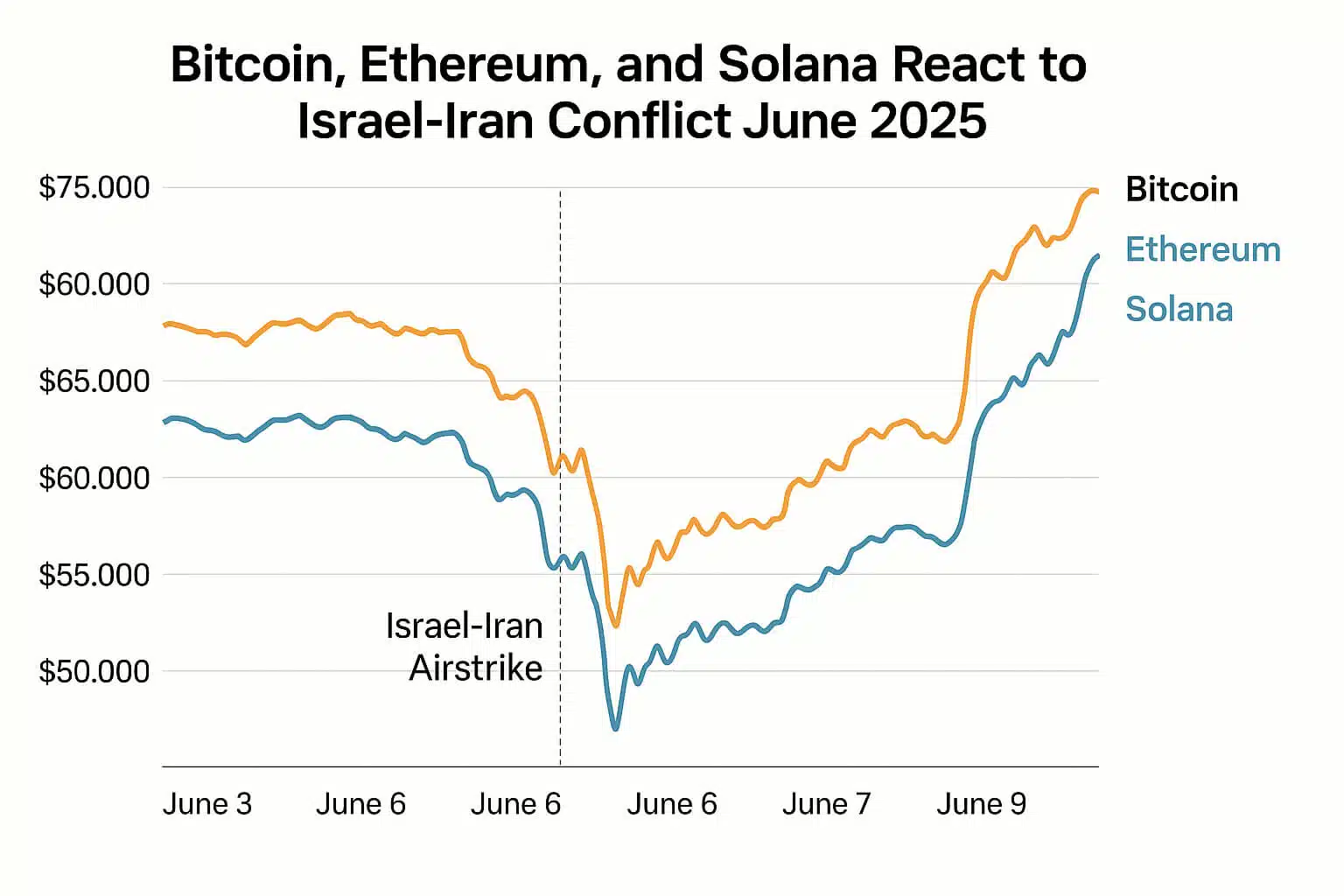

The Israel-Iran airstrikes of June 13, 2025, sent shockwaves through the crypto market, with geopolitical tensions igniting a wave of volatility. Bitcoin, Ethereum, and Solana all plummeted initially, but after a brief dip, they showed signs of recovery. Meanwhile, smaller altcoins, meme tokens, and gold-backed cryptocurrencies gained traction as risk-averse investors sought stability. Let’s explore how these geopolitical tensions have affected the crypto market, the emerging winners, and what it means for traders in the short-term and long-term.

1. Market Reaction: A Risk-Off Selloff

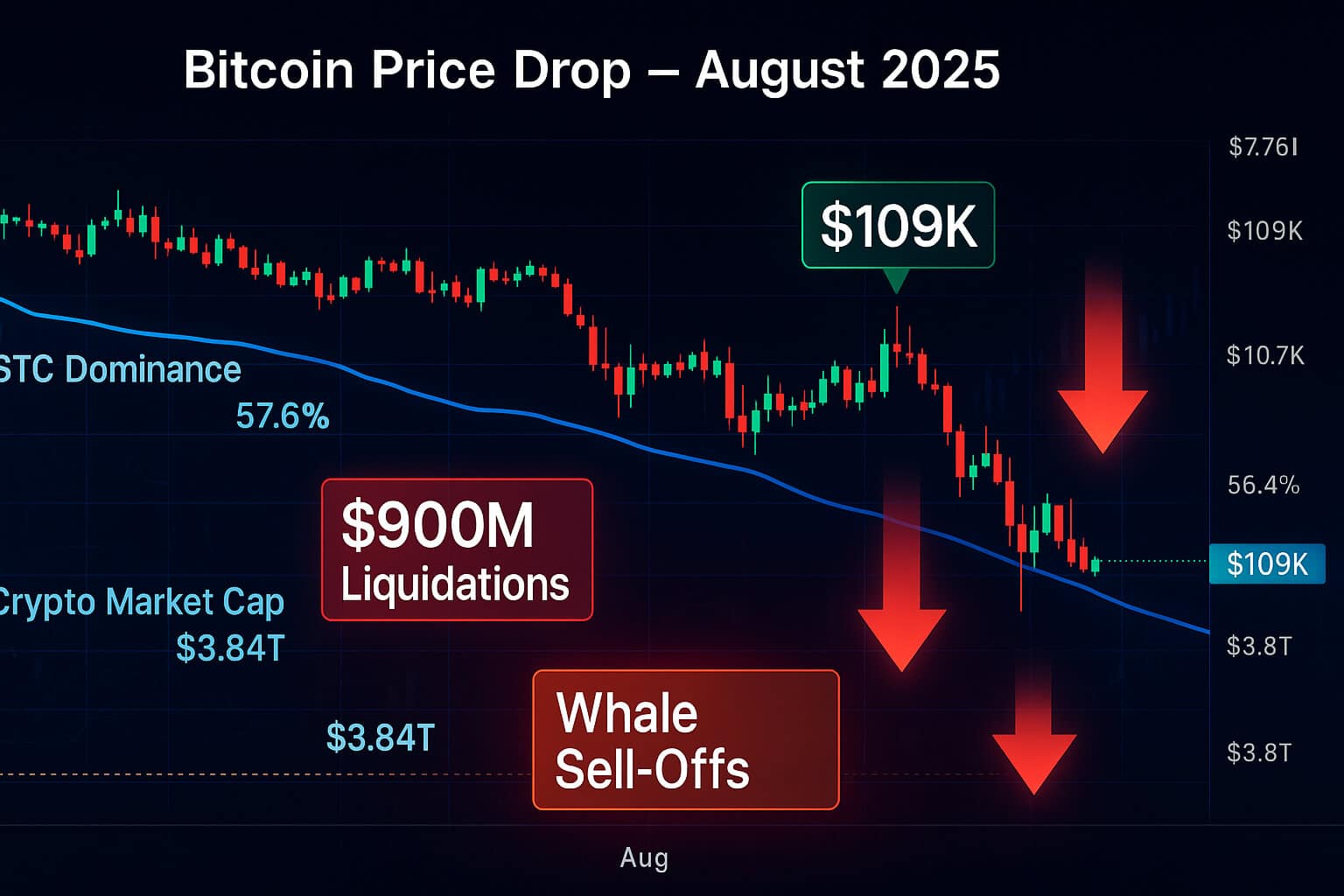

The geopolitical event triggered immediate panic . As airstrikes were launched on Iran’s nuclear facilities and military bases, crypto markets reacted sharply. The total market capitalization of cryptocurrencies dropped by 5.28%, losing approximately $140 billion in just 24 hours. Bitcoin experienced a sharp decline, falling to $102,822 before recovering to $104,676. Other major cryptocurrencies like Ethereum and Solana also saw significant losses, highlighting the risk-off sentiment that swept across the markets.

2. Bitcoin’s Price Surge Amid Volatility

Bitcoin took an initial hit but managed to recover swiftly. After falling to below $95K, it surged back to $104,676 by the end of the day, signaling resilience. Despite an Evening Star pattern that indicated short-term bearish sentiment, Bitcoin’s dominance remained strong at 63.92%. This dominance shows Bitcoin’s continued role as a market anchor. Institutional investors have shown confidence in Bitcoin, even amid geopolitical uncertainty. The RSI (Relative Strength Index) remains neutral-to-bullish, showing that market participants are still cautious but optimistic in the longer run.

3. Ethereum’s Struggle with Volatility

Ethereum (ETH) had a tougher time during this period of market uncertainty. After dropping nearly 9% to $2,489, ETH managed to stabilize at $2,539. Ethereum’s DeFi exposure and reliance on decentralized finance protocols were points of vulnerability during the crisis. DeFi’s reliance on liquid markets and volatile tokens makes it especially sensitive to geopolitical shocks. However, despite the volatility, on-chain activity has remained steady, and Ethereum’s long-term potential as a smart contract platform remains intact.

4. Solana’s Rollercoaster and Meme Token Gains

Solana (SOL) saw significant fluctuations, dipping to $141 before recovering to $145.52. Despite institutional interest, particularly with Fidelity’s ETF filing, the volatile market and memecoin speculation made Solana prone to sharp price swings. Meanwhile, meme tokens like TRUMP, DOGE, and BONK saw surge in trading volumes, offering traders high-risk, high-reward opportunities during the Israel-Iran turmoil.

5. The Impact of Gold-Backed Stablecoins

In response to market instability, investors turned to gold-backed tokens, with PAXG and Tether Gold (XAUt) leading the charge. PAXG surged by 1.33%, reaching a $208.69 million in trading volume. These gold-backed assets proved to be a safe haven during a time of heightened uncertainty. They represent a stable and secure alternative to volatile cryptocurrencies, particularly in times of geopolitical instability.

6. Geopolitical Context and Crypto Sensitivity

The airstrikes in the Middle East have exacerbated geopolitical concerns, with Iran vowing retaliation. This escalation has also led to a 10% surge in oil prices, which could delay U.S. Federal Reserve rate cuts. Historically, crypto markets react quickly to such events, as seen during the Russia-Ukraine conflict. Bitcoin became a preferred hedge for investors looking to protect wealth against inflation and geopolitical tensions. However, the market’s reaction isn’t purely based on fundamentals, and sentiment will likely shift based on news from the Middle East in the coming days.

7. Short-Term Outlook and Trading Strategies

The current market is likely to remain volatile as tensions in the Middle East unfold. Traders should look for opportunities to buy dips in major cryptocurrencies like Bitcoin and Ethereum, especially if they test support levels at $100K and $2,500, respectively. As seen in past geopolitical crises, these assets often recover once the market absorbs the immediate shock. For altcoin traders, meme coins and gold-backed stablecoins offer short-term gains, but it’s crucial to use stop-loss orders to manage risk.

8. Long-Term Implications for Crypto

The events of June 2025 may further solidify crypto’s role as a hedge against geopolitical instability. As countries like Iran continue to experience economic pressure, cryptocurrencies could be increasingly seen as a store of value, especially in regions facing financial restrictions. With Bitcoin’s fixed supply and decentralized nature, it may attract more adoption, especially in regions with unstable fiat currencies.

Conclusion:

The Israel-Iran conflict has once again shown the volatile nature of crypto markets. While major cryptocurrencies faced short-term pain, smaller altcoins, meme tokens, and gold-backed assets capitalized on the market’s uncertainty. As geopolitical tensions persist, traders must stay vigilant and adjust their strategies accordingly. Diversification and tight risk management will be crucial for those navigating the wild swings in the crypto markets. At FreeCoins24.io, we advise investors to stay informed and prepared for continued market volatility, as it brings both risks and opportunities.