Introduction

After a sharp sell-off, Bitcoin has reclaimed the $99K level, bringing relief to traders. Altcoins are also showing strong recoveries, with XRP gaining nearly 10% in the last hour and SUI erasing most of yesterday’s losses.

Although sentiment has improved, market volatility remains high. The question is: Is this a short-term bounce, or are we witnessing the beginning of a larger rally? Let’s break down the latest developments and what to expect next.

1. What’s Fueling Bitcoin’s Rebound?

Buyers Defend Key Support Levels

After dipping below critical price zones, Bitcoin saw an influx of buy orders from whales and institutional investors. This renewed demand helped push the price back toward $99K, signaling confidence among large market participants.

For more on institutional influence in crypto, check out The Rise of Crypto ETFs: A Gateway for Institutional Investors.

On-Chain Data Signals Strength

Market data shows a decline in BTC balances on exchanges, indicating that long-term holders are moving assets to cold storage rather than selling. This trend suggests investors expect further price appreciation.

For deeper insights into Bitcoin’s liquidity trends, read The Impact of Staking on Cryptocurrency Market Dynamics.

2. Altcoins Rally Alongside Bitcoin

XRP Jumps 10% – What’s Driving the Surge?

Following Bitcoin’s recovery, XRP has emerged as one of the best-performing altcoins. The price spike comes amid growing speculation around XRP ETF approval and Ripple’s continued expansion in cross-border payments.

To explore how ETFs could impact XRP, read Grayscale’s XRP ETF Filing: A Game-Changer for Institutional Crypto?.

SUI Reclaims Lost Ground

SUI, which faced steep losses earlier, has staged a strong comeback. Increased network development and investor interest have played a role in its rebound. If momentum continues, SUI could see further upside in the coming days.

For a look at blockchain innovations, read How Layer 3 Solutions Are Shaping the Future of Blockchain.

3. Is This Crypto Market Recovery Sustainable?

Critical Resistance Levels to Watch

Bitcoin reclaiming $99K is a positive sign, but breaking above $100K remains a crucial test. A successful breakout could trigger a wave of bullish momentum, while rejection at this level may result in another correction.

For a broader perspective on Bitcoin’s price action, check out The Impact of the Latest Bitcoin Halving on the Market.

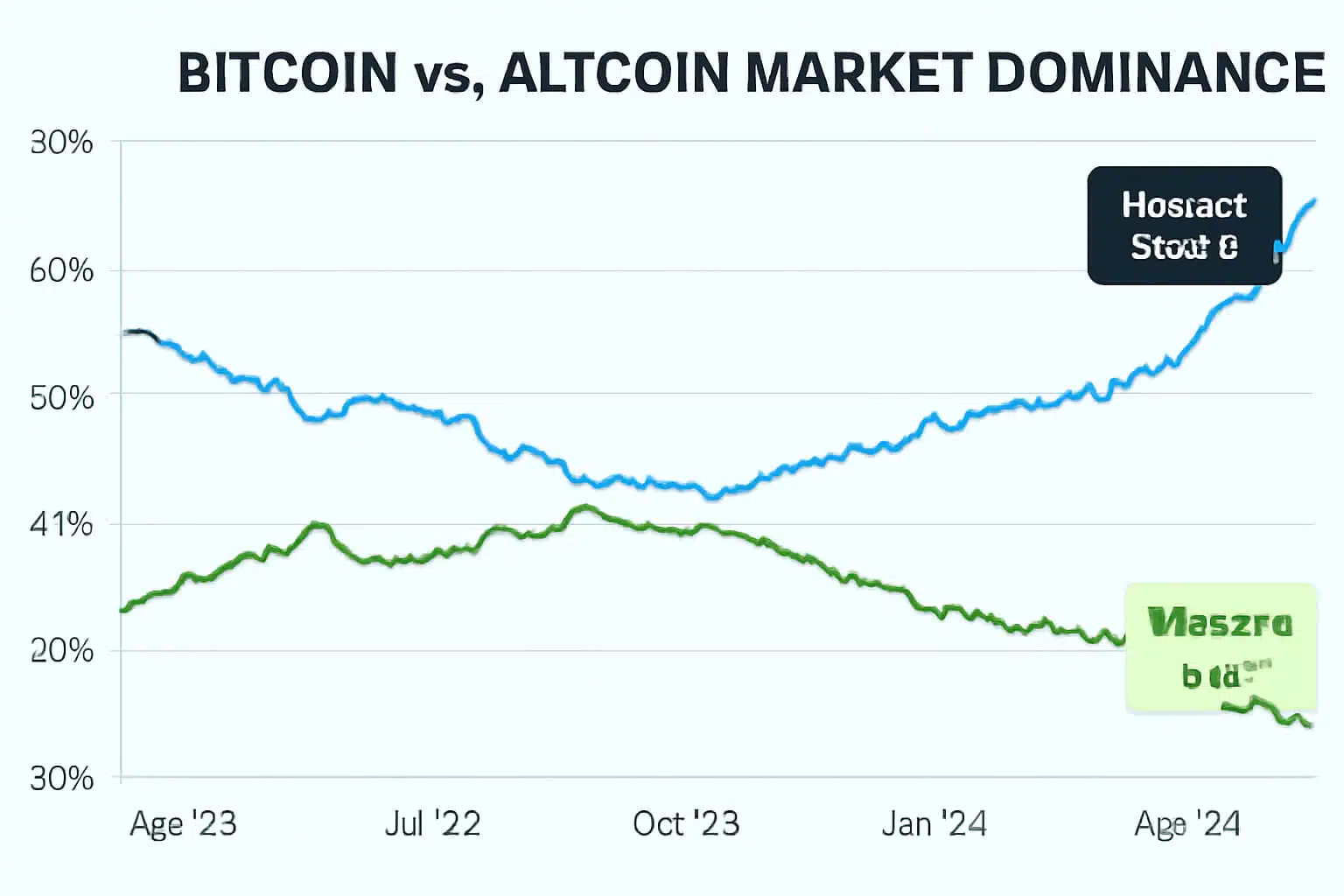

Macroeconomic and Market Trends

Beyond technical signals, several external factors will influence Bitcoin’s next move:

- Stock Market Trends – A rebound in equities could further strengthen crypto markets.

- Stablecoin Inflows – Rising liquidity signals growing investor confidence.

- Regulatory Developments – Clearer regulations could provide much-needed market stability.

For updates on crypto regulations, read The Impact of Regulatory Changes on the Crypto Market.

4. What’s Next for Bitcoin and Altcoins?

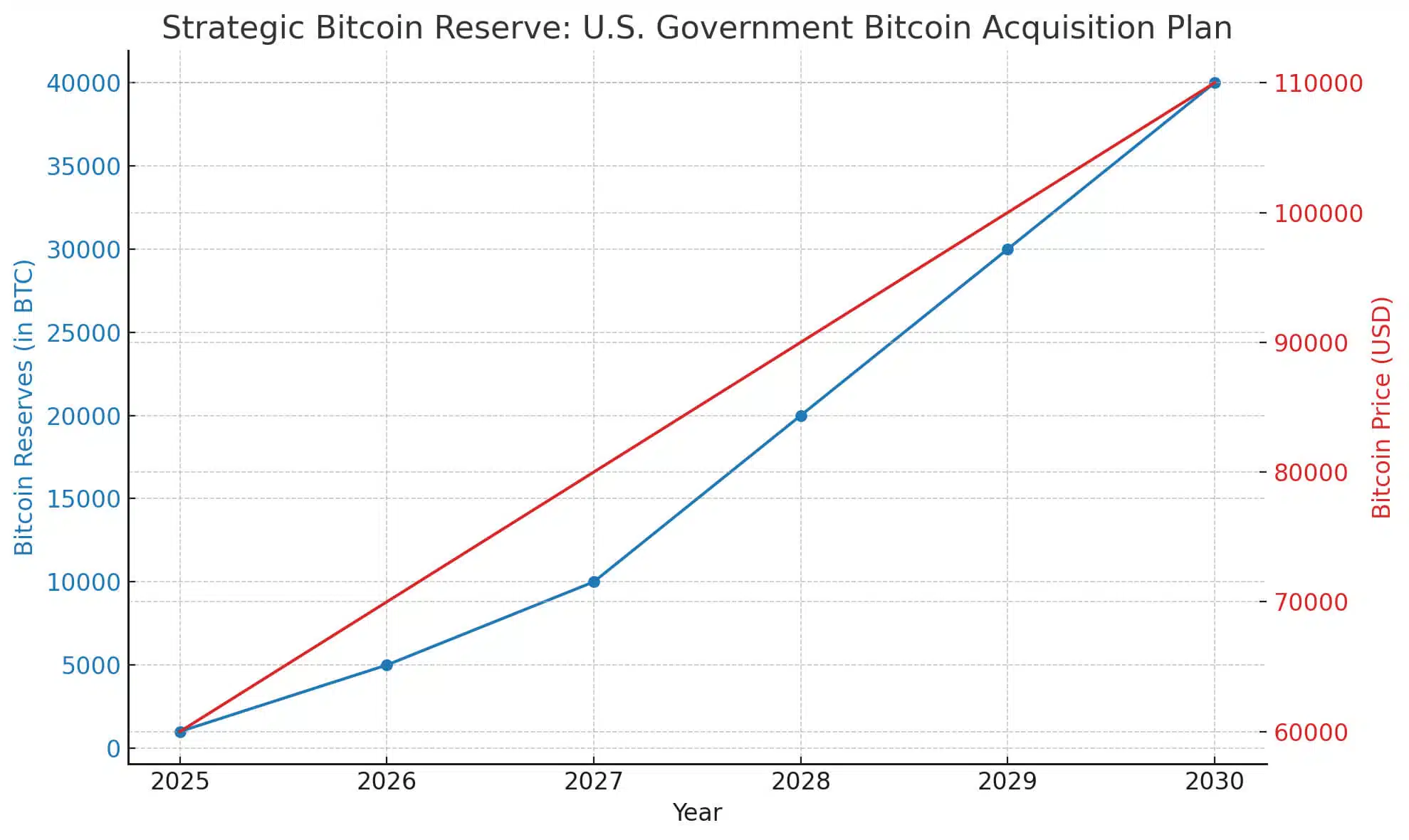

Potential Bullish Catalysts

Several key factors could drive further gains in the market:

- Continued institutional accumulation suggests growing confidence.

- Increased ETF adoption could attract fresh capital inflows.

- High Bitcoin hash rate signals strong miner confidence in future price appreciation.

For more on how ETFs are shaping the market, check out The Rise of Crypto ETFs: A Gateway for Institutional Investors.

Risks That Could Lead to Another Pullback

Despite recent gains, the market still faces some challenges:

- Macroeconomic uncertainty could weigh on investor sentiment.

- Regulatory shifts remain an unpredictable factor.

- Low trading volume might indicate a lack of strong follow-through buying.

To better understand risk management in crypto, read How to Identify and Invest in Promising Altcoins.

Conclusion: A True Bullish Reversal or Just a Relief Rally?

Bitcoin’s rapid return to $99K is an encouraging development, but the real test lies ahead. Breaking above $100K would confirm a strong bullish trend, while failing to hold gains may signal further corrections.

Meanwhile, XRP and SUI are already showing strength, reflecting renewed optimism in the broader crypto market. For now, investors should closely monitor resistance levels, whale activity, and macroeconomic shifts to assess whether this rally has long-term potential.

For more market insights, check out How Crypto Projects Are Leveraging AI for Innovation.

FAQs

1. Why did Bitcoin recover to $99K?

A mix of whale accumulation, reduced selling pressure, and improving investor sentiment contributed to the sharp rebound.

2. Will XRP and SUI continue their uptrend?

If Bitcoin stabilizes, altcoins may extend their gains, with XRP benefiting from ETF speculation and SUI from strong developer interest.

3. Is this the start of a full bull run?

While sentiment has improved, BTC must break past $100K to confirm a long-term uptrend.

4. What external factors could impact Bitcoin’s next move?

Macroeconomic events, central bank policies, stock market trends, and crypto regulations will play a key role in Bitcoin’s trajectory.

For more insights and detailed guides on cryptocurrency, visit our Crypto Guides Section.

Stay Updated

For the latest updates on cryptocurrency trends and news, follow us on:

- X: https://x.com/FreeCoins24

- Telegram: https://t.me/freecoins24

Stay informed with the latest strategies and insights in the world of cryptocurrency at FreeCoins24.io.

Special Offer

For an enhanced trading experience, consider Bybit. Sign up through our referral link to unlock exclusive rewards, including up to $30,000 in deposit bonuses, and elevate your trading journey.