Ever feel like Bitcoin hogs all the spotlight while gems like Zcash lurk in the wings? Well, buckle up. In this undervalued Zcash deep dive, we’re unpacking why ZEC, the ultimate privacy underdog could snatch 1% of BTC’s massive market throne. That’s right; a slice worth billions that might just 3x your portfolio by year’s end. With surveillance creeping in and halvings on the horizon, undervalued Zcash isn’t just a bet; it’s a smart play on privacy’s comeback. Let’s crack it open.

Eager to trade undervalued Zcash? Head to Binance now. Newbies snag up to $10,000 in deposit bonuses perfect for loading up on ZEC amid this surge.

What Makes Zcash the Ultimate Underdog?

Bitcoin’s the undisputed king, flexing a $2.18 trillion market cap as of November 1, 2025. It’s “digital gold,” sure. But in a world of data-hungry governments and AI trackers, where’s the shield? Enter Zcash, the undervalued Zcash that’s basically Bitcoin with a privacy cloak.

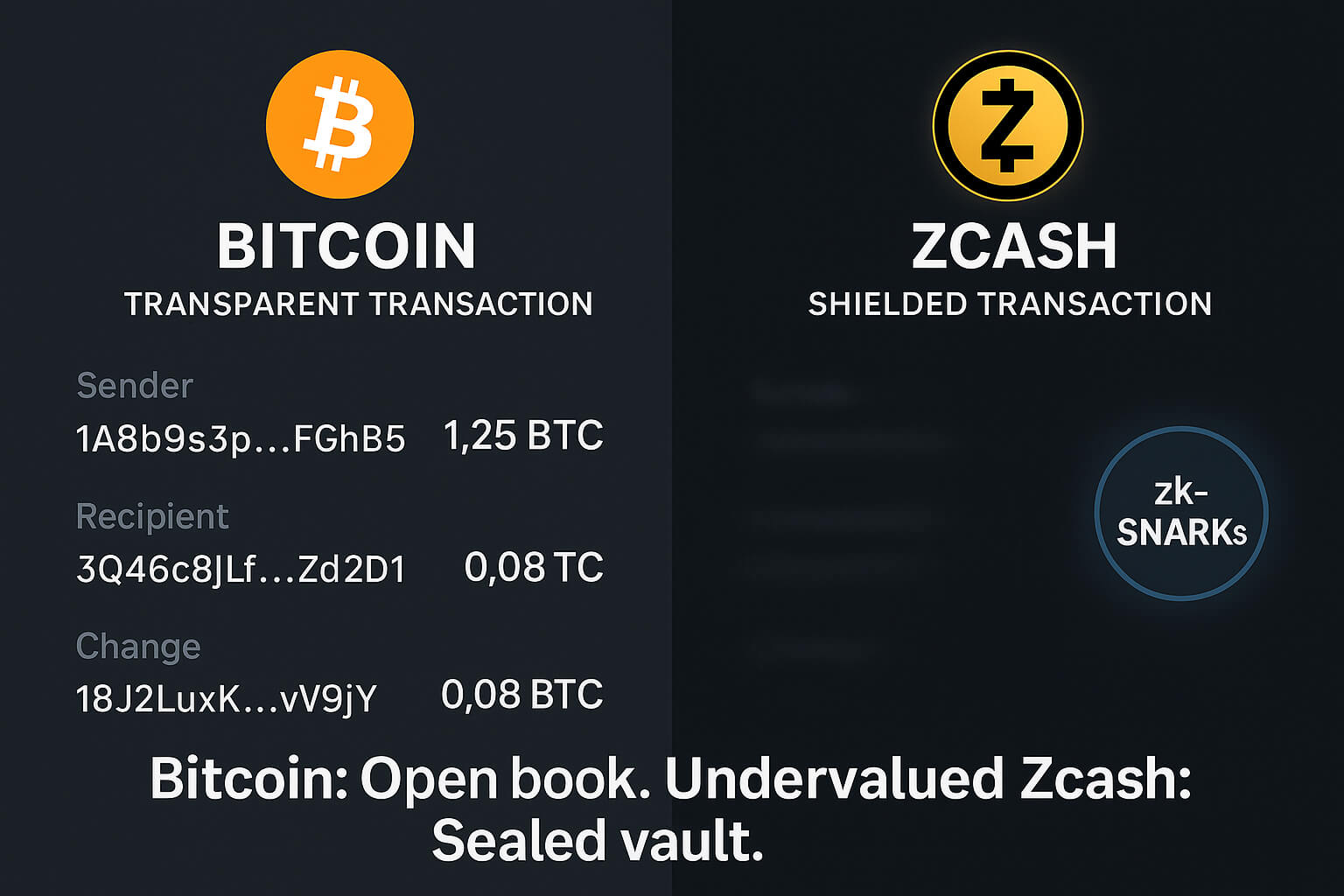

Launched in 2016 as a Bitcoin fork, ZEC amps up anonymity via zk-SNARKs, a zero-knowledge proofs that verify transactions without spilling sender, receiver, or amount details. Unlike BTC’s open ledger, Zcash lets you choose to go transparent for audits or shielded for total stealth. And get this, 27% of ZEC’s supply now hides in shielded pools, up 125% year-to-date. That’s billions in untraceable value, folks.

Why underdog? ZEC trades at a measly 0.31% of BTC’s cap, around $6.77 billion versus Bitcoin’s behemoth. Yet, with explosive +642% YTD gains, it’s screaming “undervalued.” Privacy isn’t a fad; it’s survival. As EU’s “Chat Control” scans encrypted chats and Meta slurps user data, Zcash positions as the “encrypted Bitcoin.“

The Halving Hype: Zcash’s Supply Shock Incoming

November 2025 isn’t just sweater weather, it’s Zcash halving month. On November 18, block rewards slash from 3.125 to 1.5625 ZEC, mirroring Bitcoin’s scarcity magic. With 16.36 million circulating (78% mined), this tightens supply just as privacy demand heats up.

Remember BTC’s post-halving pumps? 300%+ cycles aren’t rare. Zcash, already up 62.8% weekly, it could ride that wave. X users are buzzing “Halving catalyst, supply shock meets macro interest.” For undervalued Zcash, it’s rocket fuel. Circ supply hits scarcity mode, potentially flipping more alts and inching toward BTC’s throne.

Privacy Narrative: Why Zcash Wins in a Surveillance World

Fast-forward to 2025, CBDCs track every spend, AI scans your scrolls, and regs like MiCA eye “anonymity enhancers.” In that regard, prvacy is not optional, it’s essential. Zcash leads with Halo 2 upgrades ditching trusted setups for bulletproof security, plus ZSAs (shielded assets) tokenizing real estate privately.

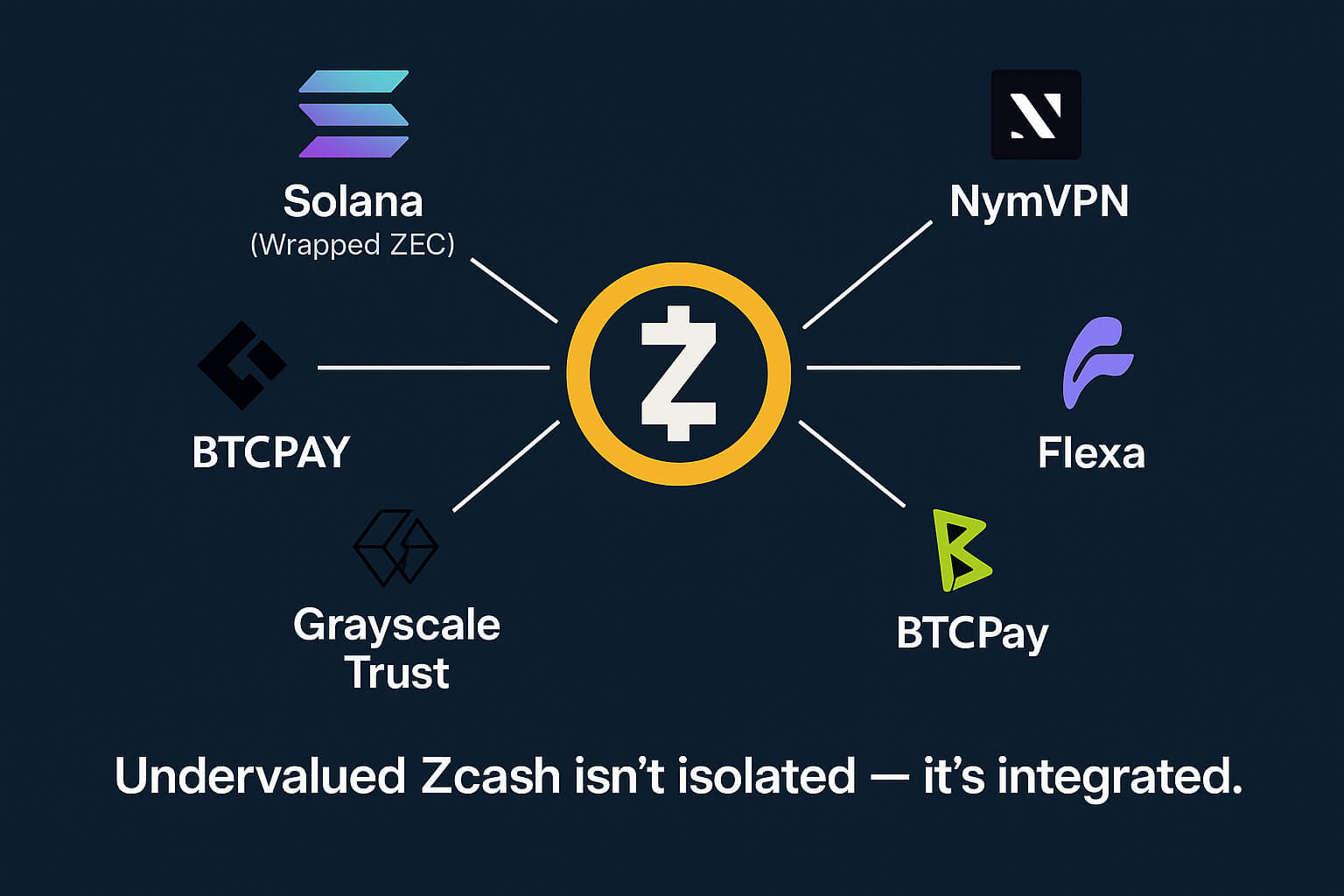

In other words, Snowden and Naval Ravikant back it as “private money.” In fact, it integrates NymVPN for anon browsing, Router Protocol for cross-chain shielded swaps, and Wrapped ZEC on Solana for DeFi liquidity. Flexa and BTCPay plug it into retail. As X sentiment hits 75% bullish, ZEC’s shielded tx volume climbs 15% monthly 3M+ ZEC hidden.

Bitcoin can’t match this. Mixers like Tornado Cash? Delisted and drama-filled. Undervalued Zcash fills the gap, turning privacy into a macro hedge.

Adoption Surge: From Niche to Must-Have

Zcash isn’t sleeping on growth. Grayscale’s ZEC Trust? Up 248% YTD, drawing institutional eyes. Wallets like Zashi hit $40M volume for shielded swaps. Nation-states eye it for confidential reserves, per early whispers.

In BTCfi, L2s like Lightning scale TPS, but no privacy. However ZCASH private memos for secure comms, ideal for whistleblowers. Barriers persist, lower hash rate vs. BTC’s 600 EH/s but upgrades like NU6.1 boost nodes 40%. Undervalued Zcash is bridging to Solana, NEAR. Let’s just watch its adoption explode.

Price Projections: 3x Portfolio Potential Unlocked

What if ZCASH crunch the numbers? BTC at $2.18T. 1% slice would be $21.8B for Zcash. That’s over 3x from $6.77B today. CoinCodex eyes $521 by Nov 30 (+41%), $632 by April 2026 (+71%). Changelly whispers $117 min, but bull cases hit $707 avg, 70% ROI.

ZEC smashed 8-year highs at $388, now consolidating $350–$370. Targets $500+ into 2026. X bulls: “If ZEC holds $400, ZEC/BTC to 0.05–0.1. But with negative funding rates, it could signal short squeezes, upside asymmetry screams buy.

Roadmap Rockets: NU6 and Beyond

Zcash’s dev fund (20% rewards) fuels fire. Q4 NU6.1 slashes latency, amps node perf. Zebrad Rust client? Faster, scalable. Post-quantum tweaks? Future-proof.

2026? ZSAs for DeFi, governance decentralization. Bridges to Ethereum via Tachyon cut fees. As Naval says, “insurance against Bitcoin.” Undervalued Zcash isn’t static, it’s evolving into crypto’s privacy layer.

Myths Busted: No, Zcash Isn’t “Just for Criminals”

Myth 1: ZEC’s optional privacy means weak anonymity. In reeality, Shielded pools hit ATH 4.9M ZEC, stronger sets than ever.

Myth 2: Too niche, no adoption. However, builders have lunached cross-chain on Solana, merchant plugs via BTCPay.

Myth 3: Will kill Monero? Nah, room for both. ZEC flipped XMR as #1 privacy coin, but XMR’s always-on suits max privacy fans. XMR to $500? Possible, but Zcash’s flexibility wins broad appeal.

The 1% Throne Grab: How Zcash 3x’s Your Bag

Snag 1% of BTC’s cap? ZEC to $1,300+ 3x from here. Halving scarcity, zk maturity, adoption flywheel more shielding is a better privacy that’ll create more pumps. ZEC’s resurrection, dawn of second era.”

Undervalued Zcash: Your Move to 3x Gains

So, undervalued Zcash steals the show. From zk-SNARK shields to halving shocks, ZEC’s primed to chip at Bitcoin’s throne, delivering 3x portfolio pops for sharp holders. Privacy’s no luxury; it’s the future. Don’t sleep on this underdog.

For deeper undervalued Zcash intel and privacy plays, hit our Privacy Coins Guides.

Stay Updated

Catch fresh undervalued Zcash breakdowns and crypto underdogs:

Unlock more at FreeCoins24.io.