Lazarus Group Moves $27M ETH as Bybit Boosts Recovery Efforts

Introduction

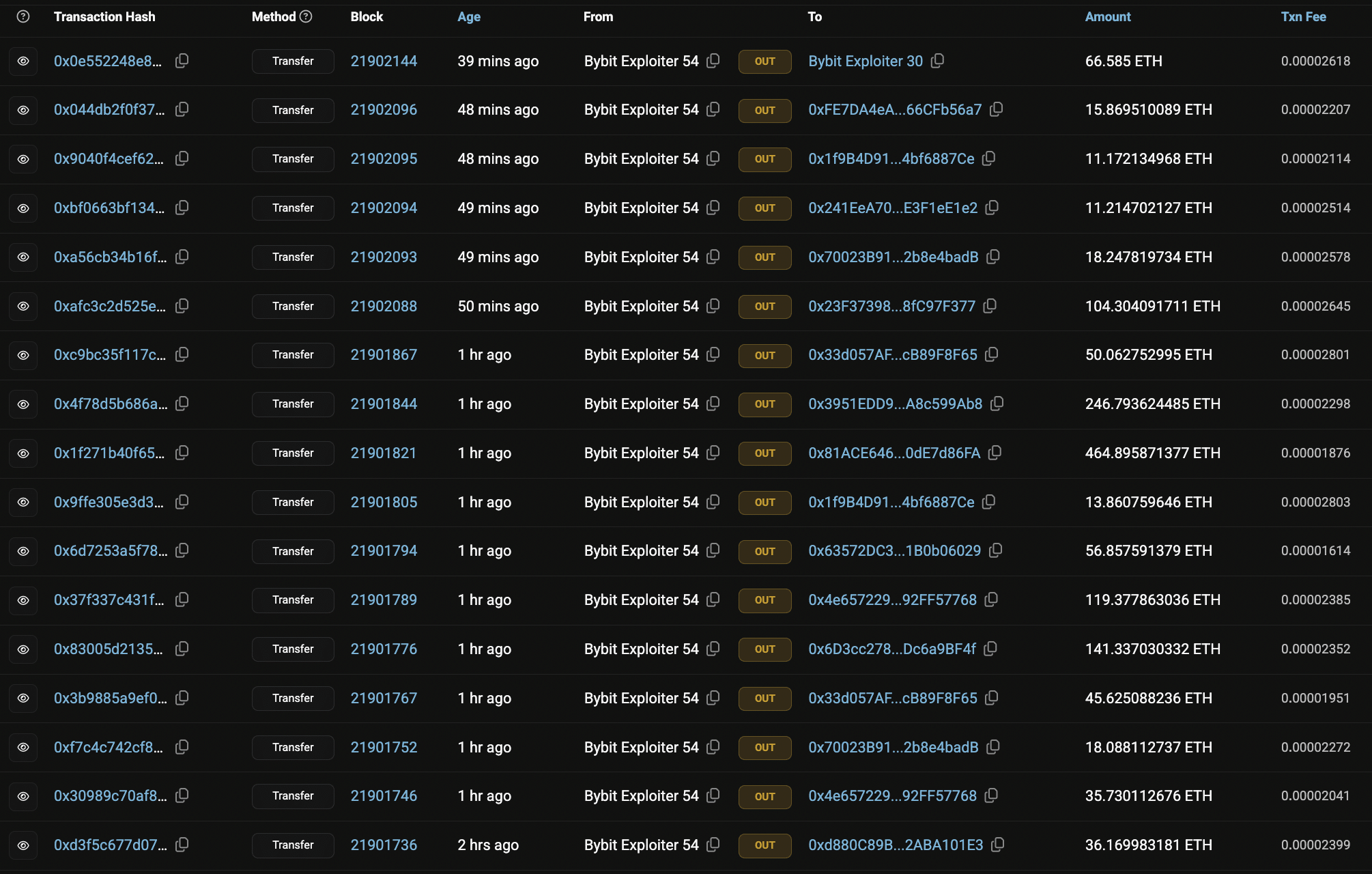

The Lazarus Group, a notorious cybercriminal organization, is once again making headlines. This time, the group transferred 10,000 ETH ($27 million) to a wallet identified as Bybit Exploiter 54. The $1.4 billion Bybit hack, labeled the largest crypto exchange exploit in history, continues to shake the market.

On-chain analytics firm Lookonchain reports that Lazarus still controls 489,395 ETH ($1.3 billion) and 15,000 Mantle Restaked ETH (cmETH) across 53 wallets. In response, Bybit has launched a $140 million bounty program, encouraging the crypto community to assist in the recovery of stolen assets.

How the Lazarus Group Laundered Stolen ETH

Blockchain investigator ZackXBT has tracked the movement of these illicit funds. Data from Etherscan reveals more than 83 transactions within an eight-hour window, dispersing ETH across multiple wallets.

The latest recorded transaction involved 66 ETH ($182,831) sent to a wallet ending in CE9. This method of rapid transfers is a well-known strategy used to obfuscate transaction trails.

For an in-depth look at crypto-related fraud, check out How to Identify and Avoid Cryptocurrency Scams.

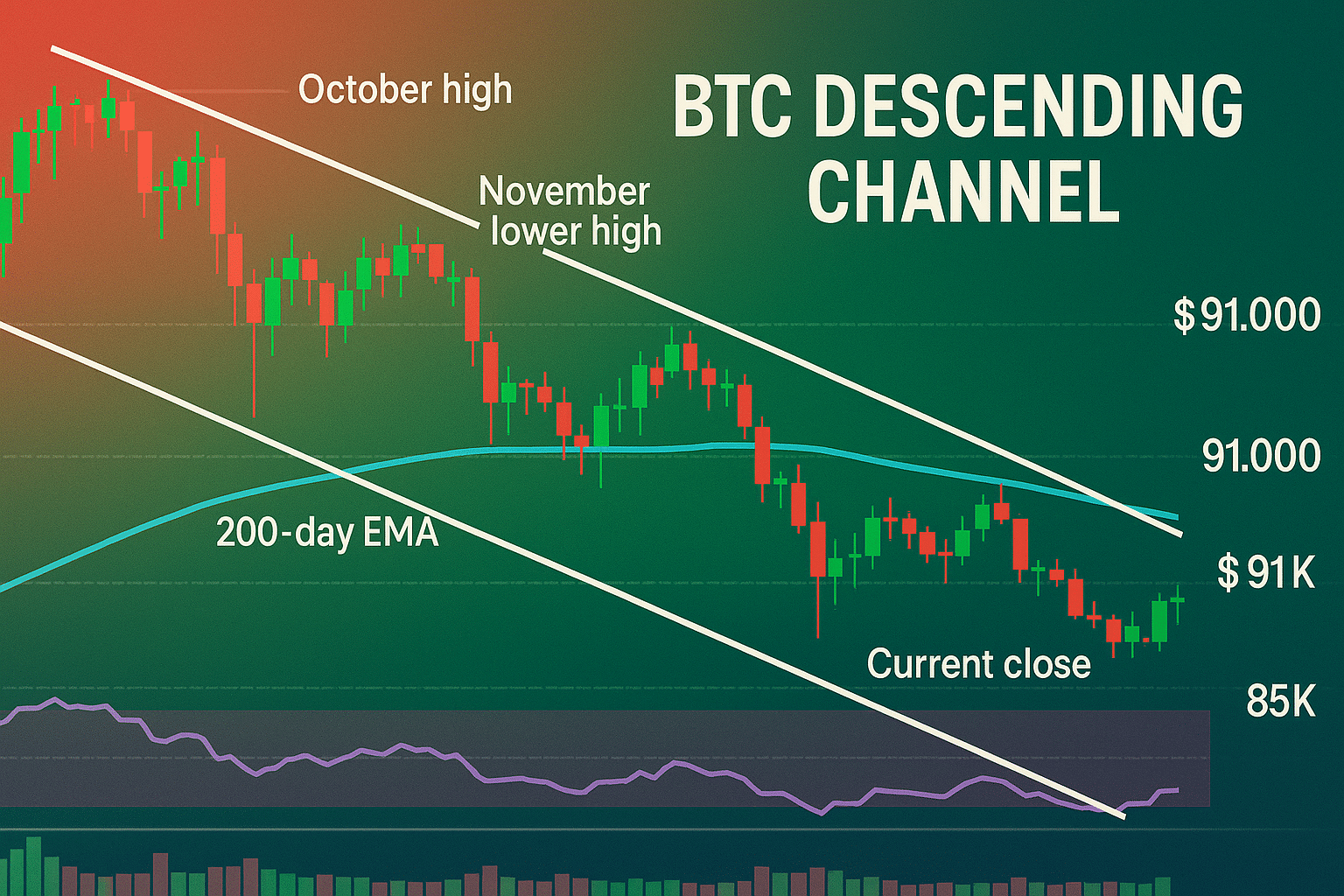

Market Impact: Ethereum and Altcoins Drop

The Bybit hack has rattled investor confidence. Ethereum (ETH) plunged 8% in a single day, dragging altcoins down with it. Panic selling added to market volatility, leaving traders uncertain about what comes next.

The scale of this breach underscores the need for enhanced security protocols across major exchanges. It also highlights the growing threat posed by state-backed cybercrime syndicates such as Lazarus Group.

Bybit’s Response: Recovery and Security Enhancements

Bybit has taken swift action to contain the situation and recover lost assets. Some of the key steps include:

- Tether Freezing Stolen Funds – Paolo Ardoino, CEO of Tether, confirmed the freezing of 181,000 USDT linked to the hack.

- $43 Million Recovered – Polygon’s CISO, Mudit Gupta, reported successful recovery efforts with assistance from Mantle, SEAL, and mETH teams.

- $140M Bounty Program – Bybit has announced a 10% reward for contributors aiding in fund retrieval.

Bybit CEO’s Reassurance to Users

Amid concerns, Bybit CEO Ben Zhou has reassured customers about the platform’s stability. In a recent social media post, he confirmed that withdrawals have returned to normal and that users can now access their funds without delays.

Bybit’s transparent communication and proactive security measures have earned widespread industry praise. The exchange remains committed to restoring trust and preventing future breaches.

What This Means for Crypto Security

The fight against crypto hacks and cybercrime continues. Exchanges, blockchain analysts, and law enforcement agencies are working together to track and recover stolen funds. The Lazarus Group’s sophisticated laundering techniques, however, make the process challenging.

Key takeaways include:

🔐 Users should prioritize security by storing assets in cold wallets and enabling multi-factor authentication (MFA).

🛡️ Exchanges must invest in advanced security measures to mitigate risks.

🔍 Real-time blockchain monitoring plays a crucial role in identifying suspicious transactions.

Conclusion

The Bybit hack and Lazarus Group’s laundering tactics have once again exposed the vulnerabilities in the crypto sector. While Bybit’s swift response and Tether’s intervention have aided recovery efforts, much remains at stake.

With a $140 million bounty in place, the crypto community remains engaged in tracking down stolen assets. The next few weeks will be crucial in determining how much of the $1.4 billion lost can be retrieved.

For more on how exchange decisions shape the market, read Bybit vs. Pi Network: No Bybit Listing as Ben Zhou Calls Pi a Scam.

FAQs

1. How did the Lazarus Group steal from Bybit?

The group exploited weaknesses in Bybit’s hot wallets, stealing $1.4 billion in digital assets.

2. Has Bybit recovered all the stolen funds?

No. Currently, $43 million has been recovered, while 181,000 USDT remains frozen.

3. What security measures has Bybit implemented post-hack?

Bybit has enhanced security protocols, increased monitoring efforts, and launched a bounty program to aid in recovery.

4. How can users protect their funds from exchange hacks?

To minimize risk, users should:

- Store funds in cold wallets for maximum security.

- Enable multi-factor authentication (MFA) to prevent unauthorized access.

- Withdraw assets only when necessary to limit exchange exposure.

For more insights and detailed guides on cryptocurrency, visit our Crypto Guides Section.

Stay Updated

For the latest updates on cryptocurrency trends and news, follow us on:

- X: https://x.com/FreeCoins24

- Telegram: https://t.me/freecoins24

Stay informed with the latest strategies and insights in the world of cryptocurrency at FreeCoins24.io.

Special Offer

For an enhanced trading experience, consider Bybit. Sign up through our referral link to unlock exclusive rewards, including up to $30,000 in deposit bonuses, and elevate your trading journey.