How to Use Crypto Airdrops to Diversify Your Crypto Portfolio

Crypto airdrops offer a unique opportunity to expand and diversify your cryptocurrency portfolio without additional investment. By strategically utilizing airdrops, you can add complementary assets, manage risks, and balance your investments effectively. This guide provides strategies for using airdrops to diversify your crypto portfolio.

Understanding the Basics of Crypto Airdrops

What are Crypto Airdrops?

Crypto airdrops involve distributing free tokens to cryptocurrency wallet holders. These distributions can promote new projects, reward loyal users, or increase the token’s circulation.

Example:

- Uniswap (UNI) Airdrop: Uniswap distributed UNI tokens to early users, significantly increasing their token distribution.

- Link: Uniswap

Identifying Complementary Crypto Assets

Researching Airdrop Projects

To diversify your portfolio effectively, focus on airdrops from projects that complement your existing assets. Research the project’s fundamentals, team, use case, and community support.

Example:

- Polkadot (DOT): If you already hold Ethereum, an airdrop from Polkadot, which focuses on blockchain interoperability, can complement your portfolio.

- Link: Polkadot

Assessing Token Utility

Evaluate the utility of the airdropped tokens within their ecosystem. Tokens with strong use cases and active development are more likely to provide long-term value.

Example:

- Chainlink (LINK): Airdropped tokens from projects like Chainlink, which provide essential services like decentralized oracles, can add valuable utility to your portfolio.

- Link: Chainlink

Managing Risks

Diversification to Mitigate Risk

Diversifying your portfolio with airdropped tokens helps spread risk across multiple assets. This strategy reduces the impact of volatility on your overall portfolio.

Example:

- Stellar (XLM) Airdrop: Participating in a Stellar airdrop can diversify your portfolio with a token focused on cross-border payments.

- Link: Stellar

Regularly Reviewing Airdropped Assets

Regularly review and evaluate the performance of airdropped tokens. Stay informed about the project’s development and market trends to make informed decisions about holding or selling these assets.

Example:

- 1inch (1INCH) Airdrop: Monitor the performance of 1INCH tokens and stay updated on developments within the 1inch ecosystem.

- Link: 1inch

Balancing Investments

Rebalancing Your Portfolio

As you receive airdropped tokens, periodically rebalance your portfolio to maintain your desired asset allocation. Rebalancing helps ensure that your portfolio remains diversified and aligned with your investment goals.

Example:

- Aave (AAVE) Airdrop: If you receive AAVE tokens, assess their proportion within your portfolio and adjust other holdings as necessary to maintain balance.

- Link: Aave

Long-Term vs. Short-Term Holdings

Decide which airdropped tokens to hold long-term and which to trade in the short-term. This decision depends on the token’s potential for appreciation, its role in your portfolio, and your overall investment strategy.

Example:

- SushiSwap (SUSHI) Airdrop: Evaluate whether to hold SUSHI tokens for long-term staking rewards or to trade them based on market conditions.

- Link: SushiSwap

Practical Tips for Maximizing Airdrop Benefits

Using Reputable Wallets

Store your airdropped tokens in reputable wallets that offer robust security features. This ensures the safety of your assets and provides easy access for trading or staking.

Example:

- MetaMask: A popular wallet that supports various tokens and offers strong security.

- Link: MetaMask

Staying Informed About Upcoming Airdrops

Follow reliable sources and communities to stay informed about upcoming airdrops. Participating in early airdrops can often provide significant benefits.

Example:

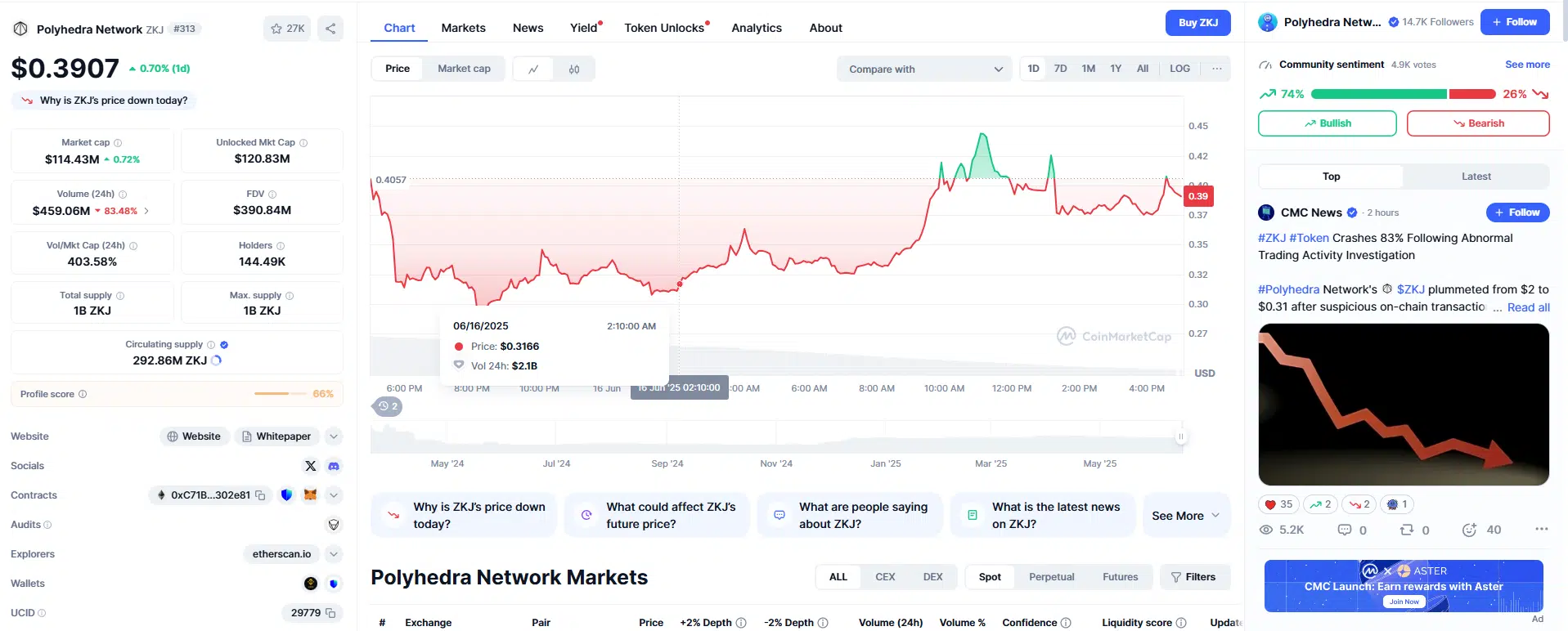

- CoinMarketCap Airdrops: Stay updated with airdrop opportunities listed on CoinMarketCap.

- Link: CoinMarketCap Airdrops

Conclusion

Using crypto airdrops to diversify your portfolio is a strategic way to enhance your cryptocurrency holdings without additional investment. By identifying complementary assets, managing risks, and balancing your investments, you can optimize your portfolio for long-term growth and stability. For more insights into maximizing your crypto investments, follow us on Twitter and join our Telegram channel.

To explore more strategies on managing your crypto portfolio, visit our crypto guides. This guide offers valuable information on various aspects of cryptocurrency, from beginner tips to advanced strategies. Additionally, check out our reviews of different exchanges to find the best platforms for trading and managing your assets. Stay informed with the latest news and updates by visiting our news page.

Enhance Your Crypto Experience with Bybit

For a superior trading experience, consider Bybit. Sign up using our referral link to unlock exclusive rewards, including up to $30,000 in deposit bonuses, and elevate your trading journey.