The price fluctuations of Bitcoin can be exhilarating one moment and stomach-churning the next, if you’re anything like me. As of November 14, 2025, Bitcoin is trading at about $95,184 USD, down a steep 7.0% over the past day, according to CoinGecko’s live feed. This comes after the cryptocurrency fell from highs of about $106,562 over the previous week. With long-term holders cashing in amid global market jitters, ETF outflows reaching $870M, and over $1B in liquidations flushing weak hands, this is a classic recalibration phase. The good news is that this volatility presents an opportunity for you to become more strategic.

In this friendly guide, we’ll unpack the current Bitcoin market outlook, highlight real support zones backed by live data, and share actionable tips to help you trade smarter, not harder. Whether you’re a swing trader eyeing entries or just watching from the sidelines, let’s dive in and build a plan that keeps emotions in check.

If you’re ready to jump in but want a hassle-free start, check out Bitunix. No KYC required, instant free earnings on sign-up, and zero-fee withdrawals to keep your profits yours. It’s perfect for testing these levels without the red tape. Head over to FreeCoins24’sBitUnix guide for the full scoop and snag your exclusive bonus.

1. Today’s Bitcoin Snapshot

Bitcoin’s been on a bit of a slide over the past week, down about 3.9% from its 7-day high of $106,562, but that recent pressure shows buyers are testing defenses. Key stats as of this morning:

- Current Price: $95,184 USD (at the time of writing)

- 24-Hour Range: $95,241 – $103,019 (earlier highs)

- Market Cap: A whopping $1.90 trillion

- What’s Driving It: Selling from long-term holders (they’ve offloaded ~$2B in the last month), shaky tech stocks pulling risk appetite lower, and futures leverage flushing out weak hands. Yet, with BTC dominance steady at ~57%, the broader crypto ecosystem is holding its breath for a relief rally.

We’re brushing against zones where big buyers have historically shown up. No panic-selling needed, just smart watching. (Pro move: Track these live on CoinGecko’s terminal for real-time alerts. It’s free and beats staring at charts all day.)

2. The Must-Watch Support Zones

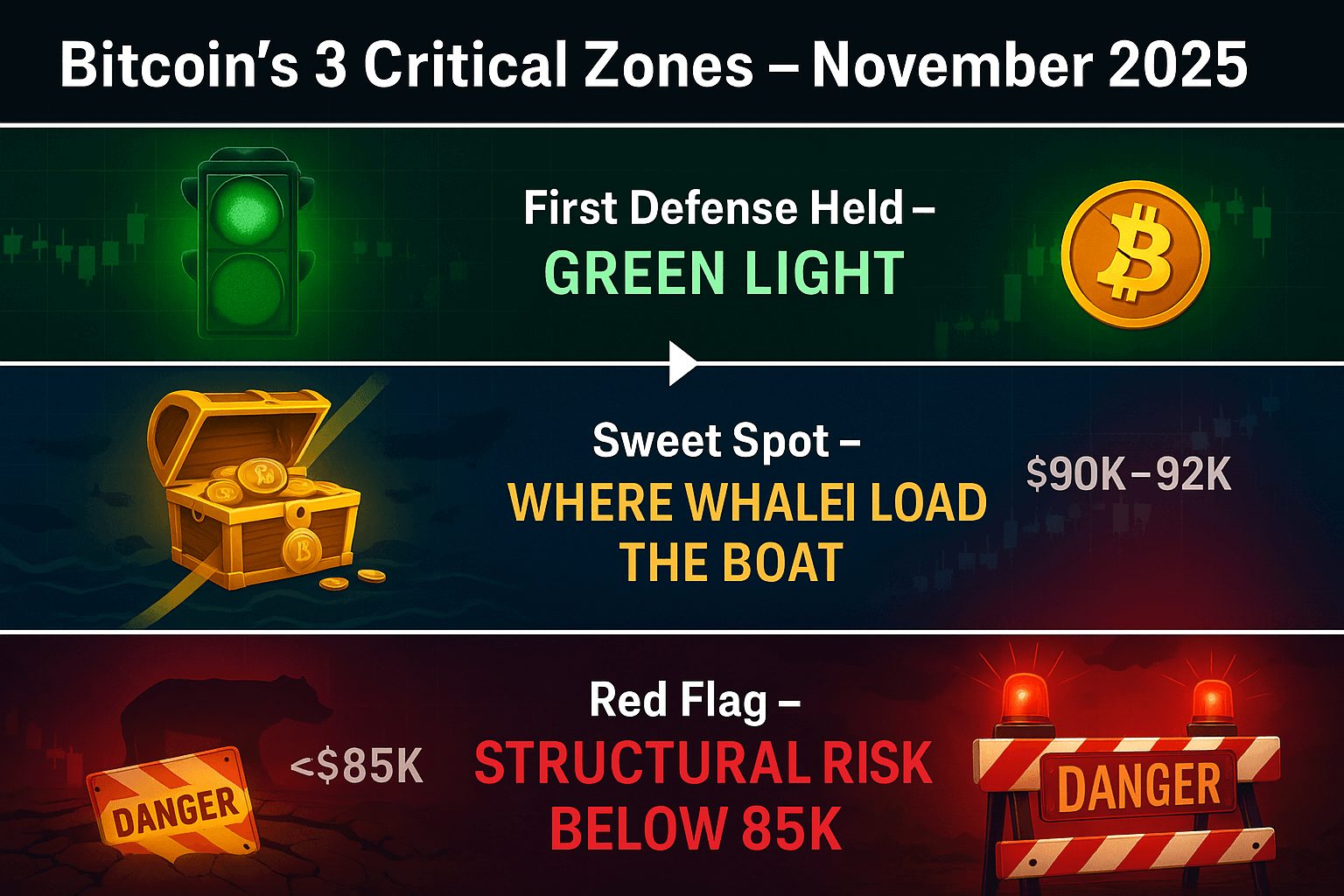

Drawing from volume profiles, historical reactions, and today’s ranges, BTC’s structure points to three key zones. Think of these as “price magnets” where action heats up. We’re smack in the upper end of Zone 1 right now, exciting times!

Zone: $94,000 – $95,000: This isn’t just any level, it’s a battle-tested consolidation spot from recent weeks, loaded with high-volume trades (over 5% of monthly volume clusters here, per on-chain data).

It’s where early bulls might test the waters before things get wilder. What to Watch For (Step-by-Step):

- Spot a daily candle closing firmly above $95,000, that’s your “hold the line” signal.

- Look for long lower wicks on the hourly chart.

- Check if RSI (14-period) bounces off 40 without diving deeper, avoid FOMO on tiny pops and stay way from bullprints influencers.

If it sticks, this could be your low-risk dip-buy window. But remember, partial positions only, no all-in heroics.

Zone $90,000 – $92,000: Well, this is the “fair value” zone everyone’s whispering about. Because, it’s aligning with the 0.618 Fibonacci retracement from the last leg up (October’s ATH at $126,080), this area’s seen massive spot accumulation in past cycle, like the $92K defense in early 2025. Why It’s Prime Real Estate:

- Matches “healthy bull retrace” depths (20-30% pullbacks).

- On-chain metrics show whale wallets stacking here historically.

- CoinGecko’s 30-day trend (up 14.3% overall) suggests oversold bounces thrive around these levels.

Bottom Confirmation Checklist:

- A high-volume green hammer or engulfing candle on the daily.

- BTC dominance dipping below 56% (room for alts to shine).

- Altcoin indices (like TOTAL3 on TradingView) flattening—no more freefall.

Nail this, and you’re positioned for that juicy rebound to $100K+.

Zone Below $85,000: To be honest, this is a red flag territory. Cross this on a daily close, and we’re talking structural shift. Hey! Greetings from the bear market. The support zone of multi-week consolidation may disappear. We’re still 24% off the ATH, so it’s not the end of the bull, but if macro headwinds (like Fed signals) continue, expect chop into the high $70Ks. If you are not an expert with unbreakable stops, you can skip this.

Platforms like Bitunix make scaling in/out a breeze with their no-KYC setup. Sign up fee-free, earn instant rewards, and withdraw anytime, no strings. Get started with our Freecoins24 x Bitunix welcome Bonus.

3. Spotting a Genuine Reversal

Reversals aren’t magic? They’re patterns with proof. Use this simple rundown to filter noise:

- Daily Close Power: Above a key zone? Green light. Below? Wait.

- RSI Reset: Exiting oversold (under 30) on daily/4H charts.

- Volume Fade: Selling bars shrinking, buying spikes growing

- Dominance Shift: BTC.D rolling over, alts get breathing room.

- Alt Strength: Coins like ETH or LINK perking up relative to BTC.

- Funding Flip: Futures rates turning neutral (neutralize that PERP pain).

Meh! Stack 2-3 time to act. Tools like Coin Gecko’s alerts can ping you, no glued-to-screen required.

4. Entry Strategies: From Cautious to Bold

Volatility’s your friend if you play it right. Based on today’s $95K perch, here’s how to ladder in wisely. (All with stops below $85K for swing plays, protect that capital!)

Conservative Play

- Trigger: Daily close > $100,000 (reclaiming the broken high).

- Why? Confirms structure intact; ideal for beginners or 1-2 week holds.

- Position Size: 25-50% of planned allocation.

- Upside: Safer ride to $110K targets.

Balanced Approach

- Trigger: Reaction at $94K-$95K with wick rejection.

- Why? Today’s range low is your edge, buy the fear.

- Position Size: 50-75%, scaled over 2-3 dips.

- Risk Note: Higher than conservative, but R/R shines (2:1 minimum).

Aggressive Hunter

- Trigger: Volume surge in $90K-$92K with reversal print.

- Why? Best prices if it holds; echoes 2024’s epic bounces.

- Position Size: Full if confirmed, but trail stops tight.

- Pro Tip: Pair with options on Bitunix for leveraged upside without the liquidation stress.

Scale out at resistance (like $103K) to lock gains, discipline pays dividends.

5. Altcoin Ripple Effects

Bitcoin sneezes, alts catch a cold, but they also party harder on recoveries. With LINK at $14.06 today (down 9.2% in 24 hours, range $13.88-$15.63), expect amplified moves.

- If BTC Holds $90K-$92K: LINK’s cozy buy zone shifts to $13.00-$12.50. And for a deep value, $11.50-$10.80 for that 20% buffer.

- If BTC Slips Below $90K: Brace for 15-25% alt dumps, LINK could test $11.

Instructive Advice for LINK Fans:

- Mirror BTC’s stability first, don’t chase alts in freefall.

- Use relative strength (LINK/BTC pair) to time entries.

- 60% BTC core, 40% alts like LINK for growth spice.

Patience here turns volatility into velocity.

6. Wrapping It Up: Your Path to Smarter Trades

At $95K today, Bitcoin’s teetering on the edge of glory ($94K-$90K zones could spark fireworks) or a breather (sub-$85K chop). The bull’s alive, but confirmation is your best buddy. Stick to the checklist, honor your risk rules, and trade like the informed explorer you are.

Happy trading, and may your wicks be long and your greens be plenty! For more BTC breakdowns and crypto insights, check our Bitcoin Analysis Guides.

Want more in-depth analysis and airdrop opportunities? Visit FreeCoins24.io/airdrops to explore the latest free crypto drops.

Stay Updated

Stay in the loop with the latest crypto airdrops, strategies, and tips. Follow us on:

Stay informed with the latest strategies and insights in the world of cryptocurrency at FreeCoins24.io.