Bitcoin feels stuck. After smashing $126,296 in late October, BTC has bled for five weeks, etching lower highs and lows while probing $88K–$90K. Sentiment sours, and chatter swirls: Is this the bubble’s final gasp? We’re slicing through the hype with raw data, channels, RSI, volumes, and levels. On spoiler, this short-term exhaustion signals a bounce, but long-term bulls hold firm.

1. The Big-Picture Structure: Mid-Cycle Shakeout, Not Bubble Burst

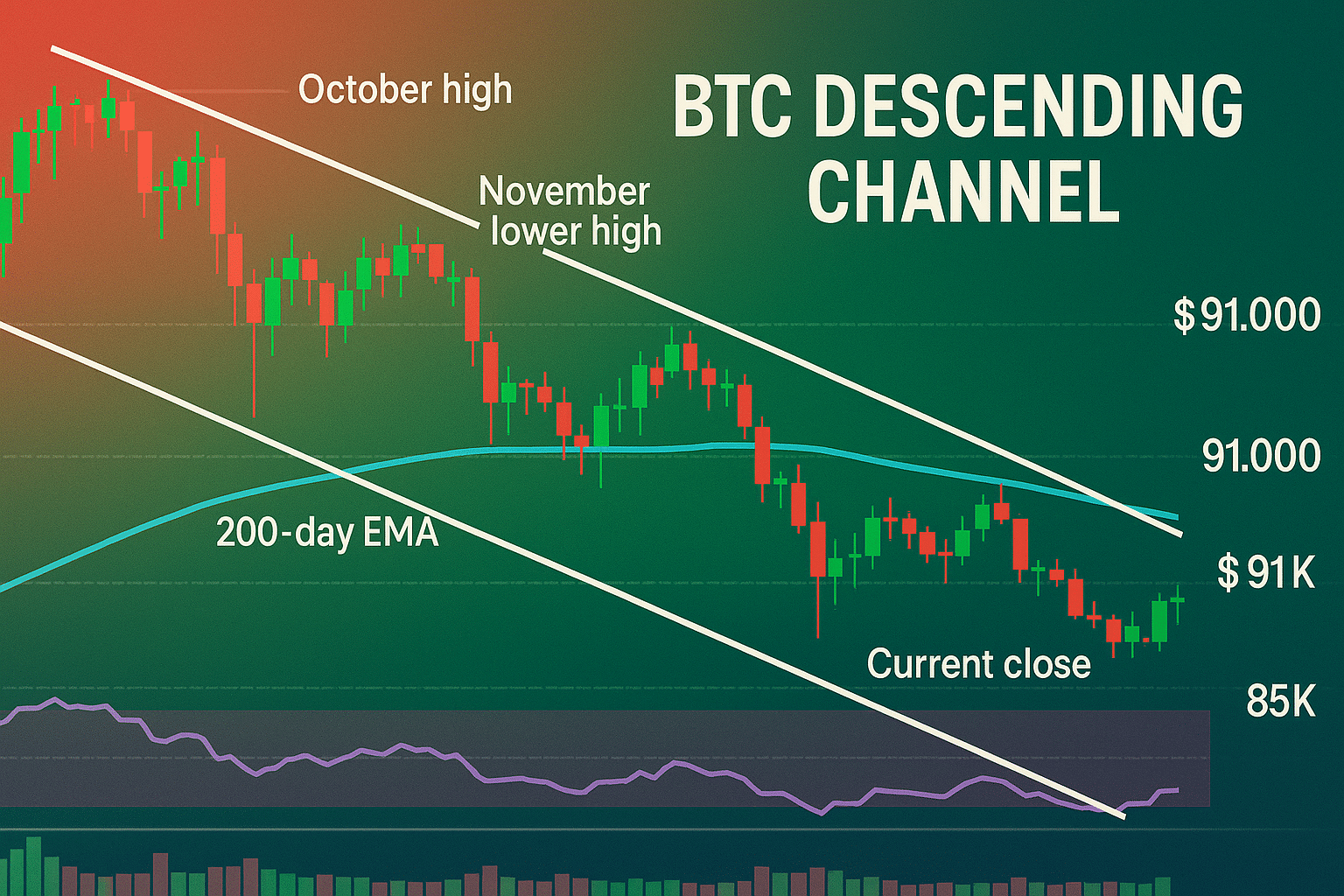

On daily charts, Bitcoin creates a classic descending channel. After reaching a peak of $126,296 in October, it fell to $93,162 on November 28 and then to $94,449 on December 3. From $80,822 on November 21 to $83,871 on December 1, the lows got deeper. On December 5th, Bitcoin closes at $91,000, a 30% decline.

This is comparable to previous post-halving resets, such as the 40% drop in 2017 and the 54% drop in 2021. The 200-day EMA is currently defended at $85,000, and the 0.5 Fib retracement is at $82,000. Buyers are found for each dip. In fact, this cycle’s net inflows of $732 billion surpass all previous cycles combined, according to Glassnode data.

Verdict: Structure stays bullish above 4H. This isn’t deflation, it’s a flush shaking weak hands.

2. RSI: Short-Term Washout, Long-Term Momentum Intact

RSI exclaims fatigue. During previous 2025 dips (three time Qs), the hourly RSI (14) plunges to 18-cycle lows, causing 4–8% bounces. Every day RSI, 48, neutral following December 1’s oversale of 36. The weekly RSI is at 49, well above the 25 bottom of 2022.

Sellers get tired easily. On-Chain Mind reports that the velocity RSI hit single digits on 3-day charts, which is uncommon since the bears of 2022. With an MVRV ratio of 2.1, accumulation rather than distribution is indicated. $92K to $94K is the likely short-term snap-back amount. In the long runA? Healthy restart.

3. Volume & Liquidity: Leverage Flush Nears Completion

Volumes whisper relief. Average daily spot? $42B last five days, down 25% week-over-week. Perpetual OI compressed 18% post-$100K break. Liquidation heatmaps confirm: Pain clustered at $96K–$100K (longs) and $88K–$90K (shorts).

Low volume on downsides + shrinking OI equals deleveraging done. Historically, this births violent rallies, think 2021’s post-flush surges. Total crypto volume? $135B, subdued but stabilizing.

Moreover, ETF outflows eased, BlackRock’s IBIT shed $113M Dec 4, but net AUM holds $120B (6.5% of BTC cap). Whales accumulate quietly.

4. Key Levels: The Lines That Decide December’s Fate

Watch these pivots closely:

- $94,500: Recent lower high (Dec 3). Break flips structure bullish – eyes $100K fast.

- $90,000: Psych midline. Holds? Choppy range persists.

- $88,000: Daily support. High-volume close below? Retest $83K–$85K.

- $85,000: 200-day EMA bull fortress.

- $82,000–$80,800: 0.5 Fib + prior low. Prime long entry – highest risk/reward this cycle.

Fed minutes tomorrow and ETF data could spark 4–8% swings. Rate cut odds? 87% for December.

4. Key Levels to Watch Right Now, Bitcoin’s Make-or-Break Zones

Here are the exact price zones that decide Bitcoin’s next move:

- $94,500 → Last lower high (Dec 3). A daily close above flips the entire structure bullish and opens a fast path to $100K+.

- $90,000 → Psychological midline + current range center. As long as price holds here, we stay in choppy consolidation. Lose it and momentum tilts lower.

- $88,000 → Immediate daily support. A high-volume close below triggers a retest of $83K–$85K zone.

- $85,000 → 200-day EMA and major bull-market defense line. This level has held every single test in 2025. Break it and real cycle risk appears.

- $82,000–$80,800 → 0.5 Fibonacci retracement + prior major low. Final shakeout territory. Historically the highest-probability long entry of the entire bull run.

These five levels are the only ones that matter for the next 2–6 weeks. Everything else is noise.

5. Short-Term vs. Long-Term: Neutral Chop to Bullish Ramp

Short-term (0–14 days): Neutral-bearish until $94.5K reclaims. Expect whipsaws on low catalysts – Fed signals, ETF flows. Oversold hourly favors $92K–$94K bounce first, but macro must align to stick.

Long-term (Q4 2025–Q1 2026): Strongly bullish above $80K. On-chain shines: 70%+ supply in 1-year HODLs, exchange balances at 5-year lows. Realized cap? $1.1T, up despite dips. Seasonality? December averages +9.7% historically.

This “feels” like deflation because healthy bulls do. Leverage flushed, hands shaken – now, $90K tests resolve.

Final Thoughts

Is the bubble in Bitcoin popping at $90K? According to the data, it is resetting for the subsequent leg. Volumes validate the flush, the structure holds, and the RSI fades out. Do you have $90K? More through 2026. Drop it? Parabolic after a brief scare to $80K.

For more insights and educational resources on is Bitcoin’s bubble deflating at 90K and BTC market analysis, visit our Crypto Market Updates.

Want more in-depth analysis and airdrop opportunities? Visit FreeCoins24.io/airdrops to explore the latest free crypto drops.

Stay Updated

Stay in the loop with the latest crypto airdrops, strategies, and tips. Follow us on:

Stay informed with the latest strategies and insights in the world of cryptocurrency at FreeCoins24.io.