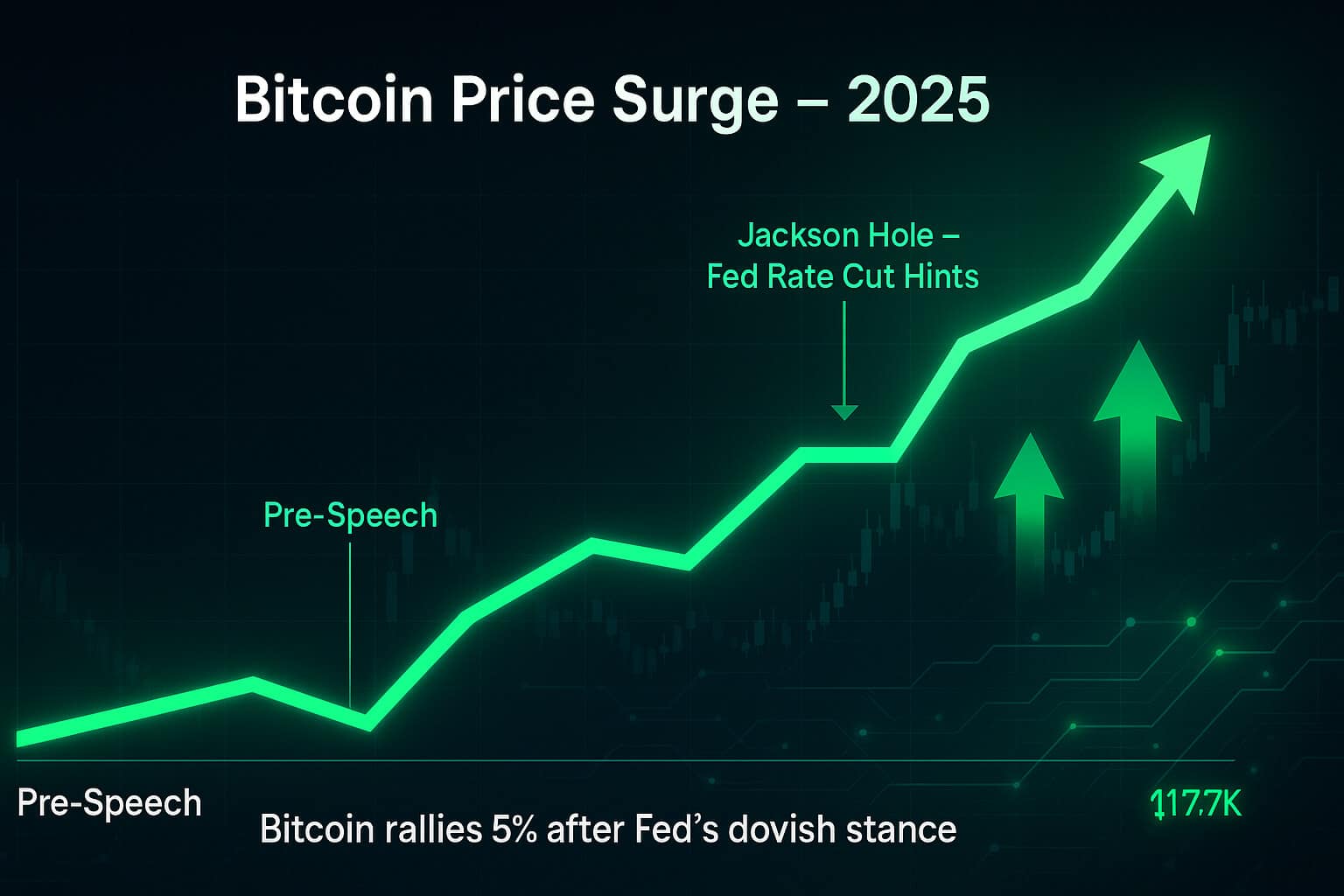

On August 22, 2025, Bitcoin lit up the charts, rocketing 5% from $112,000 to over $117,000 in a matter of minutes. This Fed’s Dovish Turn Bitcoin Surge 2025 was sparked by Federal Reserve Chair Jerome Powell’s game-changing speech at the Jackson Hole Economic Symposium, dubbed the “Super Bowl of central banking.” His dovish pivot—hinting at interest rate cuts, sent the crypto market into a frenzy, with Bitcoin leading the charge. Let’s dive into how Powell’s words flipped the script, why Bitcoin soared, and what’s next for the crypto space.

Ready to ride this Bitcoin wave? Sign up on Bybit and grab up to $30,000 in deposit bonuses to join the crypto bull run!

1. Powell’s Dovish Pivot: What Did He Say?

At the Jackson Hole Economic Symposium on August 22, 2025, Jerome Powell dropped a bombshell that got markets buzzing. His speech signaled a major shift in Federal Reserve policy, moving from hawkish inflation-fighting to a softer, growth-focused stance:

-

Rate Cut Hints: Powell declared “the time has come” for policy adjustments, opening the door to interest rate cuts as early as the September 17–18 meeting. He suggested a 25–50 basis point cut, depending on economic data like PCE inflation. This was “more dovish than markets expected,” boosting optimism.

-

Inflation vs. Jobs: With inflation nearing the Fed’s 2% target (2.6% PCE in July), Powell shifted focus to “downside risks” in employment. Job growth slowed to 35,000 per month, and unemployment hit 4.2%, prompting the Fed to prioritize growth over further cooling.

-

Market Reaction: Pre-speech, traders priced an 85–90% chance of a September cut, but Powell’s tone pushed futures markets to 89% probability for a 25-basis-point cut, per CME’s FedWatch Tool. The U.S. dollar weakened, and risk assets soared.

This dovish turn flipped the narrative, setting the stage for the Bitcoin rally.

2. Why Bitcoin Surged to $117K

Powell’s speech was like rocket fuel for Bitcoin, sparking an immediate 5% spike to $117,000. Here’s why the Fed’s Dovish Turn Bitcoin Surge 2025 took off:

-

Instant Price Pop: Bitcoin jumped from $112,000 support to $117,000 within minutes, wiping out $400 million in short liquidations. This squeeze fueled a feedback loop of bullish momentum, as traders scrambled to cover.

-

Risk-On Vibe: Lower interest rates make bonds less attractive, pushing capital into riskier assets like crypto. The Dow surged 850 points, and altcoins like Ethereum (up 7–9%) and BNB (new ATH above $882) joined the rally.

-

Institutional Fuel: Spot Bitcoin ETFs saw $150 million in net inflows on August 22, with BlackRock’s IBIT leading at $20 billion YTD. Crypto whales also piled in, tightening supply and boosting prices.

-

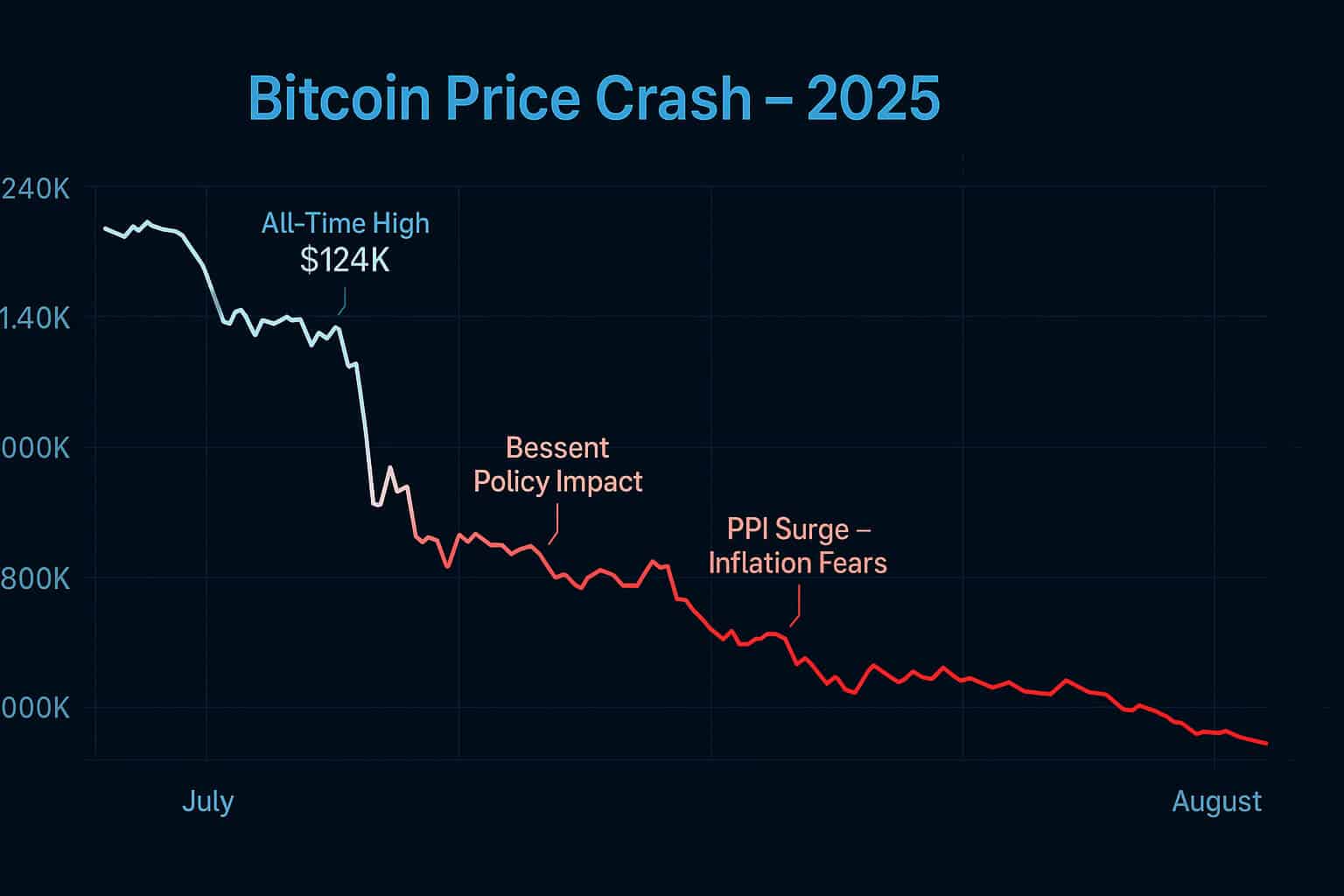

Historical Echoes: Past Fed pivots, like 2020’s Jackson Hole, sparked crypto bull runs. In 2020, Bitcoin surged from $11,000 to $20,000 post-speech. This rally feels similar, with liquidity tailwinds looming.

X posts screamed bullishness, with traders like @tazmancrypto noting a 90% chance of a September cut opening “liquidity floodgates.”

3. How the Crypto Market Reacted

Powell’s dovish stance didn’t just lift Bitcoin, it sent the entire crypto market soaring:

-

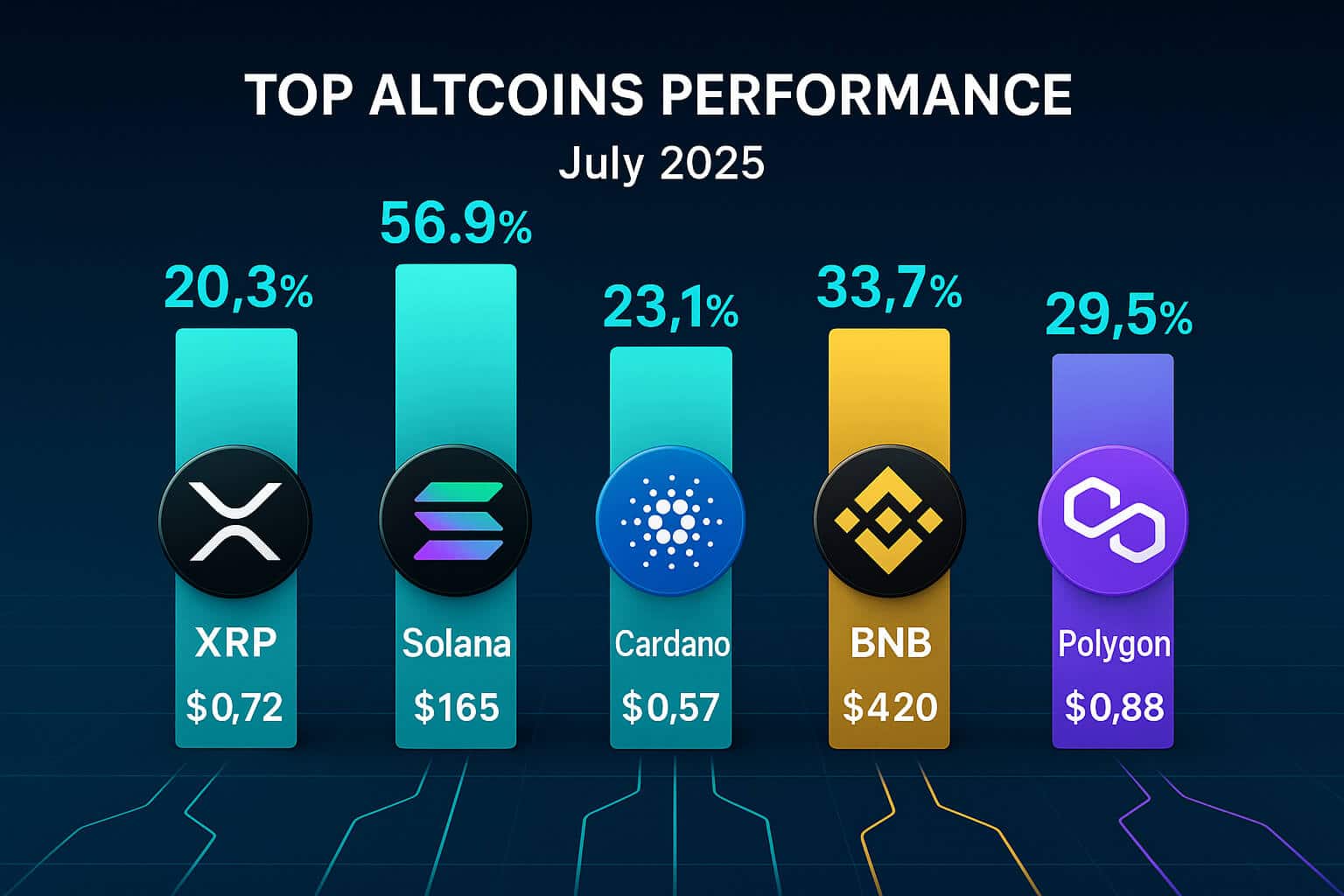

Altcoin Surge: Ethereum jumped 7–9% to $4,700, XRP hit $3.04, and BNB broke $882. The total crypto market cap reclaimed $4.1 trillion, up 4%.

-

Market Sentiment: The Fear & Greed Index flipped to “Greed,” reflecting renewed optimism. Analysts on X, like @mikealfred, predicted a “vertical” move for crypto, with Bitcoin eyeing $120,000–$125,000 if cuts materialize.

-

Liquidity Boost: A weaker U.S. dollar and falling Treasury yields (10-year at 4.255%) signaled easier money, favoring risk assets like Bitcoin. This aligns with Powell’s shift from inflation control to job support.

The crypto market is now riding a wave of bullish momentum, but volatility looms.

4. Risks and Challenges Ahead

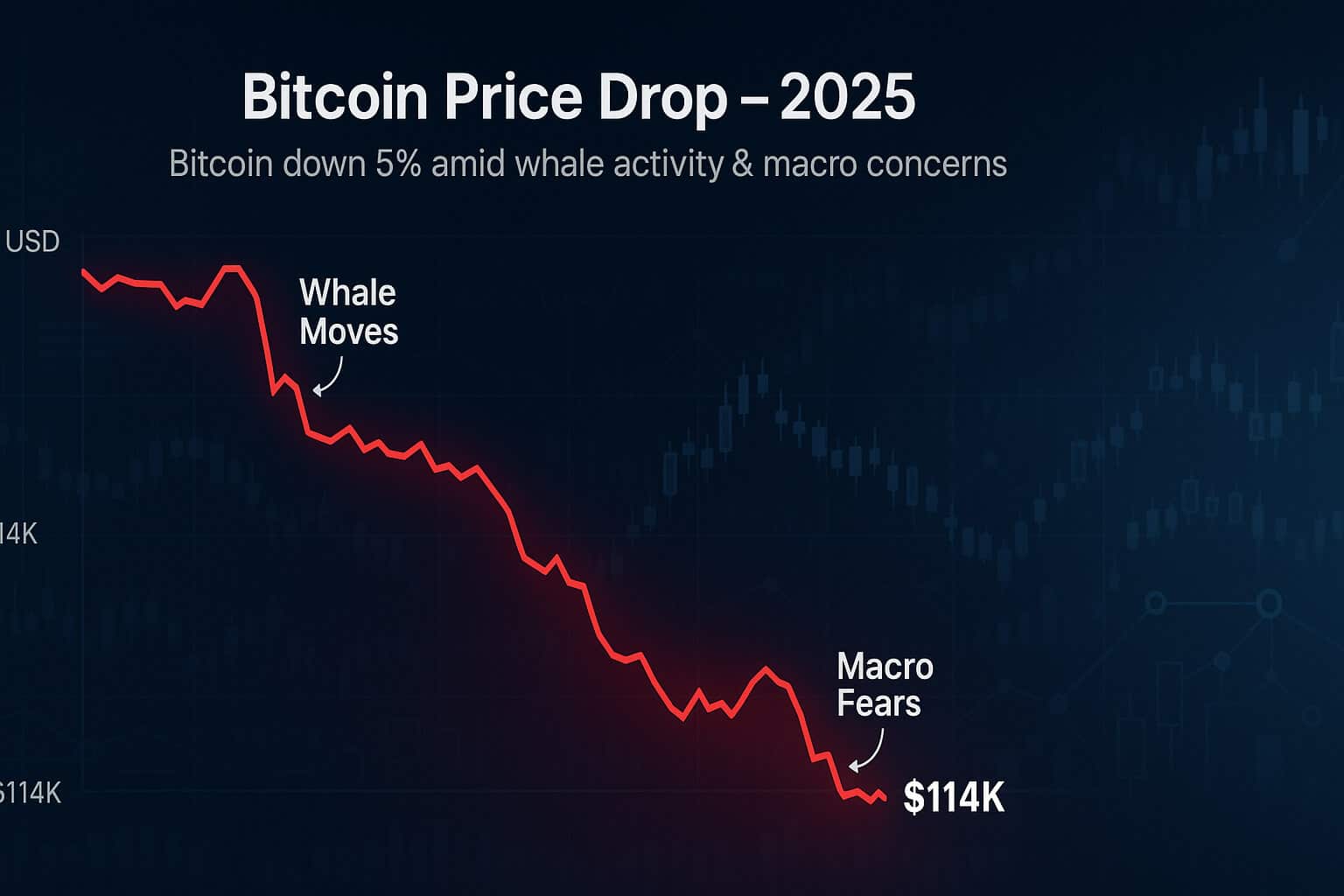

While the Fed’s Dovish Turn Bitcoin Surge 2025 is exciting, risks remain:

-

Volatility Persists: Bitcoin’s tie to macro events means a hotter-than-expected PCE inflation report (due August 30) could spark a pullback to $110,000–$112,000.

-

Delayed Cuts: If the Fed slows its pace due to tariff-driven inflation (2.6% PCE in July), bullish momentum could stall.

-

External Pressures: Trump’s push for dovish Fed appointees, like Lisa Cook’s resignation drama, raises concerns about Federal Reserve independence.

Investors must stay sharp to navigate this crypto rollercoaster.

5. How to Play the Bitcoin Rally

Want to capitalize on the Fed’s Dovish Turn Bitcoin Surge 2025? Here’s your playbook:

-

Buy the Dip: Target accumulation zones at $112,000–$114,000 if Bitcoin pulls back. Use Bitcoin ETFs for safer exposure.

-

Diversify: Add altcoins like Ethereum or Solana, which rallied 4–9% post-speech.

-

Monitor Data: Watch PCE inflation (August 30) and Fed announcements for cut confirmations. Follow X for real-time sentiment via CoinDesk.

-

Risk Management: Cap leverage at 5x and allocate 1–5% of your portfolio to crypto to balance volatility.

Check our Cryptocurrency Investment Guides for more crypto investment tips.

Conclusion

The Fed’s Dovish Turn Bitcoin Surge 2025 pushed Bitcoin to $117,000, driven by Powell’s rate-cut signals at Jackson Hole. With $150 million in Bitcoin ETF inflows, whale buying, and a risk-on market, the crypto market is buzzing. As Bitcoin consolidates at $115,900, eyes are on $120,000–$125,000 if cuts land. But with PCE data and Fed moves looming, volatility is a given.

Stay Updated

Stay in the loop with the latest crypto airdrops, strategies, and tips. Follow us on:

Want more in-depth analysis and airdrop opportunities? Visit FreeCoins24.io/airdrops to explore the latest free crypto drops.