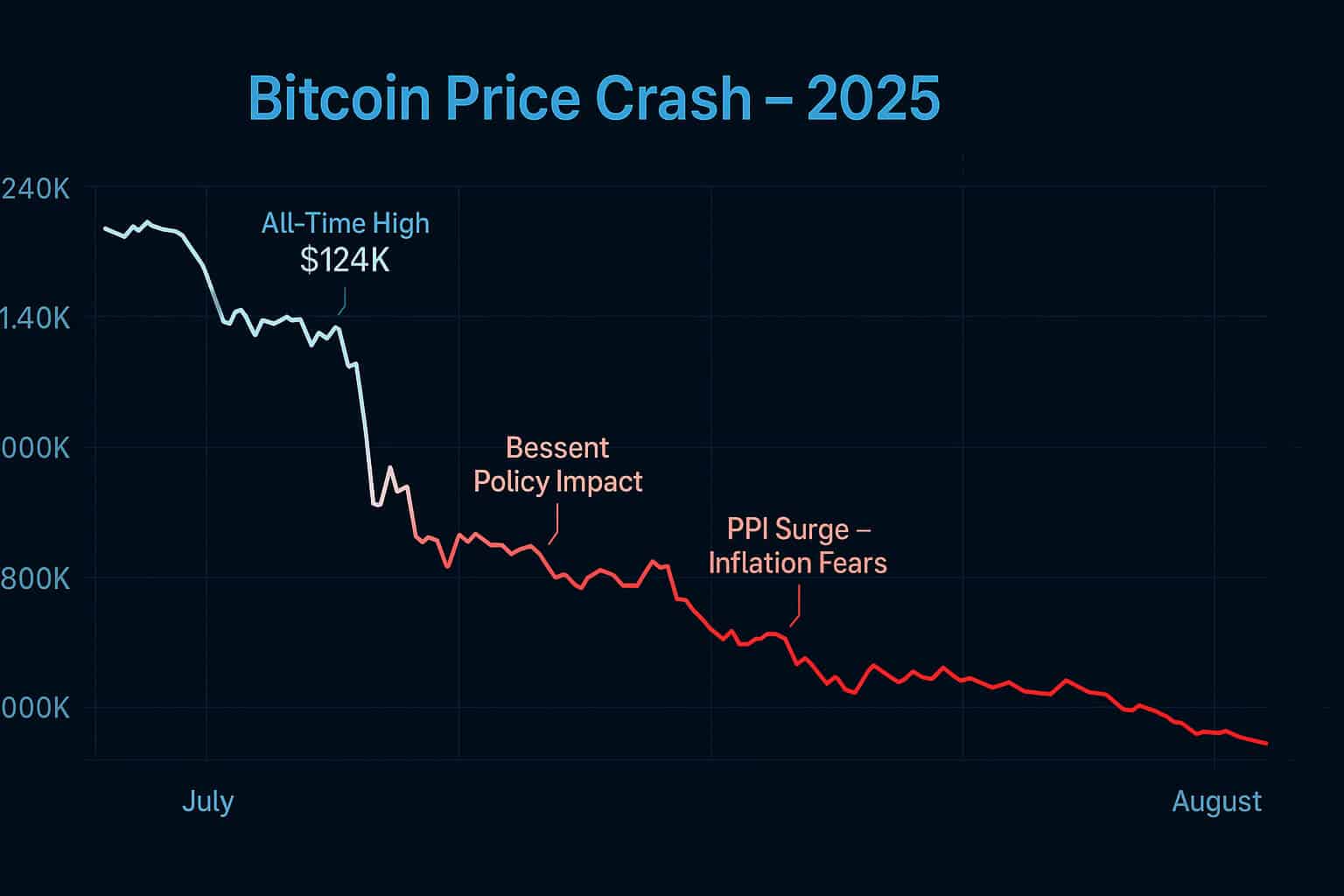

Just when Bitcoin soared to a dazzling $124,457 high on August 14, 2025, the crypto market flipped into Crypto Chaos Bitcoin Plunges Bessent PPI Surge mode. Prices crashed below $119,000, hitting a low of $118,730, wiping out over $1 billion in leveraged positions. The culprits? Treasury Secretary Scott Bessent’s “no-buy” bombshell for U.S. Bitcoin reserves and a red-hot U.S. Producer Price Index (PPI) report screaming inflation risks. X is ablaze with reactions, from “sell for treasuries” panic to bold calls for a V-shaped recovery. Is this a fleeting dip or a deeper slide? Let’s dive into the drama, packed with fresh insights like the Trump-Putin summit and a $1B USDT mint!

Ready to trade Bitcoin in this wild crypto market? Sign up on Bybit and grab up to $30,000 in deposit bonuses!

1. The Double Whammy That Ignited the Bitcoin Sell-Off

On August 14, 2025, the crypto market got slammed by two shocks. First, Treasury Secretary Scott Bessent stunned investors on Fox Business, saying the U.S. “is not going to be buying” Bitcoin for its reserves, crushing hopes of aggressive accumulation under President Trump’s pro-crypto agenda. The twist? By August 15, Bessent softened his stance, hinting at “budget-neutral” ways to acquire Bitcoin, like partnerships or swaps. X users like @CryptoDailyTrade called it “policy whiplash at its finest,” fueling volatility.

Second, July’s PPI report surged 0.9% month-over-month, the biggest jump in three years, way above the expected 0.2%. Year-over-year, it hit 3.3%, driven by soaring services (5.8% in portfolio management fees, 3.1% in hotel prices) and goods (38.9% in fresh vegetables, 4.6% in beef). Core PPI (excluding food and energy) also rose 0.9%, pushing the annual rate to 3.7%, the highest since March 2022. Economists point to Trump’s tariffs letting businesses hike prices, raising fears of persistent inflation and delayed Fed rate cuts. Reuters noted this “soured expectations,” hammering risk assets like Bitcoin.

The result? A $133 billion drop in crypto market cap in 24 hours, with Bitcoin briefly overtaking Google’s market cap as the fifth-largest asset before the plunge.

2. Liquidations, Price Swings, and X Reactions

This Crypto Chaos Bitcoin Plunges Bessent PPI Surge unleashed a bloodbath across the crypto ecosystem:

-

Price Plummet: Bitcoin dropped nearly 5% from $124,457 to $118,730, recovering slightly to $117,500–$117,970 by August 16, 2025. Ethereum and Solana fell too, with Ethereum down 4%, per Yahoo Finance and Bitbo charts.

-

Liquidation Chaos: Over $1 billion in positions, mostly longs (80–85% of trades), were wiped out, echoing March 2025’s $620 million crash when Bitcoin hit $67,572. CoinDesk called it a “healthy pullback,” but traders felt the sting.

-

Broader Impact: Wall Street slumped, Treasury yields spiked, and the dollar strengthened, per Axios and Bloomberg. Crypto stocks like Coinbase took hits.

-

X Sentiment: X is electric with debate. @KryptoVerz’s thread hyped a $1B USDT mint for liquidity and the Trump-Putin summit (Aug 15, 2PM EST) as “rocket fuel” for peace deals and pumps. @GastonHolds called it a “discount,” while @WayneVaughan quipped, “Sell your BTC for treasuries.” @TeddyBitcoins moaned, “See you in 2029,” but @CryptoWorldd_ fired back, “Bitcoin hit $106,142 without government help.”

Historical dips, like Bitcoin’s rebound from $80,000 to $82,629 in March 2025, suggest recovery potential. With Jackson Hole (Aug 21–23) and FOMC (Sep 17) looming, 78% odds of a September rate cut could spark a rally.

3.The Forces Fueling the Bitcoin Tumble

Why was this Crypto Chaos Bitcoin Plunges Bessent PPI Surge so brutal? Let’s break it down:

-

Bessent’s Policy Flip: Bessent’s “no-buy” for the $15–$20 billion U.S. Bitcoin reserve, built from seized assets, clashed with Trump’s pro-crypto moves like the 401(k) crypto order. His August 15 pivot to “budget-neutral” acquisitions (e.g., partnerships) sparked a partial recovery, per Cointelegraph.

-

Inflation Firestorm: July’s 0.9% PPI jump, with core PPI at 3.7% annually, was fueled by tariff-driven price hikes (38.9% in vegetables, 4.6% in beef), per Reuters and Morningstar. This crushed hopes for Fed rate cuts, hitting crypto assets.

-

Leverage Trap: High leverage triggered $1B+ liquidations, mostly longs, amplified by automated bots, mirroring 2025’s $1.3 billion wipeout.

Geopolitical tensions (Israel-Iran, tariffs) added pressure, per LinkedIn posts. But a $1B USDT mint on August 15 and SEC Chair’s push for a U.S. crypto capital offer hope.

4. Weighing the Dangers and Upsides in This Crypto Turbulence

This Crypto Chaos Bitcoin Plunges Bessent PPI Surge is a wild ride, but it’s not all doom:

-

Risks:

-

Extreme Swings: Bitcoin’s 4x S&P 500 volatility (2021–2023) makes dips deadly for leveraged traders, per CoinDesk.

-

Global Headwinds: Wars and tariffs could push Bitcoin toward $106,000, per Yahoo Finance.

-

Policy Wobble: Bessent’s flip-flop undermines Trump’s crypto capital vision.

-

-

Upsides:

-

Dip-Buying Goldmine: @KryptoVerz sees a “capitulation signal” with bottoms in 1–3 days. Bitcoin’s 62.7% five-year CAGR screams long-term wins.

-

ETF Strength: Bitcoin ETFs could draw inflows, building on July’s $6 billion, per AInvest.

-

Catalyst Countdown: The Trump-Putin summit (Aug 15, 2PM EST), Jackson Hole (Aug 21–23), and FOMC (Sep 17) with 78% rate-cut odds could ignite a rally, per @KryptoVerz.

-

Corporate moves, like Metaplanet and Sharplink’s ETH treasury shift, signal resilience, per search results.

5. Smart Moves to Weather the Bitcoin Storm

Facing Crypto Chaos Bitcoin Plunges Bessent PPI Surge? Here’s your survival guide, inspired by @KryptoVerz:

-

Hold Steady: Avoid panic-selling. Bitcoin rebounded from $80,000 to $82,629 in March 2025.

-

ETF Safe Bet: Grab Bitcoin ETFs on Bybit for buffered exposure.

-

Diversify Wisely: Mix in altcoins like Solana, resilient in past crashes.

-

Track Catalysts: Watch the Trump-Putin summit, Jackson Hole, and FOMC. @KryptoVerz suggests longing ETH/BTC with tight stops pre-summit.

-

Risk Rules: Cap leverage at 5x, target accumulation zones like BTC at $59K–$61K or ETH at $3.4K–$3.5K.

Check our Cryptocurrency Investment Guides for more crypto investment tips.

Special Offer

Trade Bitcoin or other crypto? Sign up on Bybit for up to $30,000 in deposit bonuses. Don’t miss trading innovative assets on a top exchange!

Conclusion

This Crypto Chaos Bitcoin Plunges Bessent PPI Surge slammed Bitcoin from $124,000, driven by Bessent’s policy flip and a 3.3% PPI spike. X is split, @TeddyBitcoins sighs, “See you in 2029,” while @CryptoWorldd__ retorts, “BTC hit $106,142 without government help.” Despite $1B liquidations and tariff-driven inflation fears, Trump’s pro-crypto moves like 401(k) crypto and SEC’s crypto capital push keep hope alive. With the Trump-Putin summit and 78% odds of September rate cuts, this dip could be a setup for a comeback. Stay sharp, Crypto Chaos Bitcoin Plunges Bessent PPI Surge might be the shakeout before the next rally!

For more crypto trends, visit our Cryptocurrency Investment Guides.

Stay Updated

Stay in the loop with the latest crypto airdrops, strategies, and tips. Follow us on:

Want more in-depth analysis and airdrop opportunities? Visit FreeCoins24.io/airdrops to explore the latest free crypto drops.