How Central Bank Digital Currencies Are Changing Finance?

Introduction

Central Bank Digital Currencies (CBDCs) are no longer just a concept—they’re becoming reality across the globe. As governments race to create their own digital currencies, the entire financial system could be headed for a major transformation.

For crypto investors and blockchain enthusiasts, CBDCs present both opportunities and threats. How will these government-backed digital currencies affect decentralized assets like Bitcoin or privacy-focused privacy coins? Let’s break down what CBDCs are, why governments are embracing them, and what this shift could mean for the future of digital finance.

1. What Exactly Are Central Bank Digital Currencies (CBDCs)?

Digital Money, Backed by the State

A Central Bank Digital Currency is essentially a digital version of a country’s fiat currency. Unlike Bitcoin or Ethereum, CBDCs are centralized and fully controlled by the government’s central bank.

This makes them fundamentally different from decentralized cryptocurrencies, which operate independently of any state authority. For anyone just stepping into the crypto space, understanding the differences between CBDCs and traditional cryptocurrencies is crucial.

How Do They Work?

CBDCs run on digital ledgers, which can be blockchain-based, but the government manages the network instead of a decentralized community. Every transaction is traceable, and authorities can monitor or even restrict how the money is used.

If you want to know more about blockchain basics before diving deeper, check out Understanding Blockchain Technology for a complete primer.

2. Why Are Governments Pushing for CBDCs?

Modernizing Financial Systems

Governments see CBDCs as a way to bring their financial infrastructure into the digital age. Paper cash usage is declining, and people want faster, cheaper ways to pay. CBDCs aim to offer seamless payments that work across borders while maintaining government oversight.

Controlling Monetary Policy Directly

With CBDCs, central banks could inject stimulus money directly into digital wallets during economic downturns. This bypasses the traditional banking system and allows faster, targeted financial aid.

3. What Does This Mean for Cryptocurrencies?

Competition or Coexistence?

Some believe CBDCs could threaten the adoption of decentralized assets like Bitcoin or stablecoins. After all, CBDCs offer a “safe” digital currency that carries the government’s guarantee. But for others, CBDCs could serve as educational tools, teaching the public about digital money and paving the way for wider crypto adoption.

Curious about how stablecoins fit into this evolving picture? Don’t miss Stablecoins: The Key to Reducing Crypto Volatility to understand how they compare to CBDCs.

4. Potential Benefits of CBDCs

- Faster Transactions: Payments settle instantly, cutting out intermediary banks.

- Financial Inclusion: CBDCs could give the unbanked population access to digital wallets directly from central banks.

- Transparency: Since all transactions happen on a digital ledger, illicit activities become harder to hide.

5. The Risks and Controversies Around CBDCs

Loss of Privacy

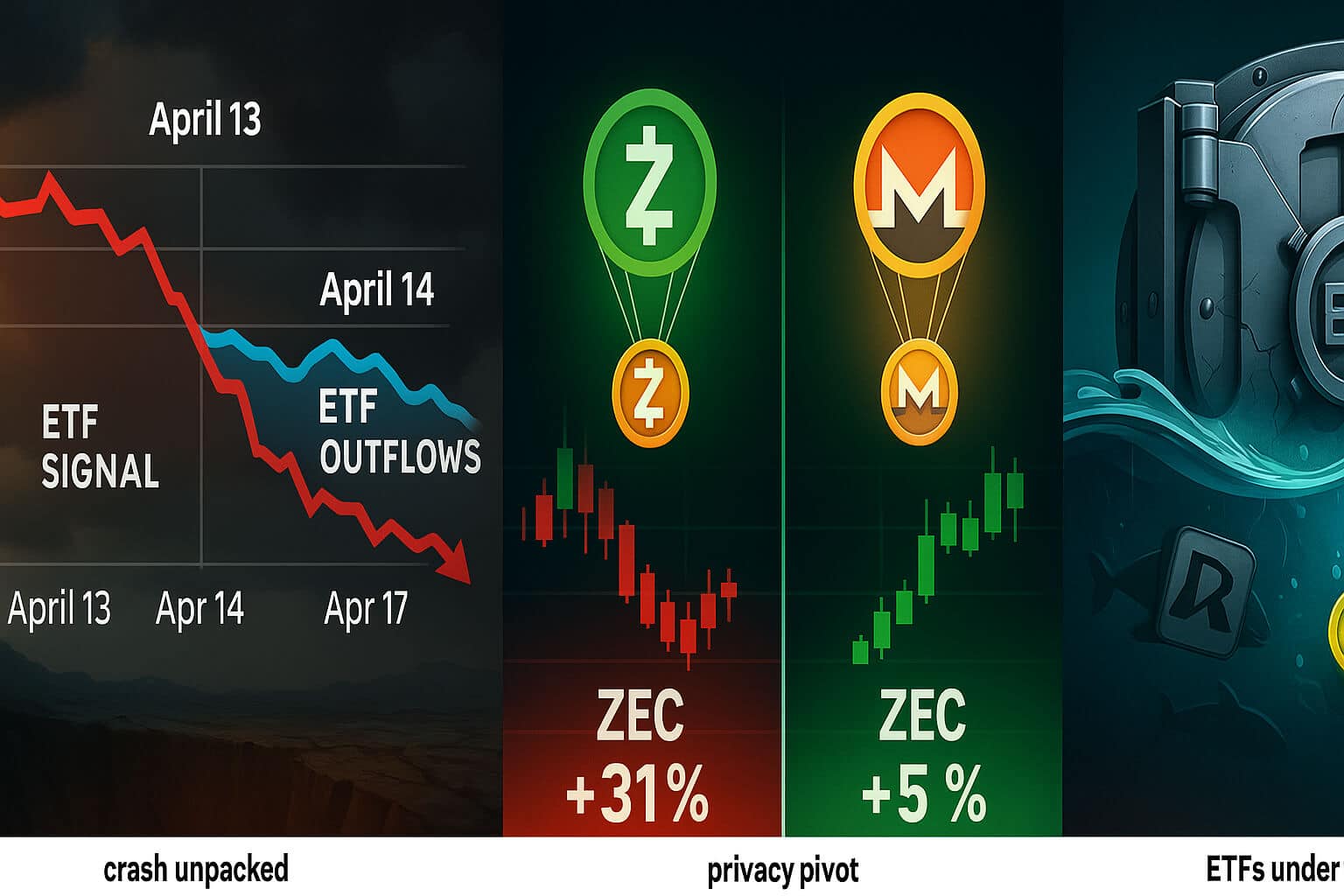

With CBDCs, governments gain unprecedented visibility into every transaction. This raises serious privacy concerns, especially in countries with limited freedom of speech or authoritarian tendencies. If privacy matters to you, consider exploring Privacy Coins Explained: How They Safeguard Anonymity in Crypto Transactions.

Programmable Money: Control or Convenience?

CBDCs can be programmed to restrict how, when, and where funds are spent. In times of economic uncertainty or political unrest, such control could easily become a tool for financial repression.

6. How Will CBDCs Shape the Future of Payments?

Cross-Border Payments Made Easy

Currently, sending money internationally is slow and expensive. CBDCs could streamline this process, allowing instant global transactions at lower costs. However, cryptocurrencies like XRP have long offered cross-border solutions too. Learn more in The Role of Crypto in Global Remittances.

A Digital Dollar vs. Bitcoin

The introduction of a U.S. digital dollar could reshape global crypto markets. If CBDCs offer stability and government backing, will people still flock to Bitcoin as a “store of value”? To see how the U.S. government’s evolving stance on crypto affects the market, check out Trump’s Crypto Reserve Sparks Massive Market Rebound.

7. CBDCs vs. DeFi: Opposing Forces?

Decentralized Finance at Risk

CBDCs could put pressure on DeFi platforms, especially if governments impose stricter regulations on non-custodial wallets and decentralized exchanges. If you want to understand the future of DeFi in this environment, explore The Rise of DeFi: How Decentralized Finance Is Changing Banking.

Conclusion: Should Crypto Investors Be Worried About CBDCs?

Central Bank Digital Currencies are coming whether the crypto world is ready or not. While they may create new efficiencies in global finance, they also pose serious risks to privacy and financial freedom.

For crypto investors, the rise of CBDCs highlights the importance of understanding both centralized and decentralized systems. Keeping up with regulatory changes, exploring privacy tools, and diversifying assets will be essential to navigating this rapidly changing landscape.

Want to stay informed on how regulations impact your investments? Start with Global Crypto Regulations: How Countries Are Regulating Crypto.

FAQs

1. Are CBDCs the same as cryptocurrencies?

No, CBDCs are issued and controlled by central banks, while cryptocurrencies are decentralized and operate without government control.

2. Will CBDCs replace Bitcoin?

Unlikely. Bitcoin’s appeal lies in its decentralization and scarcity, which CBDCs cannot replicate.

3. Are CBDCs safe to use?

They will likely be secure, but they come with privacy trade-offs due to government oversight.

4. Which countries are launching CBDCs?

China is leading with its digital yuan, while the European Central Bank and the U.S. Federal Reserve are actively researching their own versions.

For more insights and detailed guides on cryptocurrency, visit our Crypto Guides Section.

Stay Updated

For the latest updates on cryptocurrency trends and news, follow us on:

- X: https://x.com/FreeCoins24

- Telegram: https://t.me/freecoins24

Explore the latest crypto airdrops and uncover exclusive opportunities waiting for you — visit now at FreeCoins24.io/airdrops to start claiming today. Stay informed with the latest strategies and insights in the world of cryptocurrency at FreeCoins24.io.

Special Offer

For an enhanced trading experience, consider Bybit. Sign up through our referral link to unlock exclusive rewards, including up to $30,000 in deposit bonuses, and elevate your trading journey.