On August 25, 2025, the crypto market turned into a rollercoaster. A dormant Bitcoin whale unleashed a staggering $2.7 billion sell-off, crashing BTC by $4,000 in minutes. Meanwhile, Ethereum stole the spotlight, smashing a new all-time high (ATH) near $4,957 before settling at $4,656.62. This Ethereum ATH Surge Altcoin Rotation 2025 isn’t just volatility, it’s a loud signal of altcoin season, with capital flowing from BTC to powerhouses like ETH and Solana. Backed by fresh on-chain data, X buzz, and WebX 2025 hype, let’s break down the whale chaos, institutional bets, and ETH’s path to $5K.

Ready to jump into this altcoin rally? Sign up on Bybit and grab up to $30,000 in deposit bonuses to trade the crypto surge!

1. Market Snapshot: BTC Crashes, ETH and SOL Soar

The crypto market is buzzing with action on August 25, 2025, with a global market cap of $3.88 trillion holding steady despite a chaotic 24 hours. Let’s dive into what’s happening:

- Bitcoin took a brutal hit when a whale dumped 24,000 BTC ($2.7 billion) from a dormant address still holding 152,874 BTC ($17 billion+). This triggered a flash crash from $114,779 to $110,788, wiping out $550 million in leveraged long positions and dragging the market down 3%. By day’s end, BTC recovered slightly to $112,196.42, up 2.00%, but the damage highlighted how thin weekend liquidity can amplify shocks.

- Ethereum, on the other hand, soared to a new ATH of $4,957, driven by $20 billion in inflows from ETFs and institutional investors. It’s now trading at $4,656.62 (up 2.69%), with a market cap of $562 billion. Record futures open interest at $70.13 billion shows traders are betting big on ETH’s next leg up.

- Solana is riding a 10% wave, climbing 3.62% to $197.71. Institutional interest, including a proposed $1 billion treasury vehicle, is fueling its rise, with public firms holding $591 million in SOL.

This divergence, BTC bleeding while ETH and SOL shine; points to a broader shift in market dynamics.

2. Why Altcoin Rotation? From BTC Chaos to ETH and SOL Strength

The BTC whale dump was a market-shaking event. A single address, dormant for years, sold 24,000 BTC, likely to secure profits or reposition amid thin liquidity. This caused a $4,000 crash, exposing how even a single large transaction can ripple through the crypto market. But while BTC struggled, altcoins like ETH and SOL absorbed the capital, signaling a rotation:

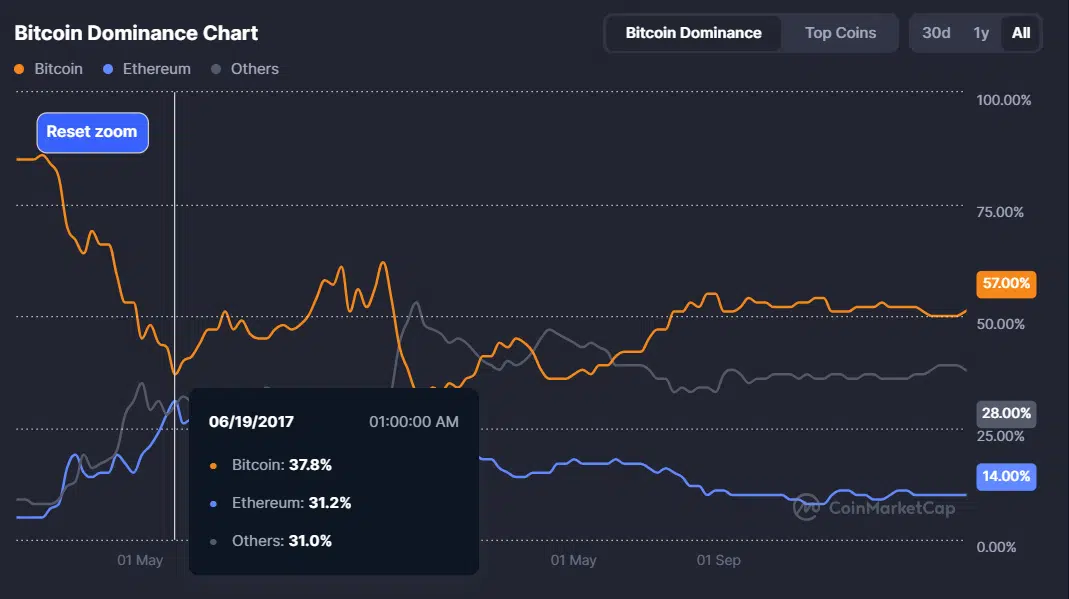

- Declining BTC Dominance: Bitcoin’s market dominance fell to 57.48%, down from 58%, as funds flowed into altcoins. This mirrors 2021’s altseason, where BTC dips fueled ETH rallies, pushing it past previous highs.

- Ethereum’s Whale Surge: ETH whales accumulated 1.8 million tokens this month, driven by $20 billion in inflows from Ethereum ETFs and institutional players. The upcoming Pectra upgrade, enhancing DeFi and AI scaling (e.g., EigenLayer), is boosting confidence. Analysts at Crypto Economy note that ETH’s role in DeFi, NFTs, and real-world assets (RWAs) is a key driver.

- Solana’s Institutional Edge: Firms like Galaxy Digital, Multicoin Capital, and Jump Crypto are reportedly backing a $1 billion SOL treasury vehicle, while VanEck’s filing for a SOL liquid staking ETF adds momentum. Public companies hold $591 million in SOL (3.5 million tokens), reflecting big-money bets on its high-speed blockchain.

X is buzzing with excitement: @AltcoinSherpa predicts SOL could outshine ETH, targeting $500–$1,000 by year-end, as traders pivot from BTC’s volatility.

3. WebX 2025: Fueling the Altcoin Fire

The timing is electri; WebX 2025, Asia’s premier Web3 event, kicked off today (August 25–26) in Tokyo, hosted by CoinPost. This conference is amplifying the altcoin narrative with high-profile talks and catalysts:

- Keynote Highlights: TRON’s Justin Sun is diving into stablecoins, while Adam Back pitches a “Bitcoin Operating System” blending BTC reliability with altcoin innovation. These discussions could spark cross-chain momentum.

- RWA and AI Buzz: Chainlink’s partnership with SBI is pushing real-world assets, a boon for ETH’s DeFi ecosystem. AI narratives, dominating 30% of WebX talks, align with ETH and SOL’s scaling solutions.

- Macro Catalysts: Japan’s recent crypto tax cuts and BTC ETF approvals are fueling optimism. Potential yuan-backed stablecoins could integrate with ETH and SOL ecosystems, driving adoption.

Recent events like Coinfest Asia (DeFi focus) and Ethereum NYC (AI integrations) have set the stage, and WebX could drop announcements that propel ETH and SOL higher.

4. Navigating the Crypto Rollercoaster

The Ethereum ATH Surge Altcoin Rotation 2025 is thrilling, but risks loom:

- Overheating Signals: ETH’s RSI shows bearish divergence near $4,957, and $70 billion in futures open interest could trigger cascading liquidations if profit-taking hits above $5K.

- Macro Volatility: The Fed’s September rate cut odds (~75%) could overheat markets, but tariff-driven inflation (2.6% PCE in July) might delay cuts, impacting BTC and alts.

- Meme Coin Froth: Hype around coins like PEPE and PENGU, plus -based pumps like LLM’s 150K% spike, signals speculative excess, risking a broader pullback.

5. How to Ride the Altcoin Wave

Want to capitalize on the Ethereum ATH Surge Altcoin Rotation 2025? Here’s your playbook:

- Target Entry Points: Buy ETH at $4,500–$4,600 dips and SOL at $180–$190. Consider altcoin ETFs for lower-risk exposure.

- Hedge Smartly: Set stop-losses at 5–7% below entry to manage crypto swings. Allocate 1–5% of your portfolio to altcoins.

- Track WebX: Watch for RWA or AI announcements boosting ETH and SOL. Follow X sentiment via CoinDesk.

- Diversify Bets: Add altcoins like XRP or BNB, which could follow ETH’s rally, to spread risk.

Explore our Cryptocurrency Investment Guides for more crypto investment strategies.

Special Offer

Conclusion

The Ethereum ATH Surge Altcoin Rotation 2025, with ETH hitting $4,957 and SOL riding institutional waves, marks a turning point. A $2.7 billion BTC whale dump, WebX 2025 catalysts, and $20 billion in ETH inflows signal altcoin season. ETH could hit $5K soon, with $10K in sight by Q4, while SOL eyes $500–$1,000. Position wisely, but hedge for volatility. What’s your top pick, XRP or SOL?

Stay Updated

Stay in the loop with the latest crypto airdrops, strategies, and tips. Follow us on:

Want more airdrop opportunities? Visit FreeCoins24.io/airdrops for the latest free crypto drops.