The future of crypto trading bots is unfolding rapidly in 2025. Once limited to developers and high-frequency traders, these bots have become everyday tools for retail and institutional users alike. In fact, many of today’s most advanced trading strategies rely on automation, not just for speed, but also for logic and precision.

As crypto markets grow more competitive, bots are evolving with them. Tokenization, AI integration, and decentralization are transforming bots from simple scripts into full-fledged platforms. More importantly, users are no longer just using bots, they’re governing them, earning from them, and helping shape their evolution.

This guide explores how trading bots have evolved, which trends are defining 2025, and what new platforms, like Banana Gun, AIXBT, GMGN AI, BonkBot and Magnum, are offering users. It also explains the risks involved and how to navigate this powerful but fast-moving sector.

2. Evolution of Trading Bots in Crypto

Trading bots started out as basic automation tools. In the beginning, these bots executed simple orders like limit buys and sells on centralized exchanges. Over time, however, they began incorporating more features: portfolio balancing, arbitrage scanning, and even technical indicator integration.

By 2021, DeFi brought a new era of bot innovation. Traders began using bots that could interact directly with smart contracts, enabling activities such as:

Sniping token launches on decentralized exchanges (DEXs)

Front-running arbitrage opportunities across multiple chains

Monitoring liquidity pools for real-time execution

Today, bots go far beyond executing simple trades. They analyze price action, sentiment, volatility, and even social media. And with decentralized infrastructure emerging, bots can now operate without a central backend, enhancing trust and accessibility.

3. Key Trends to Watch in 2025 and Beyond

AI-Powered Trading Logic

In 2025, AI is doing more than generating signals, it’s learning from the market in real time. Bots are using neural networks and predictive models to adapt to volatility, changing conditions, and unexpected catalysts.

For instance, some bots analyze sentiment across Reddit, X (Twitter), and Discord to detect bullish or bearish signals ahead of market moves. Others train on historical order book behavior to predict micro-movements. As a result, these bots are becoming faster, smarter, and far more dynamic than static rule-based systems.

Decentralized Bot Protocols

A key trend is the migration from centralized execution to decentralized hosting. Bots can now be built directly on-chain as smart contracts. Therefore, execution is transparent, censorship-resistant, and trustless.

These protocols allow for:

Permissionless deployment

Governance over strategies via token voting

Native integration with DeFi platforms

As a result, decentralized bots are unlocking a new generation of community-owned infrastructure.

Tokenized Access and Monetization

The future of crypto trading bots lies in tokenized access models. Users can gain entry to powerful bots simply by holding or staking a project’s native token. This token may also be used for:

Governance (e.g., voting on strategy changes)

Access tiers (e.g., free vs premium bots)

Revenue sharing (e.g., dividends from bot fees)

Consequently, users are no longer just customers, they become stakeholders with aligned incentives.

Bots-as-a-Service (BaaS)

Many platforms are shifting toward BaaS models, which allow users to subscribe to bots through intuitive dashboards or Telegram interfaces. Unlike before, users no longer need to write code or configure APIs.

Instead, they connect a wallet, choose a strategy, and start trading. Because of this simplicity, BaaS platforms are attracting a wave of retail users who want automation without the learning curve.

Regulatory Compliance

As bots become more powerful, they also draw attention from regulators. In 2025, jurisdictions like the U.S. and EU are drafting rules around automated financial tools. These could include:

KYC requirements for bot users

Transparency obligations for algorithmic logic

Restrictions on front-running strategies

Going forward, bots that are built with compliance in mind may enjoy greater adoption, especially by institutions.

4. The Rise of Tokenized Trading Bots

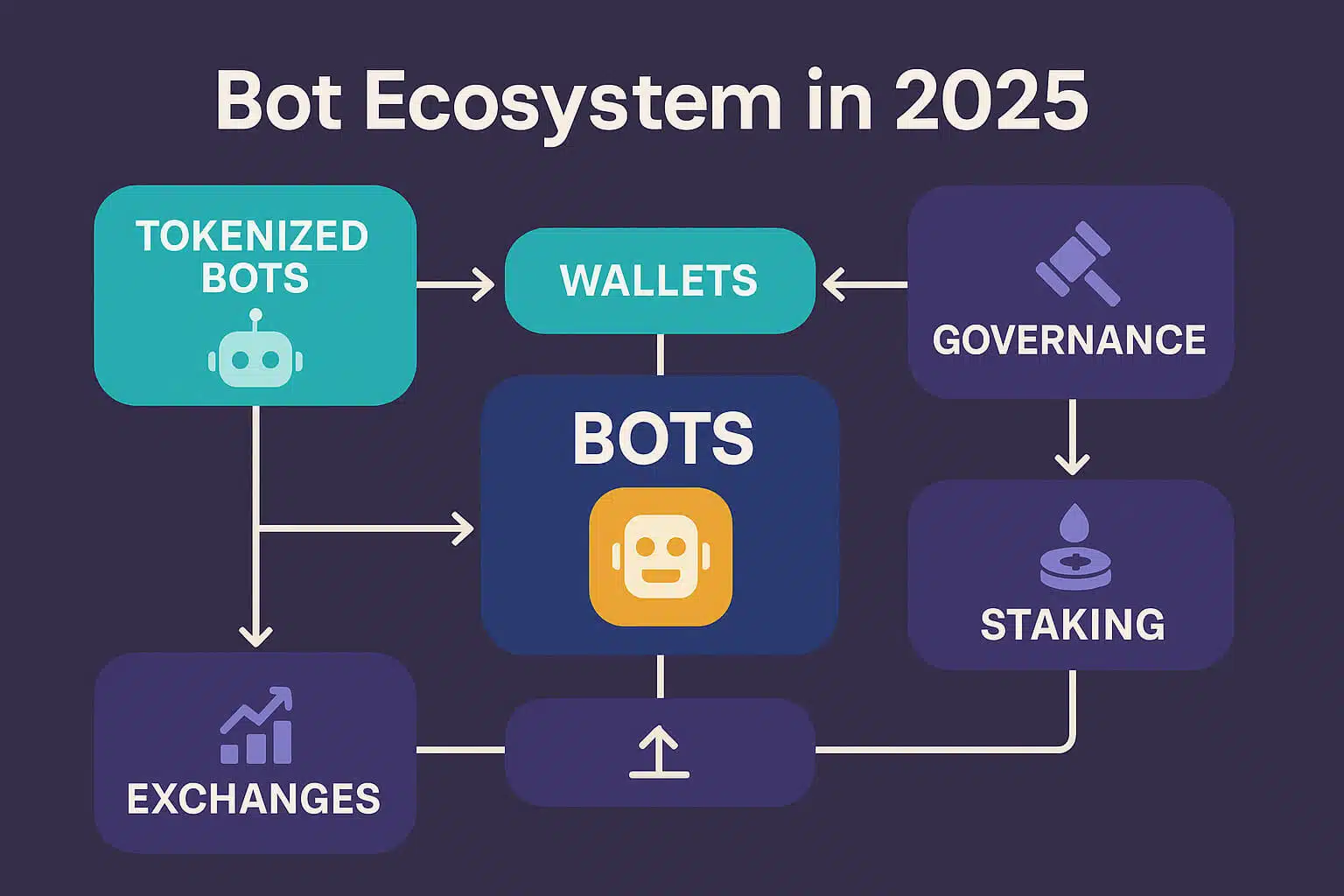

Tokenized bots are transforming the game. These bots are not just applications, they’re platforms with ecosystems, token economies, and community governance.

In traditional finance, accessing high-performance bots required deep technical expertise or insider connections. Today, anyone can participate by:

Buying the native token

Staking to unlock features

Joining governance decisions on strategy changes

Tokenized bots align user incentives, enable passive earnings, and turn software into shareable, scalable infrastructure.

For example, staking models reward long-term users while reducing sell pressure. More importantly, token holders often benefit from revenue sharing through performance fees or vault profits.

This model is allowing developers to scale their products faster while building active, engaged communities around their tools.

5. Case Study: Tokenized Bots to Watch

🍌 Banana Gun (BANANA)

Banana Gun is a Telegram-based sniper bot designed to execute fast trades the moment new tokens launch on DEXs. It’s particularly popular among memecoin traders and high-frequency users who need ultra-low latency execution.

The BANANA token grants access to bot features and revenue-sharing mechanisms. While the platform experienced a contract exploit in 2023, its swift response and relaunch restored user confidence. In 2025, it remains a go-to sniper bot with a loyal, fast-growing community.

🧠 AIXBT

AIXBT focuses on AI-powered derivatives trading, specifically on exchanges like Binance and Bybit. Its bots use predictive modeling to identify profitable long and short setups, funding rate inefficiencies, and volatility breakouts.

The AIXBT token is used to access bots, stake for rewards, and influence strategy development. Its emphasis on AI, combined with CEX compatibility, makes it an ideal choice for traders seeking leveraged exposure with automation.

🌐 GMGN AI

GMGN AI merges AI-powered trade signals with Web3-style governance. Hosted on Discord, users can activate bots, receive signals, and vote on strategy changes using the GMGN token.

This model blends automation with community ownership, allowing token holders to steer the direction of bot development. It’s also one of the few bots with tiered access tied directly to token holding, making it both functional and inclusive.

🎯 Magnum Trading Bot

Magnum is known for its low-latency cross-platform support, offering execution across DEXs like Uniswap and CEXs like KuCoin. Its core strategies include arbitrage, perp trading, and spread exploitation.

With the MAG token, users gain access to bots, contribute to liquidity vaults, and participate in fee-sharing based on usage volume. The platform appeals to both casual traders and professionals looking for robust automation in diverse markets.

6. Risks and Considerations

Trading bots — especially tokenized ones — come with a unique set of risks. Therefore, users must approach them with a clear understanding of potential downsides:

Smart Contract Exploits: Bugs in bot contracts can lead to total capital loss.

Incorrect Configuration: A single misclick or input error could trigger bad trades.

Market Overfitting: Bots trained on historical data may fail in unpredictable environments.

Token Dilution: Projects that issue too many tokens or mismanage treasuries can collapse.

Regulatory Restrictions: Depending on your region, bot usage may be limited or require additional compliance.

As always, due diligence, small initial allocations, and close monitoring are critical for anyone engaging with trading bots.

7. Rewards and Advantages

Despite the risks, crypto bots offer compelling advantages:

24/7 Execution: Bots don’t sleep. They monitor markets and execute trades even while you’re offline.

Emotion-Free Trading: Bots remove fear, greed, and hesitation — common pitfalls for manual traders.

Speed and Efficiency: Bots can act within milliseconds, often capturing arbitrage opportunities before humans even react.

Passive Income: Through staking, governance participation, or vault revenue, users can earn passively while bots do the work.

Accessibility: Thanks to tokenized models and BaaS platforms, automation is now available to non-coders, leveling the playing field.

When used wisely, bots can amplify a trader’s strategy and improve portfolio outcomes.

Final Outlook

The future of crypto trading bots is dynamic, decentralized, and democratized. As we move deeper into 2025, bots are no longer back-end tools for coders. They’re tokenized platforms with full ecosystems, empowering users of all levels to participate in automated markets.

The rise of tokenized bots is bringing financial-grade automation to retail traders, while opening new doors for developers, strategists, and passive investors. At the same time, regulations are catching up, and only projects that prioritize transparency, security, and real utility will survive.

Ultimately, the winners in this space will be users who understand how to balance innovation with caution. Crypto moves fast, but bots move faster , make sure you’re informed, protected, and ready.

Want more in-depth analysis and airdrop opportunities? Visit FreeCoins24.io/airdrops to explore the latest free crypto drops.

Stay Updated

Stay in the loop with the latest crypto airdrops, strategies, and tips. Follow us on: