This week’s Bitcoin Weekly Close marked a historic milestone, reaching approximately $106,500, its highest ever. Backed by strong ETF demand and institutional inflows, the price action signals a confident market pushing forward. Alongside this, Ripple deepened its roots in the Middle East, and a new wave of altcoin enthusiasm swept across retail investors. Meanwhile, the UK announced tighter crypto regulation, and Coinbase’s CEO made headlines with a multi-million-dollar security bill. In this recap, we break down the biggest stories shaping crypto’s momentum, starting with Bitcoin’s defining close.

1. Bitcoin Weekly Close Breaks New Ground

Bitcoin ended the week with its strongest weekly close on record, hovering near $106,500. This followed six consecutive weeks of upward momentum, affirming a bullish trend that has pushed BTC dominance above 60%.

Technically, support is forming around $104,000, while resistance is now at $109,000. The futures and options markets reflect this confidence, open interest has surged, and the derivatives landscape shows more call activity than puts, suggesting that traders expect further upside.

Fueling this are U.S.-based spot Bitcoin ETFs, whose volume continues to grow. With BlackRock, Fidelity, and others channeling liquidity into BTC, the Bitcoin Weekly Close doesn’t just mark a price point, it validates the asset’s growing role in institutional portfolios.

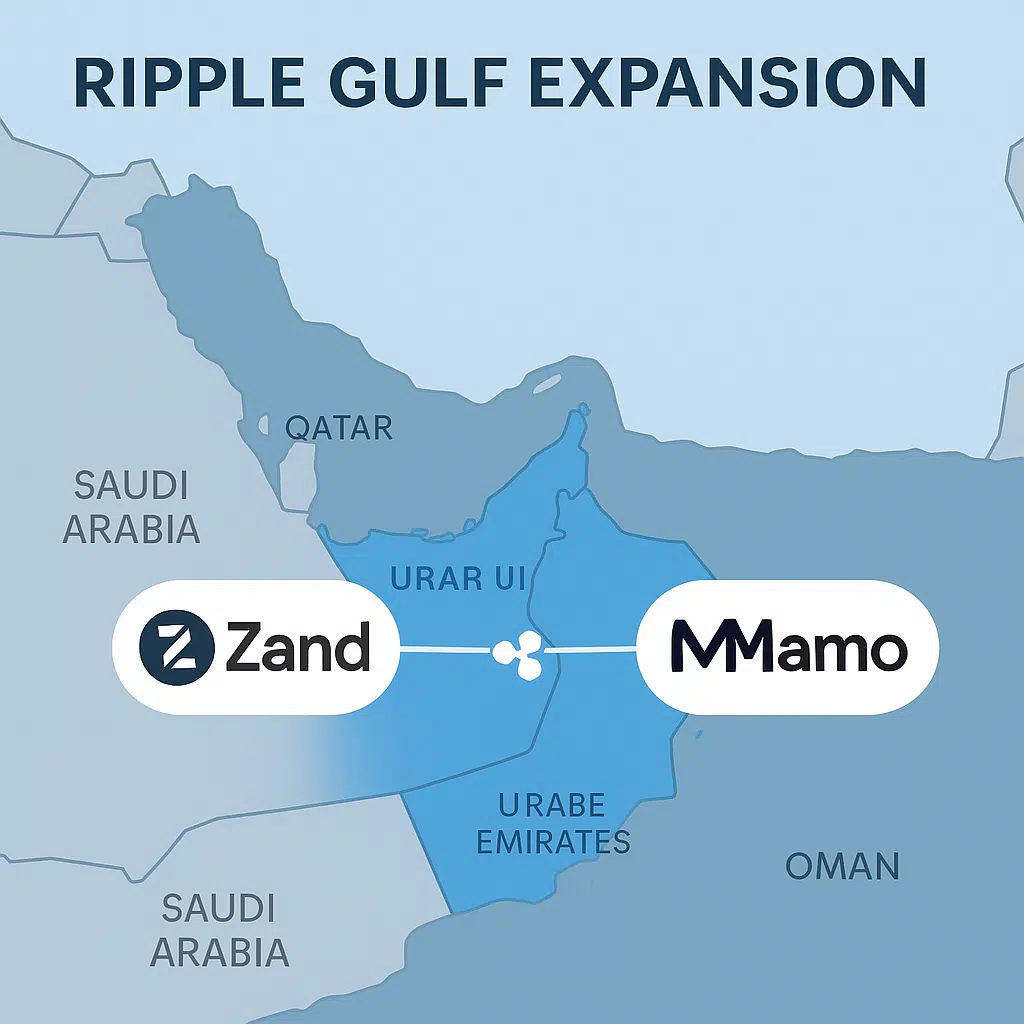

2. Ripple Expands into the Gulf with Major Partnerships

Ripple has made strategic moves in the Middle East, securing partnerships with Zand Bank and Mamo following regulatory approval from the Dubai Financial Services Authority (DFSA). This initiative is part of Ripple’s broader vision to serve global cross-border payment corridors.

The Middle East already accounts for more than 20% of Ripple’s customer base, and the region’s fintech-forward approach makes it a natural fit. By integrating with regional banks and payment apps, Ripple is not only increasing the utility of XRP, but also providing cost-effective settlement infrastructure for institutions.

While XRP saw a modest 6% price increase post-announcement, the long-term potential lies in volume growth and real-world usage. Ripple’s UAE expansion complements its push for institutional adoption — and may serve as a model for further regional rollouts.

3. Altcoin Gainers Surge Amid Speculative Euphoria

Altcoins saw an explosive week, with several tokens racking up triple-digit returns, a classic sign of speculative capital rotating down from Bitcoin’s rally.

Top gainers of the week included:

-

$GRASSITO: +4000%

-

$DEGEN: +127%

-

$MOODENG: +110.6%

-

$PEPE: +96%

-

$FLOKI: +80.45%

These gains were largely driven by community enthusiasm, meme culture, and aggressive marketing across social platforms. But it wasn’t all hype. Some projects launched new staking mechanics or revealed plans for future integrations into NFT marketplaces and DeFi protocols.

Still, it’s important to approach these rallies with caution. High-risk, low-cap altcoins can reverse just as quickly. Nevertheless, altcoin rotations are often early indicators of a broader risk-on cycle, especially when Bitcoin Weekly Close levels remain strong.

4. UK Rolls Out Stricter Crypto Compliance Measures

In a move signaling the next phase of global regulation, the UK’s Financial Conduct Authority (FCA) has announced enhanced compliance requirements for crypto firms. These include stronger AML/KYC mandates, stricter disclosures for retail clients, and new reporting standards for DeFi protocols.

This shift aligns with Europe’s MiCA (Markets in Crypto-Assets) framework, and reflects a growing global trend toward formalizing oversight in digital assets. While larger exchanges are expected to comply, smaller operators may face pressure due to cost and administrative burden.

The UK government’s stance may dampen certain speculative markets in the short term, but many believe it sets the stage for greater institutional confidence in the long run. For developers and platforms, it’s a signal that the days of regulatory ambiguity are coming to an end.

5. Coinbase CEO’s Security Costs Raise Alarm Over Web3 Threats

Coinbase disclosed in its 2023 filings that it spent over $6.2 million on personal security for CEO Brian Armstrong, a number far surpassing what traditional financial CEOs typically require. The revelation sparked industry-wide discussion about executive vulnerability in crypto.

The high cost points to growing risks in the industry, including physical threats, cyberattacks, and targeted social engineering. Coinbase has also dealt with internal breaches, such as the widely reported $400 million phishing incident involving compromised support staff.

This highlights the increasing need for personal and corporate security standards in the crypto space. As Web3 scales, protecting builders, leaders, and contributors will be as important as securing protocols and wallets.

6. Broader Market Insights: Altcoins, Ethereum, and Stablecoin Flows

Ethereum’s Lag Raises Rotation Questions

Despite the market-wide excitement, Ethereum (ETH) underperformed against Bitcoin. Analysts suggest this could be due to capital rotating into BTC and altcoins. However, Layer 2s like Base and Arbitrum are seeing increased usage, indicating healthy fundamentals underneath ETH’s short-term price stagnation.

Solana’s Ecosystem Growth Continues

Solana showed strong on-chain activity growth this week, with DEX volumes and NFT mints rising. Multiple tokens in the Solana ecosystem also ranked among the top gainers, further supporting the network’s recent resurgence.

Stablecoin Supply Growth Signals Bullish Intent

A noticeable uptick in USDT and USDC supply on-chain suggests capital is waiting to re-enter risk assets. Historically, stablecoin growth has preceded bull runs, offering a bullish undertone to the broader market outlook.

Final Thought

The Bitcoin Weekly Close above $106,000 is more than a charting milestone, it’s a confirmation of Bitcoin’s mainstream arrival. Ripple’s growing presence in the UAE shows that blockchain infrastructure is maturing at the institutional level. Meanwhile, the altcoin surge reflects renewed retail enthusiasm, while regulation and security issues remind us how high the stakes are becoming.

With Ethereum finding its footing and Solana proving it’s not done yet, the crypto market is showing early signs of broad re-acceleration. But as always, fundamentals, utility, and smart navigation will separate lasting projects from short-lived speculation.

Want more in-depth analysis and airdrop opportunities? Visit FreeCoins24.io/airdrops to explore the latest free crypto drops.

Stay Updated

Stay in the loop with the latest crypto airdrops, strategies, and tips. Follow us on: