The geopolitical conflict between Israel and Iran has left the crypto markets in turmoil, with Bitcoin and other cryptocurrencies facing significant volatility. As tensions escalated in mid-June 2025, the crypto space was rocked by market fluctuations, with Bitcoin’s role as a potential hedge coming under scrutiny. This article delves into Bitcoin’s performance during the Iran-Israel war, evaluates its viability as a hedge, and explores blockchain-based alternatives for safe hedging in times of geopolitical unrest.

Crypto Market Performance During the Iran-Israel War

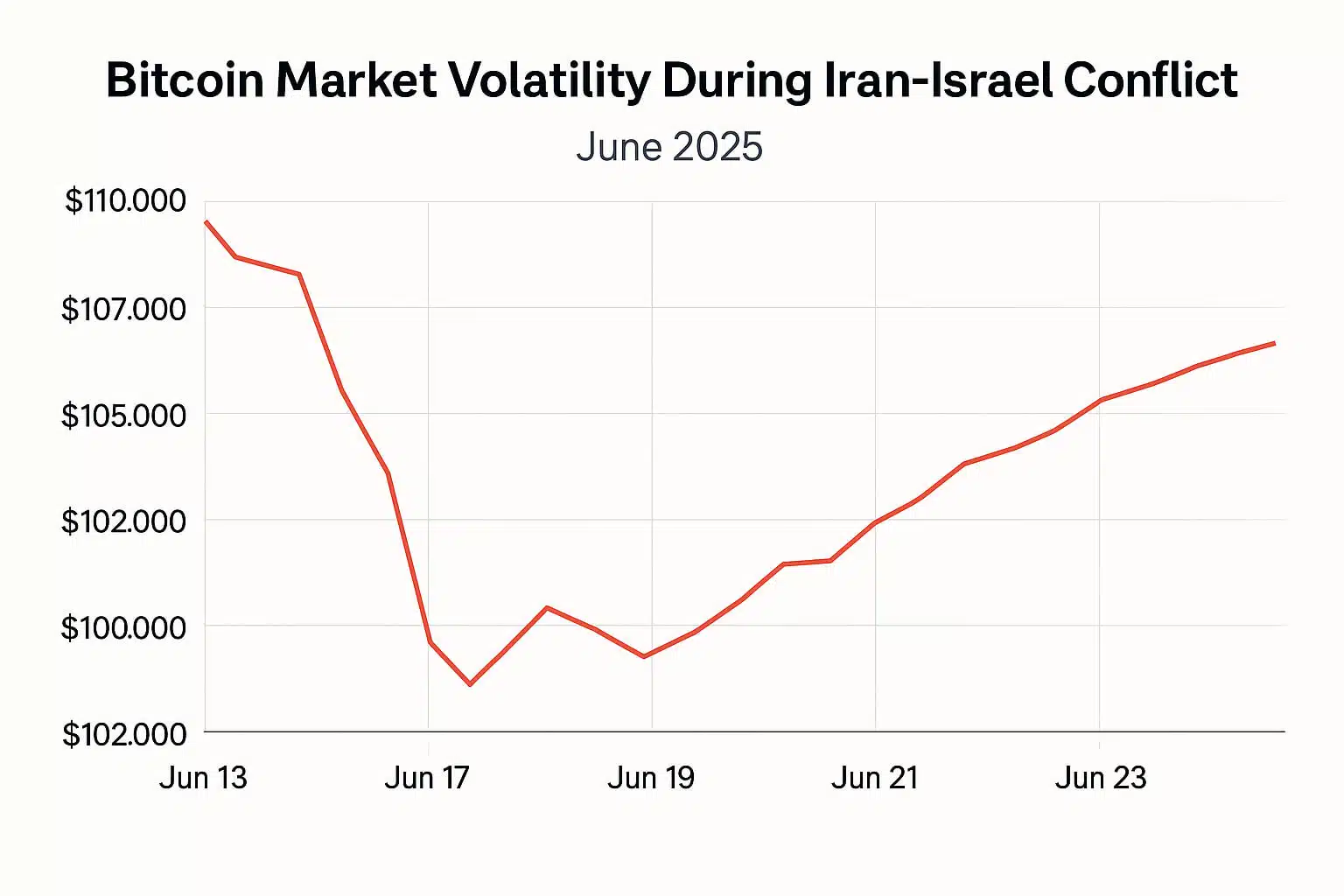

On June 13, 2025, following Israel’s airstrikes on Iranian military targets, Bitcoin saw a sharp drop, losing 4.5% to hit an intraday low of $104,343. The broader crypto market followed suit, shedding over $420 billion in market capitalization, while leveraged liquidations totaled $1.2 billion during Asia’s trading hours. Despite the pullback, the Crypto Fear & Greed Index shifted from 65 (greed) to 54 (neutral), signaling a cooling of speculative enthusiasm but not a panic selloff.

By June 23, Bitcoin had dropped further, closing at $102,250. However, this decline is not as dramatic as many had feared, with some analysts predicting a further 10-20% drop if U.S. involvement in the conflict escalates. Meanwhile, gol, a traditional safe haven, initially surged to $3,428 per ounce on June 13, before dropping to $3,362 by June 23, as global markets remained volatile.

Bitcoin as a Hedge Fund: Evaluation and Controversy

Bitcoin is often touted as a “hedge” against geopolitical risk, but its performance during the Iran-Israel conflict raises doubts. Historical data suggests Bitcoin has shown promise as a store of value during past geopolitical events. However, during this war, Bitcoin’s price movements have behaved more like high-risk assets than a reliable hedge.

Several crypto influencers took to Crypto Twitter to express differing views on Bitcoin’s role in this crisis:

@ThinkingBitmex warned that Bitcoin could plummet to $40,000 if the conflict further escalated.

@0x_gremlin pointed out that Bitcoin has historically rebounded from dips following geopolitical tensions, suggesting it could recover over time.

@CobakOfficial noted that investors are fleeing to traditional safe-haven assets like gold and oil, underlining Bitcoin’s failure to establish itself as a safe-haven asset.

This uncertainty highlights the complex nature of Bitcoin’s role during times of crisis. While Bitcoin’s attributes, such as counterparty risk-free, censorship-resistant, and scarce supply, suggest it could be a hedge, its current volatility and market behavior indicate it may be more susceptible to market panic than initially anticipated.

Blockchain-Based Alternatives for Safe Hedging Against War

Given Bitcoin’s shortcomings as a reliable hedge during the Iran-Israel war, investors are looking to alternative blockchain-based solutions for safe hedging. Several digital assets and decentralized financial tools offer potential as safer alternatives during times of geopolitical instability. These alternatives include:

Stablecoins

Stablecoins, like USDT, USDC, and DAI, are pegged to fiat currencies like the U.S. dollar and offer minimal volatility compared to Bitcoin. They maintain liquidity and offer a stable store of value, especially in countries facing currency devaluation or political turmoil. Stablecoins are also widely used in decentralized finance (DeFi), adding to their appeal during unstable times.

Tokenized Gold

Gold has historically been a go-to hedge during geopolitical conflicts, and now, blockchain technology has brought gold to the digital world. Tokenized gold, such as PAXG or Tether Gold (XAUt), represents physical gold on the blockchain, offering the stability of gold with the advantages of blockchain transparency and easy trading. These tokenized assets can be a safe alternative to Bitcoin during market volatility.

Crypto Derivatives

For more experienced traders, crypto derivatives such as futures and options allow for hedging against price drops. These instruments provide risk management and leverage opportunities, though they come with their own set of complexities and risks. Their usage surged during uncertain times, with many seeing them as a way to shield their portfolios from large drops.

DeFi Protocols

DeFi protocols, which offer yield-bearing assets and decentralized financial services, have been gaining traction in volatile markets. These platforms provide flexibility, and some of them allow for income generation even during downturns. However, these systems carry risks like smart contract vulnerabilities and platform security concerns.

Peer-to-Peer Systems and DEXs

During government-imposed blockades or internet shutdowns, peer-to-peer systems and decentralized exchanges (DEXs) provide alternatives to traditional financial systems. In countries like Venezuela and Syria, decentralized financial tools have become lifelines in times of crisis, allowing individuals to bypass local fiat systems and trade value securely on the blockchain.

Additional Considerations for Hedging in a Crisis

To make informed decisions during times of geopolitical turmoil, investors should keep an eye on on-chain metrics, such as wallet activity, stablecoin inflows, and trading volumes. These metrics offer valuable insights into shifting sentiment and capital flows, helping investors adjust their strategies accordingly. Diversifying investments across multiple cryptocurrencies, stablecoins, and wallets, both custodial and non-custodial, can also enhance portfolio resilience.

Despite these alternatives, investors should approach crypto investments with caution, particularly during conflicts. No digital asset, not even stablecoins or tokenized gold, offers guaranteed protection from geopolitical instability. Given the volatility and rapid shifts in the crypto market, adaptive strategies and ongoing research remain critical for successfully navigating uncertain times.

Conclusion

In the wake of the Iran-Israel war, Bitcoin’s role as a hedge has proven to be more complex than previously assumed. While it holds promise as a long-term store of value, its performance during geopolitical crises suggests it may not offer the stability that traditional safe havens like gold provide in the short term. As the conflict continues, investors are increasingly turning to alternative blockchain-based assets like stablecoins, tokenized gold, and DeFi protocols to mitigate risk.

The crypto market is still maturing, and while Bitcoin remains a key player, the volatility seen during the Iran-Israel war serves as a reminder of the unpredictable nature of crypto markets in times of global instability. Investors must continue to diversify and stay informed to navigate the challenges ahead.