The One Big Beautiful Bill Act (OBBBA) is shaking up discussions among crypto investors, even though it’s not specifically targeting the industry. Passed by the U.S. House in May 2025, it’s including provisions with potential ripple effects across Bitcoin, stablecoins, and decentralized finance. Meanwhile, the GENIUS Act, passed by the Senate in June, is directly addressing stablecoins, making 2025 a pivotal year for crypto regulation. Let’s unpack what you need to know.

1. OBBBA’s Full Bonus Depreciation is Cutting Crypto Mining Costs

The bill reinstates 100% bonus depreciation on capital investments through 2030, letting businesses fully deduct equipment costs in the year of purchase. Crypto miners are snapping up this benefit, as they can deduct mining rigs right away, generating paper losses that offset other income and cut tax bills. Lower operational costs are increasing profitability, encouraging investments in new mining infrastructure and potentially stabilizing or boosting Bitcoin prices by strengthening the network’s security.

Special Offer

Looking to trade Bitcoin and stablecoins? Sign up on Bybit today and enjoy up to $30,000 in deposit bonuses. Don’t miss out on the chance to trade on one of the world’s leading crypto exchanges.

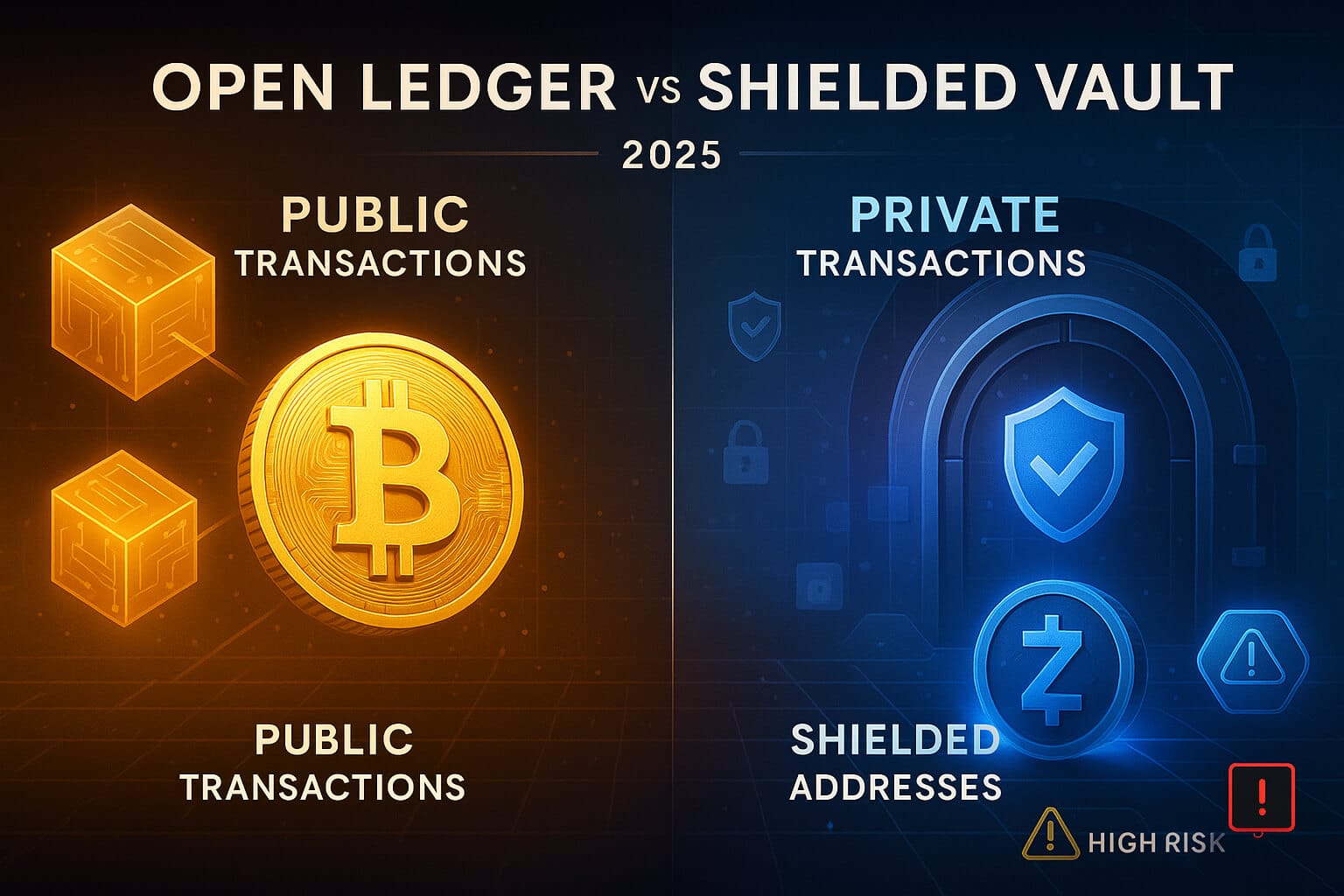

2. Crypto Taxation: New Rules Bring Relief and Headaches

The OBBBA is reshaping crypto tax strategies by:

-

Deferring mining and staking income until assets are sold, delaying tax liabilities, a clear win for miners and validators.

-

Allowing a mark-to-market (MTM) election so traders can pay annual taxes on gains/losses without worrying about wash sales.

-

Eliminating the need for qualified appraisals on crypto donations over $5,000, making charitable giving simpler.

-

Extending wash sale rules to crypto, disallowing losses if investors repurchase similar assets within 30 days, a major complication for tax-loss harvesting.

-

Exempting Bitcoin transactions under $600 from capital gains tax, treating small purchases like cash, a move that could boost retail microtransactions.

While these provisions could reduce compliance burdens and drive higher adoption, the extension of wash sale rules and unclear definitions of mining/staking income are creating uncertainty for both retail and institutional players.

3. Section 899: Tax Retaliation Risks for Foreign Crypto Entities

Section 899 lets the Treasury impose higher taxes on entities from countries with “discriminatory” tax policies, like digital service taxes hitting U.S. firms. If applied to foreign crypto companies or investors, it’s increasing tax liabilities, which may discourage foreign investment in U.S.-based crypto markets. Reduced demand could hurt liquidity in stablecoins (often backed by U.S. Treasuries) and increase market volatility.

4. OBBBA-Driven Deficits Could Push Interest Rates Higher

With projections estimating the OBBBA adding $2.4–5 trillion to national debt, interest rates are expected to climb significantly. Some forecasts predict 10-year Treasury yields rising by 1.2% by 2054. Higher interest rates are making traditional assets more attractive than volatile cryptocurrencies, encouraging institutional investors to rotate out of crypto, lowering trading volumes and price momentum.

5. GENIUS Act: Clarity for Stablecoins, But New Risks Loom

The GENIUS Act is finally bringing a regulatory framework to stablecoins by:

-

Requiring full reserves in dollars or Treasuries, which could increase confidence among investors.

-

Mandating strict AML and anti-terrorism compliance, boosting legitimacy.

-

Allowing banks and nonbanks to issue stablecoins, but limiting Big Tech unless users consent to data tracking.

-

Prohibiting senior executive officials from issuing stablecoins while in office, avoiding direct conflicts of interest.

These changes are setting the stage for mainstream adoption, as institutions and businesses gain clarity on how to issue and use stablecoins. But critics warn the bill’s AML provisions are too weak, potentially enabling misuse by bad actors or leading to market concentration if Big Tech firms dominate stablecoin issuance.

6. Market Sentiment: Clarity Could Drive Bullish Trends

Many crypto investors are celebrating the OBBBA and GENIUS Act for offering long-awaited regulatory clarity, especially around stablecoins and assets like XRP. Clearer broker definitions and simpler tax treatments are reducing regulatory FUD, encouraging institutional participation and boosting prices for Bitcoin, Ethereum, and leading altcoins.

However, market optimism is tempered by concerns over interest rate hikes and foreign tax retaliation, highlighting the complex balancing act these bills present.

Final Thoughts

The OBBBA and GENIUS Act are rewriting the rulebook for crypto in the U.S., offering both opportunities and risks. Tax breaks like bonus depreciation and deferred staking income could support miners and encourage network growth, while regulatory clarity from the GENIUS Act might legitimize stablecoins, drawing in institutional capital. On the flip side, rising interest rates and uncertain foreign tax measures may dampen investment, and weak AML rules could undermine confidence. The net outcome will hinge on Senate amendments and final implementation, so staying informed is essential for crypto investors navigating this new landscape.

For more insights and detailed guides on blockchain applications, visit our Cryptocurrency Comparisons Guides.

Stay Updated

For the latest updates on crypto legislation and market strategies, follow us on:

Stay informed with the latest insights in the world of cryptocurrency at FreeCoins24.io.