Mastering Crypto Day Trading: Proven Strategies for Success

Introduction

Crypto day trading is one of the most exciting yet challenging ways to profit in the digital asset market. Unlike long-term investing, day trading involves buying and selling cryptocurrencies within a single day to capitalize on price fluctuations. With the right strategies, traders can navigate volatility and maximize gains.

This guide explores essential crypto day trading strategies, risk management techniques, and tips to help traders succeed. Whether you’re a beginner or an experienced trader looking to refine your skills, these insights will help you trade smarter and avoid common pitfalls.

What Is Crypto Day Trading and How Does It Work?

Day trading in the crypto market involves executing multiple trades within a single day to take advantage of short-term price movements. Unlike long-term investing, which focuses on gradual price appreciation, day traders rely on quick price changes and market momentum.

The key to success lies in understanding market trends, reading charts, and using technical indicators. Many traders use leverage to increase their potential profits, but this also increases risk. Choosing the right exchange with low fees, fast execution, and advanced tools can significantly impact trading outcomes.

For insights into crypto market trends, check out Global Crypto Regulations: How Countries Are Regulating Crypto.

Key Strategies for Successful Crypto Day Trading

Successful traders follow proven strategies to maximize profits and minimize losses. Here are some of the most effective methods:

1. Scalping

Scalping involves making multiple trades within a short period to capitalize on small price movements. Traders rely on high liquidity and fast execution to make frequent, quick profits.

2. Range Trading

In this strategy, traders identify support and resistance levels to buy at the bottom and sell at the top of a predictable price range. This method works best in sideways markets.

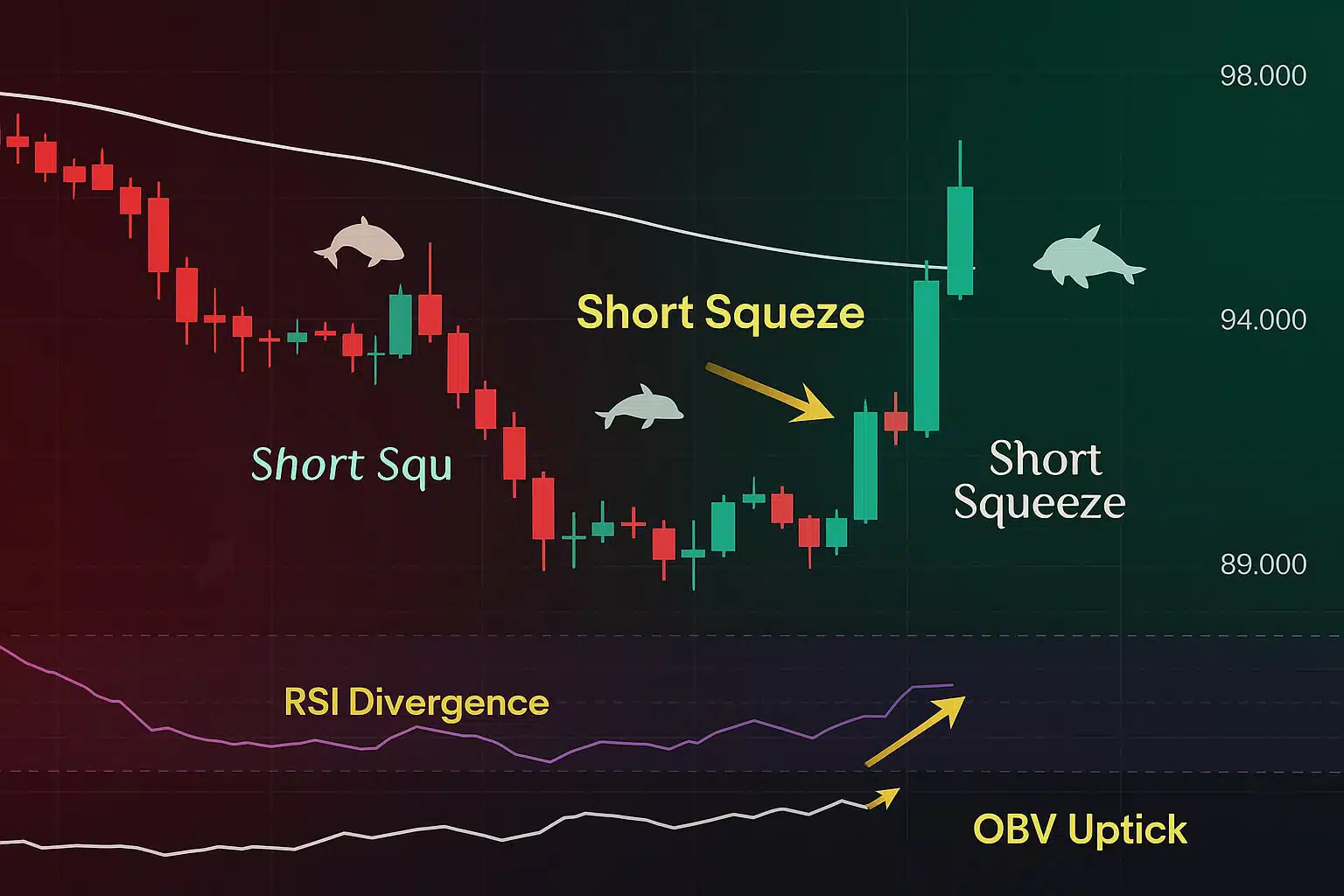

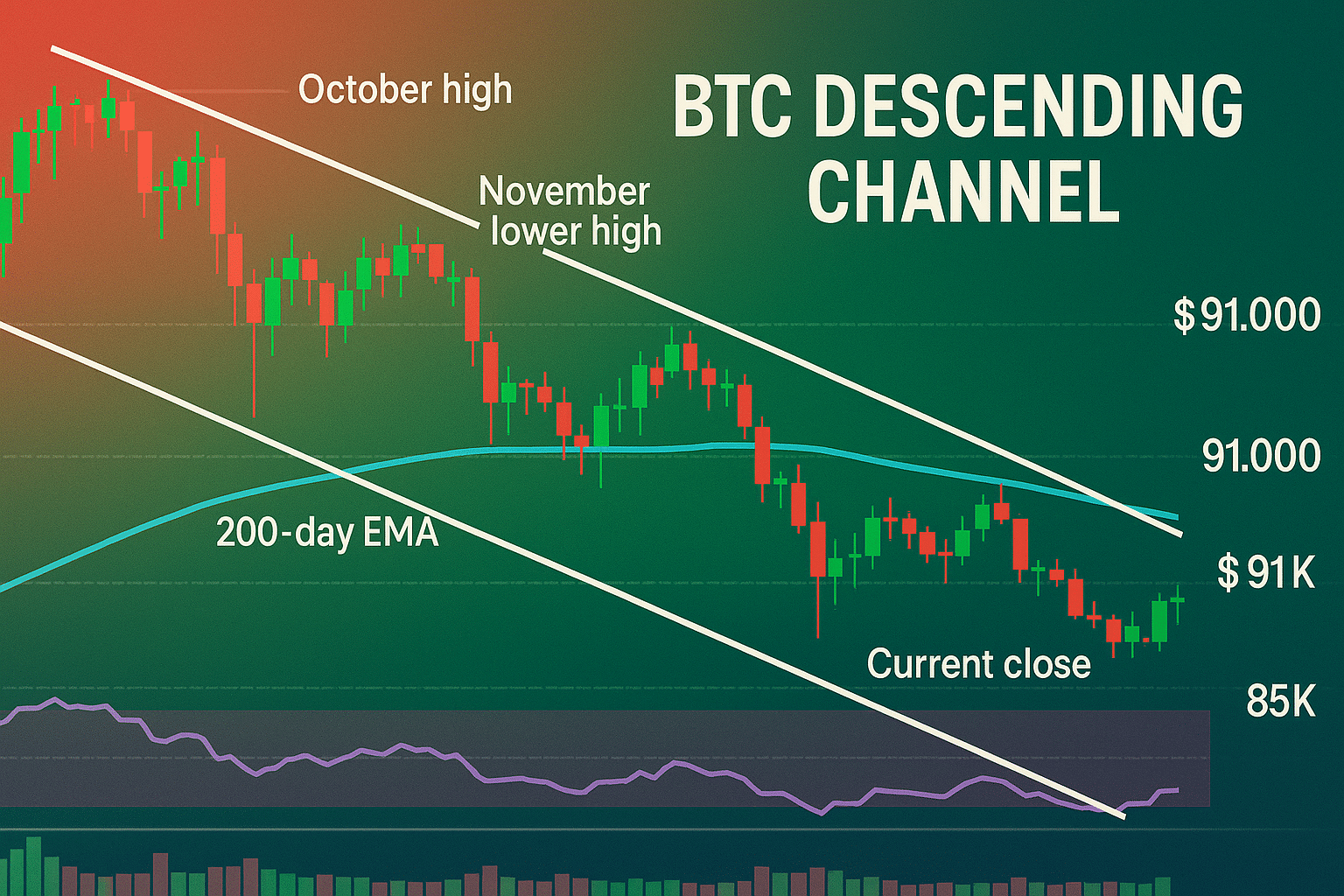

3. Trend Following

This approach involves analyzing price trends and entering trades in the direction of the trend. Traders use moving averages and momentum indicators to confirm signals before making a move.

4. Breakout Trading

Breakout traders enter positions when the price breaks above resistance or falls below support. These movements often indicate the start of a strong trend, providing opportunities for significant gains.

5. News-Based Trading

Market-moving news, such as regulatory changes or major partnerships, can cause sharp price movements. Day traders monitor news sources and social media to react quickly to breaking developments.

For a deeper dive into crypto trading strategies, explore Where to Buy, Sell, and Trade NFTs: A Guide to Top NFT Marketplaces.

Risks Involved in Crypto Day Trading: What You Need to Know

Crypto day trading comes with significant risks. High volatility, market manipulation, and liquidity issues can lead to sudden losses. Understanding these risks and using proper risk management techniques is crucial.

1. Market Volatility: Crypto prices can swing dramatically within minutes, making it easy to lose money if you’re not careful.

2. Leverage Risks: Using leverage amplifies both profits and losses. A sudden price movement in the wrong direction can liquidate an entire position.

3. Emotional Trading: Fear and greed often lead to poor decision-making. Sticking to a predefined strategy can help traders avoid impulsive actions.

4. Exchange Downtime: Technical issues or unexpected outages on trading platforms can prevent traders from executing trades at critical moments.

5. Regulatory Uncertainty: Crypto regulations vary by country and can impact trading strategies. Stay updated on policy changes to avoid unexpected disruptions.

For more on protecting yourself from market risks, read How to Identify and Avoid Cryptocurrency Scams.

The Best Cryptos to Trade for Day Traders

Some cryptocurrencies are better suited for day trading due to their high liquidity, volatility, and trading volume. Here are some of the top choices:

- Bitcoin (BTC) – The most liquid and widely traded cryptocurrency.

- Ethereum (ETH) – Offers strong price movements and high trading volume.

- Solana (SOL) – Known for its fast transactions and increasing popularity.

- Ripple (XRP) – Often experiences significant price swings due to legal and regulatory news.

- Dogecoin (DOGE) & Shiba Inu (SHIB) – Memecoins with high volatility, offering trading opportunities.

Choosing the right asset can impact profitability, so consider market trends and liquidity before making a trade.

How to Manage Risk and Avoid Major Losses in Crypto Trading

Effective risk management is essential for long-term success. Here are some key techniques:

- Set Stop-Loss Orders – Automatically exit a trade when a predefined loss level is reached.

- Use Proper Position Sizing – Never risk more than 1-2% of your total capital on a single trade.

- Diversify Trades – Avoid concentrating all funds in one asset to reduce risk exposure.

- Stick to a Trading Plan – Define entry and exit points, risk levels, and profit targets before executing trades.

- Manage Emotions – Stay disciplined and avoid revenge trading after a loss.

For insights on managing risk in volatile markets, check out Lazarus Group Moves $27M ETH as Bybit Boosts Recovery Efforts.

Conclusion

Crypto day trading offers lucrative opportunities, but it also requires skill, patience, and discipline. Understanding market trends, applying effective strategies, and managing risk are essential for long-term success. Traders should always stay informed, follow a structured plan, and continuously improve their trading skills.

By leveraging the right tools, choosing high-liquidity assets, and implementing sound risk management strategies, anyone can improve their chances of success in the fast-paced world of crypto trading.

Interested in more trading insights? Stay updated with the latest trends and strategies shaping the cryptocurrency market.

FAQs

1. Is crypto day trading profitable?

Yes, but it requires knowledge, discipline, and proper risk management to be consistently successful.

2. What is the best strategy for crypto day trading?

Popular strategies include scalping, range trading, and trend following. The best approach depends on individual risk tolerance and market conditions.

3. How much money do I need to start crypto day trading?

It varies, but many exchanges allow trading with as little as $10. However, starting with at least a few hundred dollars provides more flexibility.

4. Is leverage recommended for beginners?

No. Leverage increases risk and should only be used by experienced traders with strong risk management strategies.

5. Which crypto trading platform is best for day trading?

Platforms like Binance, Bybit, and Kraken offer advanced trading tools, high liquidity, and low fees, making them ideal for day traders.

For more insights and detailed guides on cryptocurrency, visit our Crypto Guides Section.

Stay Updated

For the latest updates on cryptocurrency trends and news, follow us on:

- X: https://x.com/FreeCoins24

- Telegram: https://t.me/freecoins24

Stay informed with the latest strategies and insights in the world of cryptocurrency at FreeCoins24.io.

Special Offer

For an enhanced trading experience, consider Bybit. Sign up through our referral link to unlock exclusive rewards, including up to $30,000 in deposit bonuses, and elevate your trading journey.