Trump’s Crypto Reserve Sparks Massive Market Rebound

Introduction

The cryptocurrency market just experienced a plot twist that few saw coming. U.S. President Donald Trump unveiled plans for a national Crypto Reserve, naming Bitcoin, Ethereum, XRP, Solana, and Cardano as its initial holdings.

This unexpected policy shift immediately revived market sentiment, pushing prices upward after weeks of painful corrections. Investors, traders, and analysts are now buzzing with speculation—could this be the spark that reignites the next big bull run?

1. Trump’s Crypto Reserve Explained

A Shift in Policy

Trump’s Truth Social announcement confirmed the reserve’s creation, positioning XRP, Solana, and Cardano as foundational assets. Later, Bitcoin and Ethereum joined the list, reinforcing their dominance. This move fits into the broader pro-crypto shift Trump signaled during his campaign.

For context, this follows Trump’s Executive Order on Digital Assets, which previously set the stage for regulatory reform.

Turning the Tide from Previous Administration

Under the Biden administration, crypto endured some of its toughest regulatory crackdowns. However, with Trump’s leadership steering the ship, U.S. crypto regulations now appear to be shifting toward support and strategic development.

Want to know how different governments are handling crypto? Take a look at Global Crypto Regulations.

2. Market Rebound: Bitcoin, Ethereum Take Off

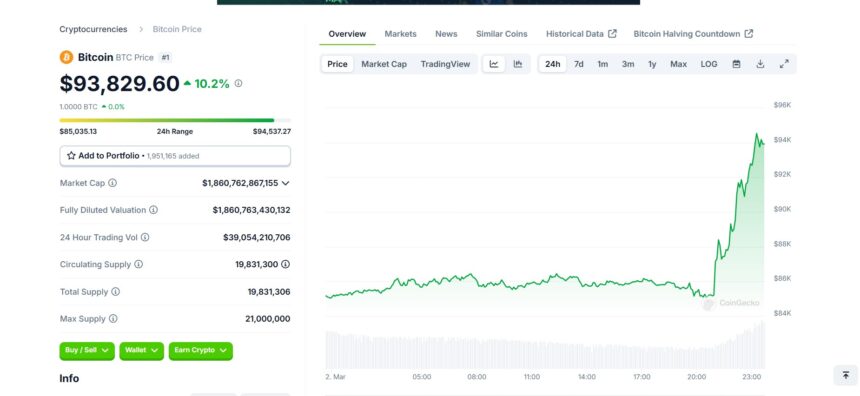

Bitcoin Leads the Charge

After the announcement, Bitcoin jumped to $94,383.33, gaining 10.82% within 24 hours. This surge came after a brutal sell-off, partly triggered by the Bybit Security Breach, which had severely shaken investor confidence.

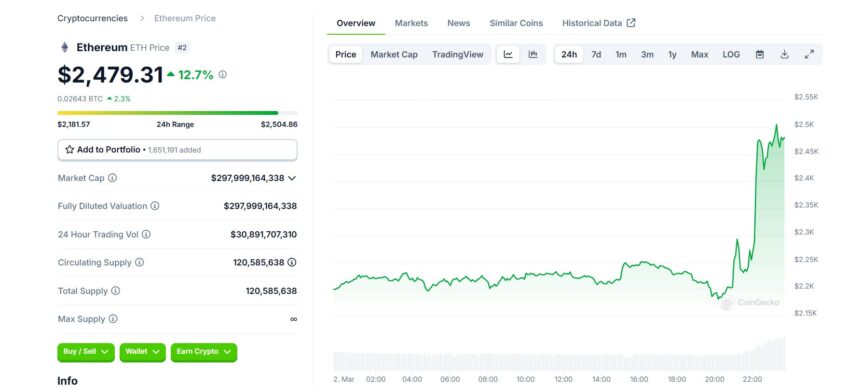

Ethereum Follows the Leader

Ethereum wasn’t left behind. It rallied to $2,466.59, rising 12.32% in a day. This price action mirrors the network’s growing relevance in global remittances—a trend covered in Crypto Remittances: The Future of Global Money Transfers.

3. Altcoins Shine – XRP, Solana & Cardano in Focus

XRP Grabs the Spotlight

XRP’s price skyrocketed to $2.90, recording a massive 35.17% gain. This comes hot on the heels of Brazil’s First XRP Spot ETF approval, adding fuel to the fire.

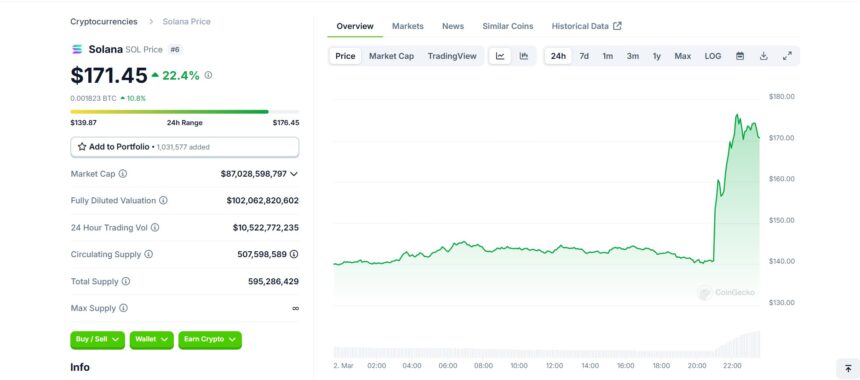

Solana’s Remarkable Comeback

Solana rebounded sharply to $173.30, notching a 24.35% gain despite recent troubles highlighted in Solana Drops 40% in a Month. This renewed interest in Solana reinforces its growing role in decentralized finance (DeFi), which you can explore in The Rise of DeFi.

Cardano Surges 70%

Cardano also saw extraordinary gains, jumping to $1.07, marking a 69.21% rally. Its role in the Crypto Reserve is expected to elevate its status among institutional investors.

Curious about how blockchain platforms like Cardano are evolving? Check out Decoding Blockchain Technology.

4. What Does the Reserve Mean for Investors?

Institutional Confidence Boost

A U.S.-backed Crypto Reserve could give institutions the regulatory clarity they’ve long craved. Such clarity might encourage institutional investors to adopt more long-term crypto strategies, similar to what we explored in Mastering Crypto Day Trading.

More than Just Hype?

Although the immediate market reaction has been overwhelmingly positive, analysts warn that long-term sustainability will depend on factors like global liquidity, economic stability, and regulatory clarity.

For those wondering how this fits into broader regulatory shifts, SEC Drops Investigation into Uniswap offers an example of changing tides.

5. Crypto Sentiment – Is This a Real Revival or Just a Bounce?

Fear and Greed Index Still Low

Despite the rally, the Crypto Fear and Greed Index sits at just 22. This cautious mood reflects lingering concerns after the recent Bitcoin Crash to $86k, which we analyzed in Bitcoin Falls to $86K – What’s Behind the Latest Crypto Crash?.

ETF Outflows Still Haunting the Market

Institutional selling remains a dark cloud. In fact, Bitcoin ETFs have seen two consecutive weeks of outflows, which could limit upside potential if this trend continues.

To understand how ETFs are shaping market sentiment, read USDC Market Cap Surges to $56B – Is It Catching Up to Tether?.

Final Thoughts – Is This Trump’s Bull Market?

Trump’s pro-crypto stance combined with concrete action like establishing the Crypto Reserve may mark the beginning of a new bullish chapter. However, seasoned investors know that crypto remains highly volatile, meaning today’s optimism could easily turn into tomorrow’s correction.

For those just stepping into the world of digital assets, now’s the perfect time to read Getting Started with Crypto: A Beginner’s Guide.

FAQs

1. What is Trump’s U.S. Crypto Reserve?

It’s a government-backed portfolio holding Bitcoin, Ethereum, XRP, Solana, and Cardano to support domestic digital asset development.

2. Why did prices spike after the announcement?

The reserve’s creation signals official U.S. endorsement of select cryptos, boosting confidence and driving buying pressure.

3. Is this rally sustainable?

Sustainability will depend on institutional flows, macroeconomic factors, and regulatory developments in the coming months.

4. Which coins benefit the most from the reserve?

XRP, Solana, and Cardano gain credibility as “officially endorsed” assets, potentially attracting larger capital inflows.

For more insights and detailed guides on cryptocurrency, visit our Crypto Guides Section.

Stay Updated

For the latest updates on cryptocurrency trends and news, follow us on:

- X: https://x.com/FreeCoins24

- Telegram: https://t.me/freecoins24

Explore the latest crypto airdrops and uncover exclusive opportunities waiting for you — visit now at FreeCoins24.io/airdrops to start claiming today. Stay informed with the latest strategies and insights in the world of cryptocurrency at FreeCoins24.io.

Special Offer

For an enhanced trading experience, consider Bybit. Sign up through our referral link to unlock exclusive rewards, including up to $30,000 in deposit bonuses, and elevate your trading journey.