Bybit Hack: $1.4B Stolen, $200M Laundered – What Happens Now?

Introduction

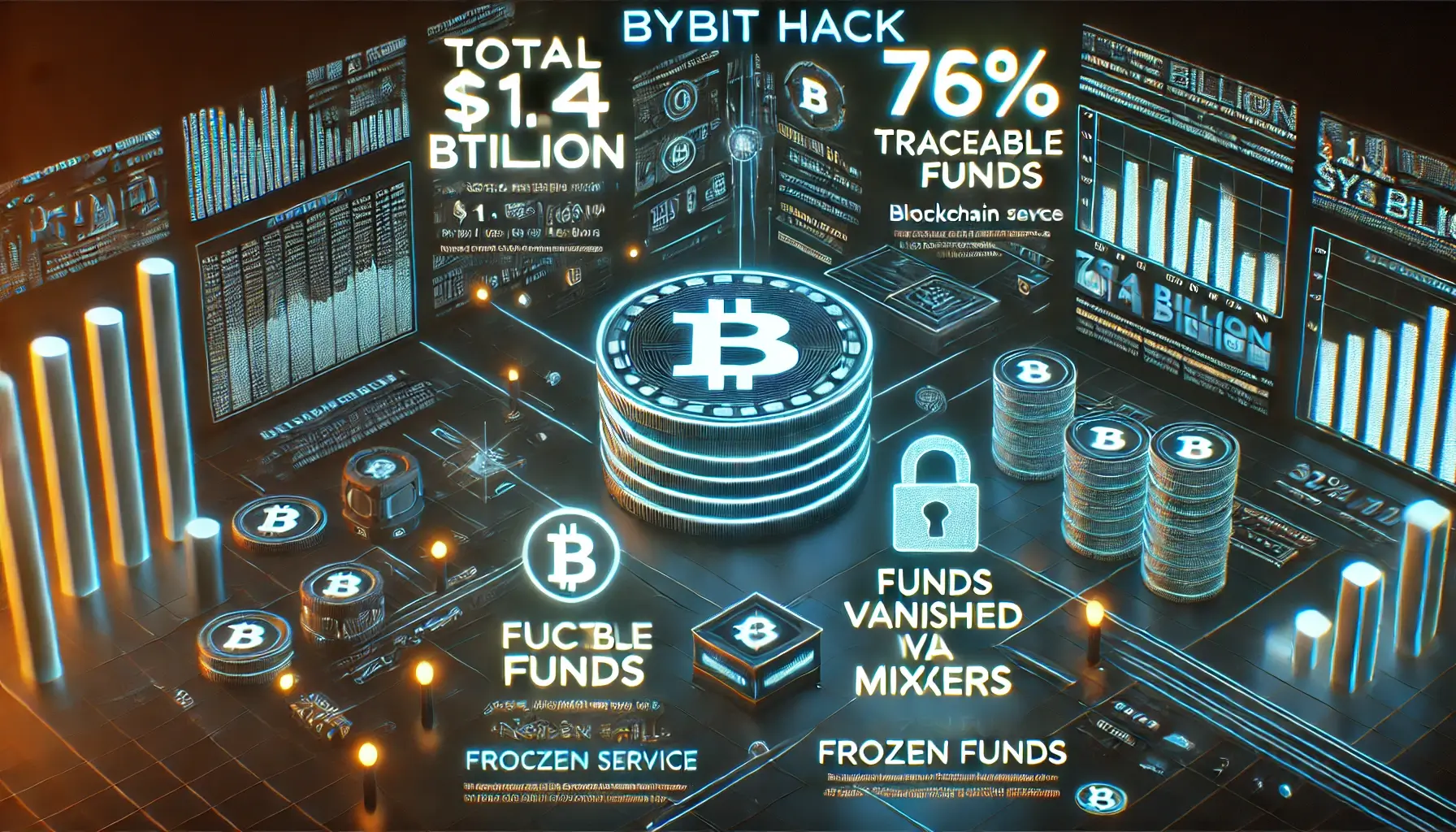

The crypto world is reeling from one of the biggest security breaches in history — a $1.4 billion hack targeting Bybit. Hackers executed a highly coordinated attack, draining 500,000 ETH alongside other digital assets.

The aftermath saw a whirlwind of transactions across decentralized platforms as hackers scrambled to cover their tracks. Despite this chaos, Bybit CEO Ben Zhou confirmed that 77% of the funds remain traceable, offering a glimmer of hope for partial recovery. Let’s break down what happened, how the funds were laundered, and what this means for the future of crypto security.

1. The Largest Crypto Heist Ever Recorded

February 2025: Bybit Under Siege

On February 21, 2025, Bybit’s systems were compromised, leading to the theft of over $1.4 billion in crypto assets. The bulk of the haul included Ether (ETH) and Staked Ether (stETH), assets widely used across the DeFi ecosystem.

This incident surpassed previous records set by the Ronin Network hack and Poly Network breach, cementing its place as the most devastating hack in crypto history.

For context on how such breaches impact exchanges, revisit Understanding Crypto Exchanges: A Guide to Trading and Investing in 2025.

2. The Path to Laundering $1 Billion

THORChain: The Laundering Highway

According to Lookonchain, blockchain investigators traced 83% of the stolen ETH — roughly $1 billion — as it was converted to Bitcoin (BTC) across nearly 7,000 wallets. Hackers exploited THORChain, a cross-chain protocol, to swiftly swap assets without centralized oversight.

THORChain’s validators refused to block these transactions, adding to the controversy. This decision sparked debate around decentralization ethics, leaving many wondering if platforms should play a more active role in preventing such laundering events.

For those unfamiliar with decentralized finance tools like THORChain, read The Rise of DeFi: How Decentralized Finance Is Changing Banking.

3. Privacy Mixers & Vanished Funds

The ExCH Mixer Twist

Roughly 16% of the stolen funds — valued at around $160 million — vanished into the dark corners of ExCH, a privacy-focused mixing service. Mixers deliberately obscure fund trails, making it exponentially harder for investigators to trace assets.

Privacy tools like these are not inherently illegal, but they’re increasingly controversial. To understand more about how privacy coins and mixers work, check out Privacy Coins Explained: How They Safeguard Anonymity in Crypto Transactions.

4. Missing Data & Recovery Efforts

OKX Web3 Wallet Data Loss

On top of the laundering chaos, $65 million worth of funds were rendered irretrievable due to missing wallet data from OKX’s Web3 platform. This glaring data gap highlights the risks of relying on partially centralized services within decentralized ecosystems.

Despite these setbacks, bounty hunters managed to freeze $2.1 million so far. For perspective on how bounty programs help recover stolen funds, you can read about Bybit’s ongoing bounty program covered in Lazarus Group Moves $27M ETH as Bybit Boosts Recovery Efforts.

5. Who’s Behind the Attack?

The Lazarus Group Connection

Blockchain sleuths, including Arkham Intelligence, linked the attack to Lazarus Group, a North Korean hacking collective notorious for targeting financial platforms. Analysts believe these attacks help finance North Korea’s weapons programs, adding geopolitical weight to the incident.

Lazarus has been involved in several historic breaches. To learn more about their previous exploits, revisit Bybit CEO vs. Pi Network: What Really Happened?.

6. Industry-Wide Security Rethink

Time for a New Approach

Following the Bybit hack, experts across the industry are urging exchanges to rethink how they approach security. Michael Pearl, Cyvers’ VP of Strategy, recommended implementing off-chain transaction validation — simulating transactions before they’re processed on-chain.

This technique could theoretically prevent up to 99% of hacks, adding a crucial extra layer of protection. For those wanting to better secure their own assets, check out Essential Crypto Wallet Security Tips: How to Protect Your Digital Assets.

7. What Happens Next for Bybit & Its Users?

Tracking, Freezing & Long-Term Lessons

Ben Zhou reassured users that Bybit is working closely with regulators, security firms, and blockchain investigators to trace and freeze stolen funds wherever possible. According to Zhou, 77% of the hacked funds remain traceable, giving users hope for partial recovery.

For Bybit users, this incident serves as a powerful reminder of the importance of platform security and self-custody strategies. If you’re still learning how to store crypto safely, How to Store Cryptocurrency Safely – Best Crypto Wallets offers essential advice.

Final Thoughts

The Bybit hack stands as both a warning and a wake-up call for the entire industry. Sophisticated attacks aren’t going away, and platforms must constantly evolve to keep pace with these threats.

Decentralized finance continues to offer innovation and opportunity, but its openness also creates vulnerabilities. Whether you’re a seasoned trader or a new investor, understanding exchange security, safe wallet practices, and the risks tied to privacy tools is more important than ever.

To stay informed about critical crypto updates like this, dive into our full guide: Understanding Crypto Exchanges: A Guide to Trading and Investing in 2025.

FAQs

1. How much was stolen in the Bybit hack?

Hackers stole over $1.4 billion in digital assets, including 500,000 ETH.

2. What is THORChain’s role in this hack?

THORChain allowed hackers to swap stolen ETH into BTC across multiple wallets, avoiding centralized oversight.

3. Can Bybit recover the stolen funds?

Roughly 77% of the funds remain traceable, but the recovery process could take months or longer.

4. Who was responsible for the attack?

Investigators attribute the hack to Lazarus Group, the infamous North Korean cybercrime syndicate.

For more insights and detailed guides on cryptocurrency, visit our Crypto Guides Section.

Stay Updated

For the latest updates on cryptocurrency trends and news, follow us on:

- X: https://x.com/FreeCoins24

- Telegram: https://t.me/freecoins24

Explore the latest crypto airdrops and uncover exclusive opportunities waiting for you — visit now at FreeCoins24.io/airdrops to start claiming today. Stay informed with the latest strategies and insights in the world of cryptocurrency at FreeCoins24.io.

Special Offer

For an enhanced trading experience, consider Bybit. Sign up through our referral link to unlock exclusive rewards, including up to $30,000 in deposit bonuses, and elevate your trading journey.