AI agents aren’t just narrative; they’re here to stay. This is because of their daily use and growing adoption. They’re reshaping the daily lifestyle and deeds while shortcutting every routine to just a click action to achieve a goal. AI agents on a decentralized network are essential for automating and optimizing users interactions and collecting feedback at light speed. The crypto space is almost considered by retail investors as a giant casino or digital tulips with no real use beyond speculation. This is because we’ve seen cycles of hype in every bull market, such as DeFi summer with LSD, NFTs, memecoins, RWAs. Each promised to be the thing that makes crypto matter, but a lot of it faded into pump-and-dump noise.

To grab this quickly, AI agents aren’t just another trend; it’s starting to feel like the piece that could actually give crypto a lasting purpose. Let’s break it down, see why it works, and see why 2026 might be the year it takes over.

1. What AI Agents Really Are

You’ve probably heard the term “AI” before; it stands for Artificial Intelligence. AI Agents are typically other AI that have been trained on top of other models such as Grok from XI, ChatGPT from OpenAI, and others. These programs automate complex tasks such as email responses, customer service, market news updates, and order book management. They are essentially the next step up from LLMs.

In crypto, this autonomy shines. Imagine an agent that monitors DeFi protocols, swaps assets for the best APY, or rebalances your portfolio during volatility. You can have your entire portfolio managed without you lifting a finger. Projects like Fetch.ai (now in the ASI Alliance) and Bittensor are creating networks where agents share intelligence decentralized, with no single point of failure.

2. AI Agents Are Already Boosting Crypto Utility

It’s only the beginning, but AI is causing a watershed moment in the cryptocurrency industry. So far, it has seen a significant increase in the number of developers creating tools for the DeFi ecosystem, as well as AI trading bots. Here are the top projects that are creating great tools for crypto asset management and trading automation:

- 3commas: It provides advanced tools for smarter manual and automated trading (via DCA, grid, and signal bots), portfolio tracking, and risk management across multiple exchanges, allowing users to execute and optimize strategies efficiently while reducing emotional decisions.

- Stoic AI: The team building Stoic aims to deliver fully automated, institutional-grade quantitative portfolio strategies (long-only, market-neutral, or yield-focused) that optimize for diversified exposure, consistent returns, and risk-adjusted performance in any market condition.

- Fetch.ai or ASI Alliance: To enable autonomous on-chain AI agents for trading, optimization, and execution in decentralized ecosystems.

These are just three of many other projects developing tools for cryptocurrency growth. When considering the market at the board level, there is still room for more utilities to be developed.

- In DAOs, agents can vote on proposals or manage treasuries based on predefined logic. As an example, Virtuals Protocol lets you launch tokenized agents for tasks like vulnerability hunting in smart contracts.

- In RWAs, agents can automate compliance for tokenized real estate or commodities. While in prediction markets like Polymarket, they can aggregate data for accurate bets, making the whole system more efficient.

It’s not theory that daily volumes in AI agent projects will hit billions in 2026.

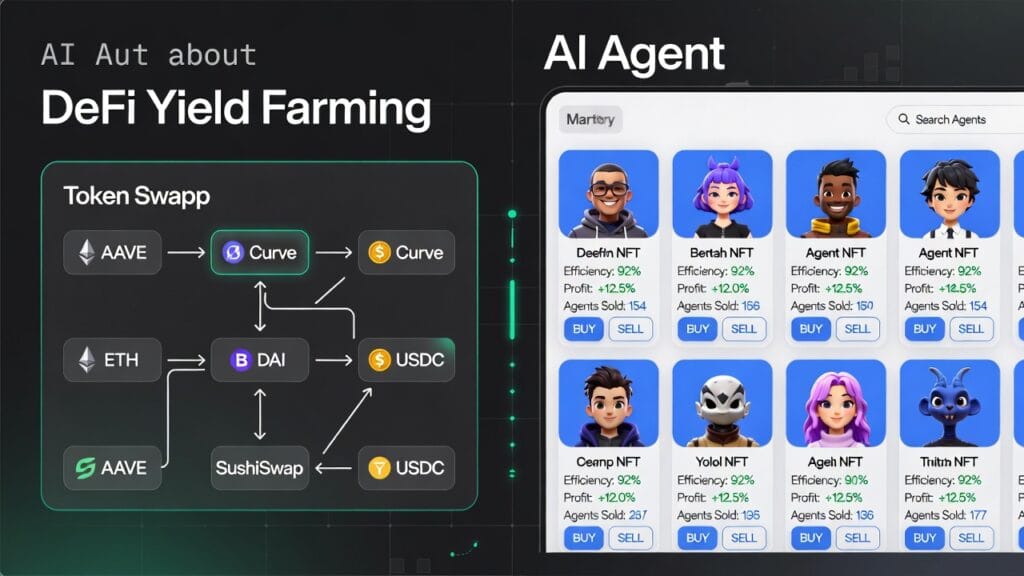

3. The Power of Agent Marketplaces

This is the main reason of this article. AI marketplaces don’t let you just rent a GPU or hire an AI agent, but the entire process to customization of your task. You can take for instance, SingularityNET or ai.com, both platforms are meant to help users tokenize, buy, sell, and compose liquidity.

Following is a simple path: you hire an agent for a job, it earns fees, pays for compute via micropayments, and revenue flows back through smart contracts. Fiat can’t handle machine-speed micropayments (high fees, delays). Stablecoins and protocols like x402 make it seamless. Plus, on-chain identity builds reputation without Big Tech control.

Without this, crypto stays speculative. With it, it becomes indispensable infrastructure for trillions in agent-driven value.

Conclusion

In a nutshell, AI agents narrative represents crypto’s best chance of permanently resolving its utility problem. From automation to marketplaces, it is laying the groundwork for a machine-powered future in which cryptocurrency leads. When we lean in, speculation fades and purpose prevails.

Stay Updated

Catch real-time buzz, airdrop alerts, AI/crypto scoops:

- Twitter: @FreeCoins24 –

- Telegram: t.me/FreeCoins24

Special Offer

FAQ

Q1: What is the definition of an artificial intelligence agent?

Advanced software that plans, decides, and acts autonomously, powered by LLMs. Unlike chatbots, they perform tasks such as trading and governance.

Q2: How do AI agents solve the utility problem in crypto?

They bring real productivity to crypto by automating DeFi, creating agent marketplaces, and enabling micropayments, transforming it into machine economy infrastructure.

Question 3: What exactly is an agent marketplace?

Platforms such as SingularityNET allow tokenized agents to be bought, sold, and hired. They earn fees through smart contracts, which stimulate on-chain activity.

Q4: How do agents operate in DeFi?

They automatically monitor yields, execute swaps, and rebalance portfolios, making complex strategies accessible to all.

Q5: Why do we need AI agents in crypto?

For seamless payments and identity verification, centralized AI falls short. Blockchains make agents trustless and verifiable.

Q6: Are there any real-world examples of AI agents in cryptocurrency?

Yes—Fetch.ai for decentralized intelligence, Bittensor for agent networks, and Virtuals for tokenised agent launches.

Q7: What are the challenges that AI agents face on-chain?

Reliability (hallucinations), governance (liability), scalability (cost calculation), and potential scams in marketplaces.

Q8: Will AI agents drive the next cryptocurrency bull run?

Yes, according to Grayscale/Gartner, agentic AI will increase adoption, fees, and value beyond speculation.

Q9: How do I get started with AI agents?

You can chekc on platforms such as Virtuals or Fetch.ai. Try to create/test agents, join marketplaces, or invest in related tokens.

Q10: Is the story about AI agents overhyped?

Not if it delivers; focus on projects that have demonstrable utility, not just buzz. DYOR to differentiate between real and vaporware.