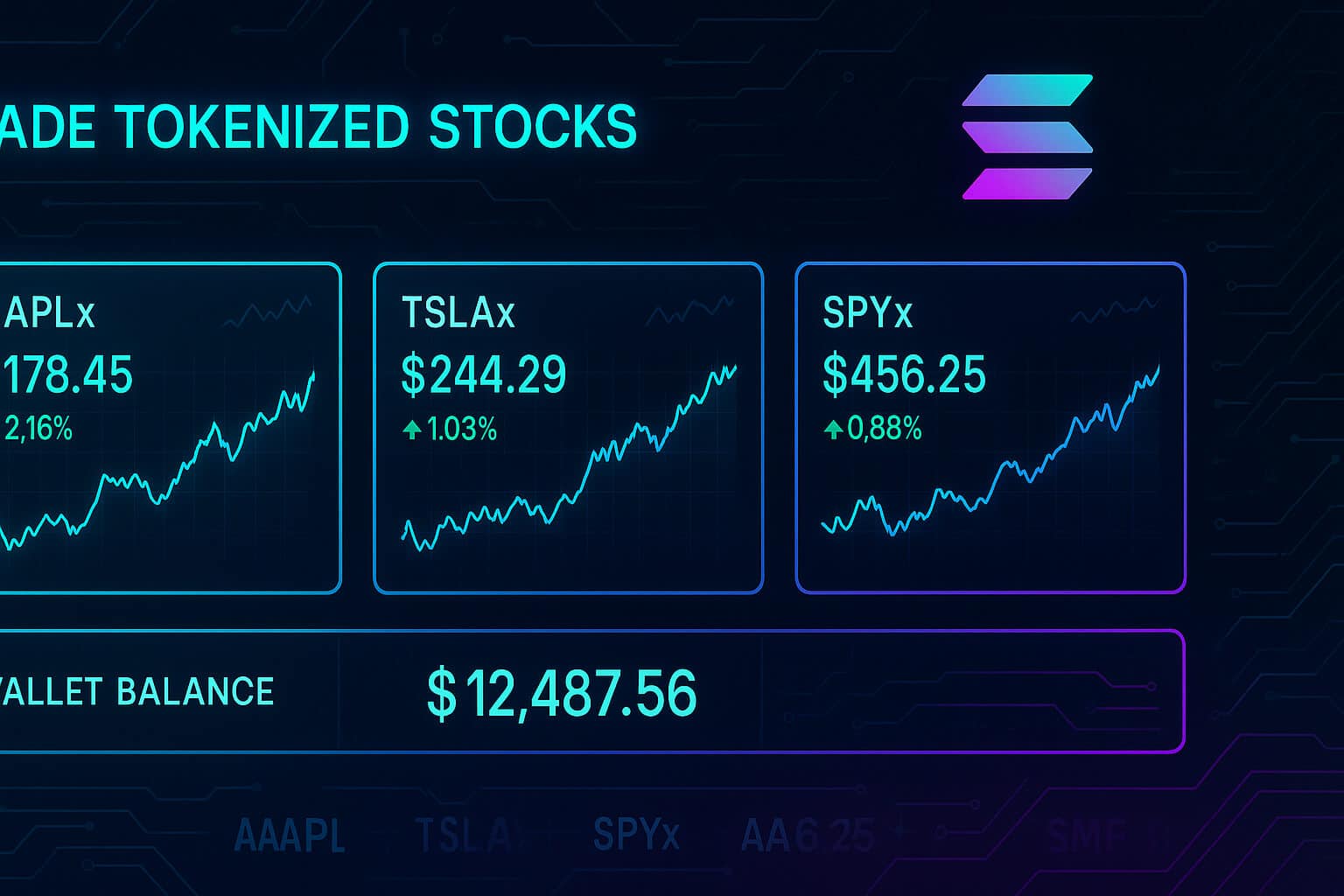

On June 30, 2025, Backed Finance officially launched xStocks, a platform for trading tokenized versions of U.S.-listed stocks and ETFs on the Solana blockchain. Unlike cryptocurrencies that represent purely digital assets, xStocks converts traditional financial instruments, like Apple or Tesla shares, into SPL tokens on Solana, backed 1:1 by actual stocks held by regulated custodians. This means each token you buy represents a real share held off-chain, making it possible to invest in traditional equities directly from your crypto wallet.

1. How xStocks Tokenizes Real Stocks

Tokenization involves taking a traditional stock and issuing a digital token on a blockchain representing ownership of that stock. In xStocks’ case, shares of over 60 U.S.-listed companies and ETFs are purchased and held by regulated third parties. For every share held, an equivalent token (e.g., AAPLx for Apple) is minted on Solana’s blockchain. These tokens follow the Solana Program Library (SPL) standard, making them compatible with the broader Solana ecosystem.

Because each token is backed 1:1 by a share, holders of xStocks can be confident their tokens have real-world value, similar to stablecoins pegged to USD. Backed Finance uses Proof of Reserve systems, regularly updated records of their shareholdings, to demonstrate that every tokenized asset on the platform is fully backed.

2. Trading Beyond Market Hours: Why 24/7 Access Matters

One of the most significantinnovations of xStocks is enabling trading 24 hours a day, 5 days a week, with weekend trading planned. Traditional stock markets operate roughly 6.5 hours per weekday, limiting opportunities to react to news or manage positions outside those windows. By bringing equities on-chain, xStocks allows investors to buy or sell tokenized shares at any time Solana’s network is live, practically instantly.

This continuous access can improve liquidity and offer global investors, who may not be in U.S. time zones, the ability to trade when it’s convenient for them.

3. Who Can Use xStocks and What’s Required

xStocks are available to investors in over 170 countries, but U.S. persons are excluded due to securities regulations. Non-U.S. users can access xStocks through centralized exchanges like Kraken and Bybit, or directly on decentralized platforms integrated with Solana.

On centralized exchanges, investors typically go through KYC verification.

On decentralized platforms, like Jupiter or Raydium, no KYC is required. This means anyone with a Solana wallet can trade tokenized equities without disclosing personal identity, a major departure from traditional brokers.

Investors can fund their wallets with SOL or stablecoins like USDC, then trade directly for xStocks tokens.

4. Using xStocks Within the Solana DeFi Ecosystem

Tokenizing stocks on Solana doesn’t just replicate stock trading, it enables entirely new financial applications. For example:

Providing liquidity: Users can deposit xStocks into protocols like Raydium, earning yields on trading fees.

Collateralizing loans: Investors can use their tokenized stocks as collateral on platforms like Kamino to borrow stablecoins or other assets.

Swapping assets: Solana’s decentralized exchanges allow near-instant swaps between xStocks and cryptocurrencies.

This flexibility is a key advantage of bringing traditional assets on-chain. Unlike traditional brokers, where shares are locked in custodial accounts, xStocks allows users to deploy their holdings across DeFi strategies.

5. Fractional Investing: Lowering Barriers to U.S. Equities

A hallmark of xStocks is fractional ownership, with a minimum investment of just $1. In traditional finance, investors often need to buy full shares, which can cost hundreds or thousands of dollars (e.g., Amazon or Nvidia). Tokenization divides shares into small pieces, letting retail investors own fractions of even expensive stocks. This democratizes access to U.S. equities, especially for people in countries with fewer investment options.

Special Offer

Want to explore tokenized stocks and crypto? Sign up on Bybit today to get up to $30,000 in bonuses and start trading innovative assets.

6. Security Measures and How to Avoid Scams

Backed Finance has partnered with Chainlink to provide pricing data via decentralized oracles, ensuring real-time, accurate valuations of xStocks tokens. This prevents price manipulation that could otherwise occur on decentralized platforms.

Additionally, they maintain transparency with Proof of Reserve reports, but users are strongly advised to double-check token addresses before trading. Backed’s official xStocks tokens start with “X” (e.g., “XTSLA”) and do not end with suspicious suffixes like “pump,” which are common in scam tokens.

7. Compliance and Regulatory Considerations

xStocks complies with EU MiFID II regulations on platforms like Bybit, ensuring legal integrity for European investors. Still, users must ensure they comply with their local laws before trading. Since U.S. securities regulations prohibit offering these assets to U.S. persons, any attempt to bypass geo-restrictions could result in legal risks for individuals.

8. Potential Risks Investors Should Understand

While xStocks offers innovative ways to access U.S. stocks, investors should consider:

No shareholder rights: xStocks holders don’t get voting rights or guaranteed dividends because they don’t own shares directly — they hold synthetic representations.

Price volatility: Prices can diverge from underlying shares due to low liquidity or market inefficiencies on decentralized platforms.

Platform and technology risks: Issues like smart contract bugs or Solana network congestion could affect the ability to trade or withdraw funds.

Security concerns: As with any crypto asset, wallet security is critical. Investors should keep wallets secure and verify contracts to avoid scams.

9. Steps to Get Started with xStocks

Set up a Solana wallet: Phantom or Solflare are recommended, as they support xStocks tokens natively.

Fund your wallet: Buy SOL or stablecoins on an exchange like Kraken or Bybit, then transfer to your wallet.

Access xStocks markets: Trade on Kraken, Bybit, or decentralized platforms like Jupiter and Raydium. On centralized exchanges, complete KYC if required.

Verify tokens: Always confirm token contract addresses on Backed Finance’s official website to avoid fraudulent copies.

10. The Broader Market Impact and Future Developments

Early trading of xStocks saw over $2 million in volume within hours, signaling demand for tokenized equities. This is part of a larger trend: the real-world asset (RWA) tokenization market grew to $50 billion by March 2025, with forecasts suggesting it could reach $2 trillion by 2030.

Institutional adoption is also increasing. Companies like DeFi Development Corp. are issuing tokenized shares on Solana, and platforms like Superstate’s Opening Bell are bringing traditional assets to blockchains. Chainlink’s Cross-Chain Interoperability Protocol (CCIP) will enable xStocks to expand beyond Solana, connecting to other blockchains to reach more investors.

Final Thoughts

Tokenized xStocks represent an ambitious attempt to merge traditional equities with blockchain technology, providing new ways to invest, diversify, and interact with U.S. stocks. By offering fractional ownership, global access, and DeFi integration, xStocks lowers barriers for millions of potential investors. However, regulatory restrictions, technological risks, and lack of shareholder rights mean that investors should conduct thorough research and consider professional advice before participating.

Want more in-depth analysis and airdrop opportunities? Visit FreeCoins24.io/airdrops to explore the latest free crypto drops.

Stay Updated

Stay in the loop with the latest crypto airdrops, strategies, and tips. Follow us on: