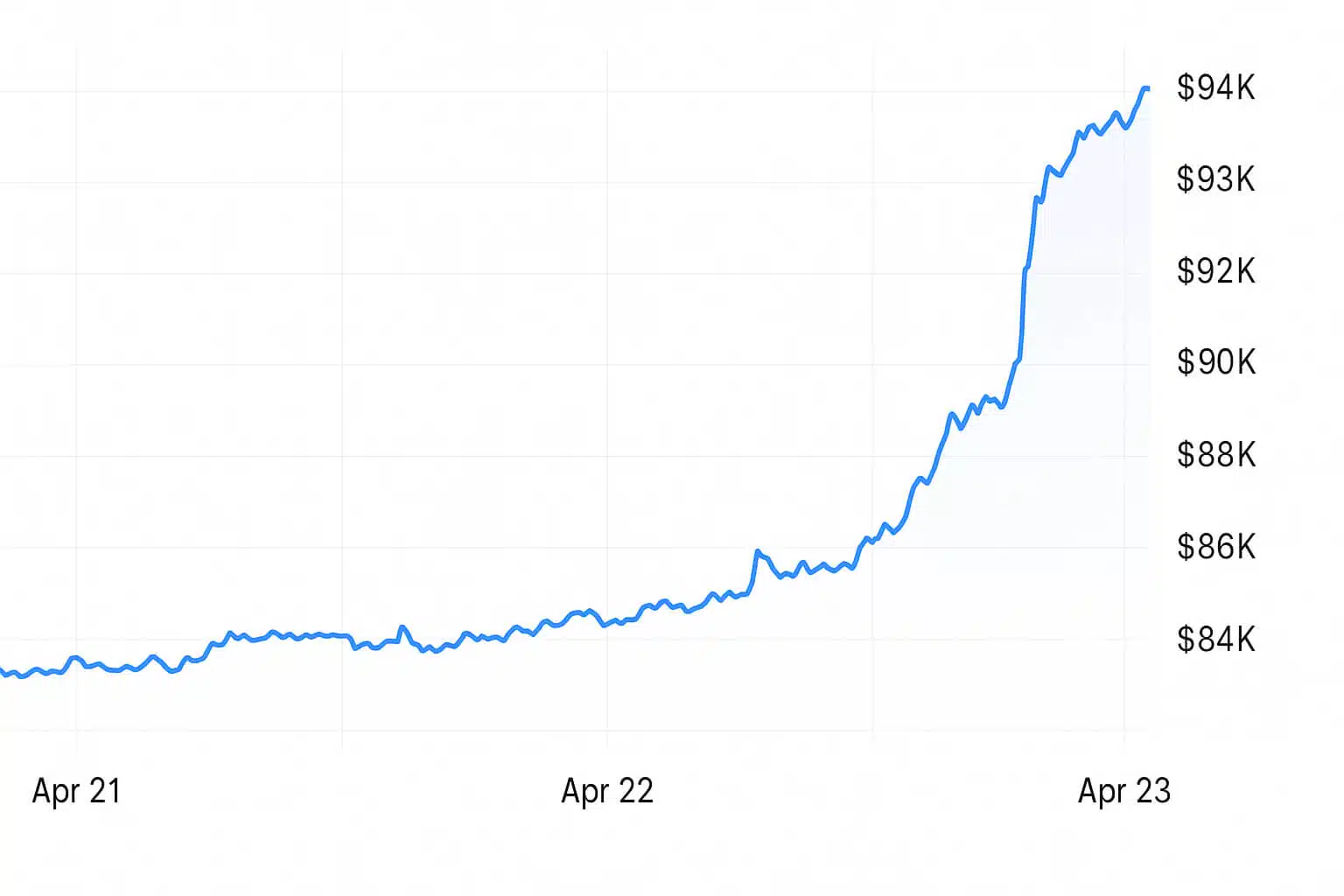

Bitcoin has officially reignited the crypto market’s fire. Over the past 48 hours, the world’s largest cryptocurrency surged to nearly $94,000, specifically $93,590 as of April 23, 2025, leaving traders, analysts, and crypto enthusiasts scrambling for answers. From institutional demand to macroeconomic pressure, there’s more to this sudden rally than meets the eye.

Let’s break it all down and see why this surge has everyone buzzing and what it could mean for the rest of 2025.

What’s Fueling the Pump?

A combination of forces converged at just the right time to push Bitcoin to this near all-time high, and none of them are happening in a vacuum. Here’s a deeper dive into what’s driving the price action:

1. Institutional Money is Flowing In

The approval of spot Bitcoin ETFs in the United States in early 2024 was a defining moment in crypto history. These financial products gave traditional institutions, including hedge funds and retirement accounts, a secure and regulated way to gain Bitcoin exposure. Since then, capital has steadily flowed into Bitcoin markets. By 2025, estimates suggest the total assets under management from Bitcoin ETFs could top $190 billion.

Beyond ETFs, companies like MicroStrategy are continuing to scoop up large amounts of BTC. In fact, reports show the firm acquired more than 506,000 BTC in 2025 alone. These high-volume purchases shrink available supply and naturally create upward pressure on price.

2. Regulatory Clarity Post-Election

The 2024 U.S. presidential election had a seismic impact on crypto regulation. With a pro-crypto administration now in office, led by President Trump, policy has tilted heavily in favor of blockchain innovation. Trump’s vow to turn America into “the crypto capital of the world” was more than rhetoric. It triggered a regulatory thaw that emboldened crypto companies and investors alike.

This shift created an environment of confidence and clarity, something the industry has desperately needed. For large investors, knowing the government isn’t out to stifle crypto is a game-changer.

3. Halving Economics Are Catching Up

In April 2024, Bitcoin underwent its fourth halving event, slashing mining rewards from 6.25 to 3.125 BTC per block. While halving cycles typically take time to show their impact, we’re now one year removed, precisely the window in which previous bull markets ignited.

The halving essentially cut the rate of new Bitcoin entering the market in half. Combine this with increased demand from ETFs and corporate treasuries, and the supply squeeze becomes very real. Historical data backs this pattern, and it seems to be unfolding once again.

4. Macroeconomic Tailwinds

Across the globe, central banks are cutting interest rates in response to slowing economic growth and waning inflation. For risk-on assets like Bitcoin, this is a positive signal. Lower rates reduce the appeal of holding fiat, and investors start looking for yield and upside elsewhere.

Bitcoin, which historically thrives when real interest rates are low or negative, is benefiting from this macro shift. As fiat returns diminish, digital assets that offer scarcity and long-term upside become more attractive.

5. Political Momentum and Market Euphoria

Politics and markets don’t always move together, but in crypto, sentiment often tracks political winds. Following Trump’s pro-crypto victory, markets celebrated. Bitcoin soared past $100K in late 2024, and now, fueled by policy optimism and continued adoption, we’re seeing another leg up.

Investors are betting not just on Bitcoin, but on a broader digital asset ecosystem that’s finally getting mainstream buy-in.

Crypto Twitter Reacts: Bullish and Boisterous

The crypto community on X (formerly Twitter) didn’t hold back their excitement. From bullish memes to serious technical analysis, sentiment has turned sharply positive. Traders are noting Bitcoin breaking past key resistance zones like the Ichimoku Cloud, with some analysts calling it the beginning of a new wave of institutional-driven momentum.

Accounts like @CryptoWealthLab are predicting new highs above $150,000, while influencers like @rovercrc point to whale activity and long-term holder accumulation as bullish indicators. Whales buying up three times the daily mining supply has been widely cited as evidence that large players believe the price is heading higher.

And while some short-term traders attempted to fade the rally, evident in negative funding rates on Binance, the market appears to have steamrolled bearish bets, adding fuel to the upward move.

Can the Momentum Last?

With Bitcoin pushing toward its psychological threshold of $100K once again, the big question becomes: What happens next?

Several indicators suggest this is not a flash-in-the-pan rally. Unlike past speculative frenzies, today’s Bitcoin surge is rooted in real adoption, reduced supply, and a favorable macro backdrop. But that doesn’t mean it’s all clear skies.

Here are a few risk factors to monitor:

- Overheated momentum: Technical indicators show Bitcoin approaching overbought territory.

- Retail euphoria: As new traders flood in, volatility tends to increase.

- Regulatory surprises: Even in a friendly environment, new compliance rules or ETF outflows could spook the market.

Still, analysts generally agree that we’re witnessing the early stages of a crypto supercycle, one fueled not by memes, but by mature capital and global financial recalibration.

Final Thought

The surge to $94K is more than just a price milestone, it’s a signal. The market is moving into a new phase, one where crypto isn’t just about speculation or rebellion. It’s becoming an integrated part of global finance, powered by technology, embraced by institutions, and understood by governments.

Whether you’re a long-time holder or a curious newcomer, this moment matters. It reflects years of infrastructure, policy shifts, and cultural evolution converging into a clear message: Bitcoin is here to stay, and it’s growing up.

Stay Updated

Want more in-depth analysis and airdrop opportunities? Visit FreeCoins24.io/airdrops to explore the latest free crypto drops.

Follow us for live news and updates: