Airdrop trading on decentralized exchanges (DEXs) is revolutionizing the way users earn and trade tokens in the crypto space. Decentralized platforms, such as Uniswap, PancakeSwap, and SushiSwap, provide seamless, permissionless access to trading airdropped tokens directly from personal wallets. But without clear strategies, trading on DEXs can be overwhelming.

This guide explores how to use decentralized exchanges for airdrop trading, maximizing profits, and minimizing risks through proper preparation and trading techniques.

1. Why Decentralized Exchanges Are Essential for Airdrop Trading

1.1 The Role of DEXs in Airdrop Token Trading

Decentralized exchanges operate without intermediaries, offering a trustless environment for trading airdropped tokens. Unlike centralized exchanges, DEXs ensure that users maintain control over their funds, while providing access to a broad range of newly issued tokens.

1.2 Benefits of Trading Airdropped Tokens on DEXs

- Immediate Accessibility: Trade tokens as soon as they’re distributed.

- No KYC Requirements: Participate in trading without undergoing lengthy verification.

- Global Token Listings: Most airdropped tokens debut on DEXs before reaching centralized platforms.

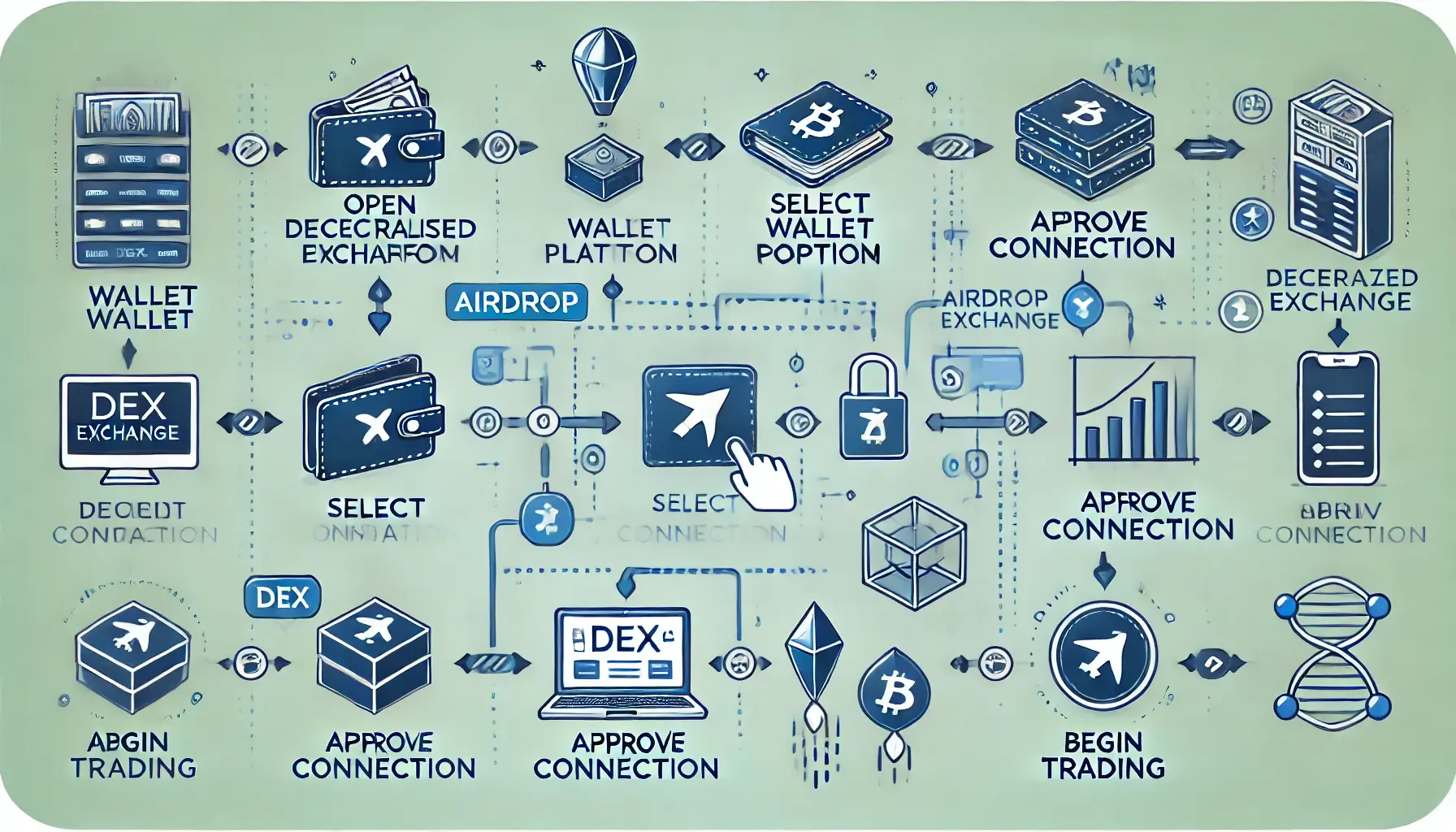

2. Steps to Start Airdrop Trading on DEXs

2.1 Connect Your Crypto Wallet

To trade on DEXs, you need a compatible wallet like MetaMask, Trust Wallet, or WalletConnect.

- Install the wallet as a browser extension or mobile app.

- Import your airdropped tokens using their contract address.

2.2 Choose the Right DEX for Trading

Each decentralized exchange specializes in certain ecosystems:

- Uniswap for Ethereum and Layer 2 solutions.

- PancakeSwap for Binance Smart Chain tokens.

- Trader Joe for Avalanche-based tokens.

2.3 Understand Trading Pairs

Find the appropriate trading pair for your token. For example, most tokens on Uniswap trade against ETH or USDT.

3. Strategies for Profitable Airdrop Trading

3.1 Leverage Price Spikes

Many tokens experience price spikes immediately after being listed. Selling during this period can yield high returns. However, be cautious of slippage, which occurs when the final price differs from the expected price due to market movement.

3.2 Analyze Liquidity Levels

Liquidity is critical for successful trading. Use tools like DEXTools to check liquidity pools, ensuring the token can be traded without drastic price changes. Tokens with higher liquidity are generally more stable.

3.3 Use Staggered Selling Techniques

Divide your tokens into multiple portions:

- Sell one portion during the price spike.

- Hold the rest for potential long-term gains if the project shows promise.

4. Avoiding Common Pitfalls in Airdrop Token Trading

4.1 High Gas Fees

Trading on Ethereum-based DEXs can be expensive during high network congestion. Reduce fees by using Layer 2 networks like Arbitrum or Optimism, or opt for low-fee platforms like PancakeSwap.

4.2 Scams and Fake Tokens

Double-check the contract address of your token on trusted sources like Etherscan or CoinGecko. Scammers often create fake tokens to trick users.

4.3 Market Volatility

Airdropped tokens are prone to extreme price fluctuations. Set realistic expectations and avoid over-trading.

5. Enhancing Profitability with DEX Tools

5.1 DEX Aggregators

Platforms like 1inch and Matcha help users find the best price for their trades across multiple DEXs. This ensures minimal slippage and maximum profit.

5.2 Limit Orders

Limit order features on platforms like 1inch allow you to set a desired price for buying or selling, preventing impulsive trades.

5.3 Staking and Farming Opportunities

Many DEXs offer staking or yield farming options for airdropped tokens, enabling users to earn passive income while holding their assets.

Conclusion

Trading airdropped tokens on decentralized exchanges is a lucrative opportunity for cryptocurrency enthusiasts. By leveraging price spikes, ensuring proper liquidity analysis, and using advanced tools like DEX aggregators, users can maximize their profits while avoiding common pitfalls. Platforms like Uniswap, PancakeSwap, and SushiSwap provide unparalleled access to airdropped tokens, making DEXs an essential part of any trader’s strategy.

For more insights and detailed guides on crypto trading and airdrop strategies, visit our Blockchain Technology Guides.

Stay Updated

For the latest updates on trading strategies, airdrop insights, and crypto trends, follow us on:

Stay informed with cutting-edge crypto insights at FreeCoins24.io.

Special Offer

Want to explore trading opportunities? Sign up on Bybit today and receive up to $30,000 in deposit bonuses. Join a trusted platform for seamless trading.

Full Link: