Bitcoin Falls to $86K – What’s Behind the Latest Crypto Crash?

The cryptocurrency market took a major hit on February 25, 2025, with Bitcoin (BTC) plunging to $86,138 and Ethereum (ETH) dropping below $2,340. This sharp decline has triggered widespread panic, leading to heavy liquidations and further selling pressure. A combination of regulatory concerns, security breaches, and institutional outflows has fueled this sell-off, raising questions about where the market is headed next.

Key Reasons for the Crypto Market Crash

1. Trump’s Tariffs Shake Investor Confidence

President Donald Trump’s latest tariff announcement has had ripple effects across multiple markets, including cryptocurrency. The administration confirmed a 25% tariff on Canadian and Mexican imports, along with a 10% levy on Canadian energy exports, starting March 4. These trade restrictions have heightened economic uncertainty, causing investors to pull out of risk assets like crypto.

Historically, Bitcoin has shown signs of correlation with traditional markets, and this recent downturn aligns with losses seen in major stock indices. The Nasdaq Composite dropped 1.2%, marking its third consecutive day of losses. Investors are closely watching whether further economic disruptions will continue to impact digital assets.

For more on how regulatory shifts affect crypto, check out our guide on Global Crypto Regulations.

2. Bybit’s $1.5 Billion Hack Fuels Market Fear

The Bybit hack, one of the largest security breaches in crypto history, has also played a major role in market instability. Hackers stole approximately $1.5 billion worth of digital assets, damaging investor confidence and prompting many to withdraw funds from exchanges. Security concerns like these often lead to significant sell-offs as users move assets off trading platforms.

Bybit has since launched a $140 million bounty program to recover stolen funds, similar to past industry efforts after high-profile exchange breaches. Despite these efforts, the hack has reinforced concerns about centralized exchange security.

For a deeper dive into crypto exchange vulnerabilities, read our analysis on The Bybit Hack and Its Market Impact.

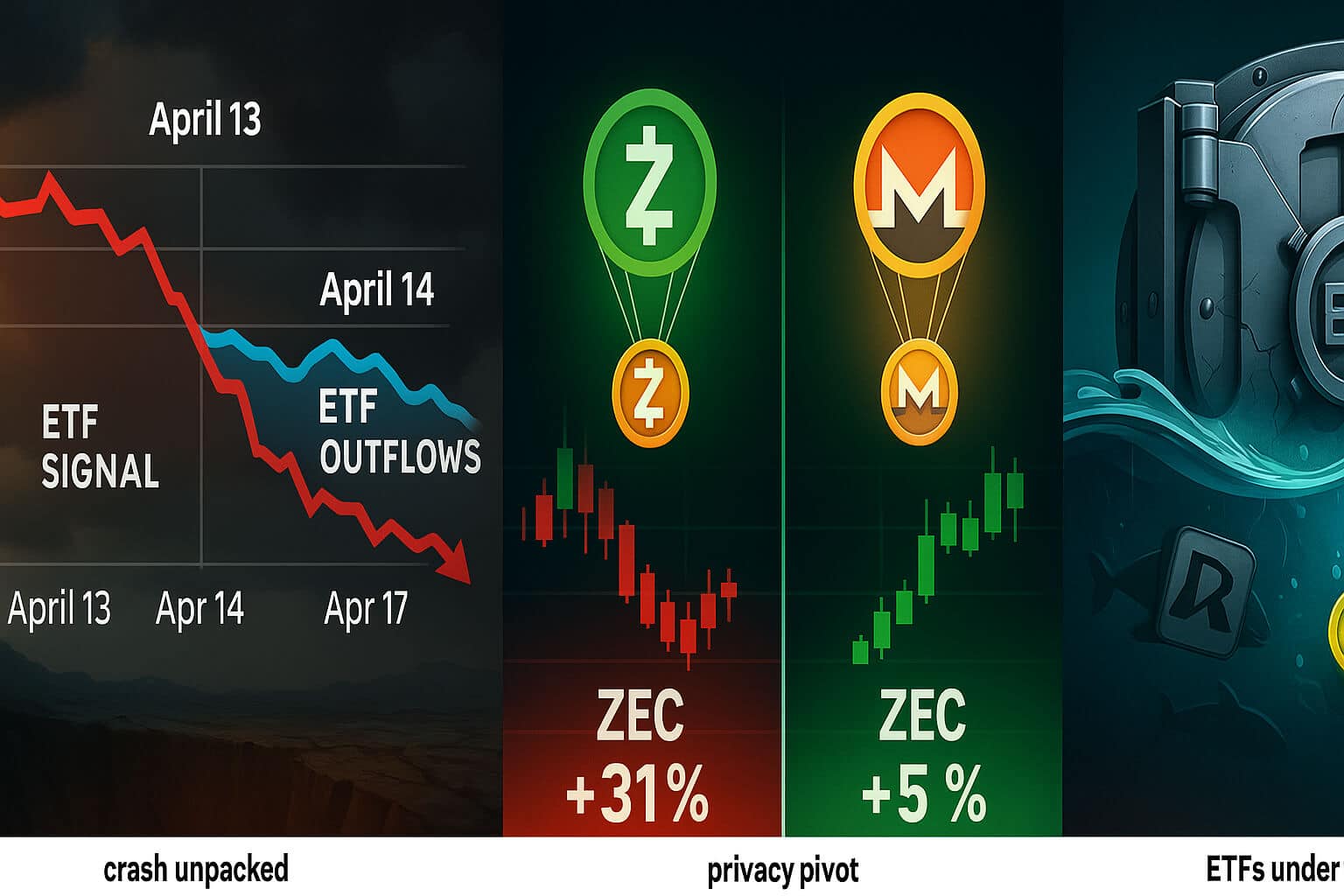

3. Bitcoin ETFs See Heavy Outflows

Institutional investors are also pulling funds from Bitcoin exchange-traded funds (ETFs) at an alarming rate. Over the past two weeks, Bitcoin ETFs have recorded $500 million in outflows, with Grayscale’s GBTC losing $60.08 million in just one day. Other funds, including Fidelity’s FBTC and Bitwise’s BITB, have also seen major withdrawals.

ETF outflows often signal a loss of confidence among large-scale investors, further exacerbating downward pressure on prices. The continued trend of capital exiting Bitcoin funds suggests that institutions remain cautious about crypto’s near-term prospects.

For more insights on ETF dynamics, check out our article on List of Available Crypto ETFs.

Altcoins Follow Bitcoin’s Lead

The broader altcoin market has mirrored Bitcoin’s decline, with some assets experiencing double-digit losses:

- Ethereum (ETH) fell to $2,339.55, breaking key support levels.

- Solana (SOL) dropped 14.85%, hitting $143.13 amid concerns over its upcoming 11.2 million SOL token unlock on March 1.

- XRP declined 10.85%, trading at $2.30.

- Cardano (ADA) lost 10.96%, falling to $0.6859.

- BNB (Binance Coin) dipped 6.55%, currently priced at $615.13.

For a closer look at Solana’s struggles, read Solana Drops 40% in a Month – Can It Recover?.

Is the Market Nearing a Bottom?

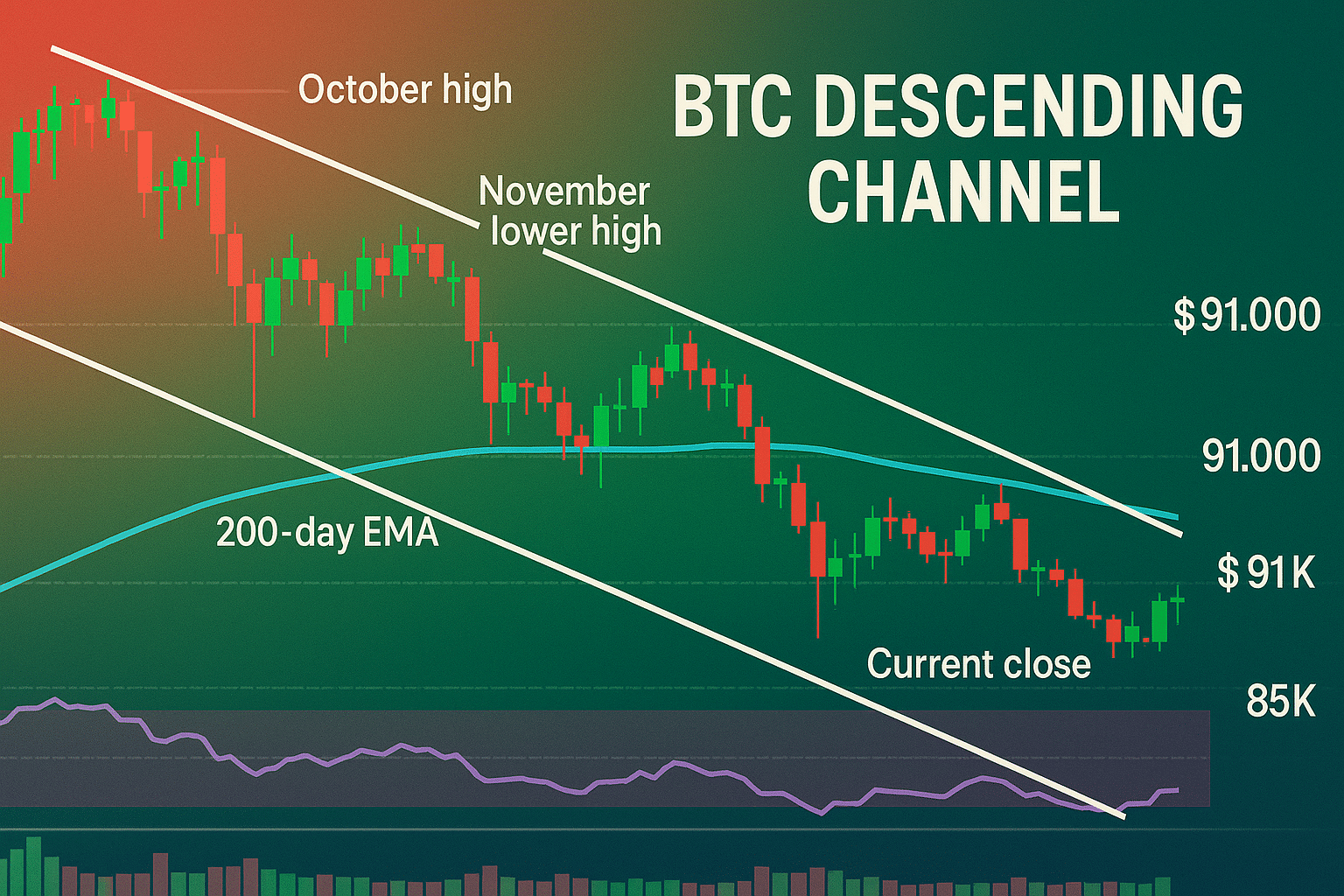

Technical Indicators Show Extreme Overselling

Despite the bearish trend, technical indicators suggest the market could be nearing oversold conditions:

- Bitcoin’s RSI (Relative Strength Index) is at 28, indicating potential buying opportunities if demand returns.

- Ethereum’s Money Flow Index (MFI) is at 15, another sign of oversold conditions.

- Bitcoin’s SMA (Simple Moving Average) and EMA (Exponential Moving Average) remain bearish, reinforcing caution.

While a short-term bounce is possible, the overall trend remains uncertain. Investors should keep an eye on key support and resistance levels in the coming days.

For more on risk management, read How to Become a Crypto Day Trader.

Final Thoughts – What’s Next for Crypto?

Bitcoin is now down 4% year-to-date, wiping out most of its early gains from January 2025, when it briefly surpassed $100,000. The current market downturn highlights the risks associated with economic uncertainty, exchange security, and institutional investment trends.

With the March 4 tariff deadline approaching, investors remain cautious about potential retaliatory actions from Canada and Mexico. A rebound in ETF inflows or easing economic tensions could provide support, but volatility is expected to persist.

Key Takeaways:

- Bitcoin dropped to $86,138, Ethereum fell to $2,339, and the market remains under pressure.

- Trump’s tariffs, ETF outflows, and the Bybit hack contributed to the sell-off.

- Technical indicators suggest extreme oversold conditions, but recovery remains uncertain.

For more crypto insights, check out How Stablecoins Are Reducing Market Volatility.

FAQs

1. Why did Bitcoin drop to $86K?

Bitcoin’s decline was driven by a combination of Trump’s tariffs, ETF outflows, and the Bybit hack, which spooked investors.

2. Will Bitcoin recover soon?

The market is currently oversold, but sustained recovery depends on economic conditions and institutional demand.

3. What’s happening with altcoins?

Ethereum, Solana, and XRP have all dropped sharply. Solana faces additional pressure from its March 1 token unlock.

4. Should I buy Bitcoin at these prices?

Traders should assess market conditions, risk factors, and technical signals before making any decisions.

For more insights and detailed guides on cryptocurrency, visit our Crypto Guides Section.

Stay Updated

For the latest updates on cryptocurrency trends and news, follow us on:

- X: https://x.com/FreeCoins24

- Telegram: https://t.me/freecoins24

Stay informed with the latest strategies and insights in the world of cryptocurrency at FreeCoins24.io.

Special Offer

For an enhanced trading experience, consider Bybit. Sign up through our referral link to unlock exclusive rewards, including up to $30,000 in deposit bonuses, and elevate your trading journey.