The crypto market is slowly positioning itself for a new expansion cycle. While prices remain uneven, capital is rotating, infrastructure is strengthening, and on-chain activity is increasing. If a full crypto recovery in 2025–2026 materializes, airdrops are once again becoming one of the highest-upside opportunities in the market.

This time, the setup is different. Projects are tracking real usage, rewarding long-term contributors, and delaying token launches until liquidity conditions improve. That combination is creating a strong foundation for airdrops with serious price potential once momentum returns.

Instead of surprise distributions, most teams are building points systems, leaderboards, and usage-based allocations. When tokens finally launch into a recovering market, supply pressure is lower and demand is already in place. That is where value expansion happens.

1. Why Market Recovery Could Create High-Value Airdrops

Airdrops tend to perform best when liquidity is expanding and sentiment is improving. During bear markets, many users sell immediately. During recoveries, behavior changes. Holders are expecting follow-through.

In 2025–2026, several structural factors are aligning:

-

VC funding cycles are restarting

-

Retail participation is increasing

-

On-chain activity is rising before price

-

Token launches are being delayed intentionally

Projects are distributing tokens after traction, not before it. That shift is reducing instant sell pressure and increasing the chance of post-launch appreciation. When market confidence returns, early allocations often reprice quickly.

2. Projects Positioned To Benefit From a Bullish Market

The strongest airdrops in a recovery phase usually share the same traits. They are already generating usage without a token, they serve infrastructure or recurring demand, and they attract non-speculative users.

Key categories showing the most upside:

-

Layer 2s and app chains with fee revenue

-

DeFi infrastructure used by other protocols

-

Gaming and social layers with daily users

-

Data, identity, and AI-adjacent networks

Projects in these segments are not relying on hype alone. They are already embedding themselves into daily workflows. When tokens launch, they often represent utility first, speculation second, which supports stronger valuations.

3. Expected Token Launch Prices Based on Market Trends

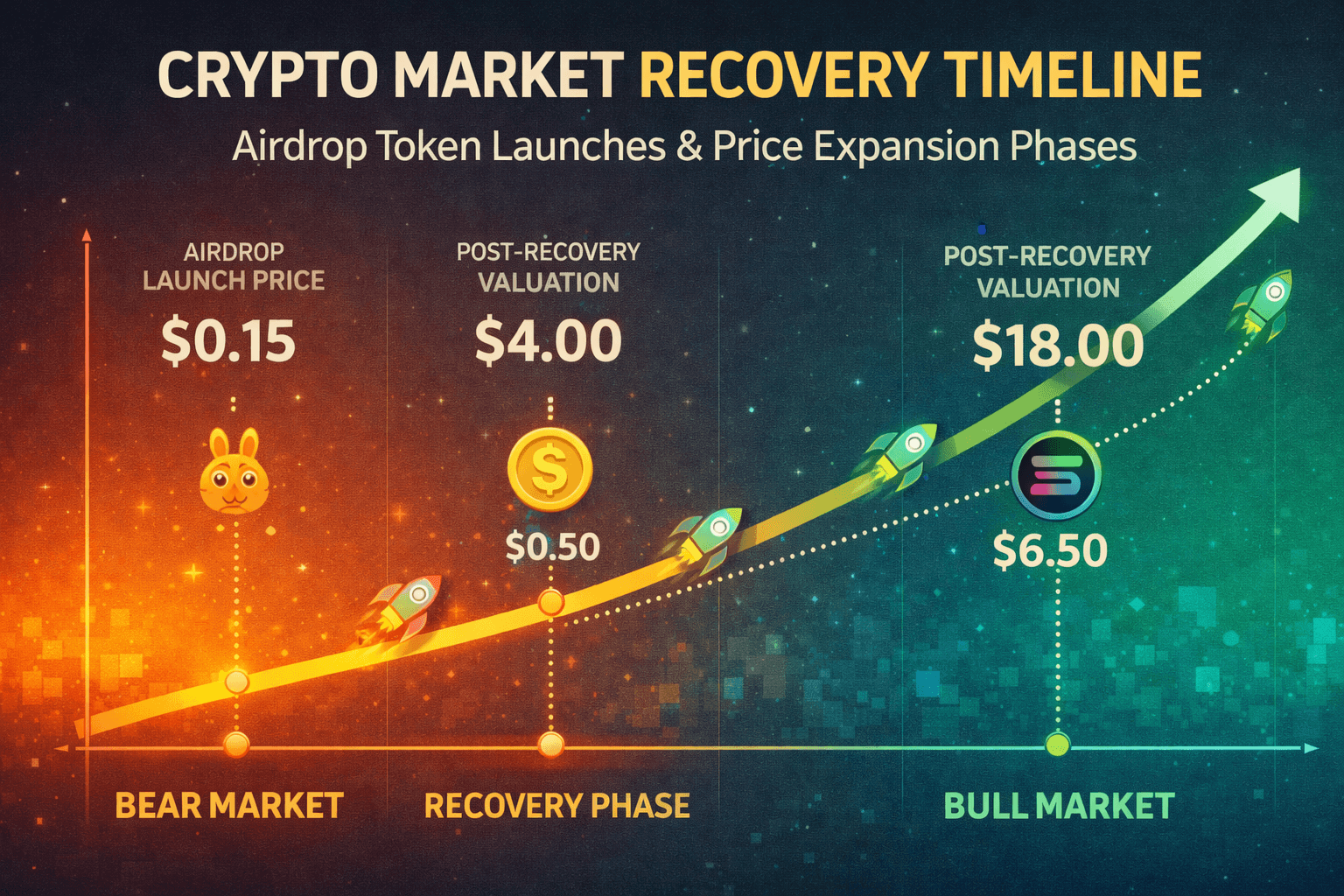

Launch prices depend on supply design, unlock schedules, and market conditions. However, recent cycles show consistent patterns.

In early recovery phases:

-

Small-cap infrastructure tokens often launch between $0.05–$0.20

-

Mid-scale platforms tend to open between $0.20–$0.80

-

High-demand networks can debut above $1.00 if float is controlled

If market momentum accelerates, secondary expansions of 3x–10x are not unusual within months. The key variable is how much of the supply is liquid at launch. Projects that lock team and investor tokens longer historically outperform.

4. User Actions To Secure Eligibility Before Market Momentum

Most high-value airdrops are no longer passive. Projects are tracking behavior in detail and filtering out low-effort farming.

Actions that are consistently rewarded:

-

Regular protocol usage over time

-

On-chain transactions, not just sign-ups

-

Participation in governance or testing

-

Leaderboard presence or streaks

-

Single-wallet consistency!

Users positioning early are benefiting from compounding points systems. Small daily actions often matter more than one-time volume. As momentum builds, late entrants usually receive reduced allocations.

5. Historical Cases Where Airdrop Tokens Exploded in Bull Runs

Past cycles offer clear examples. Tokens like UNI, DYDX, ARB, and OP all showed stronger performance after broader market recovery, not at the exact moment of distribution.

The pattern is repeating:

-

Early users receive large allocations

-

Initial volatility shakes out weak hands

-

Recovery phase attracts new demand

-

Supply remains constrained

-

Price reprices upward over time

The biggest gains typically occur weeks or months after launch, not on day one. That is why holding strategy matters more than immediate selling in recovery conditions.

Conclusion

The next crypto expansion is shaping up around utility-driven tokens, not empty incentives. This makes Top Airdrops Likely To Surge in Value one of the most important narratives going into 2025–2026.

Users who are engaging early, staying consistent, and focusing on real usage are positioning themselves ahead of market momentum. When liquidity returns, these tokens are often repricing quickly as demand catches up to limited circulating supply.

For more insights and educational resources on high-potential crypto opportunities, visit our Airdrops & Giveaways category.

Want more in-depth analysis and airdrop opportunities? Visit FreeCoins24.io/airdrops to explore the latest free crypto drops.

Stay Updated

Stay in the loop with the latest crypto airdrops, strategies, and tips. Follow us on: