On June 15, 2025, Polyhedra Network’s ZKJ token crashed by 63%, causing widespread turmoil in the crypto markets. The sudden drop triggered by large-scale sell-offs raised suspicions of a rugpull. As the project fell under scrutiny, many crypto traders wondered if insiders were responsible for the price collapse. In this article, we’ll break down the events surrounding the ZKJ crash, assess the evidence pointing toward a potential rugpull, and highlight important lessons for crypto traders.

1. Project Overview: Polyhedra Network and ZKJ Token

Polyhedra Network launched in 2023 as a promising cross-chain interoperability solution built on Zero-Knowledge Proof (ZKP) technology. It aimed to provide privacy, scalability, and efficient asset transfers across Layer 1 and Layer 2 networks. With backing from top investors like Polychain Capital and Binance Labs, the project seemed poised for success. Its native token, ZKJ, was integral to its ecosystem, facilitating transactions and governance. However, on June 15, 2025, ZKJ suffered a dramatic crash.

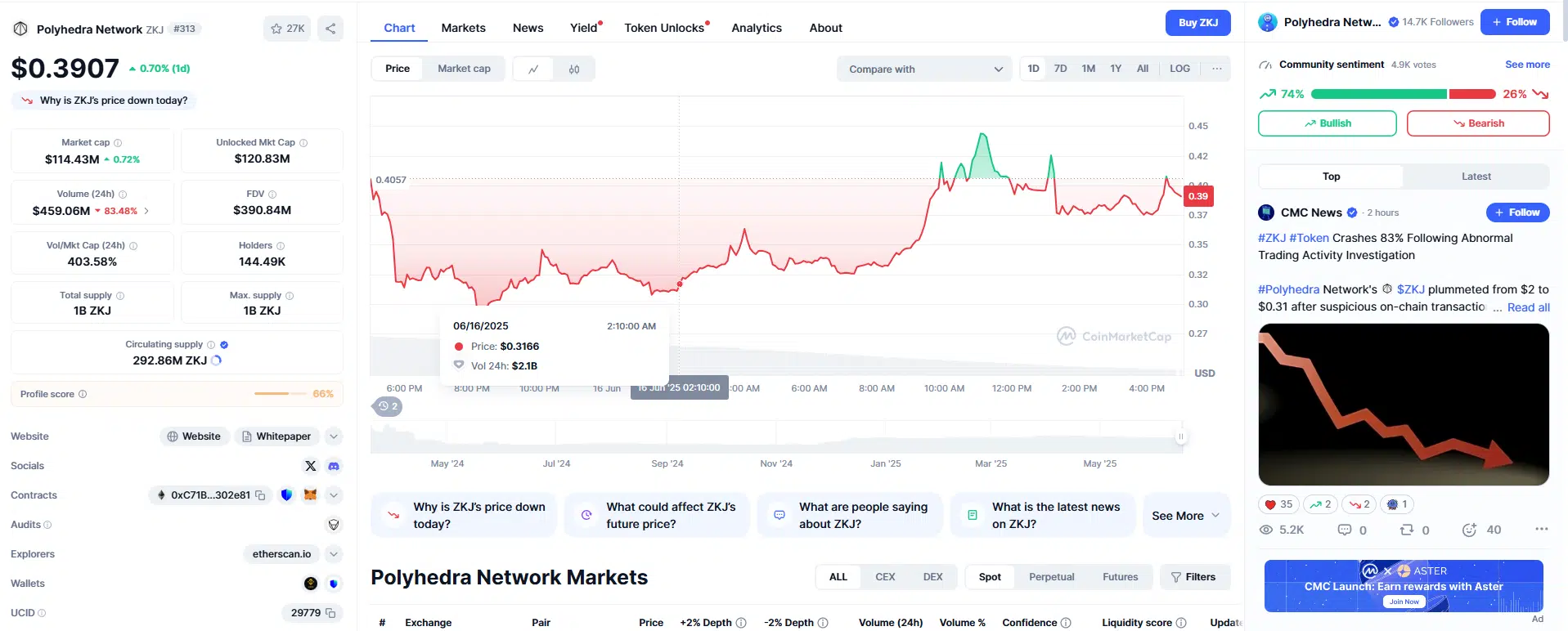

2. The Price Crash on June 15, 2025

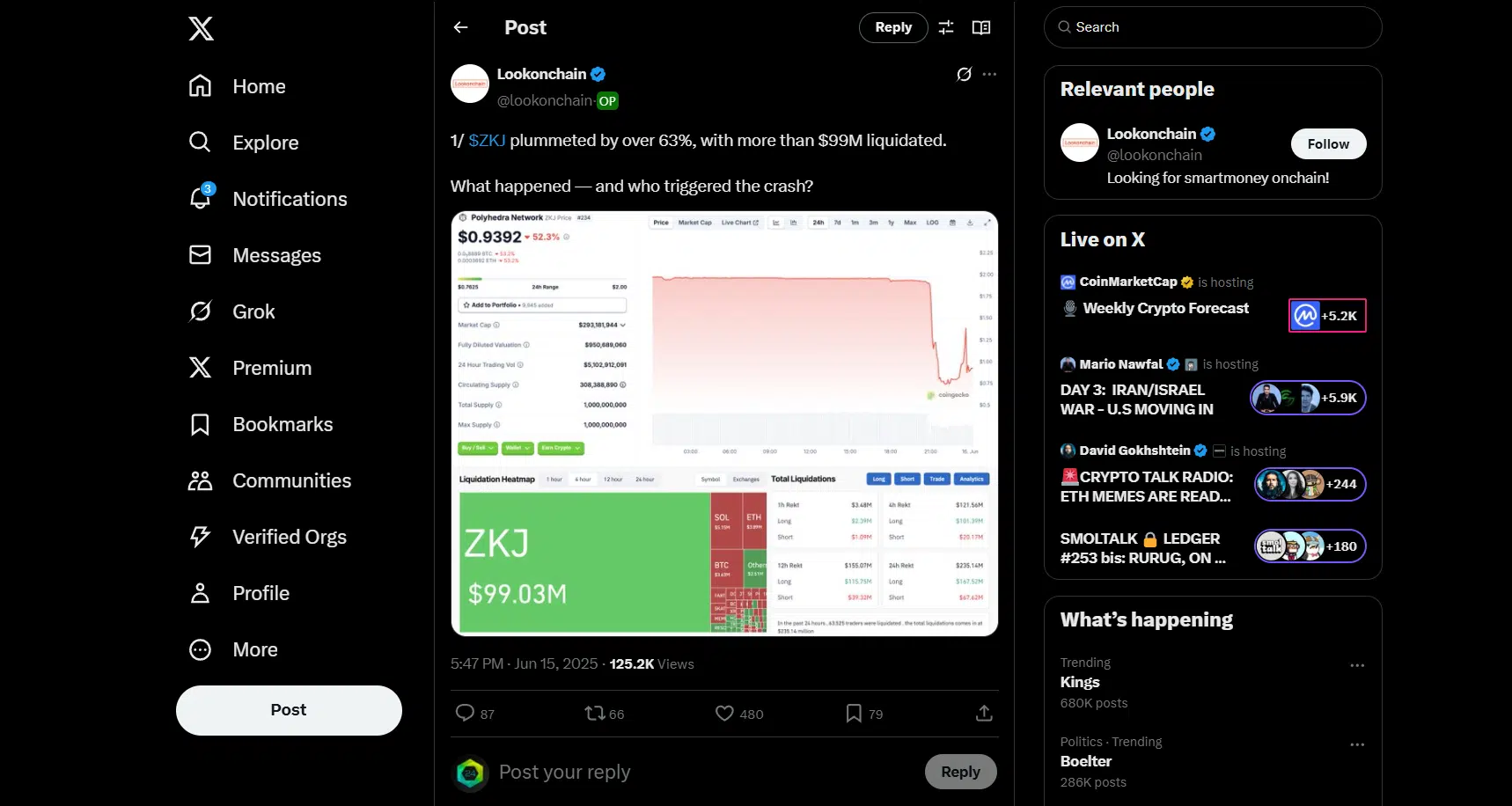

ZKJ dropped 63% in under two hours, wiping out over $99 million in liquidations. Whale wallets were behind the massive sell-off. According to blockchain tracker Lookonchain, six wallets collectively sold 5.23 million ZKJ tokens, totaling around $9.66 million. These wallets had previously withdrawn liquidity from both ZKJ and KOGE, exchanged KOGE for ZKJ, and then sold off the tokens, causing the price to plummet.

3. Evidence Suggesting a Rugpull

The signs of a rugpull are clear. Here’s why:

- On-Chain Activity:

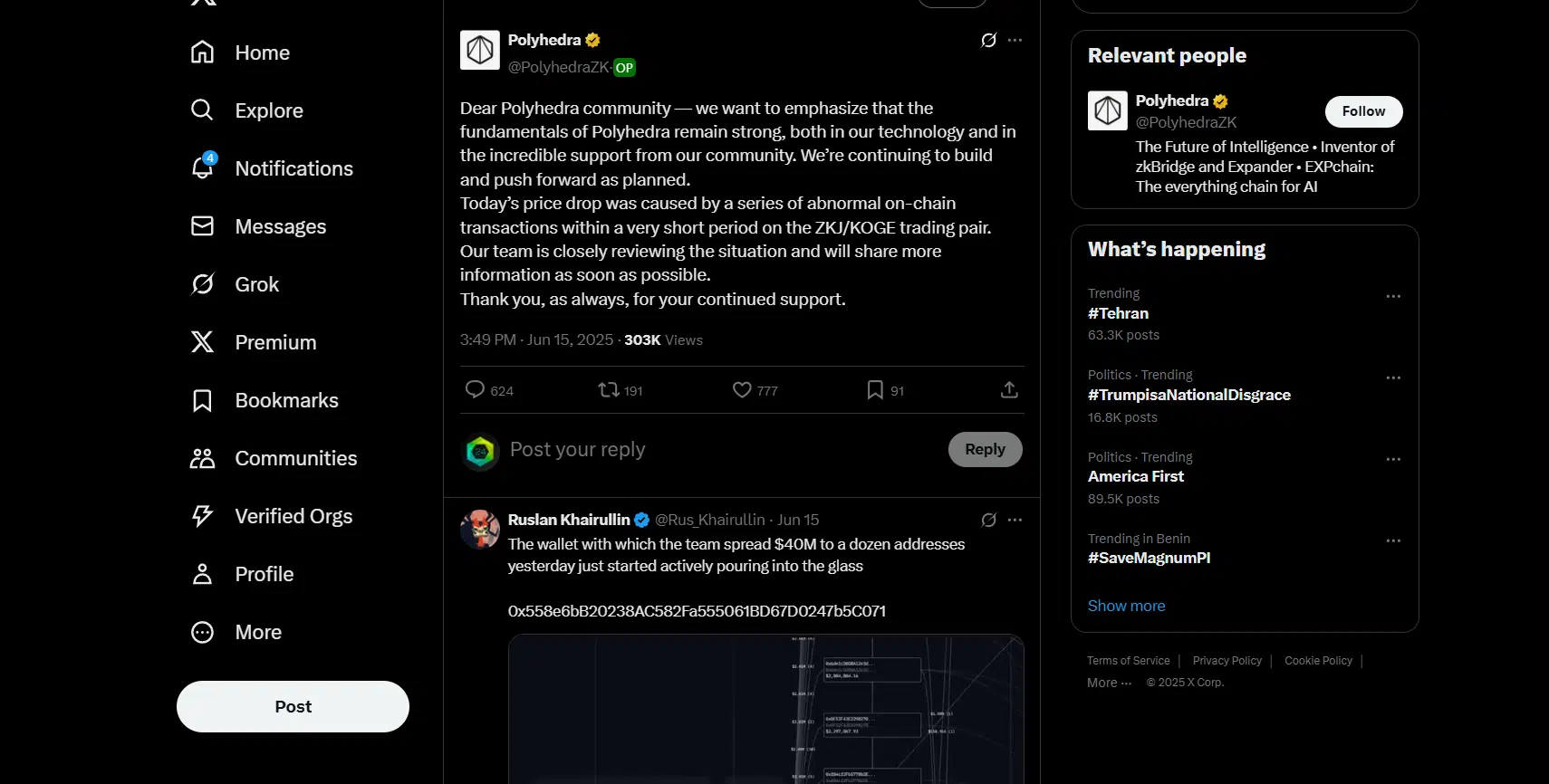

On June 14, 2025, a wallet linked to Polyhedra’s team moved $40 million worth of ZKJ to anonymous wallets. These tokens were then dumped on the market, coinciding with the price crash. This movement raises red flags, suggesting insider involvement. - Community Accusations:

The community reacted strongly. Users on X criticized Polyhedra, calling it a “classic rugpull.” They pointed out that the $40 million transfer was highly suspicious, as it aligned with the price drop the following day. - Binance’s Statement:

Binance acknowledged the price volatility and suggested that the issue might stem from large holders removing liquidity. This adds to the suspicion that insiders played a role in the price collapse.

4. The Team’s Official Response

Polyhedra Network issued a statement on June 15, 2025, claiming the crash was due to “abnormal on-chain transactions.” They denied any fraudulent activity, emphasizing their commitment to the project’s fundamentals. However, the community wasn’t convinced. Many pointed to the large token transfers as proof of intentional manipulation.

5. Community and Market Reaction

The crypto community was quick to voice its frustration. Many X users condemned Polyhedra Network, calling it a scam. The price drop was significant, with CoinGlass data showing over $97 million in liquidations. Traders who had leveraged long positions suffered the most.

6. Analysis of the Rugpull Allegations

Based on the evidence, it appears that Polyhedra Network was indeed rugpulled. Key factors include:

-

Timing of the Sell-Off: The $40 million transfer to anonymous wallets just before the crash fits the pattern of insider manipulation.

-

Binance’s Statement: Binance confirmed that large holders had removed liquidity, possibly indicating internal involvement.

-

Community and On-Chain Data: The community’s suspicions and the unusual wallet activity align with previous rugpull scenarios.

Although Polyhedra denies any wrongdoing, the lack of transparency has left investors in limbo. It’s also unusual for a project backed by credible investors like Polychain and Binance Labs to engage in such practices.

7. Key Tips for Users to Stay Safe While Trading

To avoid falling victim to rugpulls and other crypto risks, consider the following tips:

-

Research the Project: Investigate the team’s background, track record, and transparency. Avoid projects with anonymous teams or vague details.

-

Monitor On-Chain Activity: Use tools like Etherscan to track large wallet movements and watch for sudden dumps.

-

Avoid Over-Leveraging: Use leverage cautiously. The ZKJ crash caused $99 million in liquidations. Protect your positions with stop-loss orders.

-

Diversify Your Portfolio: Don’t put all your capital into one project. Diversifying reduces risk.

-

Be Skeptical of Hype: Avoid projects that promise quick returns. Assess their whitepaper, roadmap, and tokenomics.

-

Use Reputable Exchanges: Only trade on trusted exchanges like Binance and ensure your funds are stored in secure wallets.

8. Conclusion

The ZKJ crash has served as a cautionary tale for crypto traders. Whether or not Polyhedra Network orchestrated a rugpull, the event highlights the dangers of investing in projects with opaque team actions and unclear tokenomics. As always, it’s essential to perform thorough due diligence, monitor market activity, and employ sound risk management strategies. The ZKJ crash reinforces the need for caution, especially when dealing with volatile, high-risk assets.

Want more in-depth analysis and airdrop opportunities? Visit FreeCoins24.io/airdrops to explore the latest free crypto drops.

Stay Updated

Stay in the loop with the latest crypto airdrops, strategies, and tips. Follow us on: