchanges.

Despite the breach, Bybit remains one of the largest and most financially stable exchanges in the industry. However, users should remain cautious and monitor ongoing security updates.

Final Thoughts on the Bybit Hack

The Bybit hack of February 21, 2025, stands as the largest exchange breach in history. While Bybit’s financial strength has prevented user losses, the event has highlighted serious vulnerabilities in the security of centralized exchanges. The incident has sparked an industry-wide conversation about the need for stronger security measures, better fraud detection systems, and potential regulatory oversight to prevent similar attacks in the future.

As for now, Bybit continues to operate, but traders and investors should take precautions and consider diversifying their assets across multiple storage solutions to minimize risk.

For More Insights

For more insights and detailed guides on blockchain applications, visit our Blockchain Technology Guides.

Special Offer

Sign up on Bybit today to receive up to $30,000 in deposit bonuses.