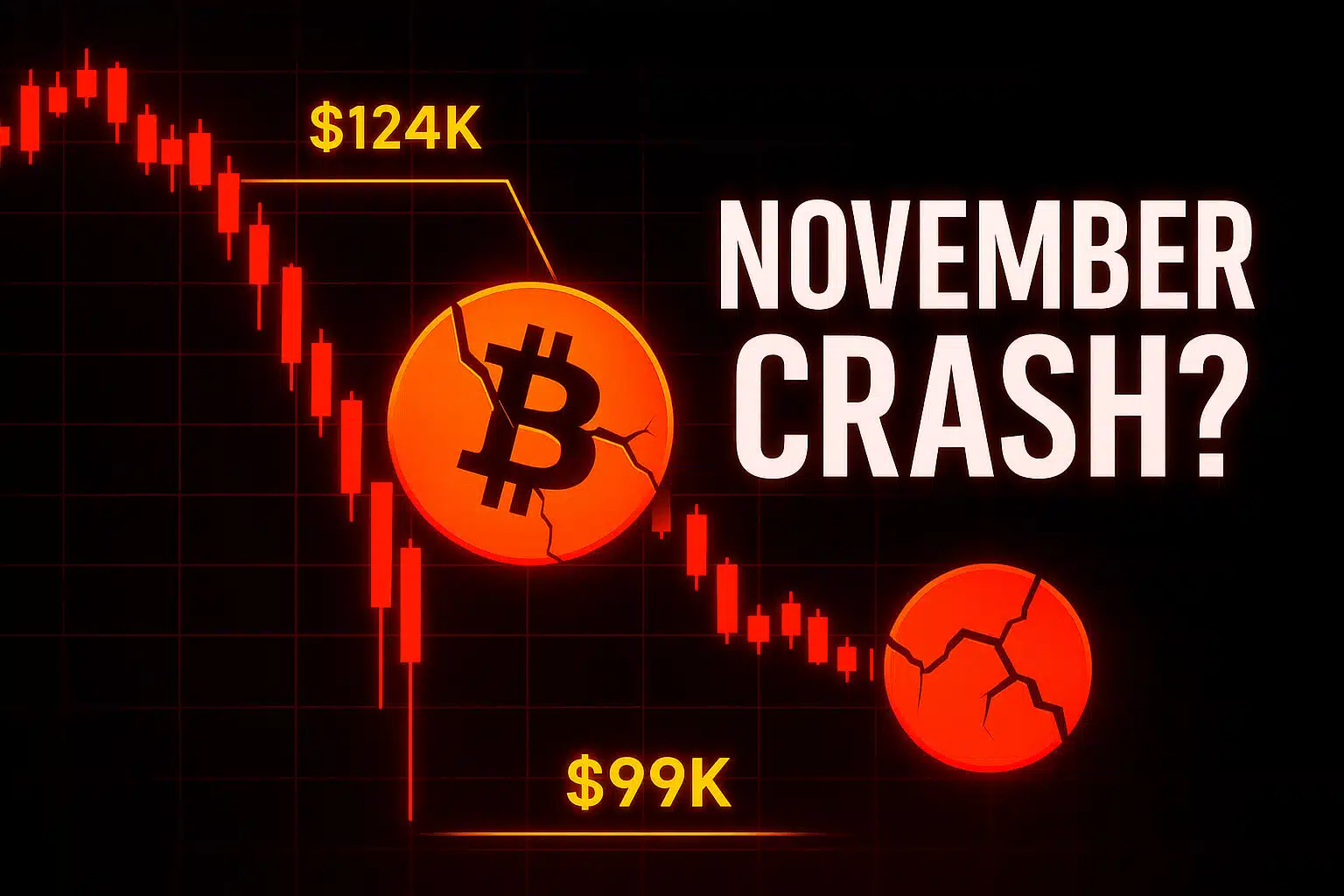

Hey FAM! Let’s talk about the elephant in the blockchain. As of November 5, crypto market liquidation is making headlines, with BTC dipping to around $101,600 USD. That’s a brutal 2.9% slide in the last 24 hours alone, and a whopping 19% wipe out from that juicy mid-October peak of $124,765. Yeah, the charts look like a horror movie right now and is testing $100K support, with wicks down to $99K. But is this the end of the bull bash, or just a pit stop before the after-party kicks off?

We’re unpacking the chaos, sentiment swings, trader hot takes, and what’s next. Remember, crypto’s volatile so always DYOR, stack what you can hold, and never bet the farm.

1. November Bitcoin Crash: The Timeline of the Tumble

Let’s walk through the price action step by step, no tables, just the story. September 2025 started calm, Bitcoin opened at $94,500 and closed strong at $108,240, up 14.5% on steady buying after a quiet summer. Highs touched $109,020, lows held firm at the open. It felt like accumulation mode.

Then October flipped the script. Opened at $108,240, rocketed to a fresh all-time high of $124,765 mid-month on ETF frenzy and election hype. But the reversal hit hard, closed at $109,566, down 3.92% for the month despite the pump. Lows dipped to $106,441. Worst monthly close since 2022’s bear market.

November continued exactly where October had left off. It started at $109,566, but as of November 5, it is down 7.3% to about $101,600. 99,000 was scraped by intraday wicks. At 55% for the 30-day realized vol, volatility is rampant. Panic sales ensued after liquidations were triggered by overleveraged bets below $107K. Although it’s a drastic correction, bull cycles frequently experience it.

2. Is the Pump Over? Techs and On-Chain Clues Say ‘For Now’

The simplest response is, “Yeah”, that hype rocket from $94K to $124K?” That’s grounded. From overbought 70+ to neutral 45 on daily, the RSI cooled. No bullish cross is visible, and the MACD is losing steam. On-chain? As ETF purchases slowed, holders dumped, and exchange inflows surged. Currently, daily mined supply surpasses net institutional grabs. Puell Multiple at 1.2: neutral, not blatantly oversold.

But there’s a twist, Bitcoin enjoys 20-30% mid-cycle haircuts. These are resets, not recessions. Post-2021 peaks and 2017 euphoria dumps have all resulted in larger blasts. Since 2013, November has averaged +42% due to year-end FOMO and fresh liquidity. Macro drags like sticky U.S. inflation (CPI Nov 13 could sting if >2.3%) and Nasdaq wobbles add weight, but post-election crypto nods, such as tax breaks, could change the script.

Special Offer

3. Sentiment Shift: From Greed Fest to Extreme Fear Blues

Vibes are what drive cryptocurrency, and at this moment, it’s a source of fear. Fear & Greed Index plummeted from October’s greedy 71 to 23/100—Extreme Fear. While Twitter’s BTC buzz sour, Google’s “Bitcoin crash 2025” spikes. With BTC dominance at 57%, social weight decreased (flight to “safe” king coin). As leverage bleeds, funding rates are negative, shorts are ruling perps, and OI is down 15%.

In broader, significant holders (with 1,000 or more BTC) have discreetly acquired Bitcoin during dips below $105,000, while retail investors appear to be capitulating, as evidenced by the rising trend of “sell Bitcoin” at 2025 highs. The equities market remains unstable, with the Nasdaq down 1.5% today; however, potential positive influences from the upcoming elections may be on the horizon. The greed observed in October, driven by FOMO surrounding ETFs, has transitioned into a more pessimistic outlook in November, reflecting a classic contrarian opportunity.

4. Crypto Twitter’s Hot Takes: Bears Roar, Bulls Sneak In

Crypto Twitter is buzzing—bears are declaring “the party’s over,” while bulls are urging to “buy the dip.” Here’s a roundup from credible voices (50+ likes, post-October):

Bearish perspectives:

- @CryptoFaibik predicts a 50% correction, citing an overstretched RSI.

- @BitBullish suggests an 80% cap on the rally, with early investors exiting and dampening the excitement.

- @crypto_birb analyzes the cycle, stating that 99.3% of the upward phase is complete, anticipating a blow-off followed by a bear market. This sentiment echoes James Wynn’s skepticism: “Billionaires are cashing out during the euphoria.”

Bullish responses:

- @APompliano asserts that the October bear market is finished. It’s time to manage emotions.

- @DaanCrypto describes the current phase as “back season” chop, expecting a bounce from the lows.

- @DefiWimar outlines a pattern of pump-shakeout-consolidation-pump, claiming the shakeout is over.

- @Sykodelic notes that whales are aggressively bidding, projecting a $150K end-of-year target.

Neutral observations: @gobitcoinisland believes the bull market has just begun, with fiat flooding in. The sentiment on Crypto Twitter leans 60/40 bearish, but the patience vibes from Pomp and Daan reflect Wynn’s view that “corrections are features.”

5. Near-Term Plays: Choppy Waters, Strategic Swims

in outlook, the price is projected to range between $98,000 and $113,000 through mid-November. A shift in sentiment could lead to a target range of $117,000 to $134,000 by December. Should a break occur, a retest of $90,000 may be anticipated. For 2026, a price exceeding $150,000 is possible if the cycle extends, although distribution risks are significant. It is advisable to avoid leverage, as it may serve as a trap for exits. Consider placing bids on days characterized by fear, and accumulate Bitcoin.

Pay attention to the noise from Crypto Twitter and monitor the Consumer Price Index report on November 13. Volatility is the cost of participation; while the current upward momentum has paused, a subsequent rally may be on the horizon.

Conclusion

November Bitcoin crash feels like a gut punch 19% off highs, fear at fever pitch. Party over? Nah, just intermission. History’s on rebound’s side, whales lurking, November magic waiting. Stay sharp, play smart, crypto’s a marathon, not a sprint.

For more BTC breakdowns and crypto insights, check our Bitcoin Analysis Guides.

Want more in-depth analysis and airdrop opportunities? Visit FreeCoins24.io/airdrops to explore the latest free crypto drops.

Stay Updated

Stay in the loop with the latest crypto airdrops, strategies, and tips. Follow us on: