The cryptocurrency and stock markets have seen explosive growth in the past 24 hours, with Bitcoin surging to new all-time highs above $118,000, and Ethereum crossing $3,000. Alongside this, the S&P 500 and Nasdaq Composite have also hit record highs, largely driven by tech stocks, particularly those involved in artificial intelligence (AI). This surge, marking the biggest rally in recent history, is not only fueling market optimism but also setting the stage for altcoins to shine in 2025.

Let’s break down the key factors behind this rally, explore why it’s happening, and which altcoins are primed for significant growth over the coming months.

Market Context and Recent Performance

As of July 11, 2025, the cryptocurrency market has experienced a massive surge. Bitcoin reached new heights above $118,000, while Ethereum crossed the $3,000 mark. The total cryptocurrency market capitalization has now surpassed $3.5 trillion, marking a new era of growth for digital assets. The stock market, particularly the Nasdaq Composite and S&P 500, also reached record levels, bolstered by strong performances in technology stocks, especially those linked to AI advancements.

This rally is not only driven by retail investors but also by significant institutional participation. For example, Bitcoin ETFs have crossed $50 billion in assets under management, with Ethereum ETFs seeing $4.72 billion in inflows since the start of 2025 (InvestX Market Insights).

Reasons for the Market Bounce

Institutional Investor Demand

A major factor in this rally has been unprecedented institutional demand for cryptocurrencies. The rise of exchange-traded funds (ETFs), particularly those focused on Bitcoin and Ethereum, has opened the floodgates for institutional capital. This demand from traditional financial players has laid the foundation for a strong price increase, as these large-scale investors inject capital into the market, creating a ripple effect that attracts retail investors.

Liquidations of Short Positions

The crypto market saw a wave of short liquidations, particularly in Bitcoin, as the price surged to new highs. Over $1 billion in short positions were liquidated, with 237,000 traders getting caught in the short squeeze. This caused a feedback loop where traders who had bet against Bitcoin were forced to buy back their positions, further pushing prices upward. This dynamic mirrors the tech stock market, where short covering also contributed to the rally, particularly in AI stocks (Reuters Market Watch).

Capital Gains and Market Sentiment

As the markets surged, many investors realized capital gains, locking in profits from their holdings. This is particularly evident in both the crypto and stock markets, where rising liquidity has led to greater market participation. The Fear and Greed Index has reached 75, signaling extreme greed, and suggesting that investors are embracing riskier assets like Bitcoin and altcoins.

Technical and Macroeconomic Factors

Technical Indicators for Bitcoin

Bitcoin has formed positive technical patterns, such as the “cup-and-handle” and “bullish flag”, indicating potential growth beyond $140,000. These patterns are strong technical signals that suggest the momentum is likely to continue, at least in the short term.

Macroeconomic Factors Supporting Growth

On a broader scale, the global economic recovery and expectations for continued monetary policy easing have created favorable conditions for risk assets. With interest rates expected to remain low, more capital is flowing into speculative investments, including cryptocurrencies.

Regulatory Developments and Their Impact

Crypto Tax Reform Bill

On July 3, 2025, Senator Cynthia Lummis introduced a crypto tax reform bill, which could provide much-needed clarity for crypto investors. This bill aims to reduce the tax burden on digital assets, potentially encouraging more market participation.

Spot ETFs for Altcoins

Another key regulatory development is the growing anticipation of spot ETFs for altcoins like XRP, Solana, and Cardano. If approved, these ETFs would significantly increase liquidity, drawing institutional investors into the altcoin market and potentially boosting their prices. For example, analysts predict a 90% chance of a Cardano ETF approval by the end of 2025, which could trigger a bullish breakout for the coin (Bloomberg).

Market Metrics and Volatility Analysis

Volatility Metrics

Crypto Volatility: Bitcoin’s supply has been tightening due to strong accumulation pressures, and Open Interest has surged past $78 billion. This suggests that the bullish momentum could continue, though volatility is likely to remain high in the short term.

Stock Market Volatility: The VIX index, a measure of stock market volatility, indicates mixed sentiment. It’s up 43.7% year-over-year, signaling increased market uncertainty, though it’s down month-over-month.

Predictions and Outlook for the Next Few Months

Crypto Market Predictions

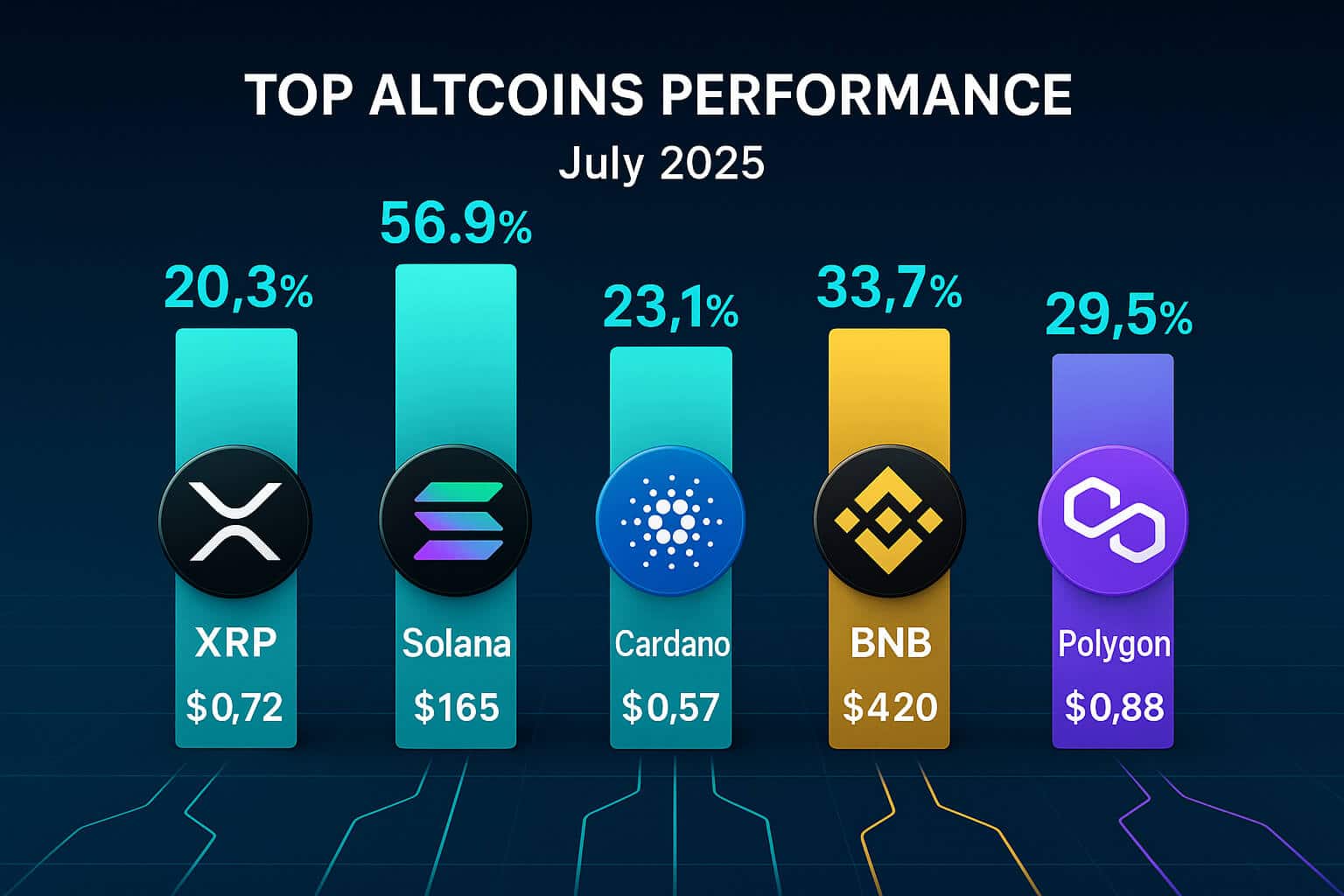

Bitcoin is forecasted to potentially reach $120,000 or higher in the short term, with some analysts predicting it could hit $125,509 by July 12, 2025 (Changelly). Other altcoins such as XRP, Solana, and Cardano are also expected to perform well, with strong ETF inflows likely to drive their prices higher.

Stock Market Predictions

The S&P 500 remains slightly overvalued, but strong tech sectors—particularly AI stocks—should continue to drive momentum. However, some analysts predict a 2.5% correction by the end of 2025, based on broader economic uncertainties.

Updated Recommended Altcoins to Watch

Based on recent developments, here are some altcoins to keep an eye on:

-

XRP: $2.62, with the XRP ETF and XRPL EVM sidechain launch providing strong catalysts.

-

BNB: $688.51, bolstered by the Maxwell hard fork and institutional interest.

-

Polygon (POL): $0.22841, with its network upgrade and growing developer activity.

-

Solana (SOL): $164.35, poised for gains with the Alpenglow protocol upgrade and a 95% chance of a spot ETF approval.

-

Cardano (ADA): $0.723828, with ongoing Hydra upgrades and growing DeFi adoption.

Conclusion and Recommendations

The July 2025 market surge reflects a complex interplay of institutional demand, short liquidations, and high-risk appetite. While both the crypto and stock markets are experiencing strong growth, the coming months are likely to see continued volatility and potential corrections. Bitcoin could continue its upward momentum, with altcoins like XRP, BNB, and Solana poised for growth, driven by institutional ETFs, network upgrades, and increasing adoption.

As always, investors should remain cautious of potential pullbacks and market corrections. For those looking for high-upside opportunities, XRP, BNB, Polygon, Solana, and Cardano are the altcoins to watch, with promising catalysts on the horizon.

Stay Updated

For the latest updates on cryptocurrency trends and market insights, follow us on:

Stay informed with strategies and insights at FreeCoins24.io.

Special Offer

Want to explore crypto assets further? Sign up on Bybit and claim up to $30,000 in bonuses. Start trading with one of the top exchanges for crypto assets.