In early July 2025, Bitcoin wallets dormant for over 14 years suddenly became active, transferring vast amounts of Bitcoin (BTC), valued at billions of dollars. This unexpected reactivation has raised eyebrows and sparked speculation across the cryptocurrency community.

This article explores the details behind the Bitcoin wallet transfers, the possible motivations for these movements, and the risks and opportunities for investors. We’ll dive into insights from on-chain analysts and the X community to shed light on the market impact of these significant shifts.

Background and Context

The Bitcoin movement began when wallets dormant since April 2011 came back to life. In one instance, two wallets transferred 20,000 BTC, worth approximately $2.18 billion. Another whale moved 60,000 BTC, valued at $6.5 billion. These wallets were originally bought at $0.78 per BTC, making the current value a 140,000x return. At today’s price of $108,000–$109,000, the holders stand to gain immensely.

Recent X Posts on Dormant Bitcoin Wallet Transfers

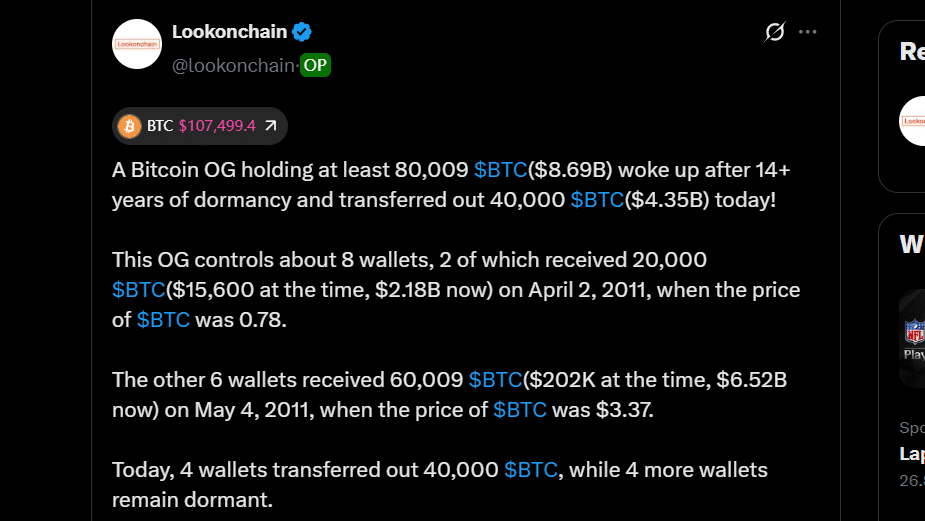

Several on-chain analysts, including Lookonchain, have shared updates about these large-scale Bitcoin transfers on X. Here are some highlights:

July 3, 2025: “A wallet that’s been dormant for over 14 years just transferred 10,000 BTC ($1.09B). It received the BTC in April 2011 at $0.78.”

July 3, 2025: “Another wallet of the same Bitcoin OG also transferred 10,000 BTC ($1.09B) after being dormant for 14+ years.”

July 4, 2025: “Currently, all 8 wallets woke up and transferred 80,009 BTC ($8.69B).”

These transfers show that 80,009 BTC (~$8.69 billion) have moved from wallets that had been dormant for 14 years, creating significant interest in the crypto community. While the reasons for these movements are still speculative, the impact is undeniable.

Why Are These Transfers Happening?

Several theories have emerged as to why these dormant wallets are being activated:

1. Profit-Taking After Massive Gains

The most straightforward theory is that holders are realizing profits after seeing a 140,000x return on their investments. What started as a $15,600 investment in 2011 is now worth over $1 billion, prompting some holders to take action. However, the absence of exchange transfers suggests that these are likely OTC (over-the-counter) deals or private sales rather than public sell-offs.

2. Security Upgrades or Wallet Consolidation

The Bitcoin may have been moved to more secure wallets. These transfers could represent a security upgrade, with the owners consolidating their holdings in more advanced storage solutions such as multisig wallets or institutional custody systems.

3. Strategic Repositioning

These movements might also reflect strategic consolidation. A single entity, for instance, could be consolidating multiple wallets for easier management or to prepare for future transactions. This is suggested by the fact that these transfers seem to be planned and executed rapidly, without any preliminary test transactions.

4. Market Sentiment or External Triggers

The timing of these transfers is also significant. Bitcoin is nearing its all-time high, and there is growing institutional interest in the asset. Some analysts speculate that these wallets are activating to take advantage of favorable market conditions before any significant price corrections.

How Are These Transfers Happening?

The mechanics behind these transfers are straightforward, but the scale and sophistication of the operations indicate advanced planning:

On-Chain Transactions: These movements have been conducted on the Bitcoin blockchain, with no involvement of exchange wallets, signaling that the transfers were private transactions or OTC deals.

Modern Wallet Formats: The Bitcoin was moved from legacy addresses to more secure formats. This suggests that the owners are updating their security measures or consolidating their holdings for future use.

Sophisticated Execution: The wallets were activated with precision and no signs of hesitation. This indicates that these transfers were likely executed by entities with experience in managing large Bitcoin holdings.

Special Offer

Ready to trade Bitcoin and other cryptocurrencies? Sign up on Bybit today and unlock up to $30,000 in bonuses — start trading with one of the top exchanges for crypto assets.

Risks and Implications for Smart Investors

The activation of these dormant Bitcoin wallets presents both risks and opportunities for investors:

Risks:

Market Volatility: The large-scale movement of Bitcoin has led to concerns about a potential sell-off, which could cause short-term price volatility, especially near Bitcoin’s all-time highs.

Speculative Positioning: The increased futures open interest and growing short positions signal that speculators are betting on price corrections, which could add to market fragility.

Uncertainty of Intentions: The anonymity of the wallet holders means that investors can’t be sure whether these movements are part of a long-term strategy or a signal of upcoming sales.

Opportunities:

Market Resilience: Despite the transfers, Bitcoin’s price remains stable at around $109,000, showing strong market support and suggesting that the asset remains a safe haven for investors.

Long-Term Confidence: On-chain data shows that 14.7 million BTC have not moved in over 155 days, indicating that many long-term holders are not selling. This supports a bullish outlook despite short-term volatility.

Institutional Adoption: As institutional interest in Bitcoin grows, these transfers could signal confidence in Bitcoin’s long-term value, encouraging further adoption.

Conclusion

The recent activation of dormant Bitcoin wallets has sparked much speculation. Whether these movements are driven by profit-taking, security upgrades, or strategic repositioning, their impact on the market is clear. For smart investors, the key is to monitor the movements closely, assess the underlying motivations, and consider the broader market trends. Despite some short-term risks, Bitcoin’s fundamentals remain strong, and growing institutional adoption suggests a promising future.

Want more in-depth analysis and airdrop opportunities? Visit FreeCoins24.io/airdrops to explore the latest free crypto drops.

Stay Updated

Stay in the loop with the latest crypto airdrops, strategies, and tips. Follow us on: