November 20, 2025 marks a brutal milestone for cryptocurrency. The total market capitalization plunged by over $1 trillion in a single 24-hour period, erasing gains from months of post-election euphoria and sending Bitcoin to its lowest level in seven months. As of today, the global crypto market stands at $3.23 trillion, down 5.7% over the past week despite a modest +0.5% recovery in the latest session. Bitcoin dominance hovers at 57.1%, a slight retreat from 59%, signaling a subtle rotation away from blue-chip assets.

This sudden crash caught most investors off guard, triggered by hawkish Federal Reserve signals that slashed December rate-cut probabilities to around 40%, combined with escalating global liquidity squeezes and fading institutional inflows. Bitcoin (BTC) now trades at $92,497, reflecting a 0.3% daily gain but a 9.2% weekly loss. Ethereum (ETH) clings to $3,039, up 2.0% today but down 10.9% over seven days. The Fear & Greed Index remains mired in “extreme fear” territory at 15, a level historically associated with capitulation bottoms.

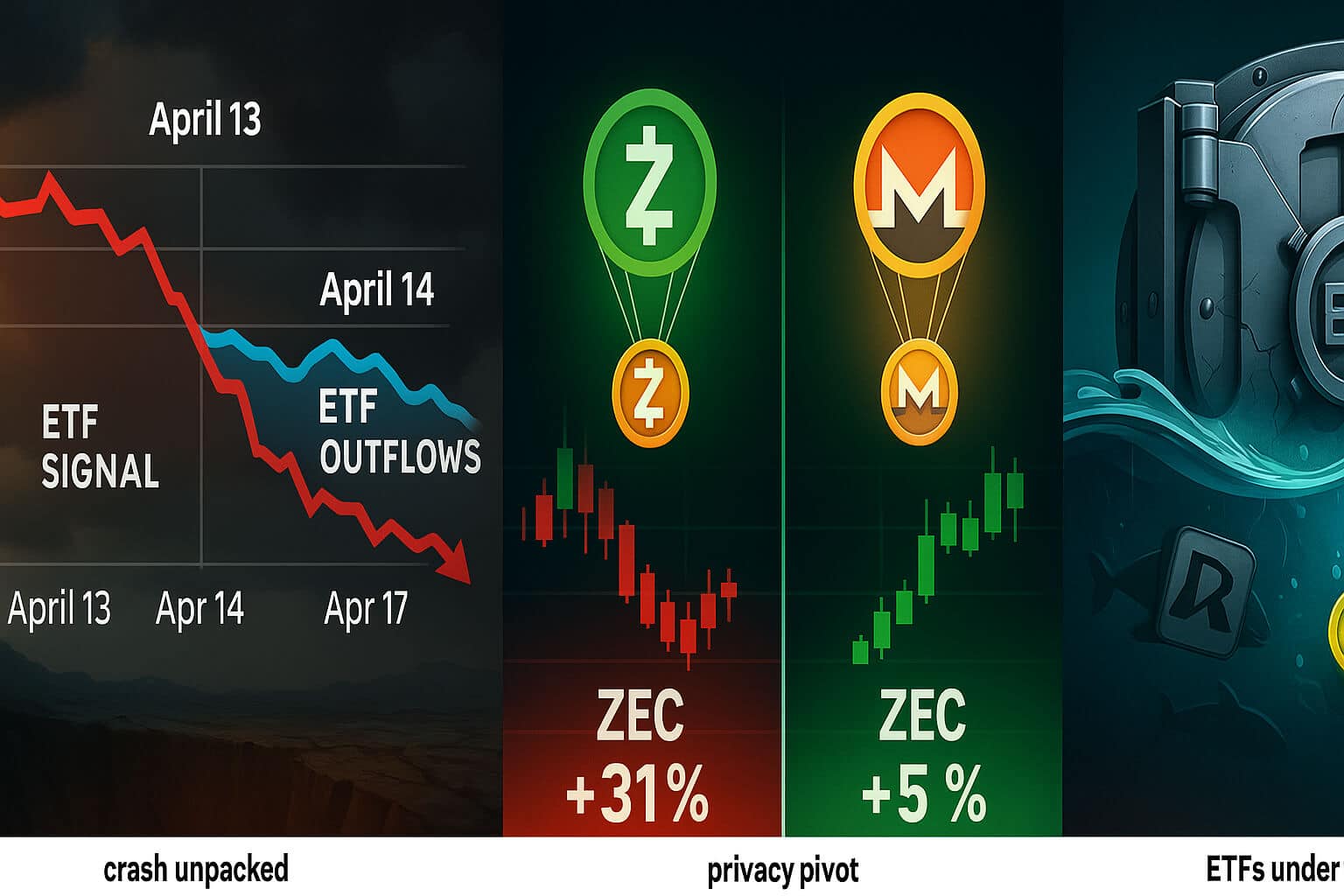

However, amid the widespread carnage, one corner of the market bucked the trend, privacy-focused coins. Zcash (ZEC) surged 12.4% in the last 24 hours and 31.7% over the week, pushing its market cap to $11.1 billion. Monero (XMR) followed with a 6.7% daily gain and 4.8% weekly rise, trading at $369 with a $6.8 billion cap. These assets did not just survive the storm, they thrived, highlighting a growing investor preference for verifiable anonymity in uncertain times.

1. The Crash Unpacked: From Euphoria to Freefall

What began as post-election optimism, Bitcoin peaking at $107,000 in early November, unraveled into a full rout. Hawkish Fed commentary on persistent inflation crushed rate-cut hopes, while ETF outflows exceeded $2.8 billion this month alone, capping assets under management at $179 billion despite year-to-date gains of $24 billion. Global equities wobbled, with the S&P 500 down 1.2% weekly, amplifying crypto’s risk-on sensitivity.

On-chain metrics reveal the depth: Long-term holders offloaded a record 815,000 BTC over the past month, realizing $79 billion in profits amid fading conviction. Trading volumes held steady, however, suggesting accumulation beneath the surface. Bitcoin’s intraday bounce from $87,000 lows to $92,500 today indicates short-term stabilization, but the asset remains 15-20% below recent peaks.

Ethereum faced similar headwinds, clawing back to $3,039 after sub-$2,850 dips, supported by Layer-2 momentum but weighed down by $37 million in ETF drains and ongoing network fee debates. Broader altcoins suffered double-digit losses, with Solana, Cardano, and Avalanche dropping sharply in 48 hours, while meme coins and low-liquidity tokens collapsed entirely.

2. Privacy Coins Defy the Downturn: The Contrarian Surge

While majors bled, privacy coins emerged as the market’s unexpected safe haven, underscoring a pivotal narrative shift toward verifiable anonymity. Zcash led the charge, rocketing 12.4% daily and 31.7% weekly to a $11.1 billion market cap. Monero trailed closely with a 6.7% daily gain and 4.8% weekly increase, trading at $369 with a $6.8 billion cap. Dash (DASH) mirrored the sector’s 71.6% year-to-date surge, though visibility remains lower.

This resilience stems from escalating surveillance concerns, including CBDC rollouts and KYC mandates on exchanges, transforming blockchains into perceived “panopticons.” Zcash now features 20-30% of its supply in encrypted addresses, driven by whale accumulation and zero-knowledge proof integrations. Ethereum’s ZK upgrades and emerging projects like COTI are embedding privacy into DeFi, while influencers, including Vitalik Buterin, position 2025-2026 as the “frontier” for privacy over AI hype.

Skeptics highlight regulatory risks, potentially turning privacy assets into “exit liquidity.” With Zcash’s halving approaching, however, this performance echoes Bitcoin and Ethereum’s early dominance: Privacy as the foundational layer for sovereignty in a tokenized future.

3. Ripple Effects: Bitcoin ETFs Under Siege

The crash’s fallout struck hardest at Bitcoin’s institutional on-ramps. Spot Bitcoin ETFs, handling 20-30% of daily volume, recorded $2.8-2.9 billion in net outflows this month—the second-worst on record—despite year-to-date inflows of $24 billion. BlackRock’s IBIT alone lost $523 million in a single day on November 19, though a $75 million inflow rebound on November 20 (led by IBIT’s $60.6 million) suggests defensive repositioning. Ethereum ETFs suffered $37 million in drains, while Solana variants saw minor inflows.

This creates a feedback loop: Declining net asset values spur further redemptions, undermining the “safe haven” narrative. Privacy’s rise—Zcash up 700% year-to-date—accelerates capital flight to untraceable assets, potentially capping ETF expansion. Long-term, issuers may integrate zero-knowledge hybrids, but for now, Bitcoin’s 30% drawdown leaves investors underwater, challenging the post-ETF rally.

4. MicroStrategy: The Leveraged Lightning Rod

No entity captures Bitcoin’s volatility like MicroStrategy (MSTR), the debt-fueled holder with 641,000 BTC valued at approximately $55 billion at current prices. Its stock has cratered 57% year-to-date to under $200, outpacing Bitcoin’s downside with a 2-3x beta, erasing gains from a $455 peak and trading below net asset value (0.977x) for the first time since January 2024. Recent $835 million buys at an average of $102,171 are now 15% underwater, intensifying dilution concerns despite Michael Saylor’s steadfast HODL philosophy (“survivable even in a 90% crash”).

Privacy’s ascent compounds the pressure: Why leverage into “transparent” Bitcoin when Zcash offers stealth? MicroStrategy’s “corporate treasury” thesis wavers, with analysts forecasting 30-50% further declines if Bitcoin tests $60,000. Nonetheless, resilience persists—insider sales rumors debunked as FUD, and Saylor’s accumulation commitments remain unwavering.

5. Glimmers of Resilience

Despite the gloom, the market shows signs of adaptation rather than outright collapse. Bitcoin’s stability at $92,000 amid a delayed jobs report (220,000 claims, exceeding estimates) demonstrates maturing sentiment, with the relative strength index at 34 (oversold) on capitalization charts targeting a rebound to $3.49 trillion. ETF retention stands at 96.5% of assets under management, while whale hoarding in privacy assets provides ballast. Layer-2 networks gained 17.5% (Starknet leading), and non-fungible token volumes reached $4.4 million in 24 hours, indicating utility-driven pockets of strength.

Privacy’s outperformance signals crypto’s next evolution: From speculative casino to sovereign finance infrastructure. As Zcash advances 12.4% daily, anticipate sustained rotation from majors if the downturn persists.

Conclusion

The $1 trillion crypto market crash on November 20, 2025 exposed vulnerabilities but also accelerated a pivotal shift. Bitcoin and Ethereum may reclaim dominance, yet privacy coins’ surge demands a diversified approach, avoid over-reliance on yesterday’s leaders. Monitor December’s Federal Open Market Committee meeting, Zcash’s halving, and Ethereum’s zero-knowledge rollouts for reversal catalysts. A Bitcoin advance above $95,000 could ignite recovery; a breach below $80,000 warrants deeper caution. Ultimately, resilience emerges not from evading storms, but from navigating them with fortified strategies.

For more market outlooks and crypto insights, visit our Crypto Market Guides.

Want more in-depth analysis and airdrop opportunities? Visit FreeCoins24.io/airdrops to explore the latest free crypto drops.

Stay Updated

Stay in the loop with the latest crypto airdrops, strategies, and tips. Follow us on:

Stay informed with the latest strategies and insights in the world of cryptocurrency at FreeCoins24.io.

Special Offer