USD.AI Airdrop is expired

The USD.AI Airdrop airdrop has officially ended, marking another completed campaign in the expanding crypto rewards space. Participants who joined during the active period were able to claim Allo Points, distributed directly through verified smart contracts. While the claim window is now closed, this archived page remains available for reference, helping users understand how the token performed after launch and how similar airdrops might evolve in the future.

Airdrop summary

Was the airdrop real or a scam?

The USD.AI Airdrop was confirmed to be real and successfully executed. Eligible users who completed the official campaign tasks received USD.AI Airdrop tokens directly in their connected wallets. The claim process was verified through the project’s account and supported by multiple blockchain transaction proofs. Community feedback across Telegram and Discord remained largely positive, with no reports of phishing or distribution issues, confirming the campaign’s legitimacy.

How much did users actually receive from USD.AI Airdrop?

The token value of the project was Allo Points. USD.AI Airdrop total rewards for the airdrop was Allo Points

Lessons for future airdrops

The USD.AI Airdrop demonstrates the importance of evaluating token utility and post-launch strategy before claiming rewards. While the campaign itself was legitimate and transparent, participants faced rapid value depreciation due to early unlock schedules and limited ecosystem adoption. Future airdrop hunters should look for projects with clear long-term token use cases, vesting mechanisms, and public liquidity plans. Tracking verified campaigns on Freecoins24 remains one of the most reliable ways to avoid low-value or high-risk drops in the market.

Analyzing expired airdrops like USD.AI Airdrop provides valuable lessons for anyone exploring new campaigns. Evaluating distribution rules, vesting periods, and project transparency before claiming rewards can prevent disappointment after token listings. Freecoins24 continues to monitor both active and past airdrops to ensure the community has accurate data and trusted insights when deciding which opportunities to join next.

Airdrop overview

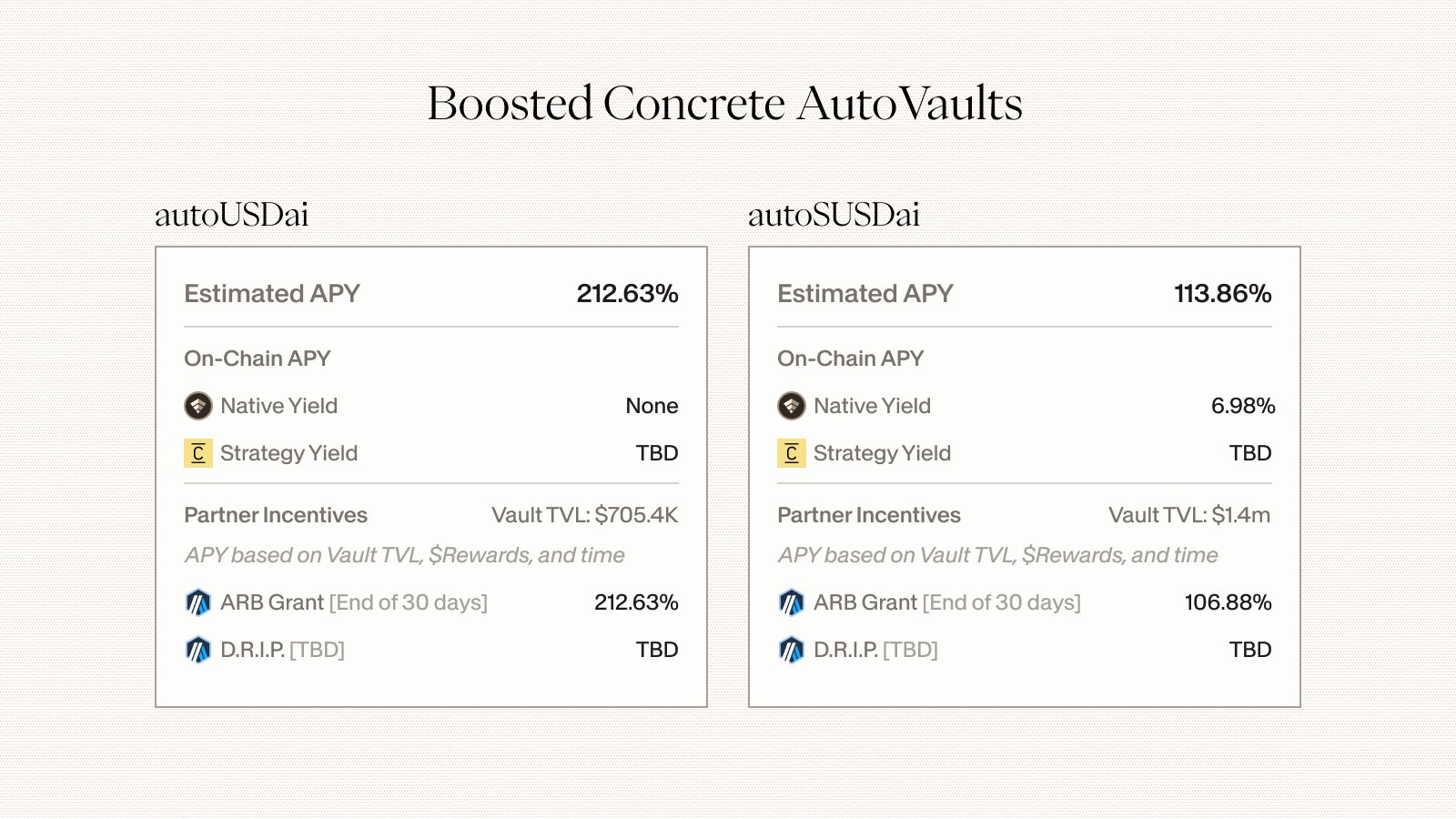

is created by Permian Labs and operates as a stablecoin protocol on Arbitrum. It funds AI infrastructure with two tokens: USDai, a USD-pegged stablecoin backed by USDC and USDT, and sUSDai, a yield-bearing token tied to AI compute assets like GPUs. The protocol uses tokenized GPU collateral to offer loans to AI startups, slashing approval times by over 90% compared to traditional lenders. For example, users deposit stablecoins to mint USDai, which swaps for the native asset, M.

The CALIBER ledger ensures on-chain asset ownership and redemption, boosting transparency. With $50M in beta deposits and $13M raised in a Series A round in August 2025, USD.AI shows strong momentum. Moreover, it integrates with Uniswap, Balancer, and Curve for deep USDai liquidity. The sUSDai token generates 5–10% APY through MetaStreet pool loans and M emissions, targeting AI-driven industries. Consequently, USD.AI leads in decentralized AI financing, blending stablecoin stability with innovative yield opportunities.

USD.AI’s Allo Point campaign, running through Q3 2025, splits into two paths: an ICO (7% of tokens, $300M FDV, 5x brown points, KYC required) or an airdrop (3% of tokens, 2x teal points with yield). Users earn points by holding USDai (ICO) or staking for sUSDai (airdrop). The campaign, capped at $100M TVL, ends at $20M Yield Paid Out. Additionally, leveraged DeFi strategies boost yields. Active participation maximizes rewards, potentially tied to future $HYPE token distributions.

Follow our complete and simple step-by-step guide to participate!

Airdrop rewards and allocation

The estimated value for USD.AI Airdrop airdrop is Allo Points

The total rewards for the airdrop is Allo Points

The USD.AI Airdrop airdrop is expiring in 2025-12-31

Step-by-step guide to get your rewards

Visit USD.AI page and connect your Arbitrum wallet.

Buy USDai with USDC or USDT for 5x brown points (ICO, no yield).

Stake USDai for sUSDai to earn 2x teal points with yield.

Check Allo Points and high-yield options in the Allo tab.

Invite friends for extra points via referral links.

Is the USD.AI Airdrop airdrop legit?

We always treat that question seriously, because protecting our community matters more than promoting any campaign. For every airdrop listed on Freecoins24, including USD.AI Airdrop, we run a basic due-diligence check before featuring it on our website.

We review the project’s official channels, look for a consistent online presence, and verify that links direct to trusted domains, not suspicious clones. We check whether the team or company behind USD.AI Airdrop is publicly known, has previous activity, or any visible history of scams or complaints. We also evaluate the airdrop mechanics, looking for unrealistic promises, impossible token allocations, or tasks that ask for sensitive information or private keys.

However, even with these checks, we cannot guarantee that any airdrop, including USD.AI Airdrop, is completely risk free. Crypto remains a high-risk environment, and new information can appear after we list or review a campaign. Our listing of USD.AI Airdrop is not financial advice, not an endorsement, and not a guarantee of future token distribution or project success. Always do your own research, verify all details using the official USD.AI Airdrop channels, and never share seed phrases, private keys, or other security credentials. Only participate with funds and wallets you can afford to risk, and consider using separate wallets dedicated exclusively to airdrops and testing. If you notice suspicious behavior or updates related to the USD.AI Airdrop airdrop, please let us know so we can review and react quickly.