Turning Airdrop Rewards into Growth Opportunities

Airdrops have become a popular way for crypto projects to reward early adopters and spread awareness about new tokens. For users, these free tokens can be a great opportunity to increase their cryptocurrency holdings without additional upfront investment. However, instead of cashing out, savvy crypto investors often choose to reinvest their airdrop proceeds to build a larger and more diversified portfolio. This article will walk you through effective strategies for using your airdrop rewards to fund further crypto investments.

1. Evaluate the Value of Your Airdrop Tokens

The first step in leveraging your airdrop proceeds is understanding their current and potential value. Many airdropped tokens initially have low liquidity or limited trading options, so it’s essential to research the token’s performance and future prospects before deciding to hold, sell, or reinvest.

Key Factors to Evaluate:

- Market Potential: Assess whether the project has a promising roadmap and potential for long-term growth.

- Liquidity: Some tokens are hard to trade initially, so check if the token is listed on major exchanges.

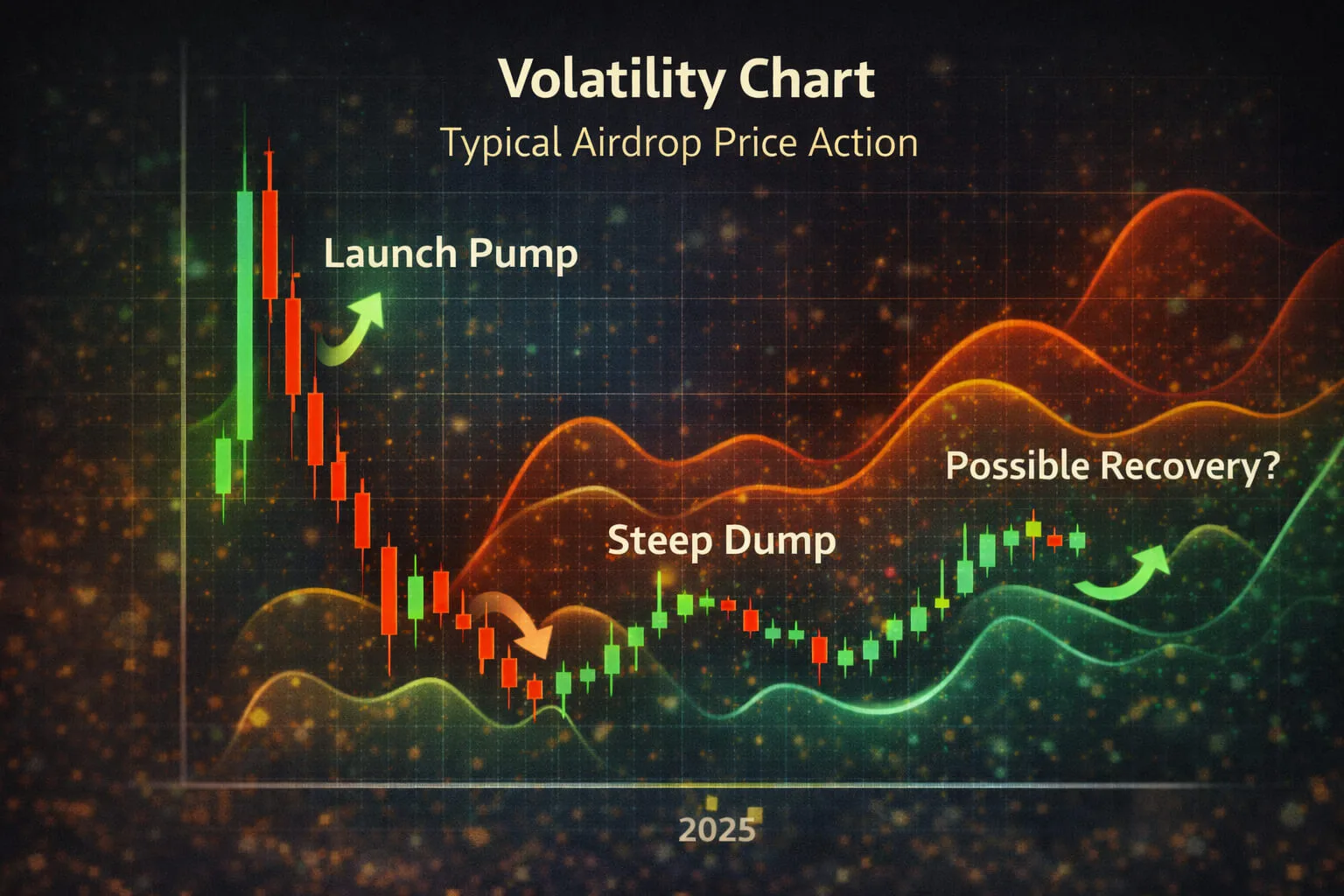

- Volatility: New airdrop tokens can experience drastic price swings. Decide if holding or selling is the better option for you based on your risk tolerance.

Once you evaluate your airdrop tokens, you’ll have a clearer idea of whether to hold, sell, or convert them into other opportunities.

2. Convert Airdrop Tokens to Stablecoins for Strategic Flexibility

If you’re not confident about the long-term potential of the airdropped tokens, consider converting them to stablecoins like USDT or USDC. Stablecoins are pegged to the value of traditional currencies, like the U.S. dollar, which makes them less volatile. By holding proceeds in stablecoins, you gain flexibility to reinvest when promising opportunities arise without worrying about price fluctuations.

Benefits of Converting Airdrop Proceeds to Stablecoins:

- Liquidity: Stablecoins are widely accepted on most exchanges, making it easy to trade or reinvest at any time.

- Risk Management: You protect your airdrop value from the high volatility often associated with new tokens.

- Investment Opportunities: With stablecoins on hand, you’re ready to invest in other projects as soon as you spot a good opportunity.

By securing your proceeds in stablecoins, you ensure that you’re ready to act quickly on new investments without being tied to the volatility of your airdrop token.

3. Reinvest Airdrop Rewards in Diversified Crypto Assets

One of the smartest ways to grow your portfolio is by using airdrop rewards to invest in a diversified mix of cryptocurrencies. Rather than focusing solely on one asset, consider diversifying across multiple projects to reduce risk and increase potential returns.

Suggested Assets for Reinvestment:

- Blue-Chip Cryptocurrencies: Consider using a portion of your airdrop proceeds to invest in well-established cryptocurrencies like Bitcoin (BTC) or Ethereum (ETH), which are generally more stable and have a higher adoption rate.

- Altcoins with Strong Fundamentals: Research altcoins that show promise, such as Solana (SOL), Cardano (ADA), or Polkadot (DOT). These coins have strong development communities and growing use cases.

- DeFi Tokens: Decentralized Finance (DeFi) tokens like Aave (AAVE) or Uniswap (UNI) allow you to gain exposure to the growing DeFi ecosystem.

- NFT and Gaming Tokens: Tokens related to NFTs and blockchain gaming, such as Axie Infinity (AXS) or Enjin Coin (ENJ), are popular sectors with high growth potential.

By diversifying your investments, you create a more balanced portfolio that can potentially weather market volatility better than a single-asset holding.

![]()

4. Stake or Lend Airdrop Proceeds to Earn Passive Income

If you’d prefer a more hands-off approach, consider using your airdrop rewards to earn passive income through staking or lending. Many cryptocurrencies, especially those operating on Proof-of-Stake (PoS) blockchains, allow you to stake tokens to earn additional rewards.

Staking and Lending Options:

- Staking: Many PoS networks, such as Ethereum 2.0, Cardano, and Polkadot, offer staking opportunities where you can earn annual yields by locking up your tokens.

- Lending Platforms: Platforms like Aave, Compound, and Celsius allow you to lend your tokens to other users in exchange for interest. Lending with stablecoins can provide a relatively safe, steady income stream.

Staking and lending provide you with a way to grow your airdrop proceeds without having to actively trade or speculate. This strategy is especially effective if you want a low-risk, long-term approach.

5. Use Airdrop Proceeds to Enter Yield Farming and Liquidity Pools

Yield farming and liquidity provision are advanced strategies that can potentially offer high returns on your airdrop rewards. By providing liquidity to decentralized exchanges (DEXs) or participating in yield farming protocols, you earn additional tokens as a reward.

How to Use Airdrop Proceeds for Yield Farming:

- Choose a Platform: Popular platforms for yield farming include Uniswap, PancakeSwap, and SushiSwap.

- Provide Liquidity: Pair your airdrop token or stablecoin with another token in a liquidity pool to earn fees from trades.

- Stake LP Tokens: Some platforms allow you to stake your liquidity provider (LP) tokens in yield farms for additional rewards.

While yield farming can be highly profitable, it’s essential to note the risks involved, including impermanent loss and the potential for smart contract vulnerabilities. Only allocate a portion of your airdrop rewards that you’re comfortable risking.

6. Reinvest in Early-Stage Crypto Projects with High Potential

Another way to maximize your airdrop proceeds is by reinvesting in early-stage projects that have the potential for high returns. Many crypto enthusiasts seek out Initial DEX Offerings (IDOs) or pre-sale opportunities for promising projects. While this approach carries risk, it can be highly rewarding if you choose the right projects.

How to Find and Invest in Early-Stage Projects:

- Research: Follow crypto influencers, industry news, and platforms like CoinGecko or CoinMarketCap to identify upcoming projects.

- Participate in IDOs: Platforms like Polkastarter, DAO Maker, and Binance Launchpad host token sales for new projects. Use a portion of your airdrop rewards to participate.

- Assess Risks: Be cautious when investing in early-stage projects. Thoroughly evaluate the project’s whitepaper, team, and market potential.

By reinvesting in promising new projects, you’re positioning yourself to potentially multiply your gains. However, due diligence is essential to avoid falling for scams or poorly managed projects.

7. Set Aside a Portion for Dollar-Cost Averaging (DCA)

Dollar-cost averaging (DCA) is a strategy where you invest a fixed amount into an asset at regular intervals, regardless of its price. Using a portion of your airdrop proceeds for DCA can help you build a long-term position in a promising asset while reducing the impact of market volatility.

How to Use DCA with Airdrop Proceeds:

- Choose a Reliable Asset: DCA is best suited for well-established assets with long-term growth potential, like Bitcoin or Ethereum.

- Set a Schedule: Invest a small, fixed portion of your airdrop rewards weekly or monthly.

- Stick to the Plan: DCA requires consistency, so avoid timing the market and stick to your investment schedule.

DCA is a reliable strategy for those who want to gradually increase their crypto holdings without worrying about market timing.

Conclusion

Airdrop rewards offer an excellent opportunity to grow your crypto portfolio with minimal initial investment. By reinvesting airdrop proceeds strategically, whether through stablecoin conversion, diversification, staking, or participation in early-stage projects, you can turn these free tokens into a pathway for long-term financial growth. Remember, every reinvestment strategy comes with its own level of risk, so consider your risk tolerance and do thorough research before committing your airdrop funds.

With the right strategies, your airdrop proceeds can go beyond a quick profit and become a foundation for a successful crypto portfolio. Happy investing!

For more insights on making the most of your crypto earnings, explore our Crypto Investment Strategies Guide.

Stay Updated

To keep up with the latest strategies and trends in the crypto space, follow us on:

Special Offer

Ready to start reinvesting your airdrop rewards? Sign up on Bybit and receive up to $30,000 in deposit bonuses to fuel your crypto journey!