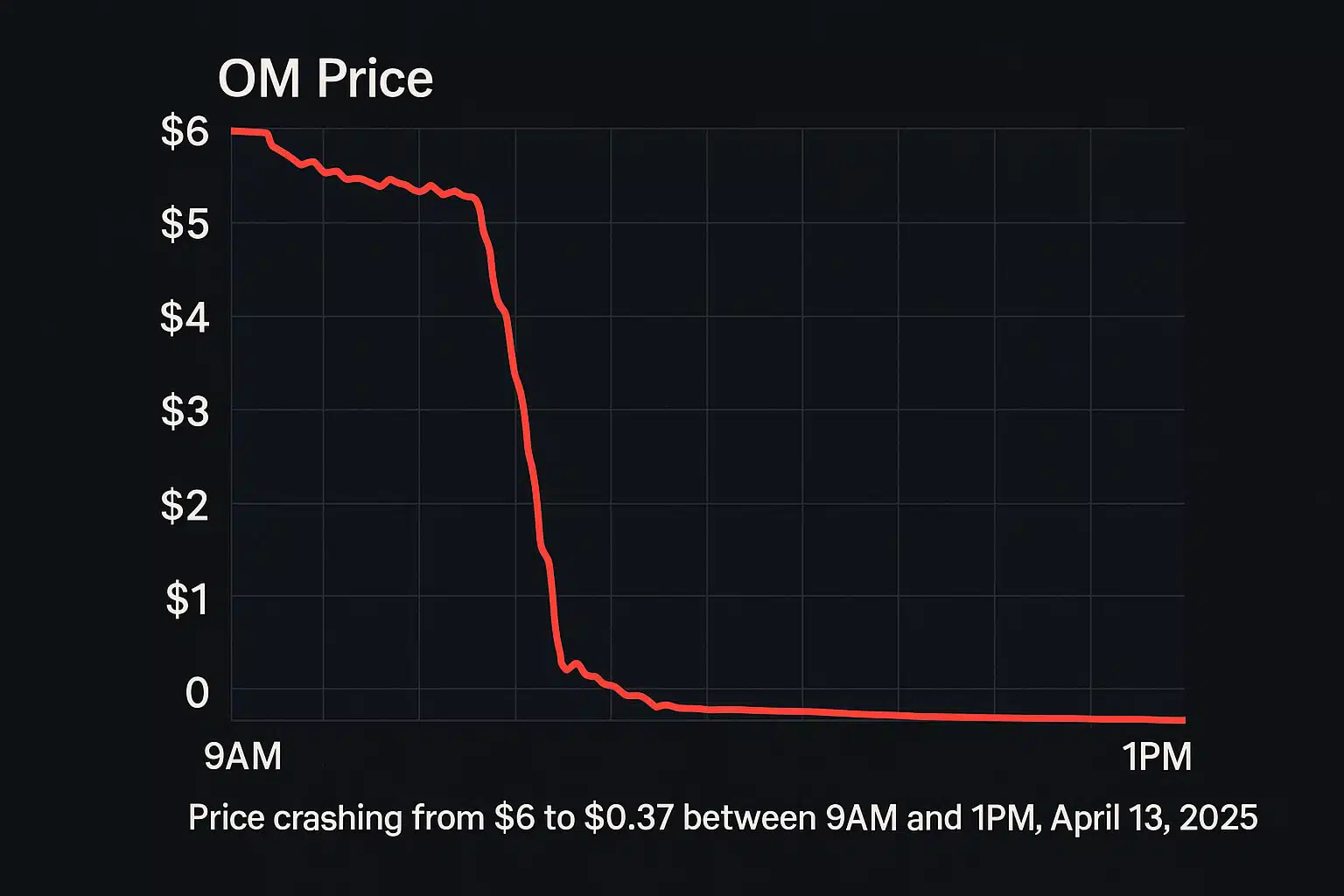

On April 13, 2025, the crypto market witnessed one of its most dramatic implosions in recent memory. OM Coin, the native token of the Mantra network, a project built to power the Real World Asset (RWA) boom, plummeted from over $6 to just $0.37 in under four hours. The crash erased more than $10 billion in market cap and left traders stunned. Many are now questioning whether this was just a market correction or something more sinister.

The Mantra Project: RWA Innovation with High Stakes

Mantra had gained traction for its innovative approach to RWAs. Touting itself as a security-first Layer 1 blockchain, it offered scalable infrastructure tailored for institutions and developers looking to tokenize real-world assets while staying compliant with regulations.

Built on the Cosmos SDK and compatible with Inter-Blockchain Communication (IBC), Mantra’s OM coin was meant to be used for staking, governance, and utility transactions. It rose sharply in price throughout early 2025, peaking at $9, becoming a darling of the RWA space. But that shine didn’t last.

The Crash: What Really Happened?

The sharp price plunge began early April 13 and intensified over four volatile hours, bringing the price to $0.37 before slightly recovering above $0.60. The sudden drop spurred rumors, anger, and endless speculation. A few leading theories emerged:

-

Team Dump Allegations: Some traders and blockchain sleuths accused the Mantra team of dumping their tokens. Rumors claim they held as much as 90% of the circulating supply, sparking fears of a coordinated rug pull.

-

“Reckless Liquidation”: The official Mantra response blamed “reckless external liquidations,” pointing to a massive dump by a single whale or institution that caused cascading sell-offs in a low-liquidity window.

-

On-Chain Clues: One wallet transferred $20 million worth of OM to OKX just a day before the crash—an ominous sign. Analysts believe this may have triggered the meltdown.

-

Delayed Airdrops & Broken Promises: The Mantra team had previously promised a $50M airdrop, now pushed to 2027. Combined with forced token bridges and questionable governance votes, community trust was already fragile before the collapse.

User Sentiment: A Mix of Rage, Panic, and Speculation

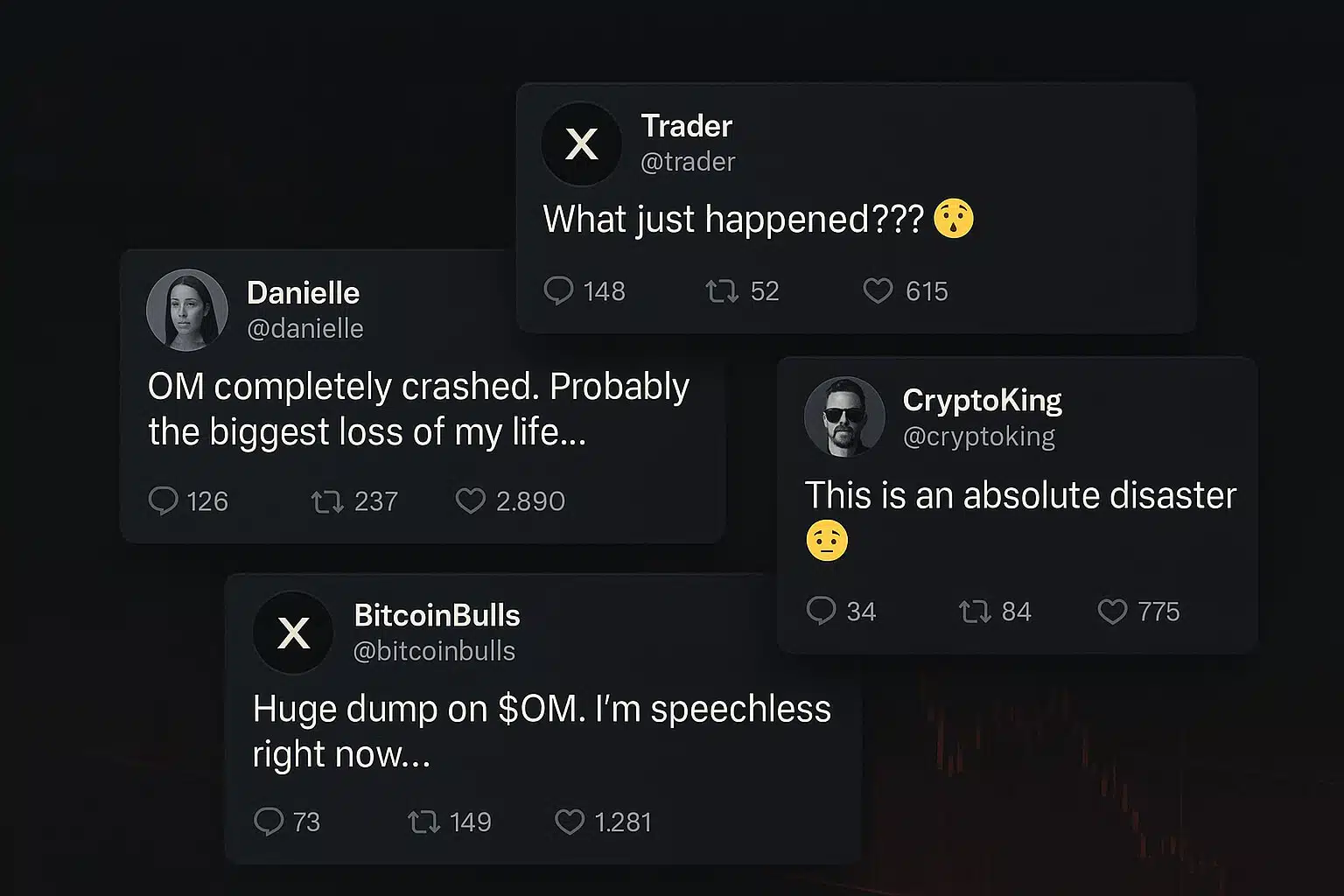

The X (formerly Twitter) community exploded. Posts from traders revealed losses of 70-90% in minutes. Some called the event “the biggest rug of 2025,” while others held out hope for a rebound.

-

@KingKaranCrypto: “OM is -85%. They rugged harder than I thought possible.”

-

@0x_Fahad_: “I warned you about this. The $50M airdrop delay was the first red flag.”

-

@GencTraderr: “$20M sent to OKX. This wasn’t random. It was planned.”

The Mantra Telegram group was locked during the crash, adding fuel to the outrage. Critics accused the team of hiding during the crisis, while the Mantra Twitter handle offered only a vague response blaming external actors.

What This Means for RWA Tokens and Crypto Risk

OM’s collapse is more than a one-off event. It reflects a broader tension in the Real World Asset (RWA) narrative. As institutions enter the space and billions flow into tokenized assets, the line between innovation and manipulation becomes dangerously thin.

It also raises urgent questions about token distribution models, liquidity risks, and project transparency. A 90% supply concentration in any project should be a red flag. So should delayed airdrops, questionable governance processes, and sudden exchange dumps.

How to Protect Yourself from Similar Crashes

In light of OM’s crash, here are key strategies to safeguard your crypto investments:

-

1. Research Tokenomics: Always check how supply is distributed. If a small group holds most tokens, risk is high.

-

2. Avoid Hype Cycles: Rapid pumps often precede sharp dumps. Look for real utility, not viral buzz.

-

3. Stay Diversified: Don’t put all your eggs in one token basket. Even the most promising projects can falter.

-

4. Monitor On-Chain Activity: Tools like Etherscan or Arkham can help you detect suspicious wallet movements.

-

5. Engage in Communities: If a project starts closing Telegram or Discord groups during turbulence, that’s a red flag.

Final Thought

The OM Coin crash is a painful reminder that even well-funded, institution-facing projects can unravel fast. Whether or not the Mantra team was directly responsible, the event underscores how fragile investor trust is—and how quickly it can vanish.

In a year dominated by Real World Asset hype, the industry must evolve past opaque governance and dubious token strategies. Transparency isn’t optional. It’s survival.

For investors, the message is clear: innovation doesn’t guarantee safety. Only due diligence, diversified portfolios, and constant vigilance can.

Stay Updated

For more insights and educational resources on crypto, explore the latest crypto airdrops and uncover exclusive opportunities waiting for you.Visit now: https://freecoins24.io/airdrops — start claiming today.

Follow Us for Real-Time Updates

Stay ahead of the curve with breaking crypto news, exclusive drops, and trading tips:

-

Twitter (X): https://twitter.com/FreeCoins24

-

Telegram: https://t.me/freecoins24