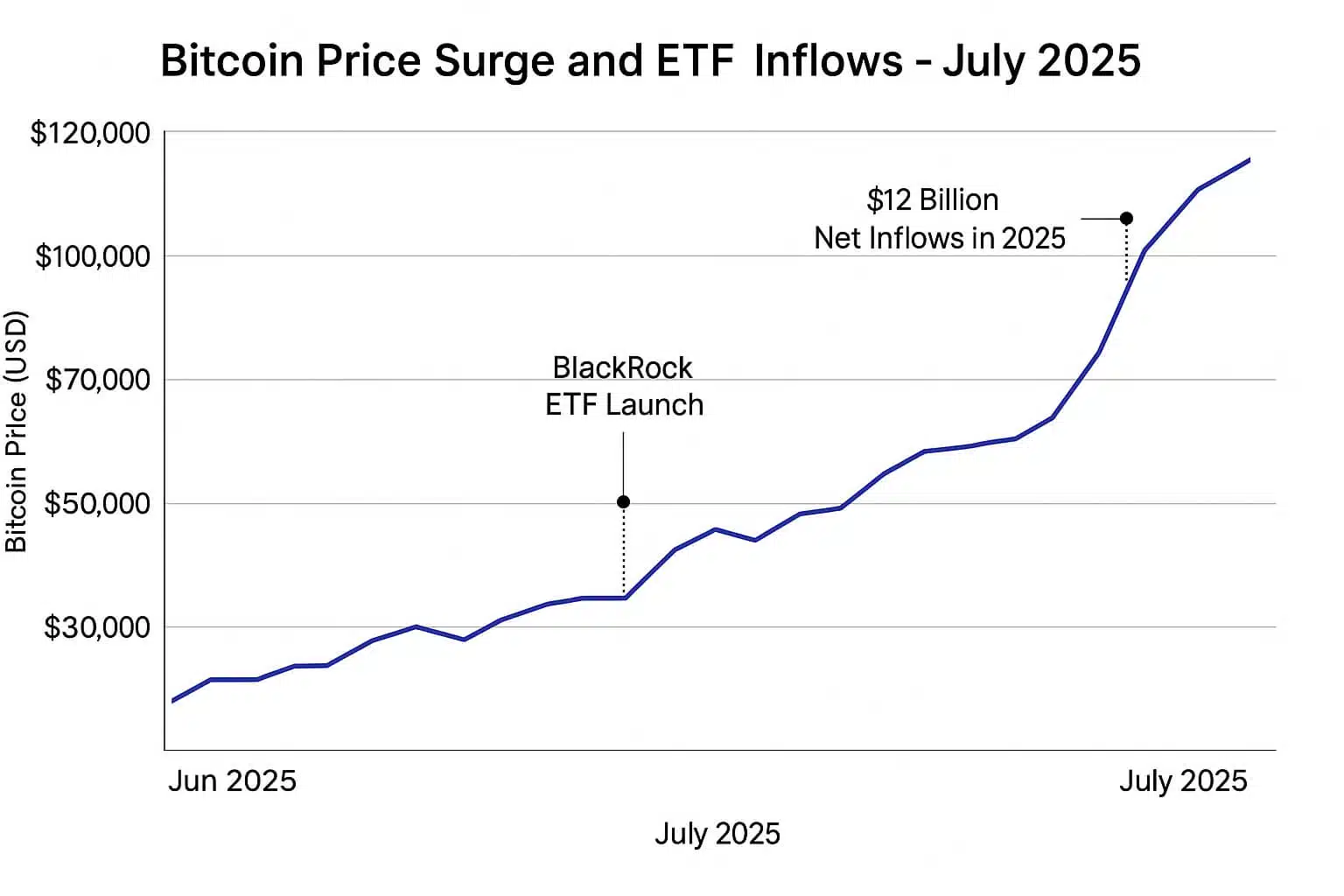

As of July 14, 2025, Bitcoin is trading at an impressive $121,040, having recently crossed the $120,000 threshold. The cryptocurrency has seen an extraordinary surge, with its all-time high recorded at $122,838. This bullish rally, marking a 14.6% increase in just one month and an 82.8% annual rise, has captured the attention of investors and market analysts alike.

While Bitcoin’s remarkable rise can be attributed to several factors, two key players, Bitcoin ETFs and institutional adoption, are proving to be central to its continued growth. In this article, we explore how these forces, along with macroeconomic conditions and regulatory clarity, are paving the way for Bitcoin’s potential to enter a supercycle.

Current State of Bitcoin

Bitcoin’s meteoric rise from $28,837 in 2020 to its current price of $121,040 reflects a 300% increase over the past five years. This surge has been fueled not only by market momentum but also by the accelerating adoption of Bitcoin as a store of value and inflation hedge.

From $66,219 in July 2024 to $121,040 in July 2025, Bitcoin’s price action has been nothing short of impressive. As Bitcoin continues to make significant price gains, the question arises: Is this rally the beginning of a supercycle, or is it just another short-term peak before a major correction?

Growth of the Bitcoin ETF Market

One of the primary catalysts behind Bitcoin’s current rally is the explosive growth of the Bitcoin ETF market. Spot Bitcoin ETFs, which were approved in January 2024, have transformed Bitcoin’s investment landscape. These ETFs provide regulated investment vehicles for both institutional and retail investors, driving substantial capital inflows.

Key Data Points:

-

Assets Under Management (AUM) in Bitcoin ETFs have surpassed $60 billion in 2025, with $12 billion in net inflows, a 50% increase from the previous year.

-

Leading players like BlackRock, Fidelity, and Grayscale are managing over $25 billion in Bitcoin ETF assets, bringing institutional-grade infrastructure to the crypto space.

-

The influx of capital has increased Bitcoin’s liquidity, reduced volatility, and provided a foundation for price discovery, allowing Bitcoin to break through its previous resistance levels.

This increased institutional involvement through ETFs has played a pivotal role in reducing Bitcoin’s volatility, making it an attractive asset for traditional investors seeking a safer bet in a volatile market.

Institutional Adoption Rate

Institutional adoption has accelerated significantly, with over 1,200 institutions now holding Bitcoin as of mid-2025. This represents a 30% increase from the previous year, signaling growing confidence in Bitcoin’s long-term value proposition.

Key Metrics:

-

MicroStrategy holds more than 250,000 BTC, making it one of the largest institutional holders.

-

Tesla, which paused its Bitcoin purchases in 2021, has resumed its Bitcoin treasury allocation as of 2025.

-

Hedge funds have been rotating out of gold and moving into Bitcoin, recognizing it as a more effective store of value.

On-chain data points, including whale accumulation and low exchange balances, further suggest that institutional players are accumulating Bitcoin, rather than speculating or engaging in short-term trading.

Notable Insights:

-

@mrofwallstreet, in a June 15, 2025 post, highlighted that hedge funds are increasingly viewing Bitcoin as a superior store of value compared to gold.

-

@Celesweb3 pointed out that the continued accumulation of Bitcoin by whales is indicative of long-term institutional buying pressure, signaling stability in the market.

Additional Driving Factors Behind Bitcoin’s Surge

While ETFs and institutional adoption are the primary drivers, several other factors are contributing to Bitcoin’s rally:

Macroeconomic Conditions

With Federal Reserve rate cuts expected in the latter half of 2025, inflation fears are subsiding, making Bitcoin an attractive asset. Concerns over the devaluation of the US Dollar have prompted investors to seek alternative stores of value like Bitcoin.

Geopolitical Sentiment

Increased geopolitical stability and pro-crypto policies (such as those from the Trump campaign) are contributing to optimism in the crypto space. Events like US Crypto Week (starting July 13, 2025) further underscore the growing acceptance of crypto as a legitimate asset class.

Bitcoin Halving Effects

The 2024 Bitcoin halving, which reduced the supply of new Bitcoin entering circulation, continues to play a role in Bitcoin’s price growth. As demand increases and the supply rate decreases, scarcity factors push Bitcoin’s value higher.

Key Movers and Predictors for Bitcoin’s Trajectory

Several factors will continue to influence Bitcoin’s price action in the coming months. Here are some critical drivers that investors should monitor:

-

ETF Inflows: Continued growth in ETF AUM, potentially reaching $80 billion by Q4 2025, will likely sustain upward pressure on Bitcoin’s price.

-

Institutional Expansion: Further adoption by pension funds and sovereign wealth funds will likely drive Bitcoin’s price even higher.

-

Monetary Policy: Fed rate cuts expected in late 2025 will likely enhance Bitcoin’s appeal, attracting more capital from traditional financial markets.

-

Regulatory Clarity: Developments from US Crypto Week or new regulations could further boost confidence, while any adverse policies could create headwinds.

-

Geopolitical Events: Political stability or instability, particularly in key regions, could have a major impact on investor sentiment and Bitcoin’s price action.

Predictions and Risks

Short-Term Predictions

Many analysts on X believe Bitcoin could see further gains in the short term, potentially reaching $150,000 to $200,000 by Q1 2026. Key drivers of this growth will be ETF inflows, institutional demand, and macroeconomic factors like Fed rate cuts.

Long-Term Outlook

The long-term outlook for Bitcoin remains bullish, supported by institutional adoption and growing ETF market penetration. However, TradingNews warns that Bitcoin’s volatile nature could lead to a 50% correction post-peak, with prices potentially falling to $60,000.

As institutional investment increases, Bitcoin’s supercycle potential hinges on its ability to maintain momentum amid regulatory hurdles and macroeconomic uncertainty.

Explanatory Content on Bitcoin Price Trends

Bitcoin’s price trajectory from $28,837 in 2020 to its current level of $121,040 highlights its long-term upward trend. The recent surge reflects a 14.6% increase over the past month and an 82.8% annual rise, marking 2025 as a pivotal year for Bitcoin. The current rise shows that Bitcoin has not only broken through previous price resistance levels but is now solidifying its position as a more mainstream investment.

Factors like institutional adoption, the growth of Bitcoin ETFs, and global economic conditions are key contributors to this surge. Bitcoin’s status as a store of value and inflation hedge has caught the attention of hedge funds, corporate treasuries, and pension funds. The combination of these institutional movements, along with macroeconomic conditions such as potential Fed rate cuts, signals a continuing bullish trend.

The recent surge also reflects the growing adoption of Bitcoin as a mainstream asset, with strong momentum created by significant institutional demand. However, like all volatile assets, Bitcoin remains subject to market fluctuations, with price corrections remaining a risk.

Stake and Investment Implications

The increasing institutional adoption and ETF growth present significant opportunities for long-term investors. However, as Bitcoin reaches new all-time highs, risk still remains. Investors must consider the possibility of short-term corrections and the regulatory risks associated with crypto assets.

The surge in institutional interest and growing ETF inflows make Bitcoin one of the most attractive store of value assets in the market, but the volatility of crypto should always be kept in mind.

Conclusion

Bitcoin’s rally to $120,000 and beyond is driven by strong demand from institutional investors, the growing popularity of Bitcoin ETFs, and macroeconomic conditions favorable for alternative assets. Whether this marks the beginning of a supercycle or just another rally before a correction remains to be seen. However, institutional adoption and regulated investment products like Bitcoin ETFs are setting the stage for continued growth.

For those interested in Bitcoin as a long-term investment, it is essential to keep an eye on institutional trends, regulatory developments, and market sentiment to make informed decisions moving forward.

For the latest updates on cryptocurrency trends and market insights, follow us on:

Stay informed with strategies and insights at FreeCoins24.io.