In a significant move for the cryptocurrency and financial sectors, the GENIUS Act and Coinbase’s tokenized stocks initiative are set to redefine the landscape of digital finance. The U.S. Senate passed the GENIUS Act, which aims to regulate stablecoins, on June 17, 2025, following a 68-30 vote. Meanwhile, Coinbase, a leading cryptocurrency exchange, has unveiled its ambition to tokenize traditional stocks, marking a substantial shift towards the integration of blockchain in mainstream finance.

The GENIUS Act: Regulatory Framework for Stablecoins

The Guiding and Establishing National Innovation for U.S. Stablecoins Act, aims to regulate stablecoins, which are digital assets pegged to traditional currencies like the U.S. dollar. The bill was passed with bipartisan support and outlines key measures, including:

-

1:1 Reserves: Issuers must maintain reserves to back the value of stablecoins.

-

Transparency and Audits: Regular audits and disclosures are mandatory.

-

AML Compliance: Anti-money laundering and counter-terrorism financing regulations will apply.

This legislation is expected to bring stability and consumer protection to the growing stablecoin market, which is valued at approximately $232 billion.

Coinbase’s Tokenized Stocks Initiative

In parallel with the GENIUS Act, Coinbase is introducing tokenized stocks. These are blockchain-based representations of traditional company shares. Tokenized stocks offer several advantages, including:

-

Fractional Ownership: Investors can own a fraction of shares.

-

24/7 Trading: Unlike traditional markets, tokenized stocks can be traded around the clock.

-

DeFi Integration: Tokenized stocks could be used as collateral in decentralized finance (DeFi) protocols.

Coinbase is seeking SEC approval to launch tokenized equities. If successful, this would position Coinbase as a direct competitor to traditional brokers like Robinhood and Charles Schwab.

Connection Between the GENIUS Act and Tokenized Stocks

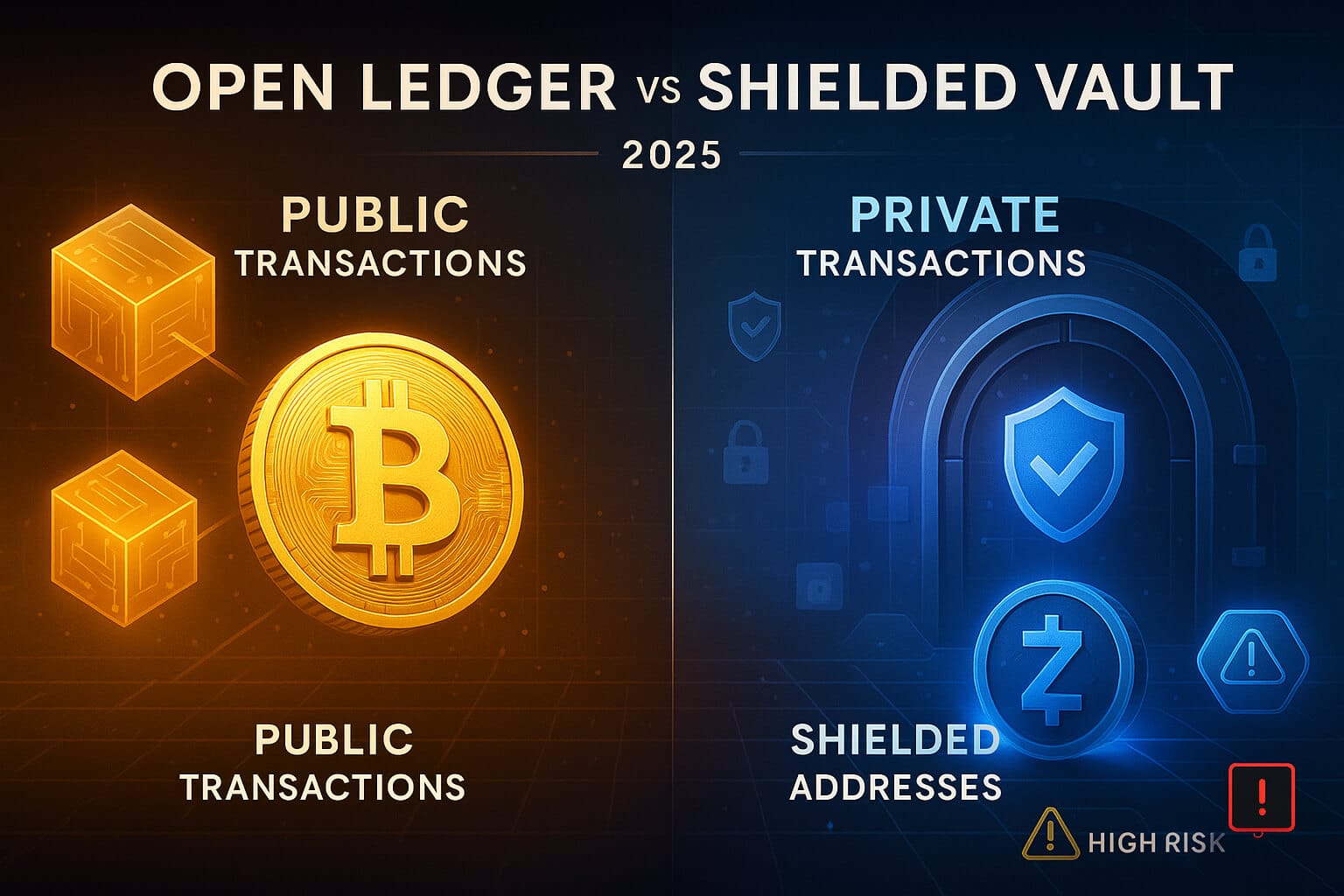

While the GENIUS Act primarily focuses on stablecoins, its regulatory framework could benefit tokenized stocks as well. Stablecoins are commonly used in DeFi protocols, which could eventually include tokenized securities. A regulated stablecoin market would create a stable foundation for tokenized stocks, making the digital asset space more attractive for institutional adoption.

Coinbase has supported the GENIUS Act, viewing it as an important step for regulatory clarity. This could potentially help the company gain SEC approval for its tokenized stocks initiative. With stablecoin regulation in place, tokenized stocks could follow suit in gaining a regulatory framework that encourages widespread use.

The Potential Impact on the Financial Landscape

Together, the GENIUS Act and Coinbase’s tokenized stocks initiative represent major shifts in the financial ecosystem. The GENIUS Act could make stablecoins a widely accepted tool for digital payments. Tokenized stocks could democratize access to equity markets, making it easier for retail investors to purchase fractional shares and trade them 24/7.

Key benefits include:

-

Lower transaction costs: Blockchain reduces the fees typically associated with traditional stock trading.

-

Faster settlement times: Tokenized stocks could provide faster and more efficient transactions.

-

Increased liquidity: Integration with DeFi could enhance liquidity for tokenized equities.

However, regulatory clarity remains a challenge. Both stablecoins and tokenized stocks must adhere to standards set by the SEC to ensure investor protection and market stability.

The Challenges Ahead

Despite the significant progress, challenges remain for both the GENIUS Act and tokenized stocks:

-

GENIUS Act Criticism: Some critics, including Senator Elizabeth Warren, argue that the GENIUS Act may not go far enough in protecting consumers from financial risks associated with stablecoins.

-

Regulatory Hurdles: Tokenized stocks will still require SEC approval, and regulatory oversight is critical to ensuring their security and compliance.

-

Standardization: Both stablecoins and tokenized stocks need to adhere to a standardized framework to ensure fairness and transparency for all participants.

The Future Outlook

The combination of the GENIUS Act and Coinbase’s tokenized stocks could usher in a new era of blockchain-powered finance. If the GENIUS Act becomes law, it could significantly expand the use of stablecoins for digital payments, with predictions of a tenfold increase in market size. At the same time, tokenized stocks could revolutionize the way equities are traded, offering greater accessibility and efficiency.

While challenges remain, the GENIUS Act and tokenized stocks represent a critical step forward for blockchain technology in traditional finance. The success of these initiatives will depend on regulatory clarity, market adoption, and consumer protection.

Conclusion

As blockchain continues to disrupt traditional finance, the GENIUS Act and Coinbase’s tokenized stocks initiative are shaping the future of digital finance. These developments hold great potential to democratize access to financial assets and enhance transaction efficiency. However, the road ahead remains filled with regulatory challenges that must be addressed for this vision to fully materialize.

Want more in-depth analysis and airdrop opportunities? Visit FreeCoins24.io/airdrops to explore the latest free crypto drops.

Stay Updated

Stay in the loop with the latest crypto airdrops, strategies, and tips. Follow us on: