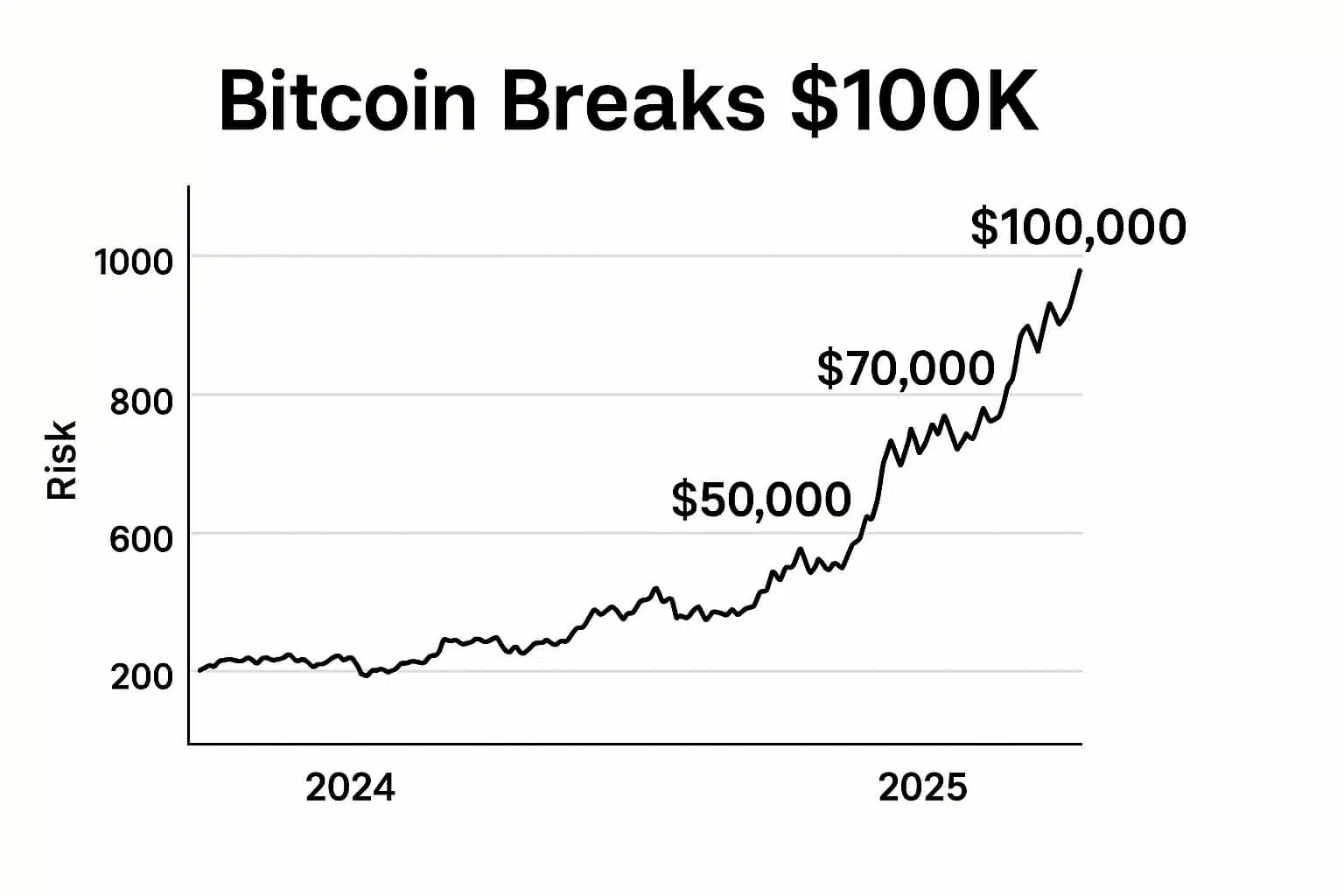

On May 8, 2025, Bitcoin officially crossed the $100,000 mark, peaking at $101,679.85, a historic moment that captured the attention of global markets. Unlike previous surges driven by speculation or halving hype, this breakout has a clear foundation in policy, geopolitics, and financial innovation.

This time, Bitcoin’s rally is the result of synchronized developments in the U.S. and global economy, a groundbreaking U.S.-U.K. trade agreement, Trump’s unprecedented crypto-friendly policies, and U.S. banks expanding into digital assets. Together, these forces have propelled Bitcoin into its first sustained six-figure run.

In this report, we’ll break down the specific events and structural shifts that triggered the breakout, analyze what they mean for the broader crypto economy, and explore the risks and opportunities facing investors as we enter this new era of Bitcoin adoption.

1. Bitcoin Soars Past $100,000: Trade Deal Sparks Crypto Confidence

Bitcoin’s climb above $100K didn’t happen in a vacuum, it coincided exactly with the announcement of a major U.S.-U.K. trade agreement, signaling renewed global economic cooperation.

Key Elements of the Trade Deal:

Tariff reductions: Steel and aluminum tariffs cut to 0%, car tariffs reduced to 10%.

Export expansion: The deal opens new lanes for U.S. agriculture and tech exports.

Projected impact: Estimated to generate $6 billion in U.S. revenues and unlock $5 billion in export opportunities.

Crypto Angle

What made this trade deal uniquely bullish for Bitcoin was its inclusion of pro-innovation clauses that explicitly promote fintech collaboration, including blockchain adoption. By facilitating regulatory alignment between U.S. and U.K. tech sectors, it boosted confidence in digital asset markets.

The deal’s immediate timing with Bitcoin’s surge suggests a clear market response to geopolitical stability and pro-growth sentiment. As Reuters reported, “Bitcoin retakes $100K on global trade deal optimism”, a headline that captures the correlation perfectly.

Bottom line: The trade deal reduced economic uncertainty, invited innovation, and shifted investor sentiment, all while placing Bitcoin at the center of the conversation.

2. Trump’s Policies and the Regulatory Shift

Since returning to the White House, President Donald Trump has made it clear that crypto is not only welcome, it’s strategic.

Highlights of Trump’s Pro-Crypto Agenda:

🇺🇸 Strategic Bitcoin Reserve

In March 2025, Trump signed an Executive Order establishing the U.S. Strategic Bitcoin Reserve. This reserve is funded with BTC seized from illicit actors, converting what was once dark market capital into state-owned assets.

This move effectively positioned Bitcoin alongside traditional reserve assets like gold, a symbolic and policy-level validation.

🛡️ Regulatory Clarity

In April 2025, the Department of Justice (DOJ) issued guidance that protected crypto exchanges and developers from prosecution for non-malicious violations. The idea was simple: encourage innovation, punish bad actors.

This regulatory relief has drastically reduced legal uncertainty, opening the door for:

Exchange expansion

U.S.-based DeFi development

Venture capital inflows into tokenized assets

🔄 SEC Restructuring

Trump’s commitment to replacing SEC Chair Gary Gensler with a pro-innovation leader has already had an effect. Speculation over a friendlier SEC is fueling market optimism, particularly for altcoins awaiting ETF approvals and token classification reform.

Market Response

After Trump’s re-election in November 2024, Bitcoin rallied 8% within hours. His policies have since created a pro-growth, crypto-friendly environment where Bitcoin and other digital assets can thrive under U.S. leadership.

3. U.S. Banks Enter the Crypto Arena

While political policy has been the front-runner, bank-level integration of Bitcoin is creating the deepest long-term impact.

What’s New?

In March 2025, the FDIC issued formal clarification that U.S. banks do not need prior approval to engage in crypto-related services, so long as they meet risk-management guidelines. Simultaneously, the Office of the Comptroller of the Currency (OCC) reinforced that national banks can provide crypto custody and settlement services.

What This Means:

JPMorgan, Bank of America, and others are now offering direct access to BTC.

Clients can buy, sell, and hold Bitcoin from their primary banking apps.

Banks are also working on offering crypto investment accounts, lending, and staking.

By bringing crypto into traditional finance infrastructure, banks are bridging the gap between Wall Street and Web3, enabling both retail and institutional investors to move capital more easily and with greater security.

Even if this wasn’t the direct cause of the May 8 breakout, it amplified the rally’s credibility. Institutional money is no longer just ETF-based, it’s now flowing through regulated banking channels.

4. Broader Market Dynamics

📊 Institutional ETF Demand

The approval of spot Bitcoin ETFs in January 2025 has unleashed significant institutional capital. Funds like BlackRock’s iBTC, Fidelity’s Bitcoin Core, and VanEck’s BTX are now seeing consistent inflows from:

Pension funds

Family offices

University endowments

This demand has created a baseline of daily buy pressure, sustaining Bitcoin’s trajectory.

🌍 Global Trade & Political Stability

Key developments include:

Eased U.S.-China tensions, thanks to negotiations led by Treasury Secretary Scott Bessent

Ceasefire talks between India and Pakistan

The Fed’s signal to hold interest rates steady amid soft inflation data

Together, these macro shifts have restored risk-on appetite, prompting capital rotation into high-performing assets like Bitcoin.

📈 Technical Factors

Bitcoin’s market dominance hit 60%, showing investor preference for BTC over altcoins. The Relative Strength Index (RSI) spiked past 67, indicating strong bullish momentum.

These indicators suggest the rally was organic and technically sustainable, not just a news-driven pump.

5. The Bigger Picture: Opportunities and Risks

✅ Opportunities

Retail Access: With banks offering custody and purchases, Bitcoin is now easier than ever to buy and hold.

Web3 Infrastructure: Layer 1 and Layer 2 networks are seeing renewed funding as BTC price action attracts developer attention.

Altcoin Rebound: Historically, Bitcoin pumps have preceded altseason — and capital is starting to flow toward ETH, SOL, and newer AI tokens.

⚠️ Risks

Policy Reversal: A potential change in administration or Congress after 2026 midterms could undo Trump’s crypto agenda.

Market Overextension: With a 40% gain in 6 weeks, short-term correction risks are elevated.

Ethical Criticism: Some economists argue that using seized BTC or tariff funds to buy Bitcoin sets a problematic precedent, especially if lower-income communities bear the economic burden.

6. Can Bitcoin Stay Above $100K? What Comes Next

As Bitcoin breaks new ground above $100,000, the key question is: Can it hold, or even rise further?

Factors to Watch:

Ongoing U.S. trade negotiations (especially with the EU and China)

Trump administration’s next round of executive orders or tax proposals

Broader crypto regulatory reform, including stablecoin legislation and exchange frameworks

If macro stability holds and policy continues to support innovation, Bitcoin may not only sustain six figures, it could target $120K–$150K as institutions and banks expand exposure.

Final Thought

Bitcoin’s surge past $100,000 isn’t just a price event, it’s a paradigm shift. Between pro-crypto policy, international economic cooperation, and full banking integration, the digital asset landscape is undergoing the most fundamental transformation in its history.

For investors, traders, and builders, this isn’t the time to sit on the sidelines. The next chapter of crypto is being written, and it’s institutional, geopolitical, and deeply integrated into the global financial system.

Want more in-depth analysis and airdrop opportunities? Visit FreeCoins24.io/airdrops to explore the latest free crypto drops.

Stay Updated

Stay in the loop with the latest crypto airdrops, strategies, and tips. Follow us on: