In 2025, altcoins vs Bitcoin is becoming the defining debate of the crypto world. While Bitcoin continues to rally and capture record-breaking market dominance, altcoins are struggling to keep pace. This altcoins vs Bitcoin trend reveals much about where investors are placing their bets and the evolving structure of the cryptocurrency market.

1. Bitcoin’s Rise and Altcoin Stagnation

Bitcoin’s performance this year has been nothing short of spectacular. It has consistently climbed, surpassing the $100,000 mark and solidifying its position as the leading cryptocurrency by market capitalization. This rally is supported by strong institutional interest, regulatory clarity around Bitcoin products like ETFs, and growing government acceptance.

In contrast, altcoins, crytocurrencies other than Bitcoin have mostly remained flat or declined. Major sectors like decentralized finance (DeFi), layer-1 blockchains (like Ethereum and Solana), and gaming tokens show little momentum. This divergence means that while Bitcoin is attracting fresh money and attention, altcoins are largely being ignored.

2. Why Altcoins Are Underperforming

Several reasons explain why altcoins are struggling:

Flight to Safety: Investors are wary amid ongoing economic uncertainties, geopolitical tensions, and regulatory scrutiny. Bitcoin is perceived as a safer asset within crypt, a digital equivalent of gold. When markets feel unstable, investors tend to flock to what they see as the most reliable stores of value, and right now, that’s Bitcoin.

Lack of Breakthroughs: While Bitcoin benefits from tangible institutional support and government adoption, many altcoins haven’t launched significant upgrades or applications to reignite enthusiasm. Without new technology breakthroughs or killer use cases, it’s hard for altcoins to justify big price moves.

Institutional Preference: Large investors, hedge funds, and asset managers want clear, regulated, and liquid products. Bitcoin offers all three through ETFs and custody solutions. Altcoins, on the other hand, lack broad regulatory approval and sufficient liquidity, making them less attractive to these big players.

3. Market Metrics and Their Impact

When you look at the data, the story becomes even clearer:

Trading volumes for Bitcoin have surged across major exchanges, showing strong buying and selling activity.

Altcoin trading volumes are shrinking or stagnant, reflecting decreased investor interest.

On-chain activity for Ethereum, Solana, and other networks has slowed, indicating fewer transactions and lower user engagement.

Liquidity pools and order books are overwhelmingly weighted toward Bitcoin pairs, making it easier and cheaper to trade Bitcoin compared to most altcoins.

This concentration of liquidity means Bitcoin remains the most accessible and desirable asset for traders and investors.

4. Bitcoin Dominance and Market Share

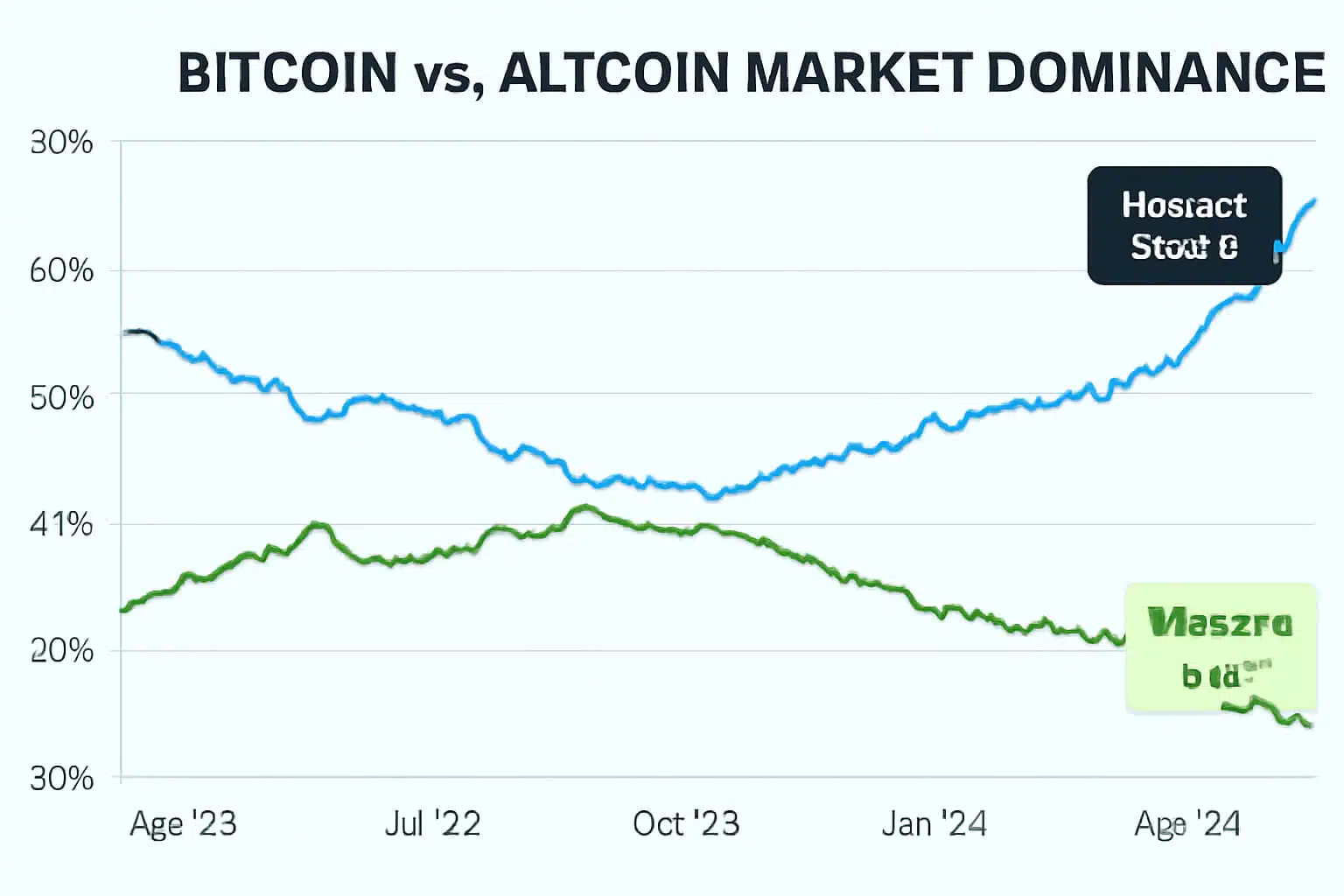

Bitcoin’s market dominance, the proportion of total crypto market capitalization it holds, has surged past 67%, a level unseen since early 2020. This dominance indicates that the majority of capital in crypto markets is concentrated in Bitcoin.

Historically, when Bitcoin dominance falls below 60%, it signals an “altseason”, a period when altcoins rally hard and attract significant attention. But in 2025, dominance remains high and rising, signaling a capital flow pattern that favors Bitcoin over altcoins.

This dominance trend is a strong signal that the market currently views Bitcoin as the primary vehicle for growth and security, while altcoins are considered secondary or speculative.

5. Institutional Adoption and ETF Growth

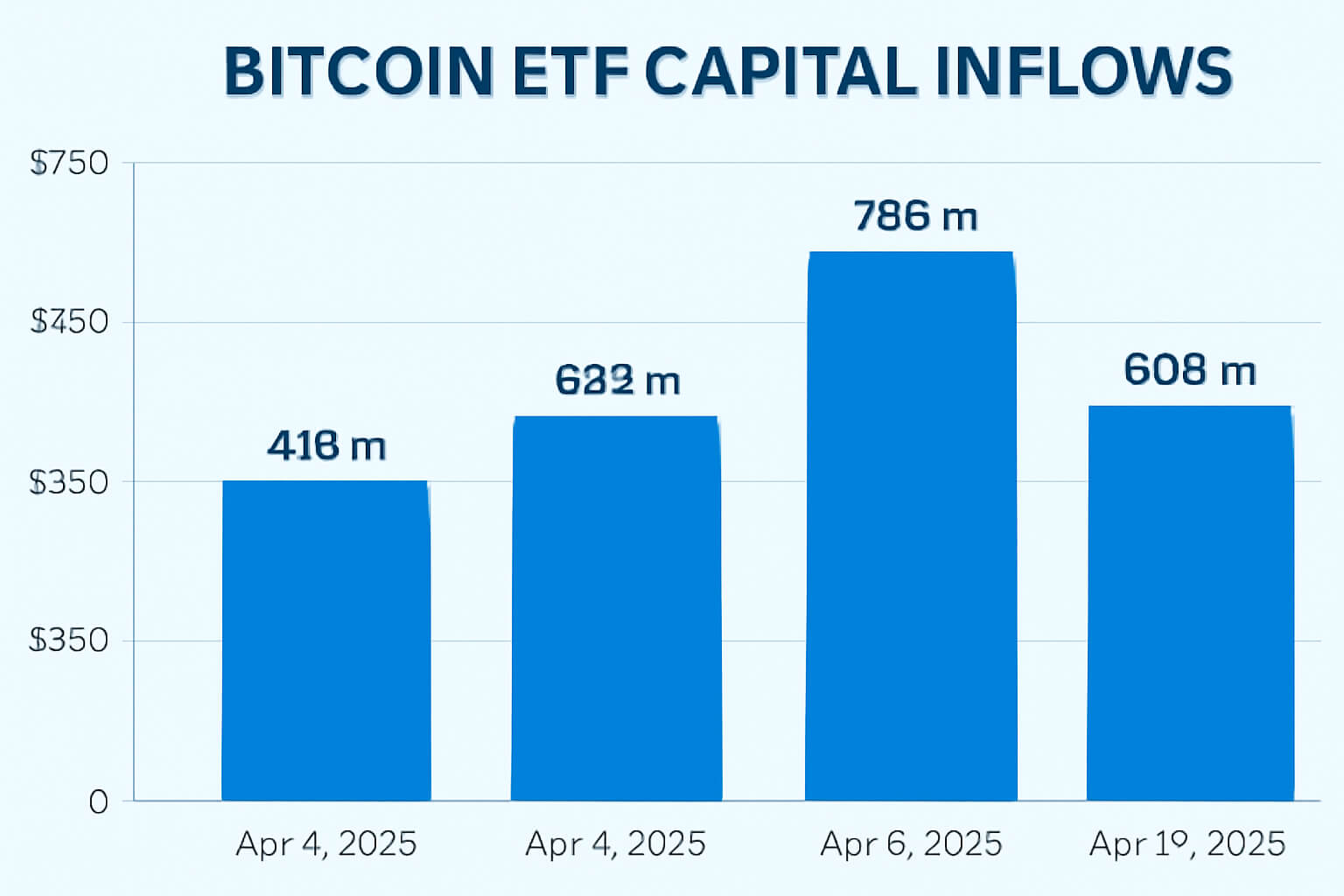

The widespread approval and launch of spot Bitcoin ETFs have revolutionized institutional crypto investing. Funds like BlackRock’s iShares Bitcoin Trust have attracted billions in investment, providing regulated, accessible ways for large investors to gain Bitcoin exposure.

These ETFs have opened the floodgates for institutional capital, driving significant inflows that support Bitcoin’s price. Meanwhile, similar ETF products for altcoins remain scarce or face regulatory hurdles, limiting their appeal to large investors.

The result? Institutional money floods into Bitcoin, leaving altcoins struggling to attract comparable capital.

6. Market Sentiment and Fear & Greed Index

Investor sentiment can often drive market moves. Currently, the Crypto Fear & Greed Index shows “Extreme Greed,” reflecting a highly bullish market mood. However, this optimism is mostly focused on Bitcoin.

Bitcoin dominates social media conversations, search engine trends, and investment discussions. Altcoins, despite some sporadic excitement, fail to capture similar widespread attention.

This difference in sentiment creates a feedback loop: investors pile into Bitcoin because it’s popular, which then increases its price and dominance, making altcoins even less attractive.

7. Governmental and Institutional Bitcoin Positions

Governments and state entities are increasingly adopting Bitcoin as part of their official reserves. Some U.S. states, like Missouri and Montana, have proposed or implemented Bitcoin reserve funds. The federal government’s Strategic Bitcoin Reserve executive order further legitimizes Bitcoin as a trusted financial asset.

Such public endorsement and integration create a perception of Bitcoin as a stable, institutional-grade asset. In contrast, altcoins lack this political or institutional backing, further limiting their growth potential in the current environment.

8. Additional Market Patterns and Observations

Altcoin narratives have lost much of their previous momentum. Hypes around AI coins, decentralized physical infrastructure networks (DePIN), and other emerging trends have not translated into sustainable growth or adoption.

New altcoin projects often launch with minimal fanfare, low trading volumes, and short-lived investor interest. The only consistent outliers remain memecoins, which thrive on social media virality rather than fundamental value.

9. Lack of Altcoin-Specific Catalysts

Bitcoin benefits from concrete catalysts: ETF approvals, government reserve accumulation, and increasing mainstream adoption.

Altcoins lack equivalent breakthroughs:

Ethereum’s major upgrades are slow and incremental.

Layer 2 solutions fragment liquidity instead of consolidating it.

Developer attention and capital increasingly flow into Bitcoin-aligned projects.

Without these catalysts, altcoins struggle to justify price appreciation or attract long-term holders.

10. Market Dynamics and Capital Flow

Past cycles saw a clear rotation of capital from Bitcoin to altcoins after Bitcoin’s initial surge. In 2025, this rotation is absent. Institutional investors prefer to hold Bitcoin, while retail investors are cautious after previous volatile altcoin cycles.

This results in altcoin rallies being brief, localized, and largely disconnected from Bitcoin’s sustained upward trend. The rise of Bitcoin-native ecosystems also pulls user and developer attention away from altcoins.

Conclusion

The Great Crypto Split in 2025 is a defining characteristic of this market cycle. Bitcoin’s rally is driven by strong institutional adoption, government backing, and clear narratives, positioning it as the flagship crypto asset. Altcoins, meanwhile, are struggling with lack of innovation, regulatory uncertainty, and diminished retail interest. While the potential for altcoins remains, the current market environment overwhelmingly favors Bitcoin.

Unless altcoins develop significant new catalysts, this gap Altcoins vs Bitcoin and the rest of the market is likely to widen before it narrows.

Want more in-depth analysis and airdrop opportunities? Visit FreeCoins24.io/airdrops to explore the latest free crypto drops.

Stay Updated

Stay in the loop with the latest crypto airdrops, strategies, and tips. Follow us on: