Every week, it’s a trend and buzz in crypto space. Crypto market has been the most boring in this Q1 of 2026. It’s certain that traders as well as most vetted investors would be looking for the next narrative that will generate millions.

Currently, crypto twitter is picking on OpenClaw, the AI agent that pops up and breaking records of performances in span of weeks. What started as an open-source AI agent framework, known as Clawdbot, is now the hot topic and creating the botconomy on Crypto Twitter.

The hype is real. It lets you set up autonomous bots that turn your portfolio into a 24/7 money printer. Automating trades, yields, analytics, and more while you sleep. Let’s break this down.

1. What OpenClaw Is?

OpenClaw is the most friendly AI agent that you can set up even on your Mac mini or a basic cloud server like telegram would much ado. It helps connect to apps you already use like WhatsApp, Telegram, slack discord or even Signal for automating encrypted communication with your friends.

Unlike most commonly used AI, such as Grok from XI and ChatGPT from OpenAI, ClawdBot only answers questions while maintaining a sense of orientation and efficient decision-making. For example, as a crypto community manager, you can set up automated checks and responses to users. If powered by LLMs like Claude or Gemini, you can add more than 5,700 community skills focused on your crypto projects.

To get this quick, folks, just take it as a smart assistant that acts without your explicit instructions. For crypto, this means monitoring markets, executing trades, or creating bots with little coding.

2. Why CT Is Hyped

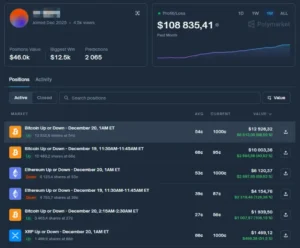

Crypto Twitter is loving OpenClaw. Simply because it’s delivering the best performances. This is going virale and the bot is printing growth like never before. One user were able to make $100 to $347 in a night via arbitrage, $115K from Polymarket scalping in a week.

Basically, the excitement comes from automation. Here are a couple of things Openclaw can help you setup if you’re active onchain trader looking for a quick way to stay ahead of the market and moves

- DeFi Yields: Openclaw can scan defi liquid staking and mining platforms like Aave, Uniswap, Compound for best APYs, swap assets, rebalance automatically. This is solving the need of manual and your attention to stake when No more manual hunts.

- Trading Bots: The bot can analyze X sentiment, on-chain data, and news such as the US CPI and FOMC announcements before trading perps on Hyperliquid against it or spotting a potential token on DEX. Some claim to have 93% win rates. By large tt can integrate with any trading platform that provides an API for automatically adding orders into the order book.

- Content: Instead of manually providing a handwritten update on a new improvement on a protocol, openclaw can automate the content drafting and posting on X as soon the protocol is updated. It can track trends suggest post and create reports. One of those already working example is Moltbook.0 It’s representing a million-entity of Reddit clone.

3. What Makes It Special

What makes OpenClaw shines is its unlimited features when it comes to automating tasks. And you can run it locally on a mini local server or a cloud computing server with a bigger computer power to unleash a huge line of command. In a nutshell:

- Autonomy: Heartbeat loop runs 24/7, no constant input needed. Infinite memory keeps context for smarter choices.

- Extensibility: Thousands of skills plus integrations like ERC-8004 for identity, x402 for payments. Things like ClawRouter switch models; Clawpay handles private txs.

- Privacy & Cost: Local run keeps data yours. Switch LLMs to cut fees.

- Innovation: Agents hire each other, trade skills, build economies, Clawnch (agent launchpad), Clawshi (AI prediction markets).

According to CT, it is democratizing pro tools to say that non-coders can scalp Polymarket or arb prices with 428% ROIs.

4. How to use OpenClaw for Crypto Analytics and Passive Income

OpenClaw levels up analytics and earnings. You can start safe by installing the sandbox, add crypto skills along with basic prompts and scale up with guadrails if needed to avoid losses. You’ll have additional information from the ClawHub’ Skill document page to know exactly how to get started and which niche is currently supported. However, when it comes to crypto portfolio, these are what you can bet one to scale up yours earning:

- Analytics: Scans X, Reddit, on-chain for insights to predict BTC moves via volatility or wallet tracking. Integrate Nansen/Chainlink for alpha, generate reports.

- Portfolio Automation: Rules for rebalancing, farming, hedging. Passive income from liquidity or scalping.

- Monetization: Sell skills on ClawHub; launch agent tokens ($CLAWD, $MOLT); run bots for fees/bounties via Clawas.

Conclusion

OpenClaw hype is real and will stay here for sometimes. But beware that prompt injections may compromise keys coupled with API expenses. It’s crucial to isolate setups, maintain vigilance, and start with small investments.

Nonetheless, the excitement surrounding OpenClaw is well-deserved. Merging AI with crypto is what would give another boost and encitement to bring back hopes and transform portfolios into automated systems.

Are you building agents or feeling skeptical? We have more AI/crypto Airdrop in our AI Crypto category.

Stay Updated

Buzz, alerts, scoops:

- Twitter: @FreeCoins24

- Telegram: t.me/FreeCoins24 Join us.

FAQ

What is OpenClaw?

Open-source AI agent framework—runs locally, automates tasks via LLMs like Claude.

How does OpenClaw help in crypto?

Automates DeFi yields, trading bots, analytics, governance—turns portfolios into 24/7 machines.

Why is CT hyped?

Viral stories like $100 to $347 flips, $115K Polymarket prints—real results.

How do I set up OpenClaw?

Install Docker, add skills, connect APIs, prompt in English—easy for beginners.

What are OpenClaw’s best features?

Autonomy (heartbeat loop), extensibility (5,700 skills), privacy (local run), low cost.

Can OpenClaw make money?

Yes—arbitrage, scalping, sell skills on marketplaces like ClawHub.

What’s an agent marketplace?

Platforms were tokenized agents are bought/sold/hired—Clawnch, Clawshi.

Are there risks with OpenClaw?

Prompt injections, costs, scams—use isolated setups, start small.

How does OpenClaw boost analytics?

Scans X/on-chain data for insights, predicts moves, generates reports.

Is OpenClaw free?

Yes, open-source. LLM costs vary, but switch models to keep low.