The digital asset world is on the cusp of major shifts, with Bitcoin potentially poised for a significant breakthrough. As of June 26, 2025, the U.S. government has announced a strategic Bitcoin acquisition plan, alongside growing discussions about weakening the Federal Reserve’s influence over interest rates. These developments could usher in a new era of monetary policy that shifts traditional financial systems and positions Bitcoin as a central figure in future monetary strategy.

The U.S. Government’s Bitcoin Accumulation Plan

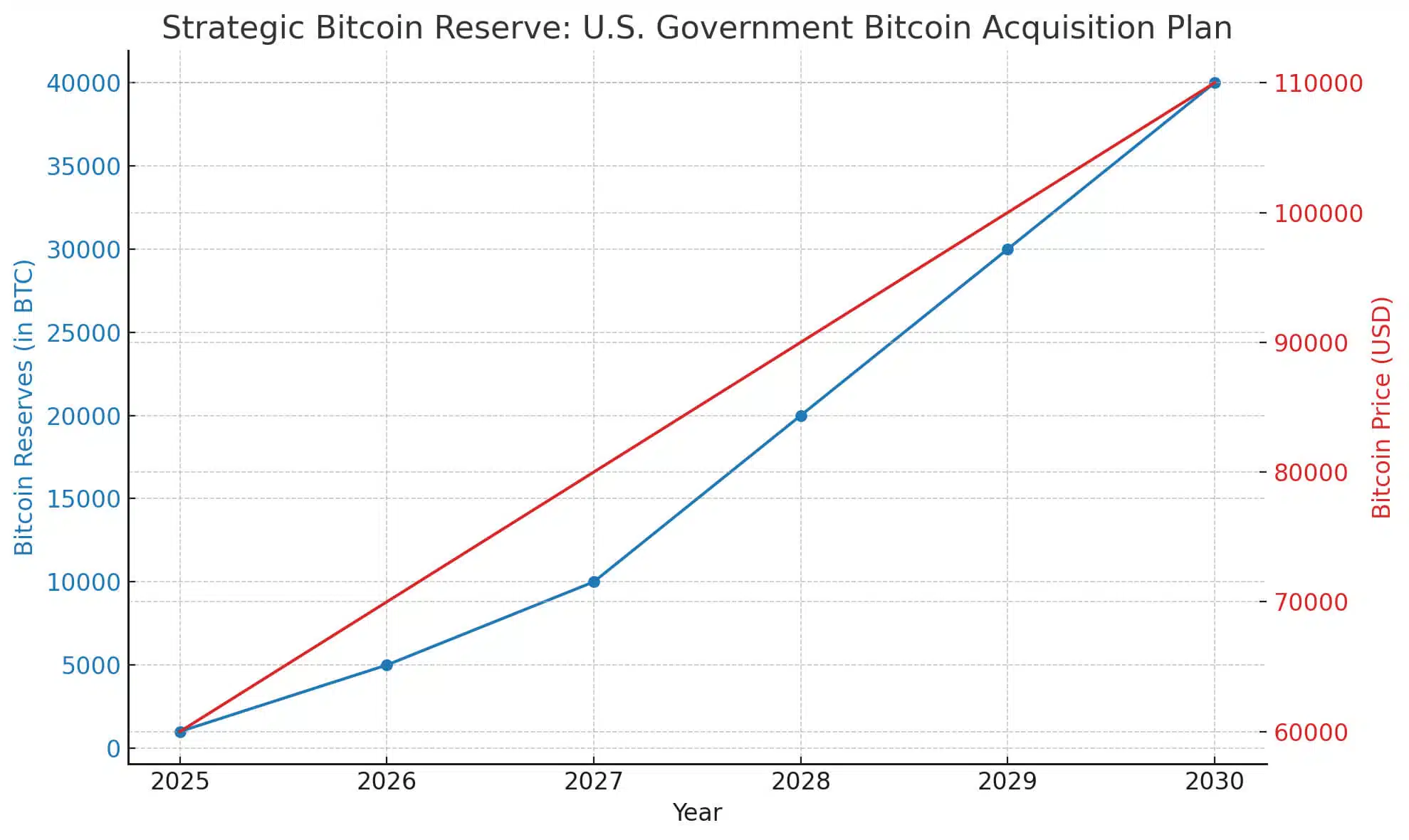

In a groundbreaking move, the U.S. government revealed its plan to accumulate Bitcoin as part of a broader strategy to treat Bitcoin as a reserve asset through the Strategic Bitcoin Reserve (SBR). Established by President Trump’s executive order in March 2025, the SBR directs the Treasury and Commerce Departments to develop strategies for acquiring Bitcoin without additional taxpayer costs. Currently, the U.S. holds approximately 200,000 BTC (~$16.8 billion), primarily sourced from criminal forfeitures, which has created a base for future Bitcoin purchases. The recent announcement on June 26, 2025, signals a move toward active acquisition, making Bitcoin a long-term strategic asset akin to gold.

Impact of a Weakened Federal Reserve

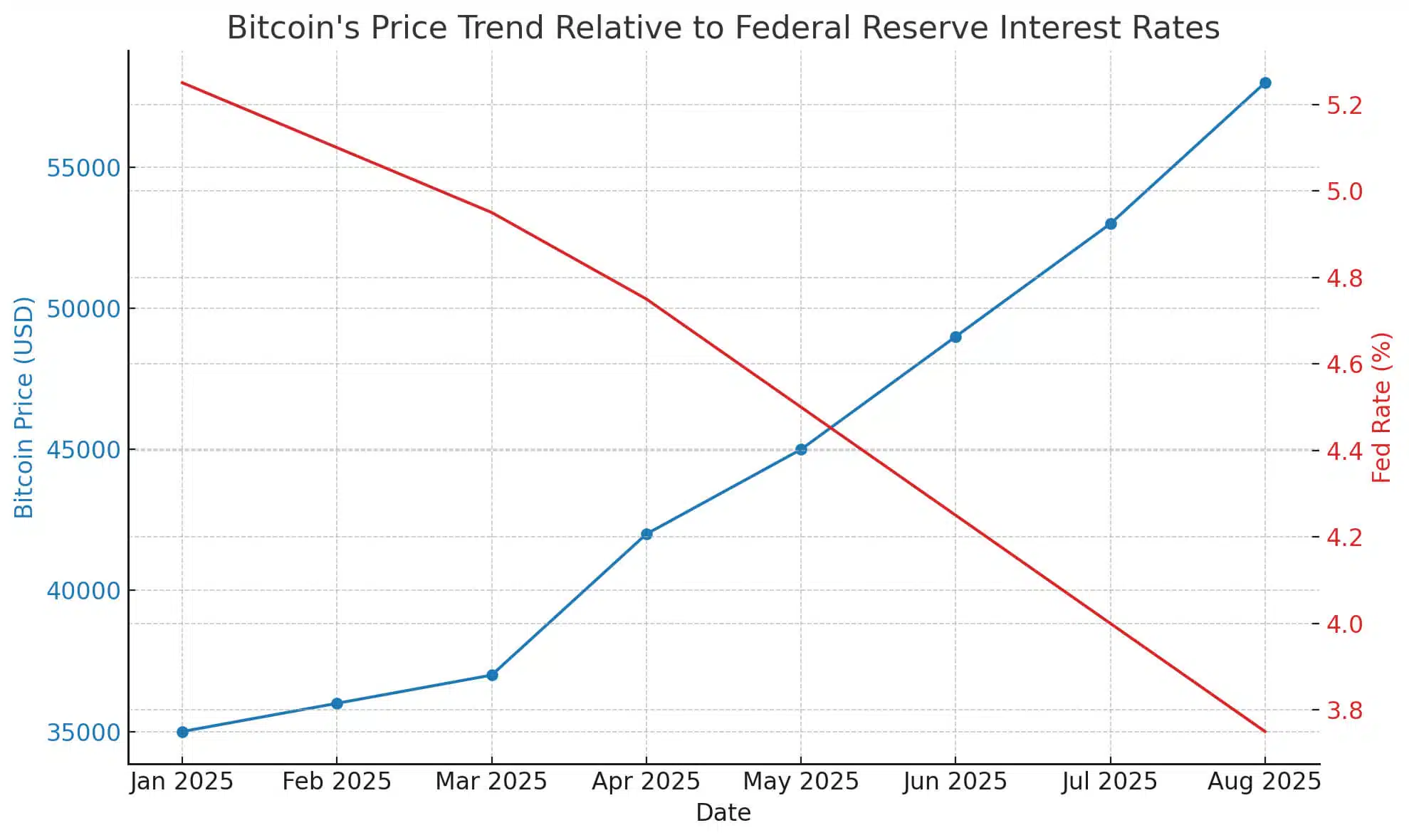

At the same time, there is growing speculation that President Trump may move to weaken the Federal Reserve’s autonomy, particularly its control over interest rates. The current chairman, Jerome Powell, has faced significant pressure, including threats of removal, suggesting that changes to the Federal Reserve’s decision-making could be imminent. A weakened Fed could lead to more aggressive rate cuts, which have historically been favorable for risk assets like Bitcoin.

Historically, periods of low interest rates have led to increased liquidity in financial markets, pushing investors toward higher-yield assets like Bitcoin. During the 2020-2021 period, when rates were near-zero, Bitcoin experienced a 375% price increase from February 2020 to February 2022. A potential reduction in rates due to a weakened Fed could thus provide the spark for Bitcoin to reach new highs, with some analysts predicting Bitcoin could hit $250,000 by the end of 2025.

The Strategic Role of Bitcoin in U.S. Reserves

The SBR reflects a shift in how governments view cryptocurrencies. Bitcoin’s decentralized nature, fixed supply, and the belief that it serves as a hedge against inflation make it an attractive asset for long-term holding, especially during periods of economic instability. The Bitcoin Act of 2025, introduced by Senator Cynthia Lummis, supports the idea of acquiring up to 1 million BTC over the next five years. This would be funded through budget-neutral strategies such as revaluing gold reserves or allowing tax payments in Bitcoin, eliminating the need for direct government spending.

If passed, the Bitcoin Act could increase the total U.S. holdings to an influential 5% of the total Bitcoin supply. This would not only solidify Bitcoin’s role as a global reserve asset but also enhance its legitimacy. Additionally, this move is expected to reduce market volatility, as the U.S. government would no longer auction its seized Bitcoin, thus lowering the potential for large sell-offs.

Economic and Market Dynamics: What’s Next?

Should the U.S. government begin purchasing Bitcoin in earnest, the broader market could experience substantial impacts. Lower interest rates would likely flood the markets with liquidity, making risk assets more attractive. Bitcoin, often seen as a speculative asset, could gain traction among institutional investors, further legitimizing it as a store of value. Experts like Geoff Kendrick from Standard Chartered have predicted that, with continued rate cuts, Bitcoin could see a price surge toward $250,000 by the end of 2025.

However, the risks of volatility remain. Bitcoin’s price can swing dramatically, with historical fluctuations of 50% or more, as seen during major geopolitical events like the Russia-Ukraine war. The U.S. government’s role in Bitcoin’s future may bring benefits but also challenges. The high volatility, potential security risks, and the sheer scale of Bitcoin purchases could distort the market and lead to unforeseen consequences.

How a Weakened Fed Could Boost Bitcoin Adoption

The potential removal or weakening of the Fed’s power over interest rates could create a perfect storm for Bitcoin adoption. If the Fed starts lowering rates in an effort to stimulate the economy, risk assets like Bitcoin would likely benefit from increased liquidity. This could further propel the growth of Bitcoin as a mainstream asset, with predictions suggesting a potential surge in its price.

Public sentiment is mixed, though, as economists like Nouriel Roubini have raised concerns about the suitability of Bitcoin as a reserve asset. They point to Bitcoin’s volatility and lack of intrinsic value, arguing that the asset could destabilize the financial system if used in large-scale reserves. On the other hand, crypto advocates are optimistic about Bitcoin’s potential to act as a hedge against inflation and traditional financial crises.

Legislative Hurdles and Risks

While there is significant momentum behind the idea of a strategic Bitcoin reserve, the Bitcoin Act faces challenges in Congress. The bill has already been introduced, but it is still in committee, with no guarantee of approval. Political polarization over Bitcoin’s role and concerns about volatility may delay the passage of such legislation. Moreover, the potential for market manipulation and cybersecurity risks, such as hacks targeting government wallets, remains a critical concern.

Internationally, the U.S. move towards a Bitcoin reserve could spark global pushback. Countries like China and Russia are increasingly viewing Bitcoin as a tool to diversify theirreserves, and European officials have warned that significant U.S. purchases of Bitcoin could destabilize global financial systems.

Conclusion: Bitcoin’s Role in 2025 and Beyond

The U.S. government’s Bitcoin accumulation plan, coupled with the potential for a weakened Fed and aggressive rate cuts, could be the catalyst for Bitcoin’s transition from a speculative asset to a mainstream store of value. As the Strategic Bitcoin Reserve expands, the legitimacy of Bitcoin could solidify, making it an essential part of global financial reserves.

However, significant risks remain. The volatility of Bitcoin, security challenges, and market distortion from large government purchases all pose potential threats to the stability of Bitcoin’s price. The future of Bitcoin as a reserve asset depends on how these challenges are addressed, with global economic conditions, political support, and regulatory frameworks playing pivotal roles in determining Bitcoin’s fate.

Investors and policymakers alike will be watching closely as Bitcoin’s role in the U.S. economy evolves, with 2025 being a key year for determining the trajectory of the world’s most well-known cryptocurrency.

Want more in-depth analysis and airdrop opportunities? Visit FreeCoins24.io/airdrops to explore the latest free crypto drops.

Stay Updated

Stay in the loop with the latest crypto airdrops, strategies, and tips. Follow us on: