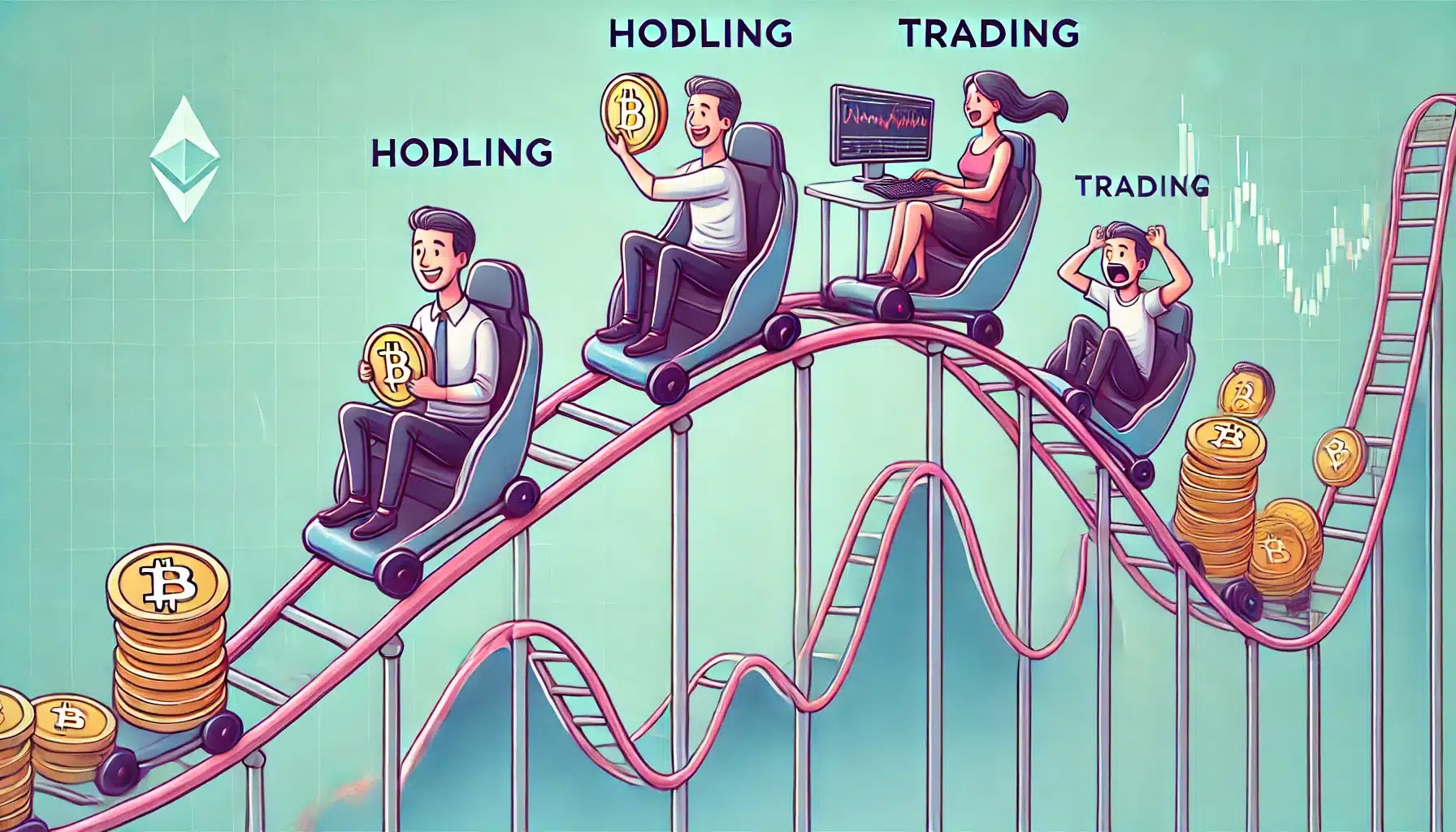

HODLing vs. Trading: Which Crypto Investment Strategy is Right for You?

When diving into the world of cryptocurrency, you’ll encounter two primary investment strategies: HODLing and trading. Understanding the differences between these approaches can help you choose the path that aligns with your financial goals and risk tolerance. Let’s explore the pros and cons of HODLing vs. trading to determine which strategy might be right for you.

What is HODLing?

HODLing is a term derived from a misspelling of “hold” that has since become an acronym for “Hold On for Dear Life.” It represents a long-term investment strategy where investors buy cryptocurrencies and hold onto them regardless of market fluctuations. The idea is to ride out the volatility and capitalize on long-term growth. Read more about HODLing.

Benefits of HODLing

- Simplicity: Once you’ve made your purchase, there’s no need to constantly monitor the market.

- Lower Taxes: Long-term investments often result in lower capital gains taxes.

- Reduced Emotional Stress: Avoiding the daily market rollercoaster can be less stressful.

- Potential for Significant Gains: Historically, cryptocurrencies like Bitcoin have shown substantial growth over time.

Drawbacks of HODLing

- Missed Opportunities: Holding long-term means you might miss out on short-term gains.

- Market Risk: If the market declines significantly, you could face substantial losses.

- Capital Lock-Up: Your funds are tied up for long periods, limiting liquidity.

What is Trading?

Trading, on the other hand, involves buying and selling cryptocurrencies over shorter periods to capitalize on market movements. Traders often use technical analysis, news, and other indicators to time their trades and maximize profits. Learn more strategies on Trading.

Benefits of Trading

- Profit from Volatility: Take advantage of the crypto market’s frequent price swings.

- Flexibility: Quickly respond to market changes and trends.

- Diversification: Spread investments across various assets and strategies.

- Liquidity: Easier to access funds due to shorter holding periods.

Drawbacks of Trading

- High Risk: Frequent trading can result in significant losses, especially for inexperienced traders.

- Tax Implications: Short-term trading often leads to higher tax rates on gains.

- Time-Consuming: Requires constant monitoring and analysis of the market.

- Emotional Stress: The pressure of making quick decisions can be overwhelming.

Psychological Aspects

Investing isn’t just about numbers; it’s also about mindset. HODLers often adopt a “set it and forget it” mentality, which can be beneficial for those prone to emotional trading. Traders need to manage their emotions and make decisions based on data rather than fear or greed.

Financial Implications

Consider your financial situation and goals when choosing between HODLing and trading. If you have a stable income and can afford to lock up funds, HODLing might suit you. If you need liquidity and have time to dedicate to market analysis, trading could be a better fit.

Market Conditions

Market conditions can significantly impact your strategy choice. Bull markets often favor HODLing, while volatile or bear markets might present more trading opportunities. Stay informed about the overall market trend and economic indicators.

Combining Strategies

Many investors find success by combining both strategies. They HODL a core portfolio for long-term gains while allocating a smaller portion for trading to capitalize on short-term movements. This hybrid approach can balance risk and reward.

FAQs

1. Is HODLing or trading better for beginners?

- HODLing is generally considered better for beginners due to its simplicity and lower risk.

2. Can I switch between HODLing and trading?

- Absolutely! Depending on market conditions and personal goals, you can adapt your strategy.

3. What tools do traders use?

- Traders use tools like technical analysis charts, news feeds, and trading platforms to make informed decisions.

4. How do taxes differ between HODLing and trading?

- Long-term HODLing often benefits from lower capital gains taxes, while frequent trading can incur higher tax rates.

5. What are the risks of trading?

- Trading risks include market volatility, emotional stress, and the potential for significant losses.

Conclusion

Choosing between HODLing and trading depends on your financial goals, risk tolerance, and the time you can dedicate to managing your investments. HODLing offers simplicity and potential long-term gains, while trading provides flexibility and opportunities to profit from market volatility. Assess your situation, stay informed, and consider combining both strategies to optimize your cryptocurrency investment journey.

For more tips and insights on navigating the world of crypto investment strategies and cryptocurrencies, be sure to read other informative blogs at Freecoins24.io and follow us on Twitter and Telegram for the latest crypto updates.